Types of wallet and its major challenge

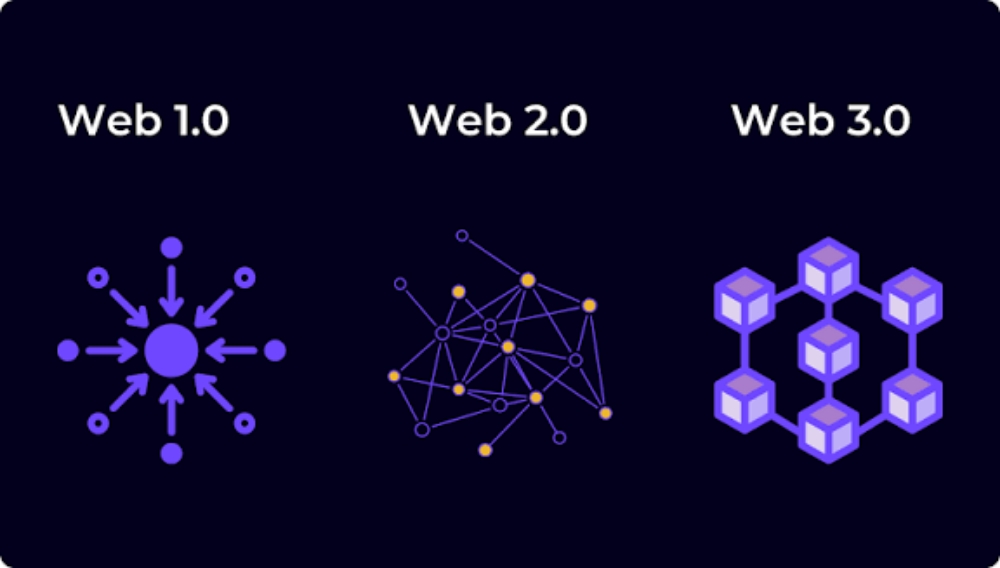

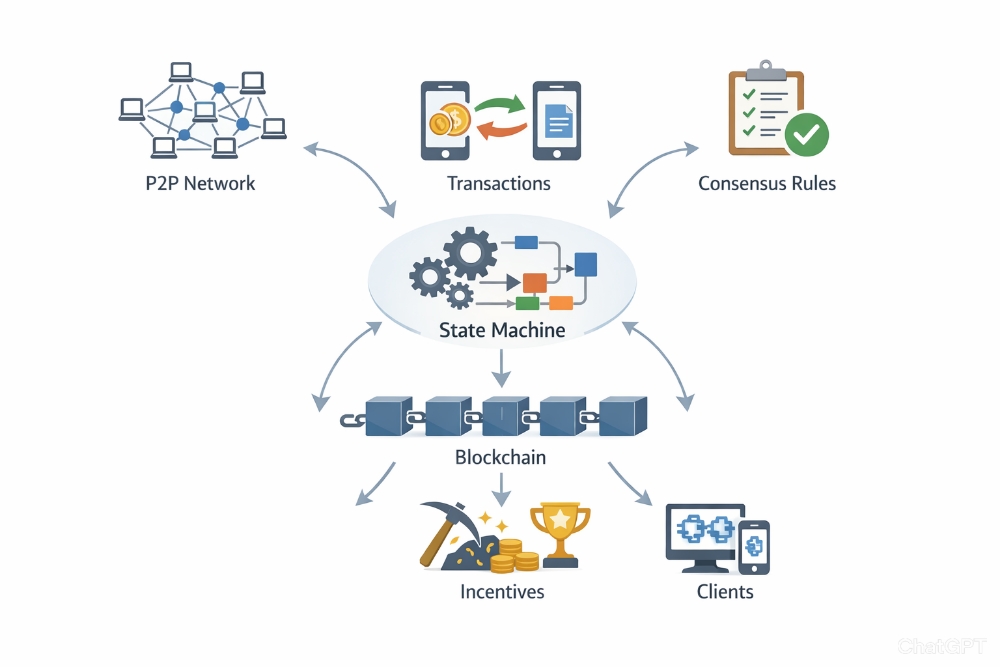

When we talk about wallets, especially in the modern digital and crypto landscape, they are generally categorized by how they store your "keys" (the digital credentials that prove you own your money) and whether they are connected to the internet.

