How Digital Incentives Are Reshaping Value in the Modern Economy

For centuries, finance has been built around institutions. Banks controlled access to money. Governments issued currency. Financial markets allocated capital. Participation depended on geography, documentation, and approval. While this system enabled global trade and economic expansion, it also concentrated power and limited access.

The digital age introduced a new layer to this structure. Information became decentralized. Communication became instant. Yet money remained largely centralized.

Cryptocurrency changed that.

Blockchain technology introduced decentralized systems of trust. Digital assets emerged that could move globally without intermediaries. And alongside these innovations came a new concept: tokenized participation.

The BULB Token sits at the intersection of finance, cryptocurrency, and social contribution. It represents more than a digital reward. It reflects a broader transformation in how value is created, distributed, and recognized online.

This article explores the relationship between BULB Token, modern finance, and cryptocurrency—and what this convergence means for the future of digital economies.

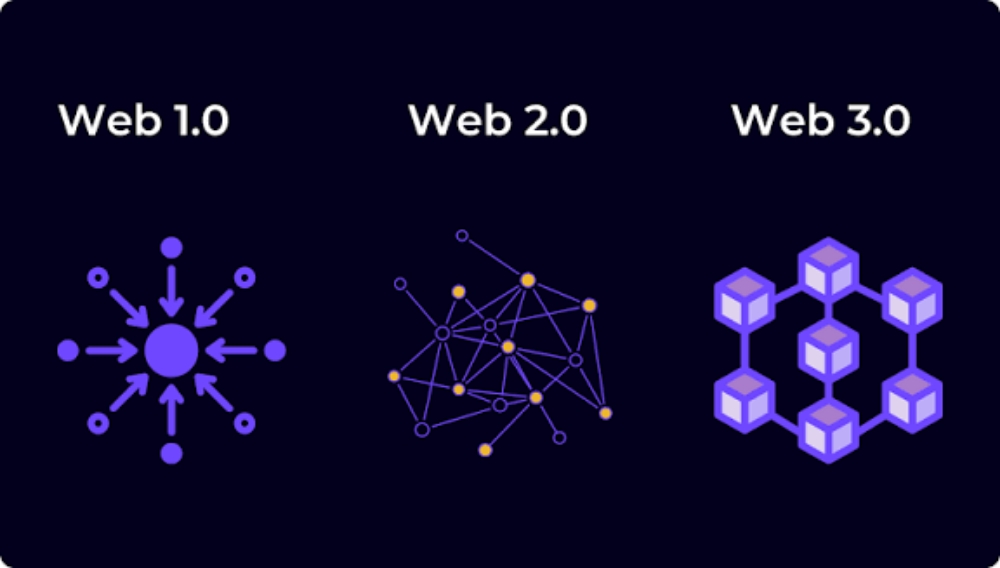

The Evolution of Finance: From Institutions to Code

Traditional finance developed around trust in centralized authorities. Banks safeguarded deposits. Payment networks processed transactions. Governments stabilized currencies. This structure worked because people trusted institutions to manage risk and maintain order.

But centralized systems have limitations.

Access can be restricted. Fees can be high. Processes can be slow. Decision-making is often opaque. Billions of people worldwide remain underbanked or excluded from full financial participation.

The internet exposed these inefficiencies. If information could travel instantly across borders, why couldn’t value?

Blockchain emerged as a response.

