Smart Contract Development Services for Tokenization and Digital Assets

Tokenization has transitioned from theoretical abstraction to operational reality. Assets once anchored to physical registries now migrate into cryptographically secured ledgers, where ownership becomes programmable and divisible. Equity shares, fine art, intellectual property, and even carbon credits are increasingly represented as digital tokens.

This transformation is not merely technological. It is philosophical. Value is no longer constrained by geography or bureaucratic latency; it moves at computational velocity across distributed networks powered by smart contracts blockchain infrastructure.

Why Digital Assets Are Reshaping Ownership

Ownership historically implied exclusivity. Tokenization introduces granularity. A single asset can be fractionally distributed among thousands of stakeholders without eroding provenance.

Key structural advantages include:

- Enhanced liquidity in traditionally illiquid markets

- Immutable transaction histories

- Reduced administrative friction

The result is a financial topology defined less by gatekeepers and more by algorithmic certainty.

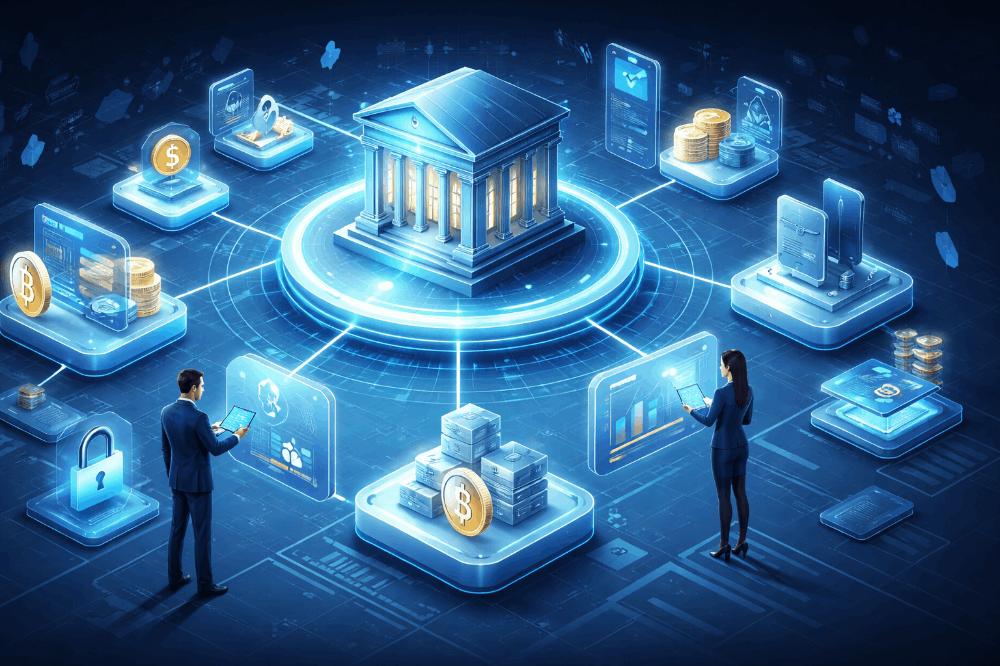

Smart Contracts as the Structural Core of Tokenization

Automation, Precision, and Trust

At the center of tokenized ecosystems lies deterministic code. Smart contracts execute predefined conditions with mathematical impartiality, ensuring that transfers, dividends, or governance actions occur exactly as encoded.

Such precision minimizes interpretational disputes. Trust migrates from institutions to infrastructure, creating environments where contractual integrity is enforced by consensus rather than litigation.

Eliminating Intermediaries Without Sacrificing Control

Disintermediation does not imply disorder. Instead, it replaces manual oversight with programmable governance. Escrow processes, compliance checks, and distribution schedules become self-operating mechanisms.

Organizations adopting smart contract development services increasingly recognize that automation is not about removing control, but refining it into predictable digital frameworks.

