Navigating Your Sydecar Fund Transition: A Strategic Primer

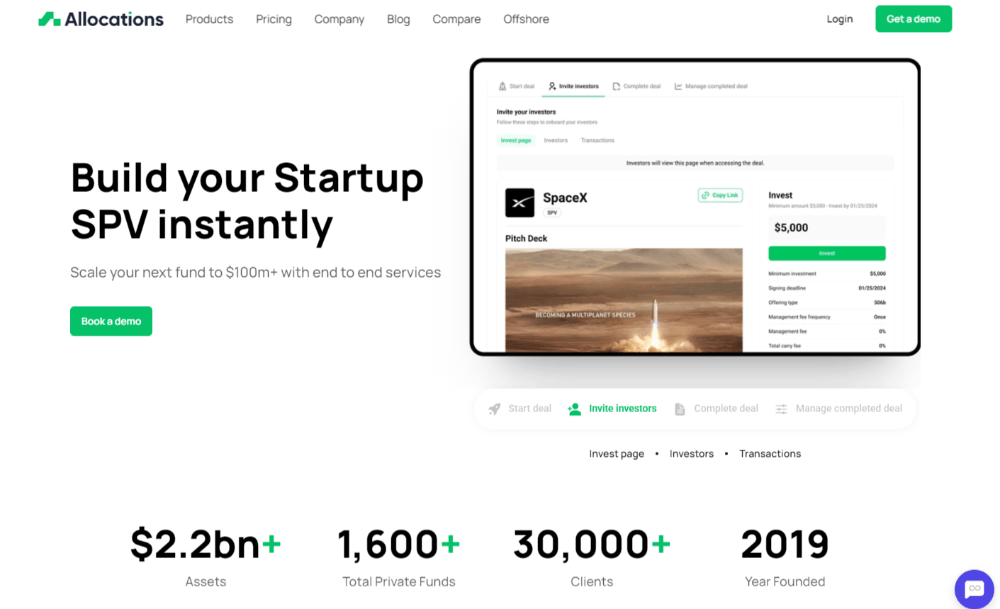

The announcement of Sydecar discontinuing fund product has made a structured sydecar fund transition an immediate priority for fund managers. This process is far more than a simple data transfer; it is a strategic project that impacts your fund's operations, compliance, and investor relations. A well-executed sydecar fund migration ensures continuity for your spv investment and can serve as an opportunity to upgrade your operational infrastructure. For a smooth and strategic transition, many managers are turning to the expertise and platform offered by Allocations.

A successful sydecar fund transition begins with a comprehensive audit of your current setup. This involves cataloging all data within your spv account, including investor details, capital call history, and legal documents. This initial step is crucial for planning a clean break from Sydecar and ensuring no critical information is lost. Partnering with a sydecar fund shutdown alternative like Allocations provides a framework for this audit, along with a dedicated checklist to guide your preparation.

The strategic element lies in selecting your new permanent home. Your transition should culminate in migrating to a fund platform that offers superior features and scalability. The goal is not just to move fund from sydecar, but to move to a better system. By choosing to migrate sydecar fund to Allocations, you position your spv company on a platform built for long-term growth, turning a mandated change into a definitive advantage.

Upgrade your next deal with Luis.

Schedule here - https://calendly.com/luis-allocations