The Infrastructure Layer Web3 Needs: How WheelX Is Redefining Cross-Chain Liquidity

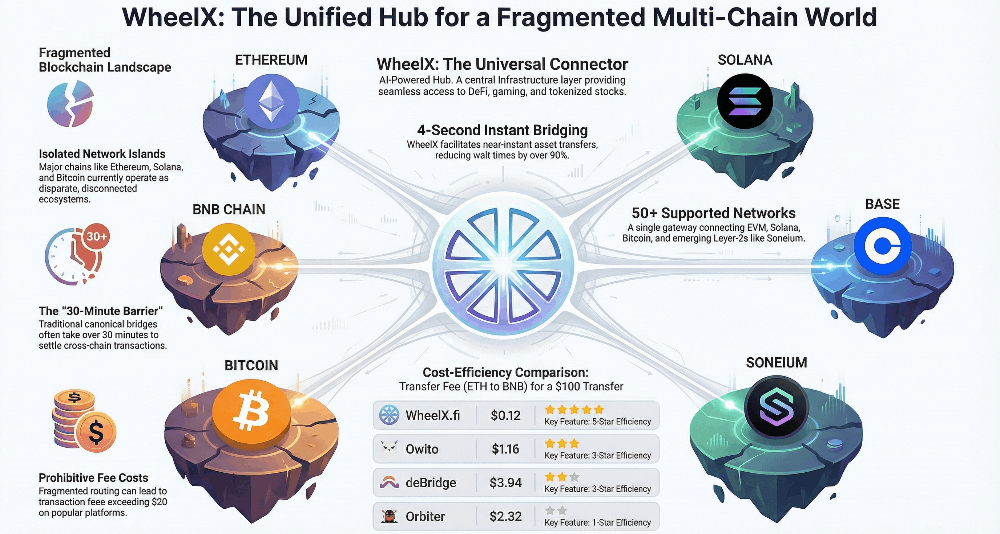

The current trajectory of decentralized finance (DeFi) is moving toward an increasingly heterogeneous landscape. While the proliferation of Layer 1 (L1) and Layer 2 (L2) solutions has solved many initial scalability concerns, it has inadvertently introduced a new set of structural challenges: liquidity fragmentation and user experience (UX) friction. As capital settles into isolated silos, the need for a high-performance cross-chain crypto bridge and routing layer has never been more critical.

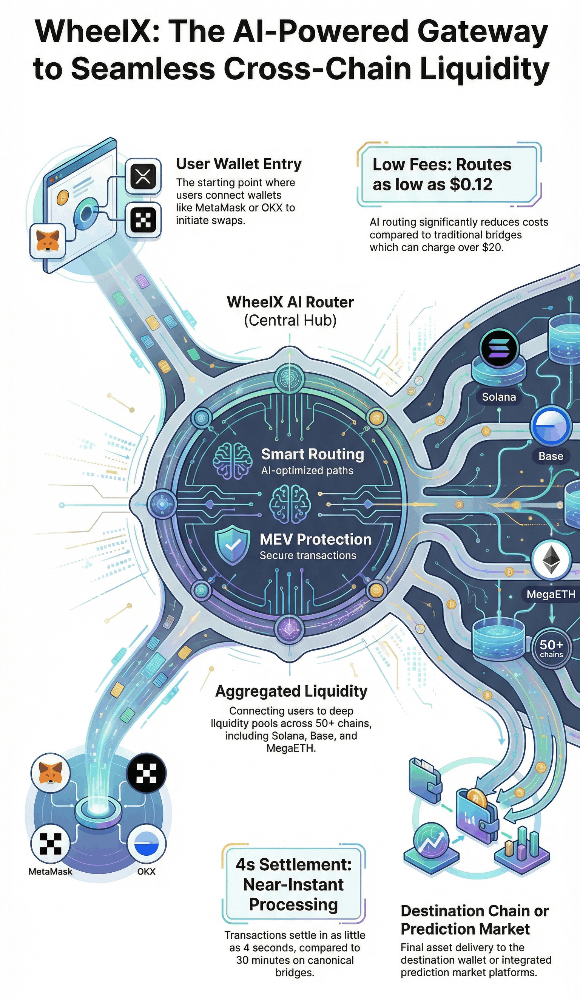

@WheelX_fi has emerged as a fundamental piece of this infrastructure, functioning not merely as a bridge, but as an AI-powered liquidity router designed to unify the fragmented Web3 ecosystem.