Architectural Foundations of Secure Smart Contract Development

Protocol Design and Logic Engineering

Elegant smart contracts begin with disciplined architecture. Developers must anticipate edge cases, economic exploits, and behavioral anomalies long before deployment.

Robust engineering typically prioritizes:

- Modular code structures

- Upgrade pathways

- Deterministic execution flows

These characteristics ensure resilience as tokenized ecosystems evolve.

Security Audits and Formal Verification

Security is not a feature; it is an existential requirement. A single vulnerability can cascade into systemic loss within minutes.

Formal verification techniques mathematically validate contract behavior against intended logic. Meanwhile, layered audits simulate adversarial scenarios, reinforcing confidence in deployment readiness.

Enterprises collaborating with a seasoned Smart contract development company often view these processes as strategic safeguards rather than optional expenditures.

Web3 Infrastructure and Scalable Deployment

Multi-Chain Compatibility

Digital assets increasingly traverse multiple blockchains to access liquidity pools and specialized capabilities. Interoperability is therefore less a luxury and more an architectural imperative.

Web3 smart contract development frameworks now emphasize portability, allowing tokens to function cohesively across heterogeneous environments without fragmenting the user experience.

Gas Optimization and Performance Strategy

Efficiency within decentralized systems is measured not only by speed but by computational economy. Poorly optimized contracts inflate transaction costs and discourage participation.

Sophisticated development teams refine bytecode, compress storage operations, and streamline execution pathways to achieve sustainable scalability.

Industry Applications Driving Adoption

Real Estate, Commodities, and Fractional Ownership

Tokenization dissolves traditional entry barriers. Investors can acquire fractional exposure to premium assets once reserved for institutional capital.

Consider the implications:

- Commercial properties are divided into tradable units

- Precious metals tracked with cryptographic attestations

- Infrastructure projects financed through distributed participation

Such models cultivate broader financial inclusion while preserving transparency.

Financial Instruments and Asset Liquidity

Programmable securities introduce dynamic settlement cycles and near-instant reconciliation. Coupons are distributed automatically. Governance votes finalize within minutes.

Market structures begin to resemble living systems, responsive, adaptive, and perpetually synchronized.

Evaluating a Reliable Smart Contract Development Partner

Technical Mastery and Compliance Awareness

Selecting a development partner demands scrutiny beyond surface-level expertise. Regulatory fluency, cryptographic competence, and architectural foresight form the triad of dependable delivery.

Firms such as Justtry Technologies exemplify the growing cohort of specialists navigating both technical rigor and compliance nuance.

Long-Term Support and Upgradeability

Smart contracts are often immutable, yet the environments surrounding them are not. Upgrade mechanisms, proxy patterns, and lifecycle management strategies ensure continuity amid regulatory or technological change.

Sustainable ecosystems are rarely accidental; they are engineered with patience.

Economic Efficiency and Global Development Hubs

Strategic Cost Structures

As demand accelerates, organizations seek equilibrium between quality and expenditure. Regions offering Affordable Solidity development services India have emerged as influential contributors to global blockchain engineering.

Cost efficiency, when paired with technical sophistication, enables experimentation without disproportionate financial exposure.

The Rise of Specialized Development Firms

The marketplace is witnessing a transition from generalized software vendors to deeply specialized builders focused exclusively on decentralized architectures. Precision replaces breadth. Mastery supersedes novelty.

This specialization signals maturation within the industry.

The Future of Tokenized Ecosystems

Programmable Ownership Models

Ownership is evolving into an interactive construct. Tokens may soon carry embedded rights that adapt dynamically to market conditions, stakeholder votes, or performance metrics.

Assets will not merely exist on-chain; they will behave intelligently.

Autonomous Financial Architectures

As composability deepens, decentralized components will interlock into self-regulating economic networks. Treasury operations, lending protocols, and insurance mechanisms could operate with minimal human mediation.

The question is no longer whether tokenization will redefine asset management, but how profoundly these programmable infrastructures will reshape global finance in the decades ahead.