How to Build a Scalable White Label RWA Tokenization Platform Efficiently?

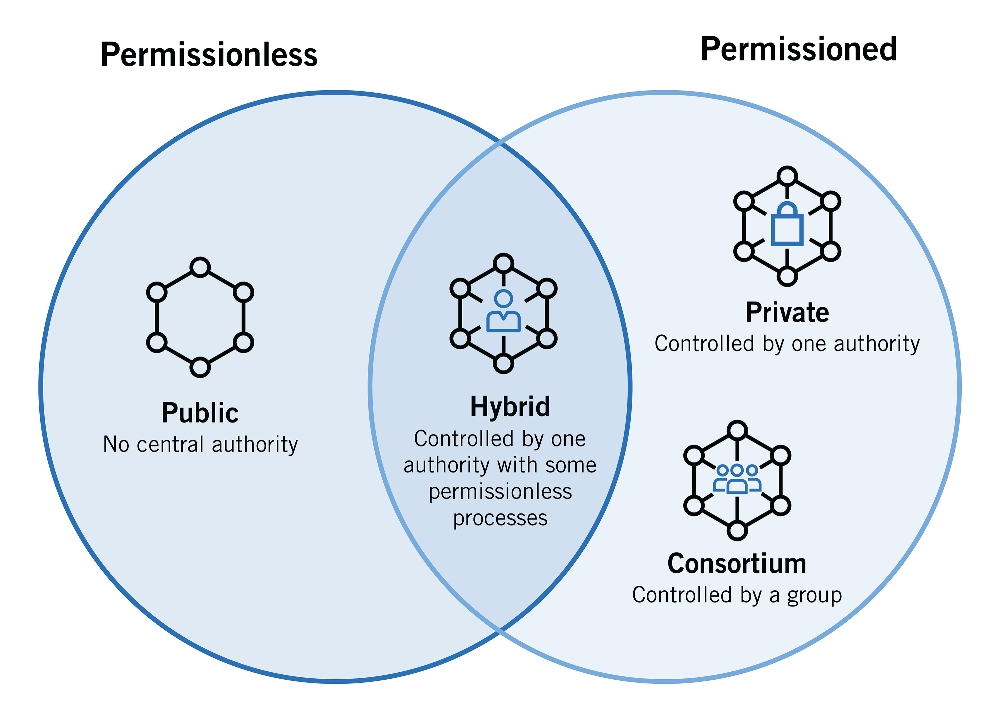

The tokenization of real-world assets (RWAs) has become a pivotal trend in modern finance, bridging traditional asset classes with blockchain-enabled digital innovation. From real estate and commodities to private equity and infrastructure, tokenization allows investors to hold fractional ownership of tangible and revenue-generating assets in a secure, transparent, and programmable manner. Among the most effective ways to implement such systems is through a white label RWA tokenization platform, which enables businesses to deploy fully branded, customizable solutions without building the underlying blockchain infrastructure from scratch.

A white label approach accelerates time-to-market, reduces development complexity, and ensures compliance while providing flexibility for diverse asset classes. This guide explores the core concepts, technical architecture, development strategies, and operational considerations involved in creating a white label RWA tokenization platform capable of supporting both residential and commercial asset tokenization.

Understanding White Label RWA Tokenization Platforms

A white label RWA tokenization platform is a pre-built solution that organizations can customize and brand as their own, designed specifically to tokenize real-world assets. The platform converts tangible assets into digital tokens representing ownership shares, entitlements to revenue, or rights to underlying cash flows. These tokens are then issued, traded, and managed on a blockchain-enabled infrastructure.

Key Advantages

- Rapid Deployment: White label solutions eliminate the need to develop blockchain infrastructure from scratch, enabling faster market entry.

- Customizability: Organizations can tailor the platform’s UI/UX, token economics, branding, and asset classes according to their business model.

- Regulatory Compliance: Many white label platforms integrate legal and compliance modules, including KYC/AML, investor accreditation, and jurisdiction-specific security token regulations.

- Cost Efficiency: Leveraging pre-built architecture reduces development and maintenance costs, freeing capital for marketing, asset acquisition, or platform scaling.

- Scalability: White label solutions can accommodate multiple asset types and token issuance structures, supporting both fractional ownership and complex investment instruments.