By providing a seamless gateway across 50+ blockchains, WheelX addresses the core bottlenecks preventing the next wave of mass adoption.

1. Problem: The Fragmented State of Web3

The Web3 ecosystem is currently suffering from extreme liquidity fragmentation. Capital that should be fluid instead trapped within specific ecosystems, often requiring users to navigate a labyrinth of technical hurdles to move assets from one chain to another. This fragmentation leads to several systemic inefficiencies:

• Prohibitive Costs: Traditional bridging solutions often involve high bridge fees, sometimes ranging from $1 to over $20 per transaction depending on the network and route.

• Latency in Settlement: Many canonical bridges require significant wait times often 30 minutes or more to achieve finality, which is unacceptable for real-time applications.

• UX Friction: Moving capital frequently requires multiple steps, manual routing, and interactions with unfamiliar interfaces, leading to significant user drop-off.

• Security Vulnerabilities: Historically, bridges have been the "weakest link" in Web3, with architectural flaws leading to some of the largest exploits in the industry's history.

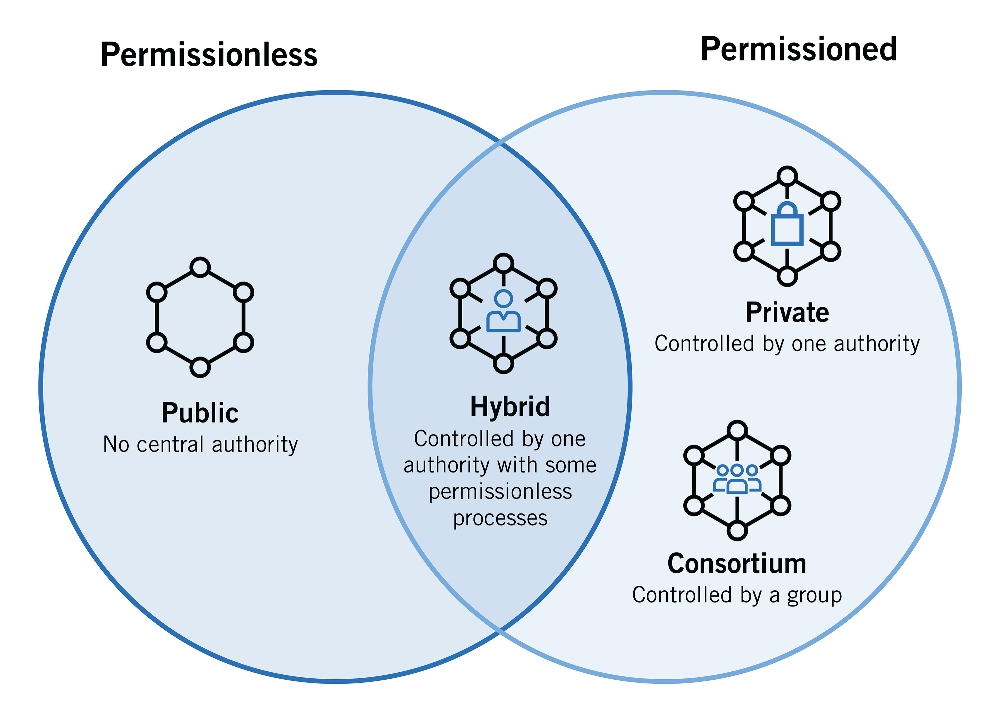

2. Why Cross-Chain Infrastructure Is the Real Bottleneck

We are currently witnessing a "Cambrian explosion" of 50+ L1/L2 ecosystems, ranging from Ethereum mainnet and high-throughput chains like MegaETH to specialized consumer-facing networks like Soneium. While this diversity encourages innovation, it creates a macro-level infrastructure issue where multi-chain interoperability becomes the primary bottleneck for scalability.

