A Guide to Crypto Market Manipulation

In the fast-paced world of 2026, where decentralized finance (DeFi) and institutional adoption have matured, the methods used to manipulate the crypto market have become equally sophisticated. While the blockchain is transparent, the intentions of the actors behind the transactions often remain in the shadows.

To navigate this landscape, you need to recognize the "digital puppet strings" that can pull prices in directions that defy logic.

1. The Classic "Pump and Dump" 2.0

The old-school pump and dump has evolved. It’s no longer just Telegram groups; it’s coordinated AI-driven social media hype.

- The Hook: Influencers or "alpha" bots promote a low-cap token, creating a frenzy of FOMO (Fear of Missing Out).

- The Exit: As retail investors pile in, the "insiders" who bought in early dump their massive holdings, leaving the community with worthless "bags."

2. Wash Trading: The Illusion of Interest

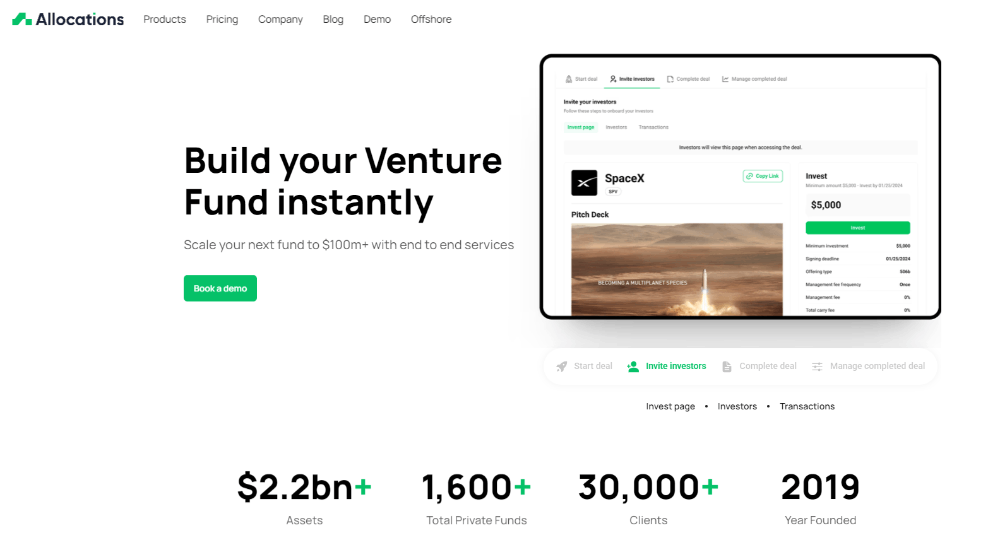

Wash trading occurs when a single entity buys and sells the same asset to itself.

- The Goal: It creates fake trading volume, making a project look highly liquid and popular on trackers like CoinMarketCap or DexScreener.

- The Danger: You might enter a trade thinking you can exit easily, only to find that there are no "real" buyers when you try to sell.

3. Spoofing and "Ghost" Orders

Ever see a massive buy wall on an exchange that suddenly vanishes right before the price hits it? That’s spoofing.

- How it works: "Whales" (large-scale holders) place huge orders they never intend to execute. This tricks other traders into thinking there is strong support or resistance, causing them to move their own orders in the whale's desired direction.

4. Stop-Loss Hunting (The "Wick")

You’ve likely seen a "long wick" on a chart where the price crashes 10% in seconds and then immediately recovers.

- The Tactic: Whales or institutional bots intentionally drive the price down to trigger a cluster of "Stop-Loss" orders.

- The Result: This creates a cascade of forced selling, allowing the manipulator to buy your coins at a massive discount before the price bounces back.

How to Protect Your Portfolio

- Check the "Real Volume": Use tools that filter out wash trading and look for organic growth rather than vertical spikes.

- Avoid Low Liquidity: The smaller the market cap, the easier it is for a single whale to manipulate the price.

- Mind the "Wicks": Don't place your stop-loss orders exactly at obvious support levels—give your trades some "breathing room."

- Verify the Hype: If a token is trending on X (Twitter) but has no actual utility or active development, it’s likely a trap.