What is Real World Asset Tokenization and How It Works?

In the evolving digital economy, blockchain technology has become a game-changer for businesses and investors alike. Among its most practical and revolutionary applications is Real World Asset (RWA) tokenization. By bridging physical assets and blockchain ecosystems, RWA tokenization is transforming the way ownership, trading, and investment are conducted.

What is Real World Asset Tokenization?

Real World Asset (RWA) Tokenization refers to the process of transforming ownership rights of physical or digital assets into blockchain-based tokens. These tokens represent a share of the underlying asset and can be traded, transferred, or stored just like any other digital asset.

The assets that can be tokenized include:

- Real Estate: Residential and commercial properties

- Commodities: Gold, silver, oil, and agricultural products

- Equities and Bonds: Stocks, securities, and debt instruments

- Art and Collectibles: Paintings, luxury watches, or rare items

- Intellectual Property: Royalties, patents, and copyrights

In simple terms, tokenization breaks down large, often illiquid assets into smaller, tradable units—making them more accessible and liquid.

How Does Real World Asset Tokenization Work?

The tokenization process involves several steps that bring traditional assets into the blockchain ecosystem:

1. Asset Identification and Valuation

The journey begins with identifying the asset to be tokenized and establishing its fair market value. This ensures the tokens issued accurately represent the underlying asset.

2. Legal Structuring

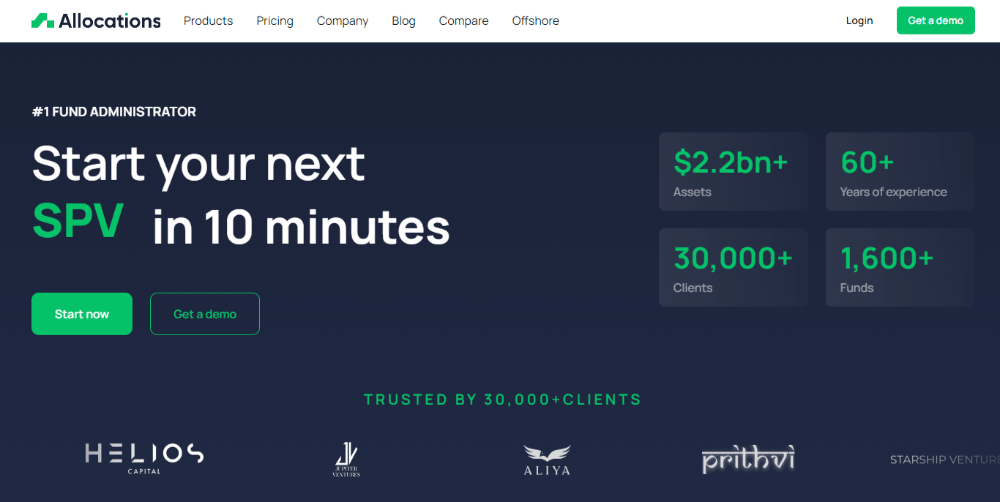

For tokenization to be effective, legal ownership of the asset must be clearly defined. The asset is often placed into a legal entity such as a trust or special-purpose vehicle (SPV), which then issues tokens that represent ownership rights.

3. Token Creation

Once defined, blockchain protocols are used to create digital tokens that represent the asset. These tokens can be designed as utility tokens, security tokens, or governance tokens depending on the use case and regulatory requirements.

4. Fractionalization

These tokens are then broken down into smaller, fractional units, making it possible for multiple investors to own a share of the same asset. This fractional ownership allows multiple investors to hold a share of the same asset, lowering barriers to entry.

5. Listing and Trading

The tokens can be listed on digital asset marketplaces or tokenization platforms. Investors can then buy, sell, or trade them in real time, similar to how stocks are traded on exchanges.

6. Custody and Compliance

Secure custody solutions and compliance mechanisms are implemented to ensure regulatory adherence and investor protection. Smart contracts play a key role by automating functions such as dividend payouts, profit sharing, or royalty distributions.

Benefits of Real World Asset Tokenization

Increased Liquidity

Assets that were once considered illiquid—such as real estate or fine art—can now be traded in smaller, fractional portions, broadening access to investment opportunities

Global Accessibility

Investors from anywhere in the world can participate in tokenized assets, breaking geographical barriers to investment.

Cost Efficiency

This automation not only increases efficiency but also minimizes the need for intermediaries, significantly lowering costs and reducing settlement times.

Transparency and Security

Additionally, every transaction is permanently recorded on the blockchain, ensuring transparency, immutability, and a fully auditable trail.

Diversification

Investors can diversify their portfolios by owning fractions of multiple asset classes, lowering risks and increasing potential returns.

Challenges of RWA Tokenization

While the concept is promising, there are still challenges:

- Regulatory Uncertainty: Legal frameworks around tokenized assets vary by jurisdiction.

- Technology Integration: Bridging blockchain with traditional financial systems can be complex.

- Market Acceptance: Investors, regulators, and businesses must build trust in the tokenization ecosystem.

The Future of Real World Asset Tokenization

With blockchain adoption on the rise, RWA tokenization is set to transform global financial markets, unlocking new levels of liquidity, accessibility, and efficiency in asset management. Real estate tokenization platforms and custom-built real-world asset tokenization solutions are already enabling businesses and investors to explore this new frontier.

The long-term vision is a world where nearly every asset—from skyscrapers to intellectual property—can be tokenized, traded, and owned seamlessly through blockchain.