When users are forced to manage assets across dozens of isolated environments, the psychological and technical burden results in stagnant capital. Developers are also affected, as they must choose between building for a single liquid ecosystem or navigating the complexity of deploying across multiple chains. For Web3 to scale to a billion users, the movement of capital must be as invisible and effortless as the movement of data in Web2.

3. Introducing WheelX: The High-Performance Liquidity Router

WheelX is a high-performance bridge and swap aggregator that enables users to trade any token across 50+ chains with minimal friction. It is positioned as an AI-powered liquidity router rather than a simple asset transfer tool.

Key pillars of the WheelX infrastructure include:

• Extensive Chain Coverage: Support for 50+ chains (some metrics indicating 60+), including Bitcoin, EVM-compatible chains, and Solana.

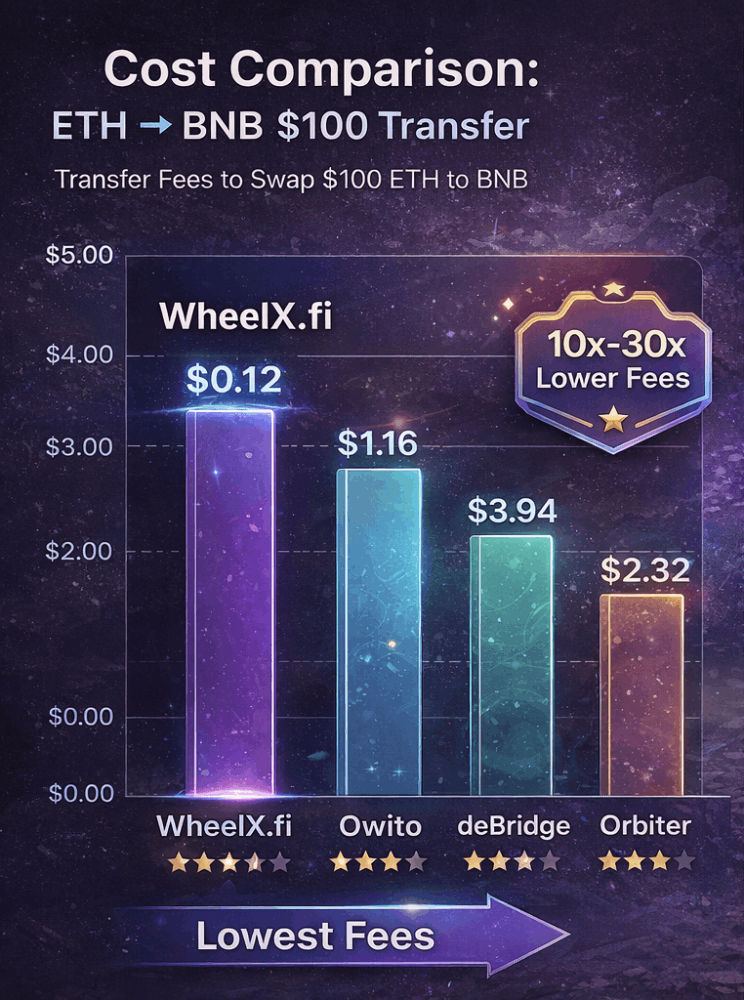

• Optimized Fee Structure: WheelX focuses on providing a low-fee crypto bridge experience, with some routes costing as little as $0.12, representing a 10x-15x reduction compared to certain competitors.

• Unrivaled Speed: In recent stress tests, WheelX demonstrated its ability to settle cross-chain transactions in as little as 4 seconds, providing near-instant access to emerging ecosystems.

• Routing Efficiency: By leveraging AI algorithms, the platform identifies the most efficient trade execution paths, abstracting the complexity of liquidity sourcing from the end user.

4. Technical Breakdown: AI-Powered Aggregation and Security

To maintain its status as a leading crypto swap platform, WheelX utilizes a sophisticated technical stack focused on optimization and safety.

