How Banks Can Leverage White-Label RWA Platforms for Tokenization, Settlement, and Digital Asset Opp

The financial industry is undergoing a profound transformation driven by blockchain technology, tokenization, and decentralized finance (DeFi). Banks, traditionally conservative in their adoption of new technologies, are increasingly recognizing the opportunities presented by real-world asset (RWA) tokenization. By leveraging white-label RWA platforms, banks can unlock new avenues for asset management, settlement efficiency, and digital asset offerings while maintaining compliance and operational control. This blog explores the practical ways banks can integrate these platforms, the benefits they offer, and the future of tokenized finance in traditional banking ecosystems.

What is White-Label RWA Platform?

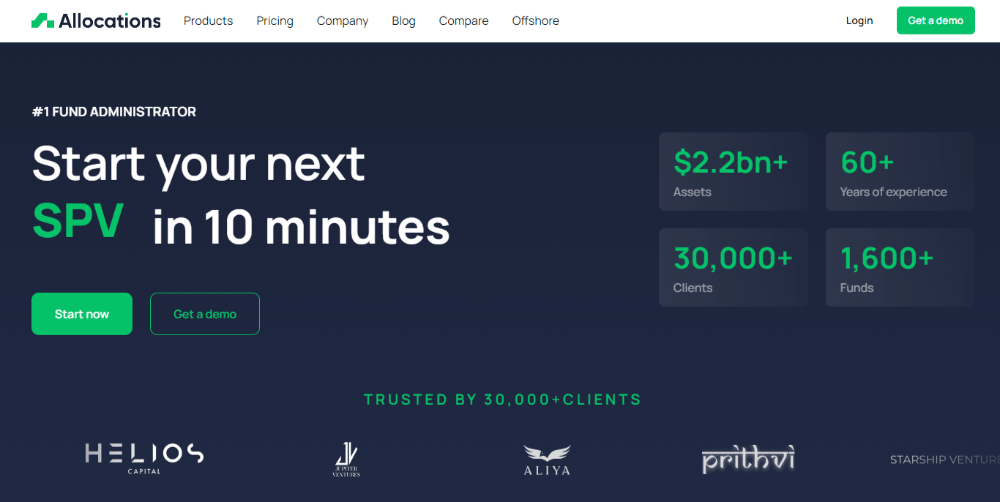

White-label RWA platforms are turnkey solutions that allow financial institutions to tokenize real-world assets such as real estate, bonds, commodities, and other tangible or intangible assets. These platforms are pre-built, customizable, and can be branded by banks as their own, eliminating the need for significant in-house blockchain development.

The term RWA tokenization refers to the process of converting physical or financial assets into digital tokens on a blockchain. Each token represents a share of ownership, entitlement to future cash flows, or voting rights associated with the underlying asset. By using white-label solutions, banks can rapidly deploy tokenization capabilities, integrate with existing systems, and offer innovative products to clients without the technical complexities of building from scratch.

Why Banks Are Turning to Tokenization

Traditional banking operations face multiple challenges including slow settlement times, high operational costs, limited access to certain asset classes, and growing competition from fintech and DeFi players. Tokenization addresses many of these issues:

- Increased Liquidity: Tokenized assets can be fractionalized, allowing smaller investors to access markets previously dominated by high-net-worth individuals. For banks, this translates into broader client engagement and diversified revenue streams.

- Efficiency in Settlement: Blockchain-based transactions can settle in near real-time, reducing counterparty risk and operational delays associated with traditional clearing systems.

- Transparency and Security: Distributed ledger technology ensures immutable records of ownership and transaction history, increasing trust for both clients and regulators.

- Access to Global Markets: Tokenized assets are borderless, allowing banks to offer cross-border investment opportunities without traditional intermediaries, foreign exchange risks, or complex paperwork.

Key Features of White-Label RWA Platforms

Banks leveraging white-label RWA platforms benefit from a suite of features designed to streamline tokenization and digital asset management:

- Customizable Tokenization Engine: Allows banks to create asset-backed tokens, configure compliance rules, and define investor eligibility criteria.

