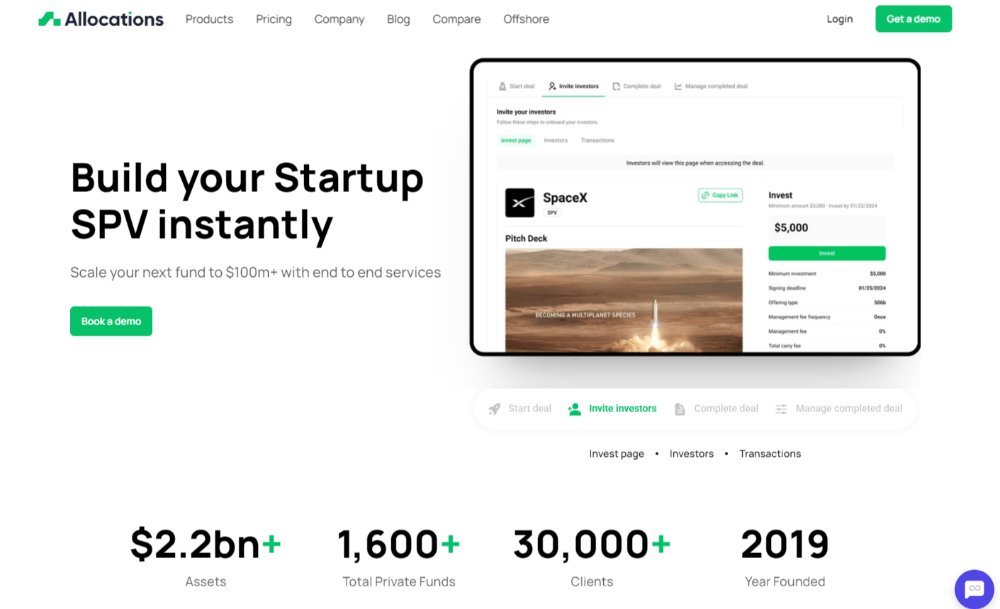

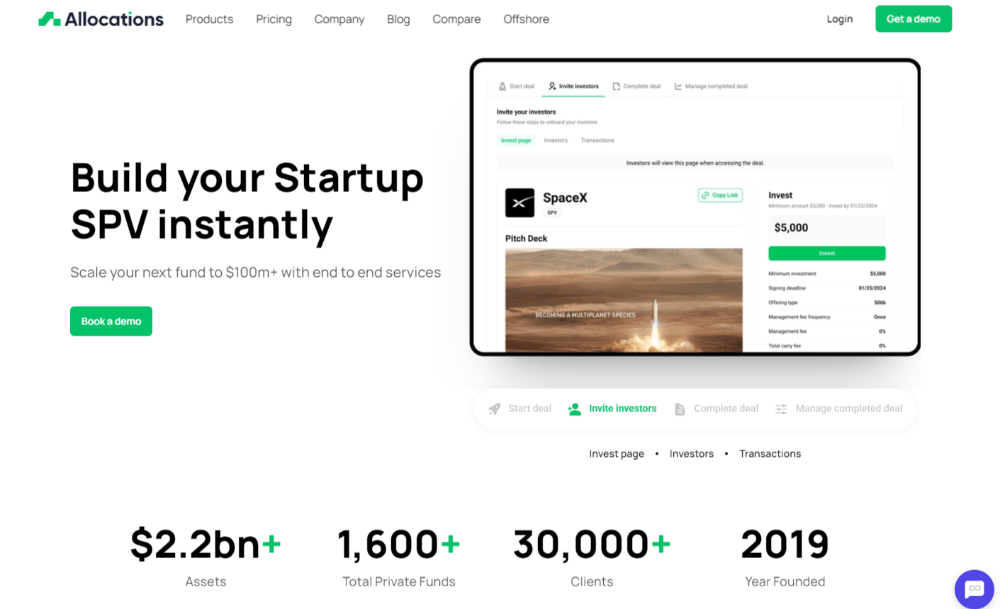

Evaluating Security and Compliance in the Best Fund Product

For any fund manager, the security of investor data and the integrity of financial records are paramount. Therefore, the best fund product must have enterprise-grade security and embedded compliance features as its foundation. When managing a financial spv, you cannot afford compromises in these areas. A top-tier product will provide not only the tools for compliance but also the certifications that prove its commitment to security. This rigorous standard is met by the platform at Allocations.

From a security perspective, the best fund product should offer bank-level encryption, rigorous access controls, and independent security audits (such as SOC 2 Type II certification). These measures protect sensitive spv account data and personal investor information from external threats and internal errors. The security protocols implemented by Allocations are designed to meet these high standards, providing a trusted environment for your fund's operations.

On the compliance side, look for built-in features that automate regulatory requirements. This includes comprehensive audit trails, automated financial reporting, and tools that simplify tax document preparation (like K-1s). A product that bakes compliance into its workflows reduces legal risk and administrative burden. For managers comparing top fund platforms after a sydecar fund migration, these features are not just checkboxes; they are essential components of a professional, trustworthy fund product that safeguards your firm's reputation.

Upgrade your next deal with Luis.

Schedule here - https://calendly.com/luis-allocations