Conceptual Bridging & Swap Routing

WheelX does not rely on a single liquidity source. Instead, it aggregates liquidity from over 50 DEXs and 30+ DApps, ensuring that users always receive the most competitive pricing. Its AI-powered aggregation algorithms analyze transaction routes in real-time, factoring in slippage tolerance, gas costs, and execution speed to deliver an optimal result.

Liquidity Sourcing

The architecture is designed to minimize capital requirements through smart routing. By acting as an aggregator layer, WheelX taps into existing liquidity pools across the multi-chain landscape, effectively "unifying" these pools into a single interface for the user.

Settlement and Performance

The platform's performance was recently validated during the MegaETH stress test, where it processed thousands of transactions as a primary gateway. While canonical bridges remained a bottleneck due to 30-minute settlement times, WheelX provided instant on-ramps, enabling real-time DeFi swaps and gaming interactions.

Security Considerations

Security is a non-negotiable aspect of the WheelX trust model. The platform utilizes non-custodial wallet support, ensuring users maintain full control over their funds throughout the transaction lifecycle. Additionally, WheelX incorporates robust mechanisms such as MEV protection and dynamic risk control to mitigate common on-chain threats. The platform’s smart contracts have undergone rigorous third-party audits to ensure infrastructure-level integrity.

5. Ecosystem Synergy: Integrated Prediction Market Support

Active participants in the Web3 prediction market space require high capital efficiency and low-latency movement of funds. WheelX serves as a critical infrastructure layer for these users by allowing them to bridge and swap directly into specialized wallets or prediction-native environments.

By reducing the steps required to move capital from a source chain (like Base or BNB) to a destination where a market is live, WheelX minimizes "opportunity cost" friction. For active traders, the ability to reallocate capital in seconds rather than minutes can be the difference between capturing a market move or missing it entirely. This synergy turns WheelX into the underlying engine for sophisticated on-chain market participants who require instant liquidity.

