Blockchain, Finance, and Cryptocurrency: How Technology Is Redefining Money, Trust, and Power

For as long as money has existed, it has been tied to trust. Not trust in technology, but trust in institutions. Kings stamped coins. Governments printed notes. Banks verified balances and approved transactions. For centuries, finance has worked because people believed in the systems that controlled it.

Today, that belief is being tested.

Blockchain and cryptocurrency are not just new financial tools. They represent a fundamental challenge to how finance is structured, who controls it, and who benefits from it. They question assumptions that have shaped global economies for generations and propose a radically different way of organizing money, ownership, and trust.

This article explores the intersection of blockchain, finance, and cryptocurrency—not as hype or speculation, but as a long-term transformation of the financial world.

The Foundations of Traditional Finance

Modern finance is built on layers of intermediaries. Banks safeguard deposits. Clearing houses settle transactions. Governments regulate currency issuance. These systems evolved to provide stability, security, and scalability.

And in many ways, they succeeded.

Global trade expanded. Credit markets grew. Complex financial instruments enabled economic growth. But these systems also concentrated power. Access to finance became conditional. Borders, documentation, credit history, and political stability determined who could participate.

For billions of people, finance is not empowering. It is restrictive.

Transactions can take days. Fees can be significant. Transparency is limited. Decisions are often opaque and centralized. The system works well for some, but poorly for many others.

This imbalance set the stage for disruption.

The Internet Changed Everything Except Money

The internet transformed communication. Information became instant, global, and cheap. Anyone could publish ideas, share knowledge, and connect across borders.

Money did not follow the same path.

Even in a digital world, value still moved through legacy systems. Online payments depended on banks. International transfers remained slow and expensive. Financial inclusion lagged behind technological progress.

This disconnect raised a simple but powerful question: if information can move freely online, why can’t money?

Blockchain was designed to answer that question.

What Blockchain Really Introduces

At its core, blockchain is a system for recording and verifying information without relying on a central authority. Instead of one trusted intermediary, multiple participants maintain and validate a shared ledger.

This introduces three critical shifts.

First, decentralization. Control is distributed across a network rather than concentrated in a single institution.

Second, transparency. Transactions can be verified independently. Records are open to inspection.

Third, immutability. Once information is recorded, altering it becomes extremely difficult.

Together, these features redefine how trust is created. Trust moves from institutions to systems, from human authority to cryptographic proof.

Cryptocurrency as a Financial Breakthrough

Cryptocurrency is the most visible application of blockchain technology. It represents digital value that exists natively on decentralized networks.

Unlike traditional money, cryptocurrency is not issued or controlled by a central authority. Its rules are defined by code and enforced by network consensus.

This changes the nature of money itself.

Cryptocurrency can be transferred globally without banks. It can be held without permission. Ownership is determined by cryptographic keys rather than account approvals.

This makes cryptocurrency both empowering and disruptive.

Redefining Ownership and Control

In traditional finance, ownership is often indirect. Banks hold assets on behalf of customers. Access can be restricted, frozen, or revoked.

Blockchain introduces the concept of self-custody. Individuals can hold and manage assets directly through digital wallets. Control is personal.

This shift is profound.

It gives individuals sovereignty over their financial assets, but it also introduces responsibility. There is no central authority to reverse mistakes or recover lost access.

Finance becomes more personal, but also more demanding.

Programmable Finance and Smart Contracts

One of blockchain’s most powerful features is programmability. Smart contracts allow financial agreements to execute automatically when conditions are met.

This removes the need for intermediaries in many transactions.

Loans can be issued automatically. Payments can be released based on predefined rules. Agreements can enforce themselves without manual oversight.

Finance becomes software.

This opens the door to entirely new financial systems that operate with minimal friction and maximum transparency.

The Emergence of Decentralized Finance

Decentralized finance, often called DeFi, builds financial services directly on blockchain networks. These services aim to replicate traditional financial products without centralized control.

Users can lend assets, borrow funds, trade tokens, and earn yields through decentralized protocols. Access is open to anyone with an internet connection.

DeFi challenges the idea that financial services must be controlled by large institutions.

However, it also introduces new risks. Smart contract vulnerabilities, market volatility, and user error remain significant concerns.

DeFi is powerful, but it is still evolving.

Financial Inclusion and Global Access

One of the most compelling promises of blockchain and cryptocurrency is financial inclusion.