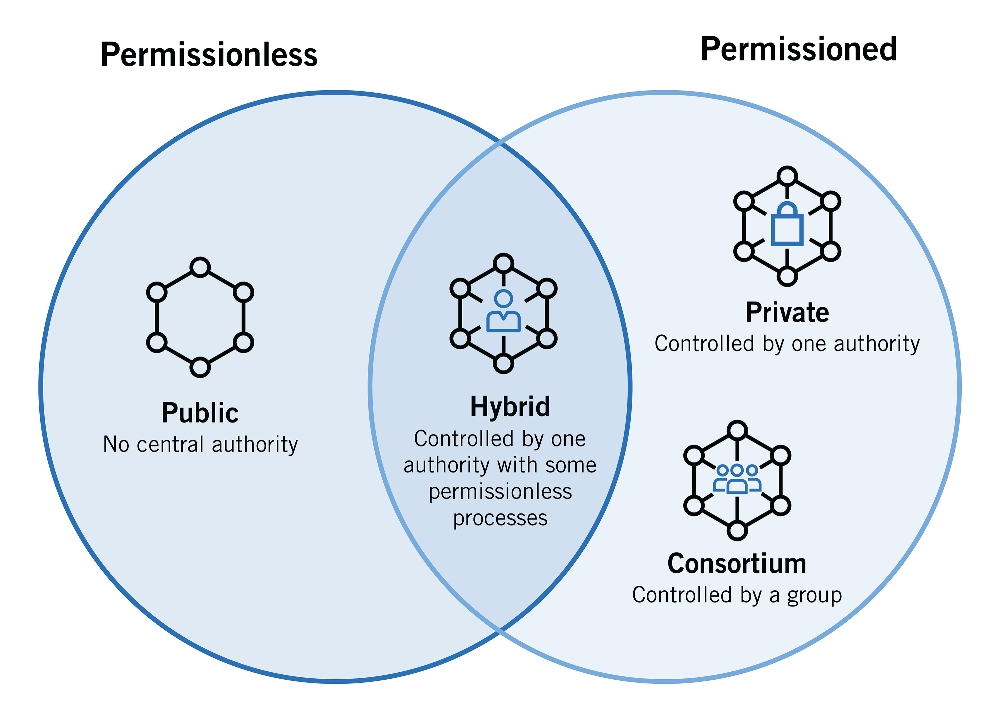

Blockchain: A New Infrastructure for Trust

At its core, blockchain is a distributed ledger system. Instead of relying on one authority to verify transactions, multiple participants maintain a shared record. Consensus mechanisms ensure agreement across the network.

This introduces three fundamental characteristics:

- Decentralization – No single entity controls the ledger.

- Transparency – Transactions are publicly verifiable.

- Immutability – Once recorded, data cannot easily be altered.

These features allow trust to be embedded in code rather than institutions.

Finance, for the first time, could operate without centralized gatekeepers.

Cryptocurrency: Digital Value Without Permission

Cryptocurrency is the most visible application of blockchain. It represents digital assets secured by cryptography and governed by decentralized networks.

Unlike traditional currency, cryptocurrency does not require banks to validate transactions. Ownership is defined by private keys. Transfers occur peer-to-peer.

This changes the concept of money.

Cryptocurrency is:

- Borderless

- Programmable

- Globally accessible

- Resistant to censorship

It transforms money from a physical or bank-controlled instrument into a digital, self-custodied asset.

The Rise of Token Economies

Beyond major cryptocurrencies, blockchain introduced the idea of tokens—digital units of value designed for specific ecosystems.

Tokens can represent:

- Governance rights

- Access to services

- Participation rewards

- Community incentives

- Utility within platforms

This gave birth to token economies—systems where contribution, engagement, and participation can be measured and rewarded.

Instead of value flowing exclusively to shareholders, token models distribute incentives among users.

This is where BULB Token becomes significant.

What Is BULB Token?

BULB Token functions as a digital incentive within a Web3-based ecosystem centered on writing, social participation, and engagement.

Unlike traditional social platforms where users create value without compensation, the BULB model introduces a reward mechanism tied to activity and contribution.

Participation becomes measurable.

Writing, engaging, reading, and interacting are no longer invisible forms of labor. They can be recognized through token distribution.

This represents a shift in how social platforms relate to their communities.

Social Media and the Attention Economy

Traditional social media platforms monetize attention through advertising. Users generate content and engagement, while platforms capture revenue.

In this model:

- Users create value.

- Platforms monetize value.

- Compensation rarely flows back proportionally.

This structure defines the “attention economy.” Time and engagement become commodities, but rewards are concentrated at the top.

Tokenized ecosystems challenge this dynamic.

Instead of extracting value from attention, platforms like BULB experiment with redistributing it.

BULB Token as a Financial Micro-Incentive

In finance, incentives shape behavior. Interest rates influence saving. Dividends influence investment. Rewards influence participation.

BULB Token acts as a micro-incentive within its ecosystem.

When users contribute:

- They may earn tokens.

