How Agricultural Commodity Tokenization Enhances Capital Efficiency in Agribusiness

Agriculture has long been a cornerstone of the global economy, supplying essential commodities such as grains, coffee, cotton, and livestock products. Yet, despite its importance, the sector often faces challenges in raising capital, managing liquidity, and optimizing operational efficiency. Traditional financing mechanisms for agribusinesses such as loans, bonds, or equity financing often involve high transaction costs, slow settlement times, and limited accessibility for small and medium-scale producers. In this context, agricultural commodity tokenization has emerged as a transformative solution, leveraging blockchain technology to digitize real-world agricultural assets, enhance transparency, and optimize capital allocation. This article explores the mechanisms, benefits, and implications of agricultural commodity tokenization in improving capital efficiency within the agribusiness sector.

Understanding Agricultural Commodity Tokenization

Agricultural commodity tokenization refers to the process of creating digital tokens on a blockchain that represent ownership or economic rights to physical agricultural assets. These assets can include crops, livestock, farmland, or even future harvests. Each token functions as a digitally tradable unit that reflects a portion of the underlying asset’s value, making it easier to transfer ownership, raise capital, and facilitate market liquidity.

Blockchain technology underpins this process by providing a secure, immutable ledger where each tokenized asset and transaction is transparently recorded. Smart contracts self-executing agreements encoded on the blockchain automate key processes such as settlement, revenue distribution, and compliance verification. By digitizing agricultural commodities, tokenization effectively converts illiquid, geographically constrained assets into liquid, tradeable financial instruments.

Unlike traditional commodity trading, tokenized agricultural assets can be fractionalized, allowing multiple investors to hold portions of a single asset. For example, a single hectare of wheat could be represented by 1,000 digital tokens, each providing proportional ownership or future revenue rights. Fractionalization democratizes access to agricultural investments, enabling smaller investors to participate in markets that were previously restricted to large agribusiness firms or institutional players.

The Mechanisms Behind Capital Efficiency

Capital efficiency in agribusiness refers to the ability to allocate financial resources effectively to maximize productivity and return on investment. Real Estate Tokenization enhances capital efficiency through several mechanisms:

1. Fractional Ownership and Liquidity

By converting agricultural commodities into digital tokens, farmers and agribusinesses can attract a broader pool of investors. Fractional ownership enables small-scale investors to participate in commodity markets without requiring substantial capital outlays. This expanded investor base increases market liquidity, making it easier for producers to raise funds quickly for planting, harvesting, and processing operations. Liquidity reduces dependency on traditional credit facilities and minimizes delays associated with conventional financing, such as bank approvals or collateral requirements.

2. Transparent Price Discovery

Tokenization platforms often incorporate real-time market data and decentralized exchanges, facilitating transparent price discovery for agricultural commodities. Accurate, timely pricing reduces the risk of underpricing assets or overestimating revenue potential. Enhanced transparency also attracts institutional investors who prioritize clarity and accountability, further improving the efficiency of capital allocation within agribusiness.

3. Automated Settlement and Reduced Transaction Costs

Smart contracts automate payments, revenue-sharing, and asset transfer processes, reducing the need for intermediaries such as brokers, banks, or legal entities. Automation cuts down on transaction costs, administrative overheads, and delays. For example, a wheat harvest can be tokenized, sold to investors, and automatically settled upon delivery, ensuring immediate liquidity for the producer while minimizing operational friction.

4. Access to Alternative Financing

Tokenized agricultural commodities create opportunities for alternative financing models such as asset-backed tokens, revenue-sharing tokens, and staking mechanisms. Instead of relying solely on traditional loans, agribusinesses can raise capital directly from token holders who receive revenue-linked returns. This model reduces dependence on debt financing, lowers interest costs, and aligns incentives between investors and producers.

5. Risk Mitigation and Hedging

Tokenization enables innovative risk management strategies. By linking tokens to specific commodities or crop yields, producers can hedge against price volatility, weather risks, or supply chain disruptions. Investors, in turn, can diversify their portfolios by holding tokens representing multiple crops or geographies. This distributed risk allocation enhances capital efficiency by stabilizing cash flows and reducing the need for expensive insurance or speculative financing.