Millions of people worldwide lack access to traditional banking. Some live in regions with unstable currencies. Others face political or economic barriers.

Blockchain-based systems require only internet access. This lowers the barrier to participation.

For many, cryptocurrency is not an investment—it is a tool for survival, savings, and participation in the global economy.

Inclusion, however, depends on education, usability, and infrastructure. Technology alone is not enough.

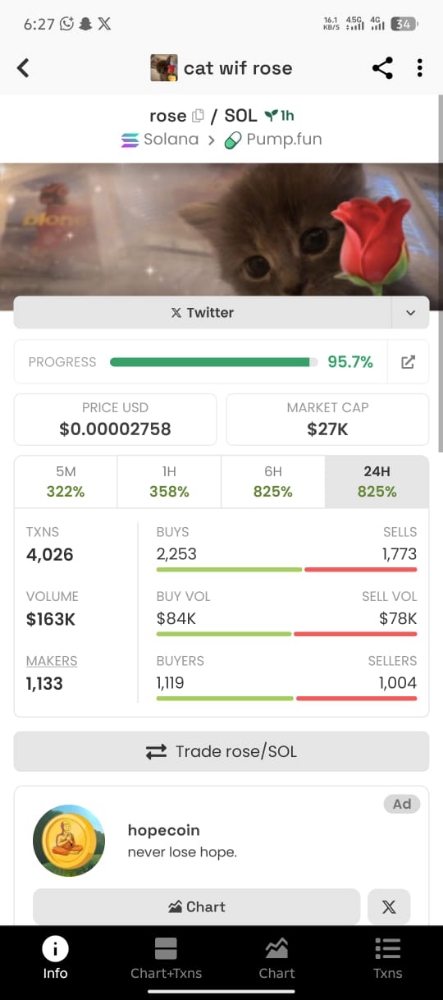

Volatility, Speculation, and Reality

Cryptocurrency markets are volatile. Prices rise and fall dramatically. This volatility attracts speculation and media attention.

But speculation should not be confused with significance.

Early technologies often experience instability. The long-term value of blockchain lies not in price movements, but in the systems it enables.

Speculation is noise. Infrastructure is signal.

Regulation and Institutional Response

Governments and financial institutions are still adapting to blockchain and cryptocurrency. Existing regulations were designed for centralized systems.

Regulators face a difficult balance. They must protect consumers without stifling innovation.

Some institutions are embracing blockchain for efficiency. Others resist decentralization due to its disruptive potential.

The future of finance will likely involve hybrid models that blend traditional structures with blockchain technology.

Blockchain Beyond Currency

Blockchain is not limited to money. Its applications extend across industries.

In finance, blockchain enables asset tokenization, allowing real-world assets to be represented digitally. This can increase liquidity and accessibility.

Ownership becomes divisible. Markets become more efficient.

These innovations challenge how assets are issued, traded, and managed.

The Psychological Shift in Finance

Perhaps the most overlooked impact of blockchain is psychological.

People begin to question assumptions about money and authority. They ask who controls value and why.

Finance stops feeling distant and institutional. It becomes interactive and personal.

This shift in mindset may be as important as the technology itself.

Risks and Limitations

Blockchain is not a perfect solution. Scalability, energy consumption, governance, and usability remain challenges.

No technology solves every problem.

Critical thinking and responsible adoption are essential. Blockchain is a tool, not a cure-all.

The Long-Term Financial Transformation

Blockchain and cryptocurrency represent a transition, not a replacement.

They introduce competition. They expose inefficiencies. They push institutions to evolve.

They empower individuals while demanding responsibility.

This transformation will be uneven. Some systems will fail. Others will reshape entire industries.

Finance in a Decentralized World

As blockchain matures, finance may become more open, transparent, and participatory.

Trust will shift from institutions to systems. Ownership will become more direct. Access will expand.

This does not mean the end of traditional finance. It means its evolution.

Conclusion: A System Being Rewritten

Blockchain, finance, and cryptocurrency are converging to redefine how money works in the digital age.

They challenge centralized control, redefine trust, and open new possibilities for economic participation.

This transformation will take time. It will involve debate, regulation, and experimentation.

But one thing is clear: the foundations of finance are no longer fixed.

Money is becoming programmable. Trust is becoming decentralized. And individuals are gaining tools that were once reserved for institutions.

The future of finance is not being decided in a single moment. It is being written line by line, block by block.

Thank you for taking the time to read.