- Their activity gains measurable weight.

- Participation carries economic significance.

Even modest rewards can change psychology. Contribution feels acknowledged. Effort feels recognized.

This aligns financial principles with social interaction.

Finance Meets Community

Traditional finance is transaction-based. Token ecosystems introduce participation-based finance.

In a tokenized model:

- Communities generate value collectively.

- Participants share in ecosystem growth.

- Incentives encourage long-term engagement.

This creates a hybrid structure—part social platform, part micro-economy.

BULB Token exists within this evolving model.

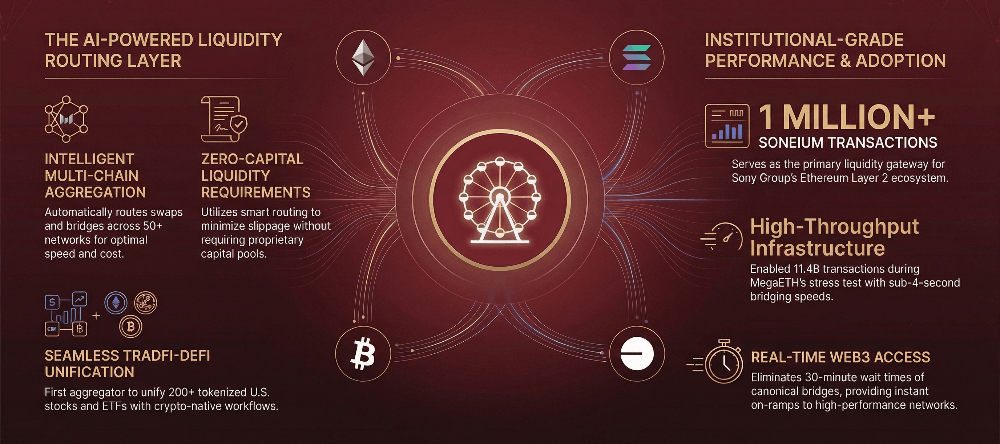

The Broader Cryptocurrency Context

BULB Token operates within the larger cryptocurrency landscape.

Cryptocurrency provides:

- The infrastructure for digital ownership.

- The ability to transfer value without intermediaries.

- Transparency in distribution.

- Security through cryptography.

Without blockchain, token-based social incentives would not be possible.

Thus, BULB Token is not isolated. It is part of a broader financial transformation powered by decentralized networks.

Ownership and Self-Custody

One of cryptocurrency’s most powerful principles is self-custody. Individuals can control assets directly through digital wallets.

In token ecosystems, this means:

- Users hold tokens personally.

- Assets are not confined to centralized databases.

- Value is portable across compatible systems.

Ownership shifts from platform-controlled balances to user-controlled assets.

This is a major philosophical departure from traditional digital accounts.

Transparency and Trust

In centralized platforms, reward algorithms can change without notice. Distribution rules may be unclear.

Blockchain-based tokens introduce greater transparency. Supply, transactions, and distribution can be verified.

Trust becomes data-driven rather than promise-based.

For finance, this represents a meaningful evolution.

---

Economic Alignment

One of the strongest advantages of tokenized ecosystems is alignment.

When participants hold tokens:

- They have an incentive to support platform growth.

- Engagement becomes mutually beneficial.

- Community success aligns with individual benefit.

This differs from ad-based models where user growth benefits primarily corporate revenue.

Alignment strengthens community resilience.

