📅 February 14 in Crypto History

How markets, psychology, and asset hierarchies have shifted over time

📈 Bitcoin Price Timeline on Feb 14

2010 ~ $0.01

2011~$1–$1.10*

2012~$4–$5*

2014 $661.99

2015 $257.32

2016 $407.23

2020 $10,312.12

2021 $48,717.29

2024 $51,826.70

2025 $97,508.97

2026 $68,838.87

📊 Market Cap & Dominance Around Feb 14

Bitcoin Market Cap

Bitcoin’s market cap has grown from billions in the early 2010s to multi‑trillion dollars. In July 2025, for example, BTC’s market cap topped $2.4 T, momentarily surpassing the market value of major global corporations. �

Bitcoin Dominance (BTC.D)

Bitcoin dominance describes BTC’s share of the total crypto market capitalization.

Historically, BTC dominance averaged >90 % in the earliest years (pre‑2017).

It declined during altcoin booms around 2017–2018.

Since 2023–2025, BTC dominance has risen again to roughly 58–60 % or higher as BTC regained share amid regulatory clarity and institutional adoption.

Current dominance data (near the date of this blog):

BTC ~56.5 %, ETH ~10.1 % (rest of the market covers stablecoins and others).

🪙 Altcoin Price Parallels on Feb 14

While Bitcoin dominates in capitalization and narrative, altcoins tell a different market story — one of diversification, growth phases, and rotation:

Ethereum (ETH)

Ethereum’s price moves often reflect broader adoption in DeFi, NFTs, and smart contracts.

On Feb 14, 2026, ETH traded around $2,054, showing strength alongside BTC.

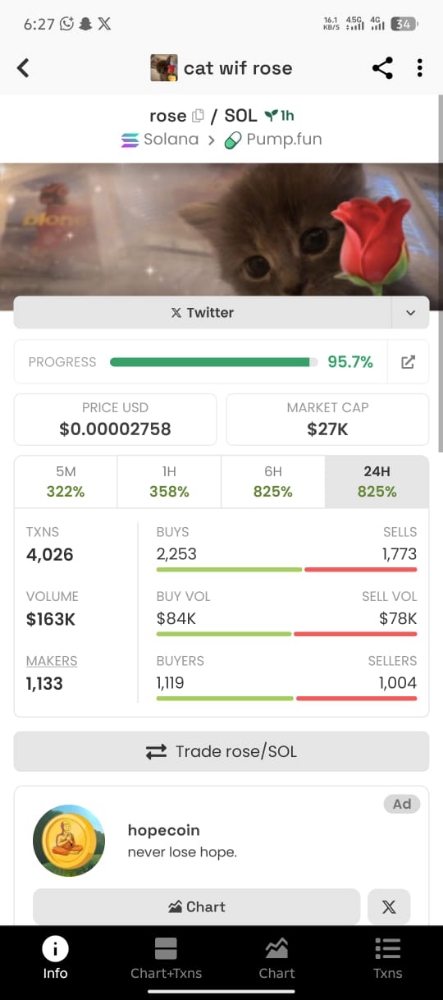

Solana, XRP, etc.

On Feb 14, 2025, ETH, SOL, XRP, and other major altcoins displayed minor divergences compared to Bitcoin’s surge above $97k, with some posting relative weakness while BTC dominated market valuation.

This highlights how BTC and alt prices can decouple in performance depending on sentiment — a theme we’ll revisit in analysis below.

🧠 February 14 Market Psychology + Narrative

2014 — Post‑Exchange Trust Crisis

Bitcoin’s price near $660 reflected lingering fallout from earlier exchange failures. This was a time when trust was currency, and decentralized custody narratives gained traction.

Impact: Users moved from centralization risk toward self‑custody awareness.

2015 — Bear Market Realization

BTC under $300 was part of a capitulation cycle where retail fear spiked and weak hands exited.

Impact: Market structure was stress‑tested; long-term holders began to distinguish themselves.

2016 — Accumulation Before Halving

BTC around $400 reflected early accumulation before the next major supply shock (halving).

Impact: This stage historically precedes bull runs as macro sentiment begins shifting.

2020 — Calm Before Pandemic Shock

Middle of a global shock year, BTC’s relative stability near $10k signaled positioning before market rot.

Impact: Structural resiliency began to appear as BTC decoupled from traditional liquidity constraints.

2021 — Institutional Inflection Point

BTC near $48k marked institutional flows entering: ETFs, corporate treasuries, and deeper derivatives markets.

Impact: BTC started behaving more like a traditional macro asset.

2024 — ETF‑Driven Structural Shift

BTC above $50k marked demand driven by regulated products rather than retail hype.

Impact: Market maturity increases, volatility compresses, and dominance strengthens.

2025 — Late‑Cycle Strength

BTC ~$97k highlighted peak cycle optimism and capital rotation dynamics.

Impact: Bitcoin dominance climbed toward cycle highs as altcoins lagged — a return to quality trade.

2026 — Post‑Cycle Recalibration

BTC around $68k reflects broader market risk‑off sentiment as liquidity tightens.

Impact: Positioning shifts from momentum to risk management.

📉 Altcoin vs Bitcoin Dynamics

Historical dominance data shows how altcoins and Bitcoin compete for capital:

2013‑2016: Bitcoin dominance ~80–90 % — altcoins minor.

2017 ICO boom: Dominance dropped significantly amid alt speculation.

2021 alt‑rotation: Dominance dipped as DeFi & NFTs boomed.

2023–2025: Dominance climbed again with institutional BTC flows.

When BTC dominance falls → altcoin “season” can begin (e.g., ETH outperforming BTC in major cycles).

When dominance rises → capital flows back into BTC as risk assets decouple from macro comfort.

📌 Conclusion — Feb 14 is a Positioning Date

Not every Feb 14 is headline noise. Many reflect positioning shifts:

Fear resets

Accumulation phases

Structural demand waves

Macro liquidity cycles

Whether BTC is at $257 or $97,000, the market psychology driving February 14 has evolved — from trust crises and bear markets to institutional product demand and macro integration.

Bitcoin dominance and altcoin price dynamics help us see where capital is rotating — not just where prices are.