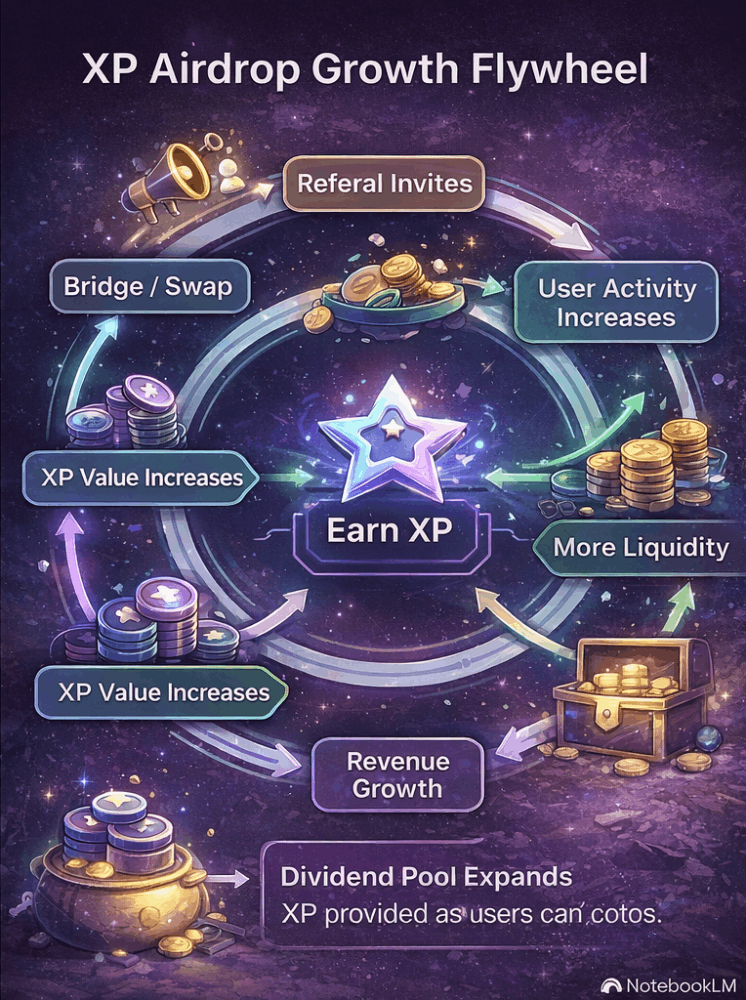

6. The Growth Engine: Behavioral Incentive Design & XP System

WheelX has implemented a sophisticated XP airdrop incentive system designed to align user behavior with long-term protocol health. This is not a typical promotional campaign; it is a behavioral incentive engine that rewards genuine on-chain activity.

XP Earning Mechanics

Users accumulate XP through a variety of high-value actions:

• Bridging and Swapping: Each successful transaction generates XP based on volume and frequency.

• Smart Contract Deployment: To encourage builder activity, WheelX offers one-click tools to deploy smart contracts on-chain, rewarding these deeper interactions with 50 XP per deployment.

• Daily Engagement: Simple interactions like "GM check-ins" on specific networks (e.g., @soneium ) help establish consistent on-chain streaks, boosting user scores.

• Referral Rewards: A tiered referral system allows users to act as "shareholders" of the network's growth, earning commissions and XP from the activity of referred users.

Value Realization and Conversion

XP serves as an "option" for future value, allowing users to redeem accumulated points for dividends from the platform's revenue. Based on the protocol's dividend mechanisms:

• 11,000 XP roughly equates to $5 in redeemable dividends.

• 2,200,000 XP equates to a high-tier accumulation of $1,000.

This system creates a growth flywheel: as more users migrate to the platform to earn XP, liquidity increases, routing becomes more efficient, fees drop further, and the protocol's revenue grows, ultimately increasing the dividend pool for all stakeholders.

7. Competitive Positioning

When compared to the broader market, WheelX distinguishes itself through three core metrics:

- Fee Efficiency: While generic high-fee bridges charge 3−20 for a 100Ethereum−to−BNBswap,WheelXhasdemonstratedtheabilitytoexecutethesametransactionforaslittleas∗∗0.12**.

- Breadth of Coverage: Many routers are limited to a handful of EVM chains. WheelX's support for 50+ networks, including non-EVM environments like Solana and Bitcoin, provides a far more comprehensive solution.

- Speed and UX: By focusing on "instant" 4-second settlement and a "one-click" interface for complex actions like contract deployment and portfolio tracking, WheelX removes the UX barriers that plague fragmented swap aggregators.

8. Macro Narrative: The Multi-Chain Future

The long-term success of Web3 depends on the "invisibilization" of the underlying infrastructure. We are moving toward a future where users do not think about which chain they are on, but rather what application they are using. In this paradigm, liquidity routers will outperform isolated ecosystems.

Infrastructure layers that can seamlessly move capital across the entire landscape will become the most valuable real estate in the industry. WheelX is building for this future by positioning itself as the foundational layer for multi-chain interoperability. As real-world assets (RWAs) such as the 200+ tokenized U.S.stocks already supported by WheelX and continue to migrate on-chain, the demand for this specialized routing will only accelerate.

9. Conclusion: Strategic Engagement

The fragmentation of Web3 is a solvable problem, but it requires a shift from isolated bridging to intelligent, AI-powered routing. WheelX provides the high-performance infrastructure necessary to navigate the complexity of the 50+ chain era with ultra-low fees and near-instant settlement.

For institutional traders, DeFi participants, and developers, WheelX offers a robust, audited gateway to the entire multi-chain ecosystem. By aligning user incentives with platform growth through the XP dividend system, WheelX ensures that its users are not just customers, but active stakeholders in the future of cross-chain liquidity.

Explore the high-performance routing of WheelX and optimize your cross-chain capital efficiency today.

join now -- https://wheelx.fi/r/104810

![[LIVE] BULB Ambassador Program: Empowering the Future of Web3 Creators](https://cdn.bulbapp.io/frontend/images/952f29cd-a8d5-47aa-8e9f-78a1255f8675/1)