Core Features of a White Label RWA Tokenization Platform

To effectively facilitate capital formation for tokenized real-world assets, a white label RWA tokenization platform must integrate several essential features that combine blockchain innovation, regulatory compliance, and investor-centric functionality.

1. Token Issuance and Management

A robust platform enables the creation and ongoing management of digital tokens representing real-world asset ownership. Key features include fractional tokenization of physical assets, configurable token standards such as ERC-20, ERC-721, or ERC-1400, and automated dividend distribution or rental income allocation. Smart contract-based governance ensures seamless handling of token transfers, redemptions, and voting rights, while providing transparency and trust to investors.

2. Compliance and Regulatory Modules

Regulatory compliance is critical for any tokenized security offering. Platforms should integrate KYC/AML verification, investor accreditation checks, and whitelist management to meet legal requirements. Jurisdiction-specific legal frameworks must be supported, ensuring that tokens qualify as regulated securities where necessary. Automated reporting capabilities for regulators and tax authorities further reduce operational risk and streamline compliance workflows.

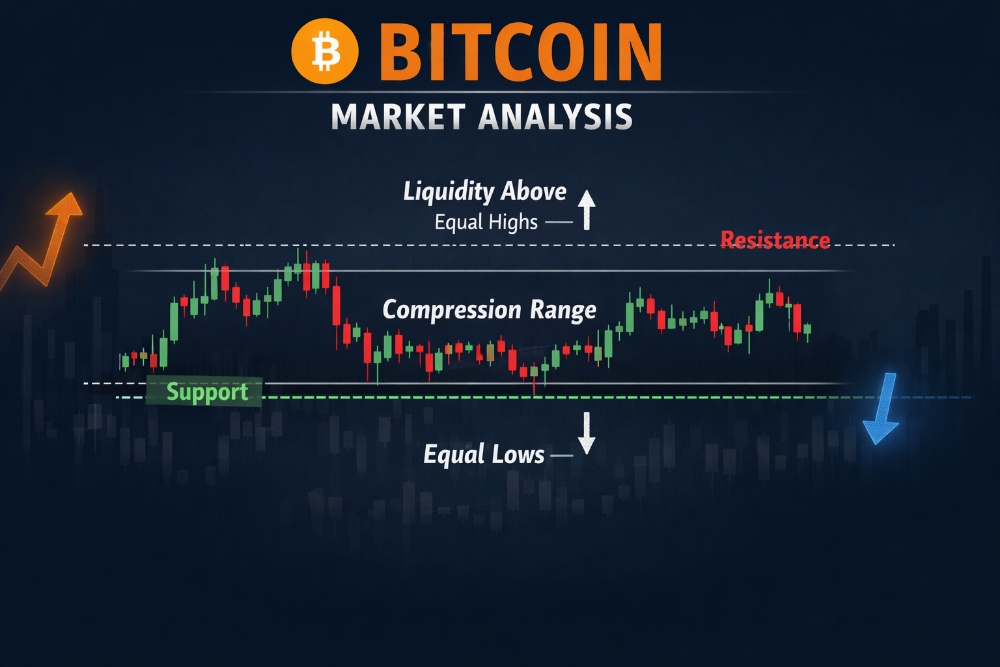

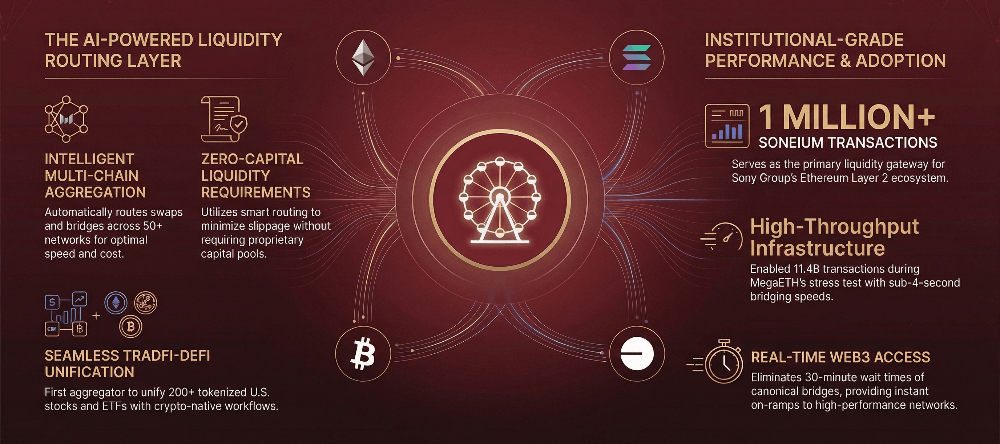

3. Secondary Market Integration

Liquidity drives investor confidence in tokenized assets. White label platforms should offer built-in secondary trading modules or seamless integration with regulated exchanges. Real-time order books, bid-ask spreads, trading dashboards, and blockchain-based settlement and reconciliation enhance market transparency and make trading tokenized assets efficient and reliable.

4. Asset Management Dashboard

An intuitive dashboard is vital for transparency and investor trust. Features include asset performance tracking, occupancy rates for real estate, cash flow analytics, token holder data, and transaction history. Automated reporting tools allow investors and stakeholders to monitor their holdings easily, supporting informed decision-making.

5. Security and Custody

Security is paramount for protecting digital assets. Platforms should implement multi-signature wallets, cold storage options, and end-to-end encryption for sensitive data. Regular smart contract audits, penetration testing, and platform vulnerability assessments help safeguard tokenized assets and maintain system integrity.

6. Integration with Payment Systems

Efficient movement of capital is critical to the tokenization process. Platforms should support fiat on-ramps, stablecoin transactions, and integration with traditional bank payment rails. Automation of dividend payouts, redemption proceeds, and other financial flows enhances operational efficiency and ensures investors receive timely returns.

Steps to Develop a White Label RWA Tokenization Platform

Developing a white label RWA tokenization platform requires strategic planning, robust technical execution, and adherence to regulatory frameworks. The following steps provide a structured roadmap to ensure a successful launch:

1. Market and Regulatory Research