Types of Wallets

1. Hot Wallets (Connected to the Internet)

These are the most common for everyday use. They are software-based and always online, making them very fast for transactions.

Mobile Wallets: Apps on your phone (e.g., Trust Wallet, MetaMask). Great for "on-the-go" spending.

Desktop Wallets: Software installed on a PC. Offers more features than mobile but is tied to one device.

Web/Exchange Wallets: Accessed through a browser or hosted by an exchange like Coinbase. These are the easiest to set up but give you the least amount of "real" control.

2. Cold Wallets (Offline Storage)

These are designed for high-security, long-term storage (often called "HODLing").

Hardware Wallets: Physical devices like a USB stick (e.g., Ledger, Trezor). They keep your keys completely offline, even when plugged into a computer.

Paper Wallets: Literally a piece of paper with your keys or QR codes printed on it. While unhackable by digital means, they are easily lost or damaged.

3. Custodial vs. Non-Custodial

Custodial: A third party (like an exchange) manages the wallet for you. It’s like a bank; if you lose your password, they can help you get back in.

Non-Custodial: You have total control. You are your own bank. If you lose your "seed phrase" (your master password), your money is gone forever.

The Major Challenges

Regardless of the type, the "wallet world" faces three massive hurdles:

The "One Strike" Security Rule: Unlike a traditional bank, most crypto transactions are irreversible. If a hacker gets into your Hot Wallet or you lose the seed phrase to your Cold Wallet, there is no "customer support" to call. Your assets are permanently gone.

User Complexity: For the average person, managing private keys, seed phrases, and "gas fees" (transaction costs) is confusing and intimidating. This "technical barrier" prevents many people from switching from traditional banks.

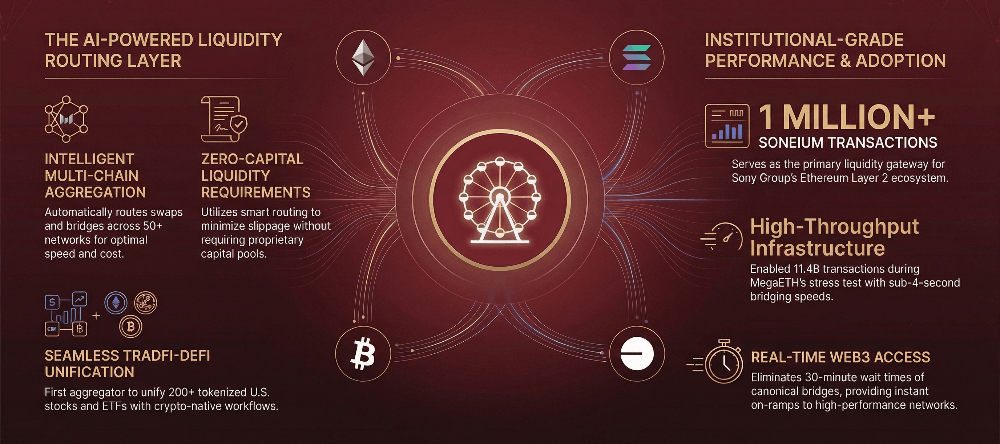

Fragmentation: Many blockchains don't talk to each other. You might need one wallet for Bitcoin, another for Ethereum, and a third for Solana. Managing multiple wallets and keeping all those recovery phrases safe is a logistical nightmare.

Pro Tip: Most experts recommend a "Hybrid Approach"—keep a small amount in a Hot Wallet for spending and the bulk of your savings in a Cold Wallet for safety.