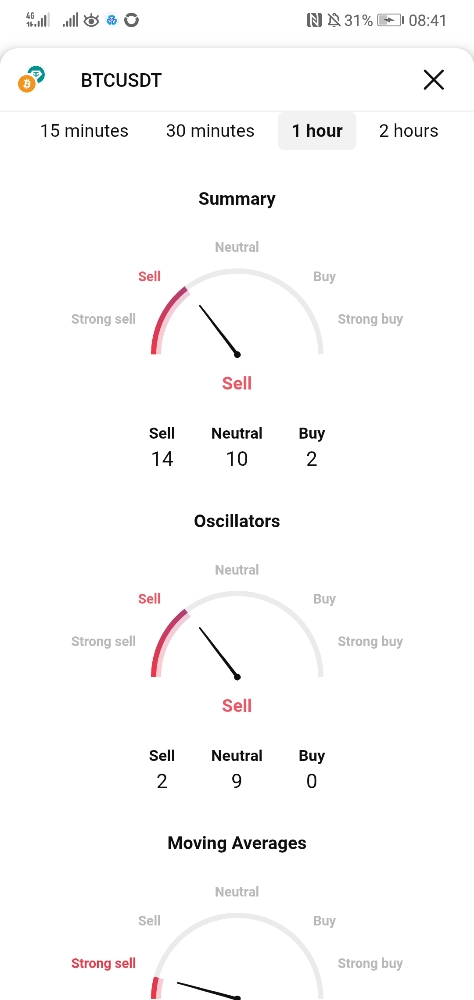

Risks and Volatility

No discussion of cryptocurrency and tokens is complete without acknowledging risk.

Digital tokens can experience volatility. Market sentiment can fluctuate. Regulatory frameworks are evolving.

For users, understanding risk is essential.

Tokens should be viewed as participation tools within ecosystems—not guaranteed financial instruments.

Responsible engagement matters.

Regulatory Considerations

As token economies expand, regulatory attention increases.

Governments aim to:

- Protect consumers

- Prevent fraud

- Maintain financial stability

Clear regulation can strengthen legitimacy. Overregulation can hinder innovation.

The future of tokenized finance will depend on balanced oversight.

Psychological Impact of Token Rewards

Finance is not only economic—it is psychological.

When users receive tokens for contribution:

- Motivation increases.

- Engagement becomes intentional.

- Effort feels validated.

This changes how people perceive digital platforms.

Time spent online no longer feels purely consumptive. It can feel productive.

Long-Term Sustainability

For token ecosystems to succeed, sustainability is critical.

Questions include:

- How are tokens distributed?

- What drives demand?

- How is long-term value maintained?

Sustainable tokenomics require balance between reward and scarcity.

Platforms experimenting with token incentives must continuously refine models to maintain equilibrium.

The Convergence of Finance and Social Platforms

The integration of BULB Token into a social ecosystem illustrates a broader convergence.

Finance is no longer confined to banks. It is embedding itself into digital platforms.

Social interaction and economic participation are blending.

This convergence may define the next phase of the internet.

From Centralized Extraction to Participatory Value

Traditional digital platforms extract value from attention. Token ecosystems experiment with participatory distribution.

The difference is subtle but powerful.

Instead of:

“You create, we monetize.”

The model shifts toward:

“You contribute, we grow together.”

This does not eliminate profit. It redistributes incentives.

The Future of Digital Finance

Blockchain, cryptocurrency, and token systems represent an evolving layer of digital finance.

They introduce:

- Decentralized ownership

- Programmable incentives

- Global accessibility

- Transparent distribution

BULB Token is one expression of these principles within a social context.

As technology matures, more platforms may adopt similar models.

Challenges Ahead

Despite promise, challenges remain:

- User education

- Security awareness

- Platform scalability

- Regulatory clarity

- Market stability

Success depends not only on technology but on responsible implementation.

A System in Transition

Finance is undergoing transformation. It is becoming more digital, more decentralized, and more participatory.

Blockchain provides infrastructure. Cryptocurrency provides value transfer. Tokens like BULB introduce incentive alignment within communities.

This is not a replacement of traditional finance overnight. It is an expansion of possibility.

The financial world is diversifying.

Conclusion: Value in the Age of Participation

BULB Token, finance, and cryptocurrency together illustrate a broader shift in economic thinking.

Value is no longer confined to institutions. It can be generated and shared within communities. Participation can carry measurable weight. Digital ecosystems can operate as micro-economies.

Blockchain redefines trust. Cryptocurrency redefines money. Token systems redefine participation.

The internet is evolving from a network of information to a network of value.

And in this evolving landscape, platforms that align incentives, reward contribution, and build transparent systems may define the next chapter of digital finance.

Thank you for taking the time to read.

![[LIVE] BULB Ambassador Program: Empowering the Future of Web3 Creators](https://cdn.bulbapp.io/frontend/images/952f29cd-a8d5-47aa-8e9f-78a1255f8675/1)