How Are Crypto Campaigns Reshaping Investor Engagement in 2026?

Investor engagement is no longer transactional. It has become participatory, emotional, and strategic. Campaigns are designed not just to attract capital but to build ecosystems where investors feel included, heard, and empowered. This shift is redefining fundraising, retention, and long-term trust in ways that extend far beyond conventional financial marketing models.

From passive investors to active participants

In traditional finance, investors typically play a passive role. They purchase shares, review performance, and wait for returns. In 2026, crypto campaigns are transforming investors into active participants within project ecosystems. Token holders vote on governance proposals, contribute to community discussions, test beta products, and even co-create development roadmaps.

This active involvement creates a stronger emotional and strategic bond between investors and projects. When investors participate in decision-making processes, they develop a deeper sense of ownership. Engagement becomes a continuous relationship rather than a one-time transaction. As a result, projects benefit from stronger retention rates and more resilient communities.

Community building as the core engagement engine

Crypto campaigns in 2026 are centered around community building rather than one-directional promotion. Instead of broadcasting messages to anonymous audiences, projects cultivate dynamic ecosystems across communication platforms, private forums, and decentralized networks.

Communities are not just audiences; they are contributors. Investors share insights, mentor newcomers, and provide feedback on product features. Campaigns are structured around interactive events such as live discussions, Q&A sessions, workshops, and digital meetups. These activities create ongoing dialogue, reinforcing trust and loyalty. Community-first engagement has proven to be far more sustainable than hype-driven strategies.

Gamification transforming engagement into experience

Gamification has evolved from simple reward systems into sophisticated engagement models. In 2026, crypto campaigns integrate quests, achievement tiers, NFT rewards, staking bonuses, and community challenges to encourage ongoing participation.

By incorporating game mechanics, projects make learning and contributing enjoyable. Investors can unlock governance rights, exclusive access, or digital collectibles based on their activity levels. Gamification lowers entry barriers for newcomers while rewarding experienced participants. This approach transforms engagement into an interactive experience that strengthens long-term commitment.

Education-led campaigns replacing hype cycles

The crypto market has matured significantly, and investors in 2026 demand more than speculation. Campaigns now prioritize education over hype. Projects publish transparent tokenomics reports, host expert panels, produce explainer content, and offer structured learning programs.

Educational campaigns empower investors to make informed decisions. Instead of relying on emotional momentum, projects focus on building knowledge and understanding. This shift fosters sustainable engagement and reduces volatility-driven panic. When investors clearly understand a project's technology and roadmap, their confidence grows, and their participation becomes more meaningful.

Hybrid digital and offline activations

While crypto is inherently digital, 2026 campaigns increasingly blend online and offline experiences. Events integrate wallet-based access, token-gated entry systems, and interactive digital overlays during physical meetups.

Investors attending conferences can connect their wallets, participate in live governance polls, or receive event-exclusive NFTs. Hybrid engagement bridges the gap between virtual communities and real-world interactions. This approach humanizes blockchain ecosystems and deepens personal connections among participants.

Social proof and user-generated storytelling

Trust in 2026 is built through authenticity. User-generated content plays a central role in reshaping investor engagement. Community members produce tutorials, testimonials, strategy breakdowns, and project reviews that resonate more strongly than corporate messaging.

Campaigns actively encourage this organic storytelling. By rewarding contributors and spotlighting community achievements, projects amplify credibility. Social proof strengthens investor confidence and accelerates adoption, as potential investors often rely on peer validation before committing capital.

Token incentives as loyalty infrastructure

Tokens have evolved beyond speculative instruments. In 2026, they function as loyalty mechanisms embedded directly into engagement campaigns. Holding or staking tokens unlocks exclusive content, governance privileges, early product access, and partnership benefits.

These incentive structures create a sense of progression. Investors are motivated to deepen their involvement in order to gain additional privileges. Loyalty-driven engagement transforms token ownership into an experiential journey rather than a static investment.

AI-driven personalization in investor communication

Artificial intelligence has significantly enhanced how crypto campaigns communicate with investors. Instead of sending generic updates, projects analyze behavioral data to deliver personalized content streams tailored to individual preferences and risk profiles.

Investors receive targeted notifications about governance votes relevant to their holdings, educational materials aligned with their knowledge level, and product updates matching their interests. Personalization increases engagement efficiency and strengthens the perception that projects understand and value their community members.

Immersive technologies enhancing engagement depth

Augmented reality and virtual reality are no longer experimental tools. In 2026, immersive environments host virtual conferences, NFT exhibitions, and interactive product demos. Investors can explore digital showrooms, attend metaverse pitch sessions, and engage in simulated blockchain experiences.

These technologies make complex concepts tangible and memorable. By immersing investors in interactive environments, campaigns increase emotional connection and knowledge retention. Engagement becomes not only informative but experiential.

Influencer partnerships evolving into strategic collaboration

Influencers continue to play a significant role, but their involvement has matured. Rather than simple endorsements, respected industry figures collaborate with projects on research reports, governance discussions, and educational initiatives.

This strategic collaboration elevates campaign credibility. Investors value insights from trusted voices who actively participate in project development. Influencer partnerships in 2026 are built on alignment and transparency rather than short-term promotional gains.

