Is Crypto Really Decentralized… or Just a New Elite System?

Web3 sells a powerful idea:

“Power to the people.”

“Financial freedom.”

“No central authority.”

But here’s a difficult question most people avoid:

If crypto is decentralized… why do so few people control so much of it?

In this episode, we examine a reality that challenges the core narrative of Web3:

Decentralization may exist in code —

but not always in power.

The Distribution Problem Nobody Likes to Discuss

In theory, blockchain networks are open.

Anyone can:

- Buy tokens

- Run a node

- Participate in governance

- Build applications

But in practice?

Token ownership is often highly concentrated.

Early adopters.

Founders.

Developers.

Venture capital firms.

They hold massive portions of supply.

And in many blockchain systems, ownership equals influence.

More tokens = more voting power.

More voting power = more control.

Is that democratic?

Or is that shareholder capitalism in digital form?

Governance: Decentralized… But Controlled

Many crypto projects promote DAO governance.

Decentralized Autonomous Organizations.

Sounds revolutionary.

But look deeper.

Most DAO proposals:

- Are created by core teams

- Require technical understanding

- Need significant token holdings to pass

And voter participation rates are often very low.

So who decides?

Usually:

- Large token holders

- Institutional investors

- Insider groups

When 5% of users shape decisions for 95%,

is that decentralization?

Or oligarchy with blockchain branding?

Mining and Validation Power

Bitcoin and many blockchains rely on miners or validators.

In theory:

Anyone can participate.

In reality:

It requires capital.

- Mining requires hardware and electricity.

- Proof-of-stake requires large token holdings.

And over time, operations concentrate in specific regions and large pools.

A few mining pools can control a majority of hash power.

A few validators can dominate consensus.

When control consolidates, risk increases.

Not because the system is broken —

but because incentives naturally centralize power.

Venture Capital Influence

Let’s talk about something rarely mentioned in marketing threads:

VC funding.

Many Web3 projects raise millions — sometimes hundreds of millions — before launching publicly.

Who gets early access?

Private investors.

Often at:

- Lower prices

- Preferential allocations

- Insider terms

By the time the public buys,

large holders already exist.

Retail investors may believe they are early.

But often, they are late to the real allocation.

Is that financial inclusion?

Or just early-stage equity mechanics in a new format?

The Illusion of “Community Power”

Crypto communities are powerful.

They build hype.

They defend projects.

They create narratives.

But ask yourself:

Who actually controls development?

Who writes the code?

Who deploys updates?

Who holds admin keys?

In many cases, a small team.

Some projects still have:

- Emergency pause functions

- Upgrade control mechanisms

- Hidden centralization layers

Necessary for security? Sometimes.

But transparency about this is often limited.

The word “decentralized” becomes a marketing shortcut.

Not always a structural reality.

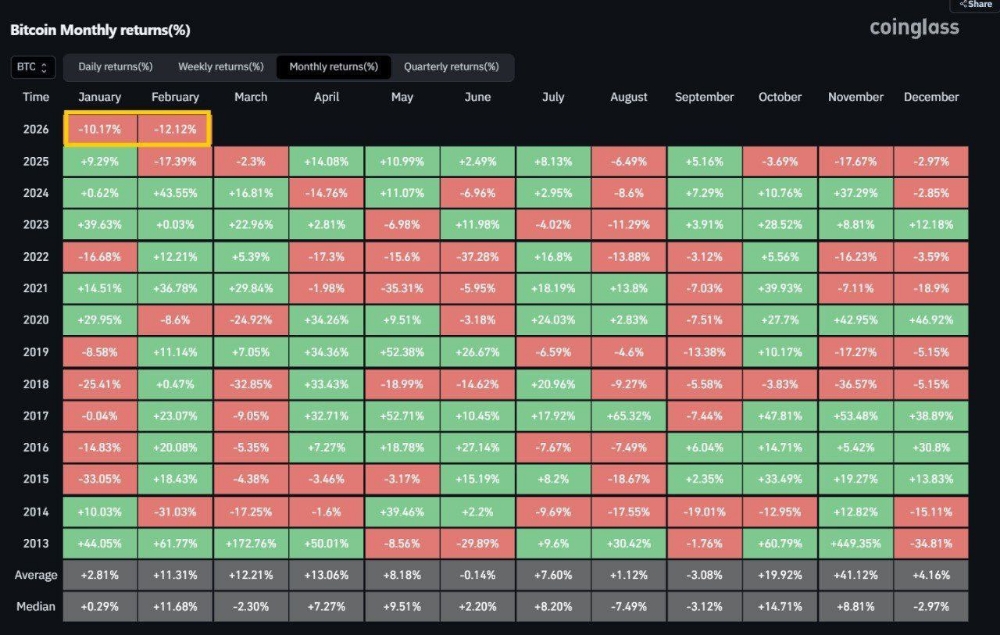

Wealth Inequality in Crypto

Another uncomfortable truth:

Crypto has created enormous wealth for some.

But it has also replicated inequality.

Whales influence markets.

Retail traders react emotionally.

Insiders exit early.

Latecomers absorb volatility.

The cycle continues.

And while blockchain is neutral technology,

the financial dynamics mirror traditional systems:

- Capital attracts capital

- Early access creates advantage

- Information asymmetry creates winners

The difference?

Speed.

Crypto accelerates both opportunity and inequality.

Is True Decentralization Even Possible?

Here’s a deeper philosophical question:

Can power ever remain evenly distributed?

Human systems tend to centralize.

Not because of conspiracy —

but because efficiency demands coordination.

Coordination demands leadership.

Leadership accumulates influence.

Influence attracts power.

Even in decentralized systems.

So maybe the issue isn’t that Web3 failed.

Maybe the issue is expectation.

We imagined a world without hierarchy.

But every system develops structure.

The real goal may not be eliminating elites.

It may be limiting their unchecked power.

The Positive Side: Why It Still Matters

Despite these critiques, Web3 still offers advantages:

- Public auditability

- Transparent transactions

- Open-source code

- Borderless participation

Even if wealth concentrates,

blockchain data remains visible.

In traditional finance, power is often hidden.

In crypto, at least, it can be analyzed.

That visibility changes the conversation.

It forces accountability — even if imperfect.

The Real Risk

The danger isn’t that crypto has elites.

The danger is pretending it doesn’t.

When marketing says:

“Fully decentralized.”

But structure says:

“Concentrated governance.”

Trust erodes.

Web3’s credibility depends on honest analysis.

Not blind enthusiasm.

Final Thought

Crypto did not magically redistribute power.

It redesigned the battlefield.

Some old elites entered.

Some new elites emerged.

The question is not:

“Is crypto perfectly decentralized?”

The question is:

“Is it more transparent and adaptable than what we had before?”

If we ignore concentration risks,

we repeat history.

If we acknowledge them,

we can design better systems.

Web3 is not automatically fair.

It is programmable.

And what is programmable can be improved.

But only if we stop believing the illusion.

![[LIVE] BULB Ambassador Program: Empowering the Future of Web3 Creators](https://cdn.bulbapp.io/frontend/images/952f29cd-a8d5-47aa-8e9f-78a1255f8675/1)