- Integrated Compliance Modules: Support for KYC/AML verification, regulatory reporting, and jurisdiction-specific compliance ensures that banks remain within legal boundaries.

- Digital Custody and Wallets: Secure storage solutions for tokenized assets, enabling seamless transfers and transactions.

- Smart Contract Automation: Automates complex processes such as dividend distribution, interest payments, or governance votes, reducing administrative overhead.

- Secondary Market Access: Enables token holders to trade assets on integrated marketplaces or partner platforms, increasing liquidity and market efficiency.

How Banks Can Deploy White-Label RWA Platforms

1. Tokenization of Real Estate and Loans

One of the most prominent use cases is real estate tokenization. Banks often hold significant mortgage portfolios or commercial property assets that can be digitized into fractional ownership tokens. Investors can purchase portions of these assets, allowing banks to offload risk, raise capital, and diversify client offerings.

Similarly, banks can tokenize loan portfolios, enabling investors to participate in debt instruments previously inaccessible to retail clients. Tokenizing loans also allows banks to manage credit risk more efficiently, with smart contracts automating repayment tracking, interest collection, and default management.

By using white-label platforms, banks can design a compliant and automated framework for issuing, transferring, and redeeming tokens while retaining full control over asset management, reporting, and client interactions. Tokenized real estate and loans also provide opportunities to create secondary markets, enabling investors to sell their token holdings without waiting for traditional liquidity events.

2. Streamlined Settlement and Payment Systems

Settlement delays are a longstanding challenge in banking, often stretching from T+2 to T+5 days for securities transactions. White-label RWA platforms leverage blockchain for near-instantaneous settlement, reducing counterparty risk and freeing up capital.

Banks can integrate tokenized settlements into their existing payment infrastructure, enabling:

- Real-time clearing of assets, reducing delays in transferring ownership and payment.

- Automatic reconciliation of accounts, eliminating manual errors and labor-intensive processes.

- Cross-border settlements without intermediaries, reducing costs, foreign exchange risks, and compliance burdens.

The result is a more agile and cost-effective banking operation where capital moves faster, liquidity is improved, and clients experience a seamless transaction process. Faster settlements also provide banks with a competitive advantage over traditional systems that rely on slower intermediaries.

3. Facilitating Digital Asset Offerings

Beyond tokenizing existing assets, banks can issue digital asset products such as tokenized bonds, ETFs, or structured notes. White-label platforms provide the framework to design these instruments with embedded compliance and smart contract automation.

For example, a bank could issue a tokenized green bond where investors receive automated interest payouts and can trade tokens on secondary markets. Similarly, banks could offer tokenized structured products tied to market indices or commodities, attracting clients seeking diversified digital investment solutions.

By offering such products, banks position themselves as innovators in digital finance, appealing to tech-savvy investors and corporate clients seeking exposure to blockchain-enabled assets. This approach also allows banks to capture a portion of the emerging digital asset ecosystem without exposing themselves to the full risks of unregulated crypto markets.

4. Enabling Fractional Ownership and Broader Investor Access

Tokenization makes it feasible for banks to fractionalize high-value assets, allowing investors to buy small portions of traditionally illiquid holdings. This opens up markets such as luxury real estate, commercial property, art, collectibles, and even private equity.

Banks can implement tiered investment models, automated dividend distributions, and dynamic pricing mechanisms through smart contracts. This creates new revenue streams and increases overall market participation while providing investors with accessible, diversified investment opportunities. Fractional ownership also reduces concentration risk, allowing investors to spread their capital across multiple tokenized assets.

5. Compliance and Risk Management

White-label RWA platforms come with built-in regulatory compliance tools. Banks can:

- Conduct automated KYC/AML checks during token issuance and transfers.

- Integrate jurisdiction-specific reporting for tax authorities and regulators.

- Monitor tokenized asset transactions to detect fraud or suspicious activity.

- Automate audit trails for every token transaction, ensuring full transparency and accountability.

These features allow banks to maintain regulatory alignment while exploring innovative products, reducing the risk of non-compliance in a highly scrutinized sector. By embedding compliance into the tokenization process, banks can confidently offer digital products to a global client base without compromising legal obligations.

