Power, Money, and the Digital Future

In every era, shifts in how money is created, controlled, and exchanged have reshaped politics and society. From the invention of coinage to the rise of central banking, financial systems have always been deeply political. Today, blockchain technology and cryptocurrency represent another major shift—one that is quietly redefining power structures, state authority, and global finance.

What makes blockchain unique is not just that it enables digital money, but that it introduces a new way of organizing trust. Instead of relying solely on governments, banks, or centralized institutions, blockchain systems use code, cryptography, and distributed networks to coordinate economic activity. This technical change has political consequences. It challenges who controls money, who sets the rules, and who benefits from the system.

This article explores the intersection of block politics, finance, and cryptocurrency—examining how decentralized technologies are influencing governance, reshaping financial power, and provoking responses from states and regulators worldwide. Rather than viewing crypto purely as an investment or speculative asset, this discussion places it within the broader struggle over economic sovereignty, transparency, and control.

1. Understanding Block Politics

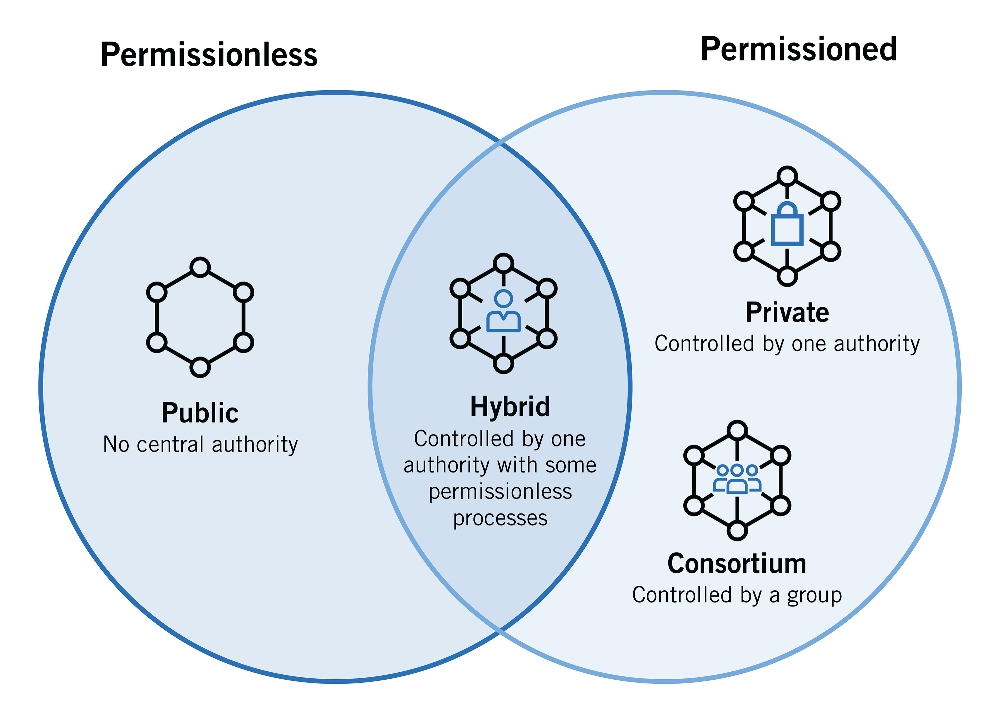

Block politics refers to the political dynamics that emerge from blockchain-based systems. Unlike traditional political structures, which are usually hierarchical and territorial, blockchain networks are distributed, borderless, and rule-based.

At its core, blockchain replaces institutional trust with procedural trust. Rules are enforced by software rather than by human intermediaries. Once deployed, these rules can be difficult to change, giving rise to new forms of governance that operate outside conventional political systems.

This has led to a form of “protocol politics,” where decisions about code design—such as transaction fees, validation methods, or upgrade mechanisms—carry political weight. Developers, validators, token holders, and users all influence outcomes, often without formal representation or accountability structures.

Block politics raises important questions:

- Who writes the code?

- Who controls upgrades?

- Who has voting power?

- How are disputes resolved?

These questions mirror traditional political debates, but they take place within technical systems rather than parliaments or courts.

2. Finance as a Political Institution

Finance has never been neutral. Banks, currencies, and markets are shaped by laws, regulations, and power relations. Governments control money supply, taxation, and monetary policy to influence economic behavior and maintain stability.

Central banks, for example, play a political role by setting interest rates, controlling inflation, and acting as lenders of last resort. These decisions affect employment, wealth distribution, and social stability. While often presented as technical or apolitical, financial governance is deeply intertwined with political priorities.