Key Benefits of Agricultural Commodity Tokenization

The mechanisms described above translate into tangible benefits that enhance the overall capital efficiency of agribusiness operations.

Improved Access to Capital

Tokenization democratizes access to agricultural investments, enabling a wider range of investors to fund production. For smallholder farmers or emerging agribusinesses, tokenized assets can attract global investment that might otherwise be unavailable. By lowering entry barriers and reducing dependency on traditional lending, tokenization allows producers to secure the necessary funds to scale operations, invest in modern equipment, and improve crop yields.

Enhanced Market Liquidity

Illiquid assets, such as farmland or unharvested crops, traditionally tie up significant capital for extended periods. Tokenization converts these assets into liquid instruments, allowing producers to monetize assets faster and reinvest proceeds into production. Increased liquidity also stimulates secondary trading markets, creating a more dynamic ecosystem where investors can buy and sell tokens based on market demand.

Transparent Ownership and Governance

Blockchain records provide an immutable, verifiable record of ownership and transaction history. Transparent ownership reduces disputes, improves trust between investors and producers, and facilitates regulatory compliance. Smart contracts can further enforce governance rules, automate dividend payments, and manage voting rights in cooperative farming initiatives, aligning incentives between stakeholders.

Reduced Operational Costs

The elimination of intermediaries and automation of settlement processes directly lowers operational costs for both producers and investors. By streamlining financing, trading, and compliance, tokenization enables agribusinesses to allocate more capital toward productive activities such as crop improvement, sustainable farming practices, and technology adoption.

Global Market Reach

Tokenization allows agricultural commodities to be marketed and sold to investors worldwide. This global access increases demand for tokenized assets and supports higher valuations for underlying commodities. Producers can raise capital across borders without relying solely on local financial institutions, expanding funding opportunities for agribusiness growth.

Use Cases in Agribusiness

The applications of agricultural commodity tokenization span various segments of the agribusiness ecosystem, demonstrating its potential to enhance capital efficiency across the value chain.

Crop and Produce Tokenization

Tokenizing harvested crops or projected yields enables producers to secure pre-harvest funding. Investors purchase tokens linked to specific crops, providing upfront capital to cover operational costs. Upon harvest, token holders receive returns proportional to the realized yield or market value of the produce. This model reduces reliance on traditional crop loans and improves cash flow predictability.

Farmland Tokenization

Farmland represents one of the most valuable yet illiquid assets in agriculture. By tokenizing land, agribusinesses can fractionalize ownership, allowing investors to participate in land appreciation and rental income. Tokenized land also enables easier access to collateralized financing, as tokens can be used to secure loans without physically transferring ownership.

Livestock and Dairy Asset Tokenization

Tokenization extends to livestock and dairy operations, where animals, milk production, or meat yields can be represented as digital assets. Investors fund breeding programs or expansion initiatives through token purchases, receiving returns from future sales or production revenue. This approach optimizes capital allocation while distributing operational risks among a wider investor base.

Supply Chain and Commodity Trading

Tokenization can integrate with supply chain management, linking physical commodity movement to digital tokens. Smart contracts trigger payments automatically upon delivery verification, reducing delays and counterparty risk. Commodity trading platforms that accept tokenized assets increase liquidity and transparency in agricultural markets, improving price efficiency and capital turnover.

Challenges and Considerations

While agricultural commodity tokenization offers significant potential, there are challenges and considerations that must be addressed for widespread adoption.

Regulatory Compliance

Tokenized assets often fall under financial and securities regulations, which vary across jurisdictions. Ensuring compliance with local laws, investor protections, and reporting requirements is critical to avoiding legal disputes and maintaining market confidence.

Technological Infrastructure

Successful tokenization requires robust blockchain platforms, secure smart contracts, and integration with physical asset tracking systems. Developing and maintaining this infrastructure can involve significant technical expertise and investment.

Market Acceptance and Education

Farmers, investors, and agribusiness stakeholders must understand the value, risks, and mechanisms of tokenized assets. Building trust and market acceptance requires education initiatives and transparent operational practices.