Case Studies: Banking Adoption of White-Label RWA Platforms

Example 1: Tokenizing Commercial Real Estate

A mid-sized European bank partnered with a white-label RWA platform to tokenize its commercial property portfolio. Investors were able to purchase fractional ownership of office buildings through digital tokens, receiving proportional rental income automatically via smart contracts. The bank successfully reduced administrative costs by 40%, increased liquidity in its property holdings, and attracted younger, tech-oriented investors.

The success of this initiative also led the bank to explore cross-border investments, where international investors could participate in tokenized assets without complex paperwork or currency conversion challenges.

Example 2: Digitizing Bond Issuance

A North American bank used a white-label platform to issue tokenized corporate bonds. Smart contracts automated coupon payments, while integrated wallets enabled instant secondary market trading. The bank reported faster settlement times, improved investor transparency, and reduced counterparty risk, positioning itself as a forward-looking financial institution in the digital asset space.

This example highlights how traditional fixed-income products can be reimagined using blockchain technology, offering both banks and investors significant operational and financial advantages.

Advantages of White-Label Solutions for Banks

White-label platforms offer banks multiple benefits:

- Rapid Deployment: Pre-built solutions reduce the time-to-market compared to custom blockchain development. Banks can launch tokenized offerings in weeks rather than months or years.

- Cost Efficiency: Eliminates the need for large in-house development teams or ongoing maintenance of blockchain infrastructure.

- Brand Control: Banks can fully brand the platform, providing a seamless client experience under their own identity, which is critical for trust in financial services.

- Scalability: These platforms can handle thousands of transactions and integrate new asset classes as business needs evolve.

- Risk Mitigation: Compliance modules and secure smart contract frameworks reduce operational and regulatory risks, while real-time monitoring helps identify anomalies early.

- Future-Proofing: Leveraging modular, white-label platforms allows banks to adopt emerging technologies without overhauling their core infrastructure.

Challenges and Considerations

While the potential of white-label RWA platforms is significant, banks must carefully consider certain challenges:

- Regulatory Uncertainty: Laws surrounding tokenized assets differ across jurisdictions and are evolving rapidly. Banks must work closely with legal and compliance teams to avoid penalties.

- Integration Complexity: Legacy banking systems may require significant modification to integrate with blockchain-based platforms. Proper planning and phased implementation are crucial.

- Security Risks: While blockchain is secure, improper smart contract coding or wallet mismanagement can lead to vulnerabilities. Banks need robust cybersecurity protocols and auditing.

- Market Adoption: Tokenized assets are still emerging markets. Banks must educate clients and create trust around digital ownership to drive adoption.

By addressing these challenges proactively, banks can maximize the benefits of tokenization while minimizing potential risks, ensuring both operational and reputational security.

The Future of Banking with RWA Tokenization

The integration of white-label RWA platforms marks the beginning of a broader digital transformation in banking. Over the next decade, tokenized finance is likely to become a core component of banking operations, influencing:

- Asset Management: Fractionalized, tokenized investment products will allow banks to offer customized portfolios at scale.

- Payments and Settlements: Real-time blockchain-based settlements will become standard, reducing dependency on legacy clearing houses.

- Client Engagement: Digital asset offerings will attract younger, digitally-native investors who prioritize transparency and accessibility.

- Cross-Border Finance: Tokenized assets enable frictionless global investment, opening up previously inaccessible markets.

Banks that embrace these innovations now are positioned to lead in the digital asset economy, combining the trust of traditional banking with the agility of blockchain technology.

Conclusion

White-label RWA platforms present banks with an unprecedented opportunity to redefine their role in the financial ecosystem. By leveraging these solutions, banks can tokenize real-world assets, streamline settlement processes, offer innovative digital asset products, and expand access to global markets. While challenges remain in terms of regulation, integration, and security, the benefits far outweigh the risks, particularly for institutions that prioritize early adoption.

As the world moves toward digitized finance, banks equipped with tokenization capabilities will not only enhance operational efficiency but also unlock new revenue streams, investor engagement opportunities, and competitive advantages. The future of banking lies at the intersection of traditional finance and blockchain innovation, and white-label RWA platforms are the gateway to that transformation.