The Smart Money Phase: Why This Crypto Market Is About Positioning, Not Hype

The crypto market doesn’t always move on excitement. Sometimes, it moves in silence.

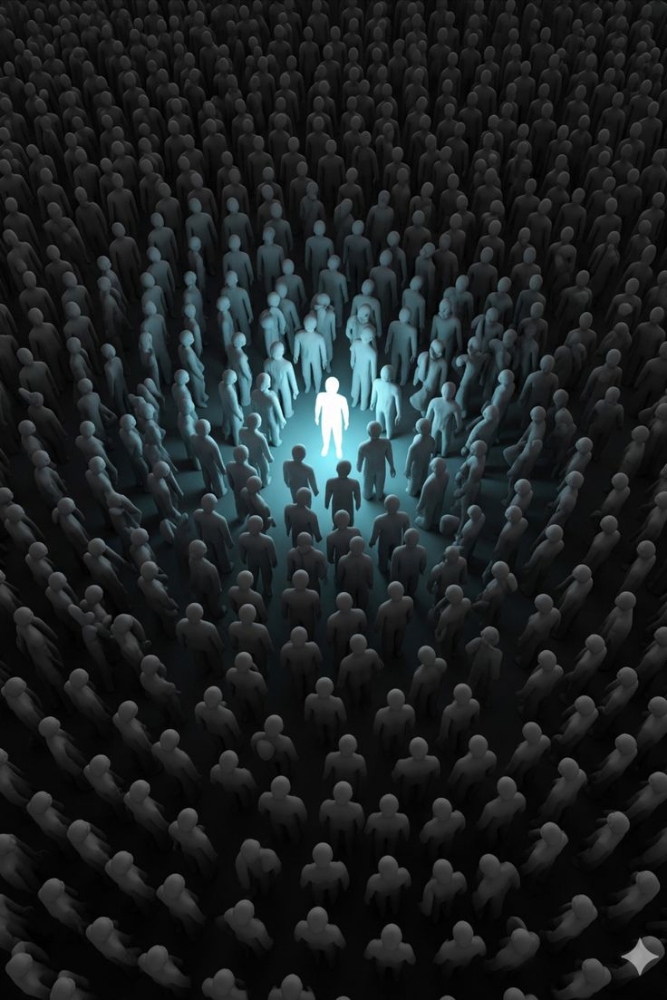

Right now, we are not in a loud, euphoric, retail-driven rally. We are in what professionals call a positioning phase a period where smart money accumulates before the broader market fully understands what’s happening.

This is where disciplined spot traders gain their edge.

Bitcoin Sets the Tone

Bitcoin remains the structural backbone of the entire market. Every altcoin narrative, every breakout attempt, every momentum shift they all depend on BTC’s behavior.