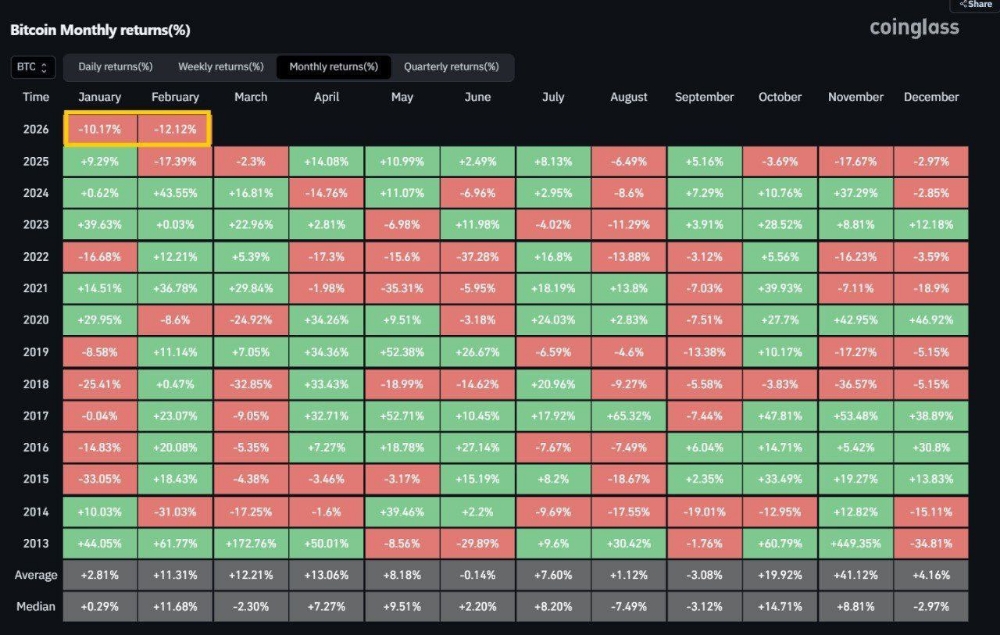

Volatility and Speculation

While tokenization can improve liquidity, it may also introduce price volatility driven by speculative trading. Measures such as stablecoin integration, revenue-linked tokens, or insurance mechanisms can mitigate these risks.

Future Outlook

The future of agricultural commodity tokenization is promising, with potential to reshape the financing landscape for agribusiness. As blockchain technology matures and regulatory frameworks become clearer, tokenization may become a mainstream tool for raising capital, optimizing liquidity, and improving operational efficiency. Advanced applications may integrate Internet of Things (IoT) devices for real-time crop monitoring, predictive analytics for yield estimation, and decentralized finance (DeFi) protocols for automated lending and insurance solutions.

In the next decade, tokenized agricultural assets could form a global marketplace, connecting farmers, investors, traders, and consumers through transparent, efficient, and secure digital infrastructure. By bridging the gap between physical agricultural production and financial markets, tokenization has the potential to unlock new sources of capital, reduce operational inefficiencies, and promote sustainable growth in the agribusiness sector.

Conclusion

Agricultural commodity tokenization represents a paradigm shift in how agribusinesses access capital, manage liquidity, and optimize operational efficiency. By converting physical agricultural assets into digital tokens, the sector can unlock fractional ownership, attract global investment, automate transactions, and enhance transparency. These mechanisms collectively improve capital efficiency, enabling producers to reinvest in growth, manage risks effectively, and participate in a more dynamic and liquid market environment.

While challenges such as regulatory compliance, technological infrastructure, and market acceptance remain, the benefits of tokenization—enhanced access to capital, reduced costs, improved liquidity, and transparent ownership—position it as a transformative innovation for agribusiness. As adoption accelerates, agricultural commodity tokenization is set to redefine capital allocation and financial strategy in the global food and farming economy.

![[LIVE] BULB Ambassador Program: Empowering the Future of Web3 Creators](https://cdn.bulbapp.io/frontend/images/952f29cd-a8d5-47aa-8e9f-78a1255f8675/1)