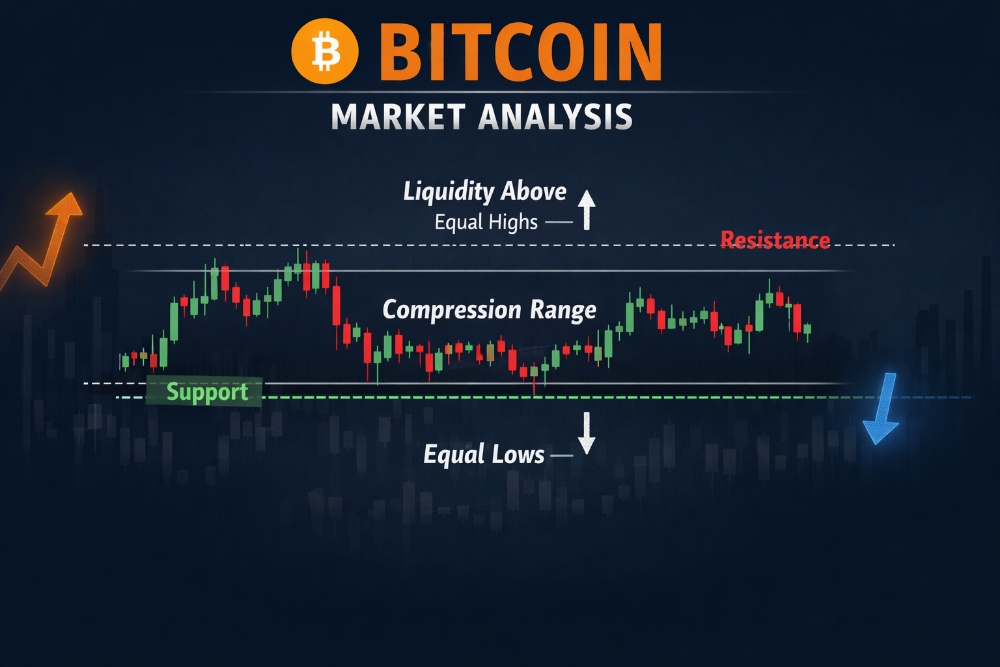

Cryptocurrency disrupts this arrangement by offering alternative financial systems that operate independently of central authorities. This challenges long-standing assumptions about state monopoly over money and raises concerns about economic control, capital flight, and regulatory effectiveness.

3. Cryptocurrency as a Political Response

Cryptocurrency did not emerge in a vacuum. Its origins are closely tied to dissatisfaction with traditional finance—especially after global financial crises exposed systemic risks, bailouts, and inequality.

For some, crypto represents resistance to centralized control. For others, it is a tool for financial inclusion, offering access to global markets without requiring permission from banks. In politically unstable or inflation-prone regions, cryptocurrencies have been used as a hedge against currency devaluation and capital controls.

This makes crypto inherently political. It embodies ideological positions about:

- Individual sovereignty

- Free markets

- Transparency

- Distrust of centralized power

At the same time, crypto adoption also creates new elites, new forms of concentration, and new power asymmetries—challenging the idea that decentralization automatically leads to fairness.

4. The State vs. Decentralization

One of the central tensions in block politics is the relationship between decentralized networks and nation-states. Governments rely on financial oversight to enforce laws, collect taxes, and combat crime. Blockchain systems, by design, reduce the need for intermediaries and can obscure traditional enforcement mechanisms.

States have responded in different ways:

- Some embrace blockchain for efficiency and transparency.

- Others regulate cryptocurrencies tightly to maintain control.

- A few attempt outright bans or restrictions.

These responses reflect deeper political priorities. Authoritarian regimes may view decentralized finance as a threat to control, while liberal democracies may focus on consumer protection and market stability.

The result is a fragmented global landscape where crypto operates in a patchwork of legal frameworks, creating uncertainty but also innovation.

5. Regulation as Political Strategy

Regulation is not just about safety—it is a political tool. How governments regulate cryptocurrency signals their stance on innovation, sovereignty, and economic openness.

Strict regulation can protect consumers but may also stifle innovation or push activity underground. Lax regulation can attract investment but increase systemic risk.

Key regulatory debates include:

- Should crypto be treated as money, property, or securities?

- How should decentralized platforms be governed?

- Who is responsible when autonomous systems fail?

These questions do not have purely technical answers. They reflect values, risk tolerance, and political ideology.