Before initiating platform development, organizations must conduct comprehensive research. This includes identifying target asset classes, such as real estate, commodities, or infrastructure projects, and evaluating investor segments, including retail, accredited, and institutional participants. Jurisdiction-specific regulatory analysis is critical, covering token issuance laws, securities regulations, and reporting requirements. Insights from this research guide platform architecture, compliance modules, and tokenomics design, ensuring alignment with market demand and legal obligations.

2. Selecting the White Label Provider

Organizations can choose between partnering with an established white label provider or acquiring a modular platform that allows integration with custom services like legal advisors, custodians, and secondary market partners. Key selection criteria include platform security, scalability, regulatory compliance, ease of customization, and the provider’s track record. Choosing the right partner accelerates deployment while mitigating technical and operational risks.

3. Designing Token Economics (Tokenomics)

Tokenomics defines how value is captured and distributed within the platform. This includes determining fractional ownership percentages, token supply, and revenue-sharing or dividend models. Governance structures, such as voting mechanisms for asset-related decisions, should also be integrated. Ensuring compliance with securities regulations is critical to prevent legal challenges and enable seamless investor participation.

4. Platform Customization and Branding

White label platforms offer the flexibility to customize the user interface, dashboards, and overall branding to align with the organization’s identity. Features for investors, asset managers, and administrators can be tailored, including communication channels for notifications, reports, and automated alerts. Customization enhances user experience while leveraging pre-built backend infrastructure, reducing development time and cost.

5. Smart Contract Development and Audit

Smart contracts automate critical platform functions such as token issuance, transfers, dividend distribution, and compliance verification for investor eligibility. They also facilitate secondary market transactions and liquidity provisioning. Conducting professional audits ensures the smart contracts are secure, reliable, and free from vulnerabilities, protecting both the platform and its investors.

6. Integrating Payment and Custody Solutions

Efficient financial operations require seamless integration with fiat and crypto payment gateways, enabling smooth capital inflows. Institutional-grade custody solutions safeguard digital tokens, while automated accounting systems provide transparent reporting for investors and regulatory authorities. These integrations improve operational efficiency and investor trust.

7. Secondary Market Enablement

Liquidity is a critical component of tokenized assets. Platforms should support internal peer-to-peer trading modules and integrate with regulated exchanges that support security tokens. Automated settlement and reconciliation ensure timely transaction processing and boost investor confidence, encouraging broader participation in the platform.