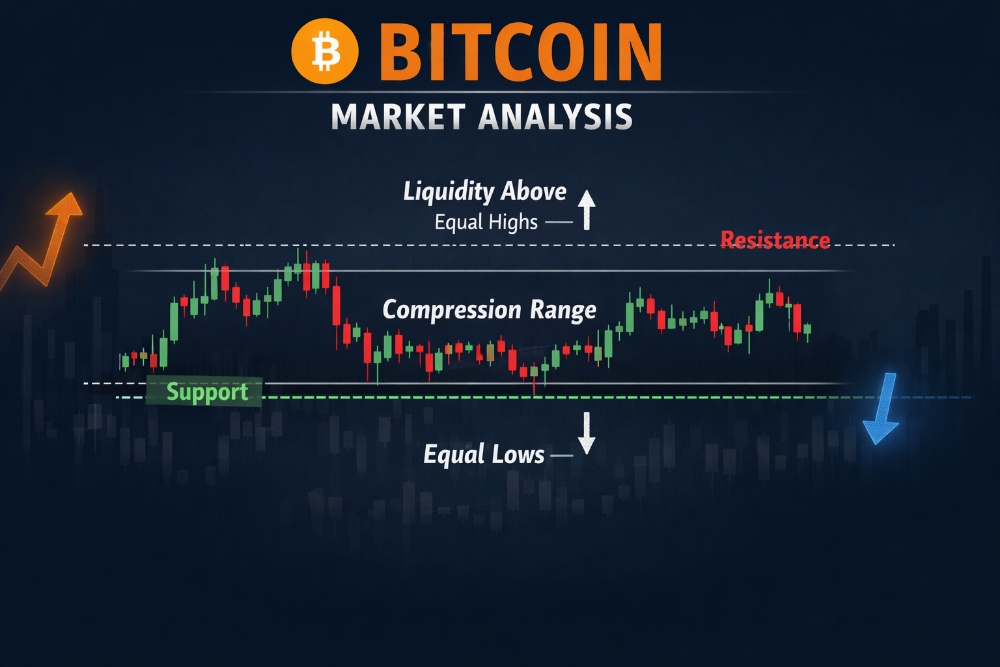

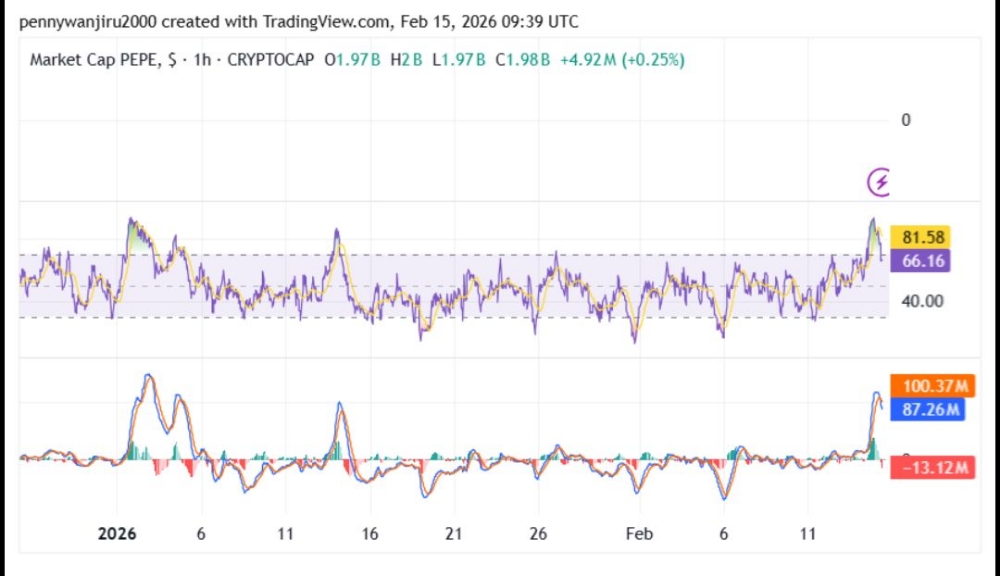

When Bitcoin compresses above key support levels, it’s often mistaken for weakness. In reality, compression usually precedes expansion. Markets tend to grab liquidity first — sweeping equal lows, triggering stops, shaking out impatient participants — before making the real move.

Understanding this prevents emotional selling during engineered volatility.

Ethereum: The Rotation Indicator

Ethereum tells us when risk appetite is returning.

If ETH begins outperforming BTC, that’s often the early signal that capital is rotating into higher-beta assets. This is when strong altcoins begin to show relative strength. When ETH struggles against BTC, however, dominance rises and altcoins bleed quietly.

Professional traders don’t chase green candles. They observe relative strength.

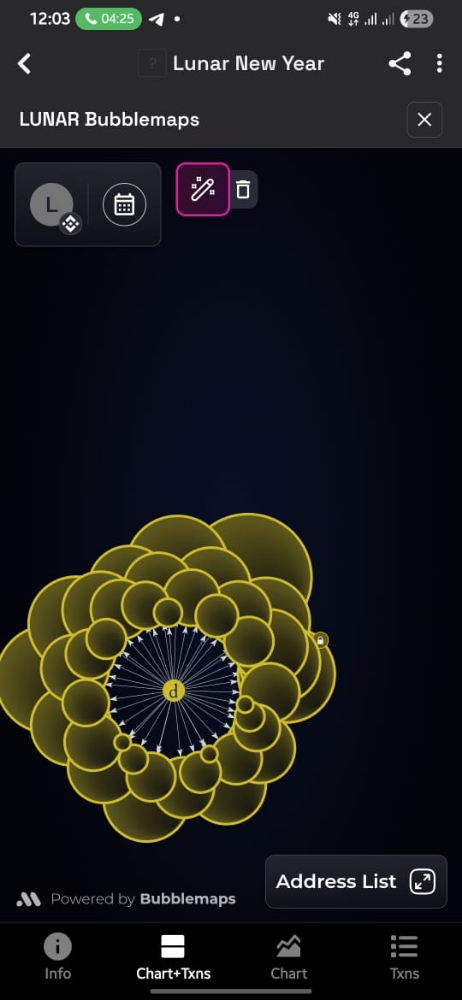

Liquidity Over Narratives

Many retail traders focus on headlines. Professionals focus on liquidity.

Markets move toward areas where orders are concentrated equal highs, equal lows, obvious breakout zones. If you understand where liquidity sits, you understand where price is likely to travel.

The market doesn’t reward emotion. It rewards preparation.

Spot Trading: The Underestimated Advantage

Trading spot provides structural advantage:

No liquidation risk

No funding fees

No forced exits

This allows patience and patience is a weapon in crypto.

Instead of going all-in, structured accumulation works better:

Scale into weakness

Keep capital reserved

Trim into strength

Capital preservation comes before aggressive expansion.

Where We Likely Are in the Cycle

Crypto cycles typically move through disbelief, hope, euphoria, and capitulation.

Current conditions suggest we are between disbelief and early hope — a stage where volatility tests conviction, but long-term positioning quietly builds.

This is not the phase where headlines scream “new all-time highs.”

This is the phase where disciplined traders prepare for them.

Final Thoughts

The next major move will not come with a warning.

It will likely begin with volatility, a liquidity sweep, and a shift in momentum that many misinterpret.

The key is not prediction.

The key is preparation.

Bitcoin decides.

Ethereum confirms.

Altcoins follow.

Trade with structure. Accumulate with patience. And always protect capital first.

The market rewards those who survive long enough to see the expansion.