Exploring the Impact of Central Bank Digital Currencies (CBDCs) on the Cryptocurrency Market

Exploring the Impact of Central Bank Digital Currencies (CBDCs) on the Cryptocurrency Market

A Paradigm Shift in Digital Finance

Central Bank Digital Currencies (CBDCs) have emerged as a transformative force in the realm of digital finance, promising to revolutionize the way we perceive, transact, and store value. As central banks worldwide explore the development and issuance of CBDCs, questions arise about their potential impact on the cryptocurrency market. In this article, we delve into the intricate relationship between CBDCs and cryptocurrencies, examining how the introduction of CBDCs by central banks could influence adoption, regulation, and dynamics within the cryptocurrency market.

Central Bank Digital Currencies (CBDCs) have emerged as a transformative force in the realm of digital finance, promising to revolutionize the way we perceive, transact, and store value. As central banks worldwide explore the development and issuance of CBDCs, questions arise about their potential impact on the cryptocurrency market. In this article, we delve into the intricate relationship between CBDCs and cryptocurrencies, examining how the introduction of CBDCs by central banks could influence adoption, regulation, and dynamics within the cryptocurrency market.

The Emergence of CBDCs

Central Bank Digital Currencies (CBDCs) represent digital versions of fiat currencies issued and regulated by central banks. Unlike cryptocurrencies like Bitcoin and Ethereum, which operate on decentralized blockchain networks, CBDCs are centralized and backed by the full faith and credit of the issuing central bank. CBDCs aim to leverage blockchain technology to enhance the efficiency, transparency, and accessibility of traditional fiat currencies, enabling faster payments, reducing transaction costs, and promoting financial inclusion.

Impact on Cryptocurrency Adoption

The introduction of CBDCs by central banks could have profound implications for the adoption of cryptocurrencies:

- Competition: CBDCs may compete with existing cryptocurrencies for market share, as they offer similar benefits, such as fast and low-cost transactions, while enjoying the backing and legitimacy of central banks. Cryptocurrencies may face increased competition from CBDCs, particularly in regions where trust in government-backed currencies is high and regulatory uncertainty persists.

- Coexistence: While CBDCs may compete with cryptocurrencies in some aspects, they may also coexist and complement each other in the digital economy. Cryptocurrencies offer unique features, such as decentralization, privacy, and censorship resistance, that may appeal to users seeking alternatives to traditional banking and payment systems. CBDCs and cryptocurrencies could coexist within a diverse financial ecosystem, catering to different use cases and preferences.

Impact on Regulation

The introduction of CBDCs may prompt regulators to reassess their approach to cryptocurrency regulation:

- Regulatory Clarity: The issuance of CBDCs by central banks may lead to greater regulatory clarity for cryptocurrencies, as policymakers seek to differentiate between CBDCs and decentralized cryptocurrencies. Regulators may develop clearer guidelines and frameworks for regulating cryptocurrencies, addressing concerns related to investor protection, market integrity, and financial stability.

- Regulatory Competition: The emergence of CBDCs may also spur regulatory competition among jurisdictions seeking to attract investment and innovation in the cryptocurrency market. Countries that embrace cryptocurrency-friendly regulations and foster a supportive regulatory environment may gain a competitive advantage in the global digital economy.

Impact on Market Dynamics

The introduction of CBDCs could reshape market dynamics within the cryptocurrency market:

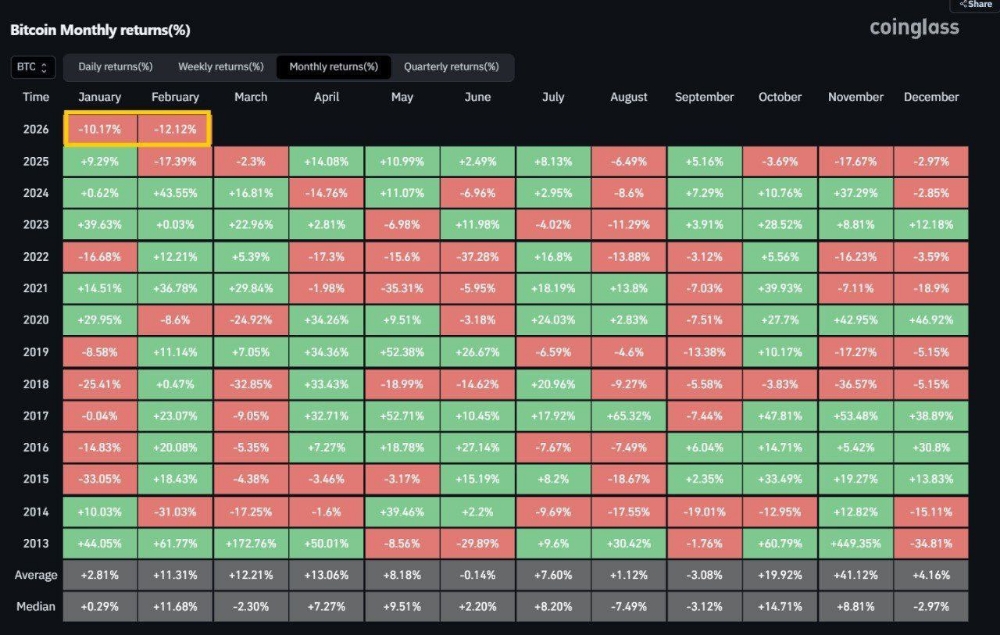

- Volatility: The issuance of CBDCs by central banks may impact the volatility of cryptocurrencies, as investors reassess their risk preferences and allocation strategies. Cryptocurrency prices may experience increased volatility in the short term as markets adjust to the introduction of CBDCs and the evolving regulatory landscape.

- Liquidity: CBDCs may affect the liquidity of cryptocurrencies, as investors diversify their holdings between traditional fiat currencies, CBDCs, and cryptocurrencies. Increased liquidity in CBDC markets could lead to enhanced price stability and reduced volatility in the cryptocurrency market, benefiting investors and market participants.

The emergence of Central Bank Digital Currencies (CBDCs) represents a paradigm shift in the realm of digital finance, with profound implications for the cryptocurrency market. As central banks worldwide explore the development and issuance of CBDCs, questions arise about their impact on cryptocurrency adoption, regulation, and market dynamics. While CBDCs may compete with cryptocurrencies in some aspects, they may also coexist and complement each other within a diverse financial ecosystem. As policymakers, regulators, and market participants navigate this evolving landscape, the interaction between CBDCs and cryptocurrencies will shape the future of digital finance and redefine the way we transact and store value in the digital age.

The emergence of Central Bank Digital Currencies (CBDCs) represents a paradigm shift in the realm of digital finance, with profound implications for the cryptocurrency market. As central banks worldwide explore the development and issuance of CBDCs, questions arise about their impact on cryptocurrency adoption, regulation, and market dynamics. While CBDCs may compete with cryptocurrencies in some aspects, they may also coexist and complement each other within a diverse financial ecosystem. As policymakers, regulators, and market participants navigate this evolving landscape, the interaction between CBDCs and cryptocurrencies will shape the future of digital finance and redefine the way we transact and store value in the digital age.

Always remember

D.Y.O.R.

Not your keys, Not your crypto!

Thank you for reading!

Find useful articles to read: HERE

![[LIVE] BULB Ambassador Program: Empowering the Future of Web3 Creators](https://cdn.bulbapp.io/frontend/images/952f29cd-a8d5-47aa-8e9f-78a1255f8675/1)