8. Launch and Investor Onboarding

A phased rollout ensures smooth adoption. Early-stage pilots can test token issuance processes with initial investors. Comprehensive KYC/AML verification, combined with educational resources for new investors, ensures regulatory compliance and promotes user confidence. Gradual onboarding helps identify issues early and refine operational workflows before a full-scale launch.

9. Monitoring, Reporting, and Iterative Improvement

Post-launch, continuous monitoring of platform performance, liquidity metrics, and investor activity is essential. Automated reporting tools generate regulatory reports and investor dashboards, while feedback collection informs iterative improvements in UI design, tokenomics, and operational processes. Regular updates and enhancements ensure the platform remains competitive and scalable for future growth.

Applications Across Asset Classes

Residential Properties

Tokenizing residential assets, such as multi-family apartments or housing developments, allows developers to raise capital efficiently. Investors gain fractional ownership and rental income, while developers benefit from immediate capital injection and liquidity management.

Commercial Properties

For office buildings, retail centers, and industrial complexes, tokenization attracts diverse capital, including institutional investors. Secondary market trading allows investors to rebalance portfolios, while developers can fund expansions, renovations, or new acquisitions.

Alternative Assets

White label RWA platforms can tokenize assets beyond real estate:

- Commodities like gold, oil, or agricultural produce.

- Private equity or venture capital fund stakes.

- Infrastructure assets such as renewable energy projects or transport facilities.

This flexibility enables organizations to broaden investor reach and enhance capital formation across multiple asset classes.

Challenges in White Label RWA Tokenization Platform Development

While white label platforms offer many advantages, several challenges exist:

- Regulatory Complexity: Navigating securities laws across jurisdictions can be challenging, requiring ongoing legal consultation.

- Cybersecurity Risks: Platforms must safeguard digital assets and sensitive investor data from hacks or fraud.

- Market Liquidity: Secondary markets for tokenized RWAs are still developing, requiring strategic partnerships for liquidity.

- Investor Education: Educating investors on tokenized assets, blockchain mechanics, and platform usage is essential for adoption.

- Integration Complexity: Incorporating payment, custody, and compliance modules requires careful architecture and testing.

Best Practices for Successful Development

- Regulatory Alignment: Ensure the platform complies with relevant securities laws and investor protection standards.

- Scalability: Design architecture to accommodate multiple asset classes and increasing investor numbers.

- Security First: Prioritize smart contract audits, encryption, and multi-layered custody solutions.

- User Experience: Build intuitive interfaces and dashboards for both investors and asset managers.

- Partnerships: Collaborate with banks, custodians, legal firms, and secondary exchanges to ensure smooth operations.

- Ongoing Education: Provide tutorials, webinars, and documentation to increase investor confidence and engagement.

The Future of White Label RWA Tokenization Platforms

By 2026, white label RWA tokenization platforms are expected to become mainstream in real estate, commodities, and alternative investment markets. Key trends include:

- Institutional Adoption: Banks, insurance companies, and pension funds increasingly deploy capital through tokenized RWAs.

- Interoperability: Platforms will support cross-chain tokenization and integrate with global decentralized finance (DeFi) ecosystems.

- Automated Compliance: AI and smart contract automation will ensure continuous KYC/AML checks and regulatory reporting.

- Enhanced Liquidity: Secondary market adoption and token exchange integration will provide more liquid investment opportunities for token holders.

- Fractionalization of Complex Assets: Infrastructure projects, renewable energy assets, and private equity funds will become tokenizable, expanding investment access globally.

Conclusion

A white label RWA tokenization platform represents a transformative tool for capital formation in residential, commercial, and alternative asset markets. By combining blockchain technology, smart contracts, and regulatory compliance, organizations can efficiently tokenize assets, attract a broad range of investors, and provide liquidity previously unavailable in traditional real estate or alternative investment markets.

The benefits of such platforms extend beyond developers and investors. They foster transparency, reduce transaction friction, democratize access to high-value assets, and enable efficient cross-border capital flows. By carefully selecting a white label provider, designing robust tokenomics, and ensuring regulatory compliance, organizations can unlock the full potential of RWA tokenization while positioning themselves at the forefront of a rapidly evolving digital finance landscape.

![[LIVE] BULB Ambassador Program: Empowering the Future of Web3 Creators](https://cdn.bulbapp.io/frontend/images/952f29cd-a8d5-47aa-8e9f-78a1255f8675/1)