6. Blockchain and Financial Inclusion

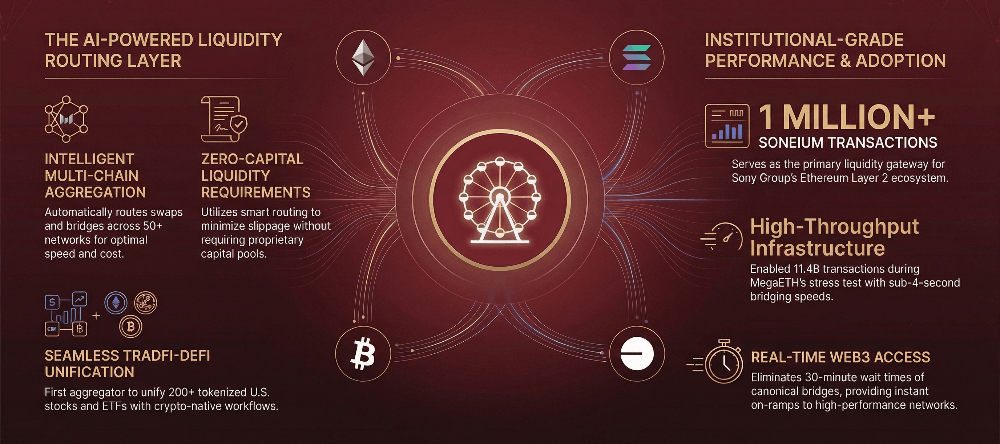

One of the most cited promises of blockchain is financial inclusion. Billions of people worldwide lack access to traditional banking, often due to documentation requirements, geographic barriers, or institutional mistrust.

Blockchain-based systems can, in theory, provide:

- Borderless payments

- Low-cost transfers

- Access to savings and credit tools

From a political perspective, this shifts power away from centralized institutions toward individuals. However, inclusion depends on infrastructure, education, and usability. Without these, blockchain risks reinforcing inequality rather than reducing it.