Cross-ecosystem campaign integrations

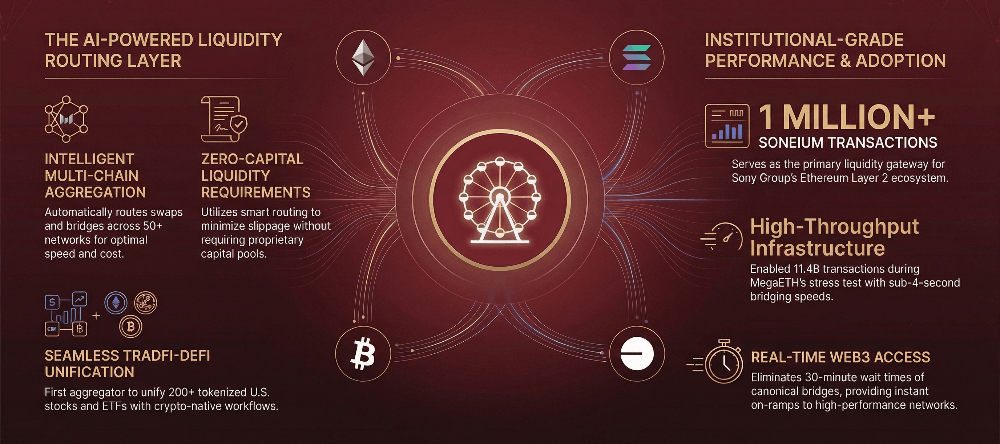

Crypto ecosystems are increasingly interconnected. Campaigns often involve strategic partnerships between DeFi platforms, NFT marketplaces, metaverse projects, and infrastructure providers.

Cross-ecosystem integrations expose investors to complementary platforms and expand engagement opportunities. When projects collaborate, they create layered value propositions that strengthen overall participation across multiple communities.

Governance engagement and transparent feedback loops

Decentralized governance has become a powerful engagement tool. Campaigns are structured around proposal discussions, voting events, and transparent reporting dashboards.

Investors who participate in governance feel empowered. Their votes shape protocol upgrades, funding allocations, and strategic decisions. This participatory model reinforces accountability and strengthens long-term trust between projects and their communities.

Crisis communication as engagement reinforcement

Volatility remains a characteristic of crypto markets. In 2026, effective campaigns prioritize transparent crisis communication during market downturns or unexpected events.

Projects provide timely updates, host live briefings, and address concerns openly. Clear communication during uncertainty prevents misinformation and reinforces investor confidence. Engagement during challenging times often determines whether communities remain resilient or fragment.

Metrics that prioritize meaningful participation

Campaign success metrics have shifted significantly. Instead of focusing solely on impressions or click-through rates, projects evaluate governance participation rates, wallet activity, community retention, and sentiment analysis.

These engagement-focused metrics provide a clearer picture of ecosystem health. Meaningful participation is now valued more highly than superficial visibility. Campaign strategies are optimized around sustainable growth rather than temporary spikes in attention.

Regulatory transparency strengthening trust

As global regulatory frameworks continue evolving, projects that proactively communicate compliance efforts gain competitive advantages. Campaigns include detailed explanations of legal structures, security audits, and risk disclosures.

Transparency reduces uncertainty and builds credibility with institutional and retail investors alike. Clear regulatory communication signals long-term commitment and responsible growth.

Ethical standards shaping campaign strategy

The industry’s maturity has brought stronger emphasis on ethics. Campaigns avoid exaggerated return promises and prioritize responsible messaging. Risk education and transparency are central components of investor communication.

Ethical engagement fosters sustainable relationships. Projects that prioritize integrity over short-term gains build reputational capital that strengthens investor loyalty over time.

Micro-communities driving deeper connections

Large communities are supplemented by smaller, interest-based groups. These micro-communities focus on specific regions, expertise levels, or functional roles within the ecosystem.

Tailored engagement within these groups leads to more meaningful participation. Investors feel recognized within their niche, increasing overall satisfaction and retention.

Frictionless onboarding expanding accessibility

Campaigns now prioritize seamless onboarding experiences. Simplified wallet integrations, guided tutorials, and intuitive user interfaces reduce technical barriers.

Lowering entry friction expands the investor base beyond experienced crypto users. Accessibility broadens engagement and encourages mainstream adoption.

Purpose-driven narratives attracting value-aligned investors

Modern investors increasingly care about sustainability, decentralization ethics, and social impact. Campaigns highlight initiatives related to environmental responsibility, community grants, and equitable governance models.

Purpose-driven narratives resonate deeply. Investors seek alignment with projects that reflect their values, strengthening emotional commitment alongside financial participation.

The evolving future of investor engagement beyond 2026

As technology continues advancing, investor engagement will become even more interactive and intelligent. Cross-chain identity systems, predictive analytics, and decentralized engagement platforms will further integrate investors into project ecosystems.

The boundary between investor and contributor will continue dissolving. Crypto campaigns will increasingly focus on building collaborative environments where financial participation is just one aspect of broader ecosystem involvement.

Conclusion

Crypto campaigns in 2026 are reshaping investor engagement by shifting the focus from transactions to relationships. Participation, education, personalization, and transparency define the new standard. Investors are no longer passive capital providers; they are collaborators, decision-makers, and advocates.

Projects that understand this transformation are building resilient communities capable of withstanding volatility and sustaining long-term growth. The future of crypto engagement is immersive, ethical, and community-driven. As the industry continues evolving, the projects that prioritize meaningful investor relationships will lead the next era of blockchain innovation.