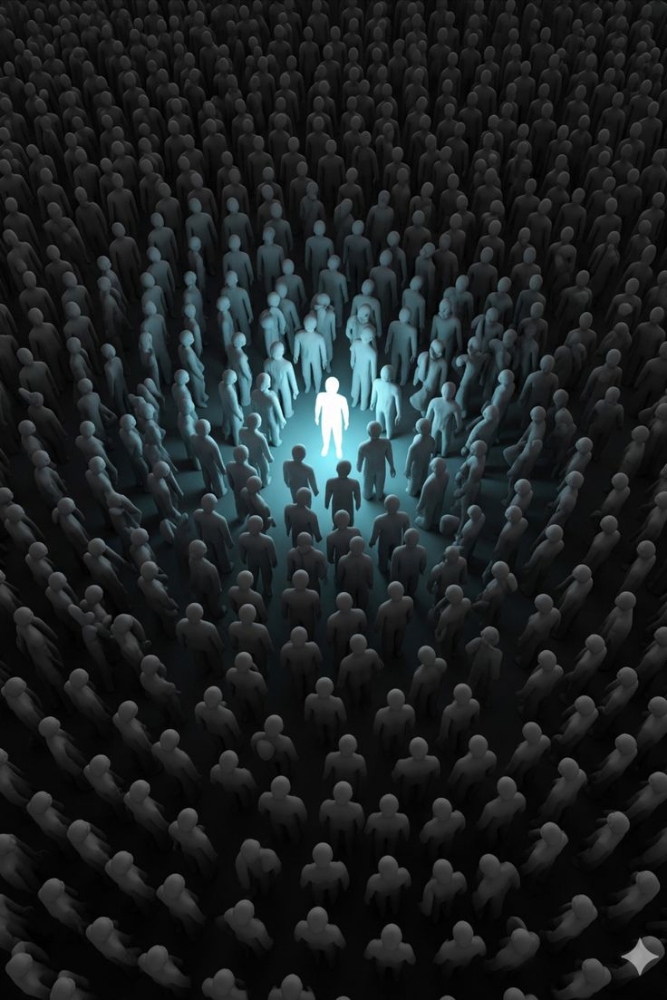

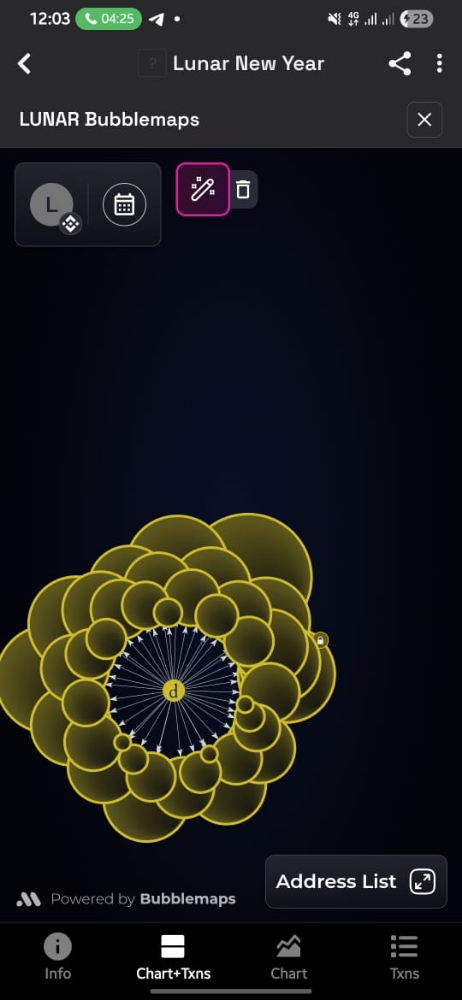

7. Power Concentration in Decentralized Systems

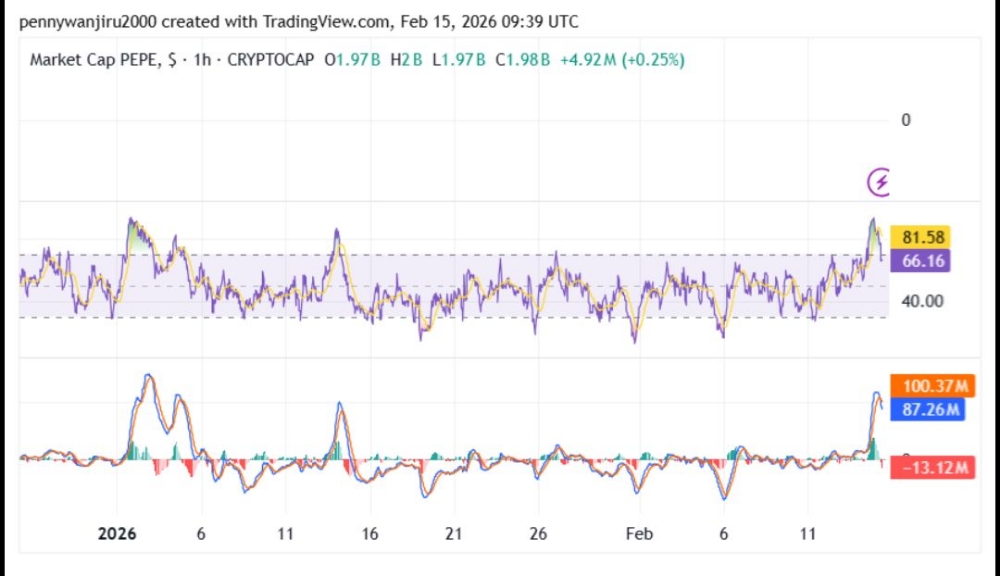

Despite its decentralized ethos, cryptocurrency ecosystems often exhibit concentration of power. Early adopters, large holders, mining pools, and major platforms can exert disproportionate influence.

This raises political concerns:

- Wealth inequality within crypto systems

- Informal governance dominated by technical elites

- Limited accountability mechanisms

Block politics must therefore grapple with the reality that decentralization is not binary. Systems can be decentralized in architecture but centralized in practice.

8. Geopolitics and Digital Currency

Cryptocurrency also plays a role in global geopolitics. Cross-border payments, sanctions enforcement, and reserve currencies are key instruments of international power.

Digital assets challenge traditional systems by enabling peer-to-peer transfers that bypass conventional financial rails. This has implications for:

- Sanctions regimes

- Capital controls

- Monetary sovereignty

In response, some states are developing digital versions of their national currencies, seeking to combine technological efficiency with political control.

9. Transparency, Surveillance, and Privacy

Blockchain systems are often described as transparent, but transparency cuts both ways. Public ledgers make transactions visible, which can enhance accountability—but also enable surveillance.

This creates political trade-offs:

- Transparency vs. privacy

- Security vs. civil liberties

- Compliance vs. autonomy

Different societies will resolve these tensions differently, reflecting broader political values.

10. The Future of Block Politics

As blockchain technology matures, block politics will become more visible and institutionalized. We are likely to see:

- New legal frameworks for decentralized systems

- Hybrid models combining state oversight with blockchain infrastructure

- Increased political debate over digital sovereignty

The key challenge will be balancing innovation with accountability, and decentralization with social responsibility.

Conclusion: More Than Technology

Blockchain and cryptocurrency are not just financial innovations—they are political technologies. They reshape how power is distributed, how rules are enforced, and how value is exchanged.

Understanding block politics means recognizing that code is not neutral, finance is not apolitical, and decentralization is not automatically democratic. The future of cryptocurrency will be shaped not only by developers and markets, but by political choices, regulatory frameworks, and social values.

As finance continues to digitize, the question is not whether blockchain will influence politics—but how societies will choose to integrate, regulate, or resist it.

The outcome of this negotiation will help define the economic and political landscape of the digital age.