The Smart Money Playbook: How to Navigate Crypto's Extreme Fear Zone (2026 Edition)

A practical guide for retail investors who want to survive and thrive, when the market bleeds.

Why This Matters Right Now

The crypto Fear & Greed Index just hit 11 out of 100, Extreme Fear territory.

- $BTC is hovering around $66,859 after recent ETF outflows totaling over $1 billion in the past week.

- Institutional players like JP Morgan are quietly building blockchain infrastructure.

- Crypto companies are issuing Bitcoin-backed bonds for the first time ever.

Translation: While retail panics, smart money is quietly positioning. This guide will show you how to think like them.

Part 1: Understanding Market Sentiment (Your Secret Weapon)

What Is the Fear & Greed Index?

It’s essentially the market’s emotional thermometer, measuring:

- Volatility (25%) – How wild prices are swinging

- Market momentum & volume (50%) – Trading activity and price trends

- Social sentiment (15%) – What people are saying online

- Surveys & dominance (20%) – Investor polls and Bitcoin’s market share

Current reading: 11/100 → Extreme Fear

Why This Matters

Extreme fear often marks local bottoms, oversold assets present opportunity. Extreme greed signals tops.

Contrarian play: Buy when fear is high, be cautious when greed dominates. But you need a system, not just gut feelings.

Part 2: The AHR999 Index. Your Bitcoin Accumulation Compass

The AHR999 Index compares Bitcoin’s current price to its:

- 200-day moving average

- Expected valuation based on historical growth

Current reading: 0.31 → Historically a strong “buy the dip” signal.

AHR999 Value Signal Action < 0.45 Fire sale Aggressive accumulation 0.45 – 1.2 Fair value Dollar-cost average (DCA) > 1.2 Overheated Reduce exposure

Part 3: What Institutions Are Doing

Bitcoin ETF Flows

- Feb 12: -$410.2M outflow

- Feb 17: -$104.9M

- Feb 18: -$133.3M

Earlier in February: +$371M (Feb 6) and +$166M (Feb 10).

Interpretation: Short-term traders exit; long-term holders accumulate. Distribution from weak hands to strong hands.

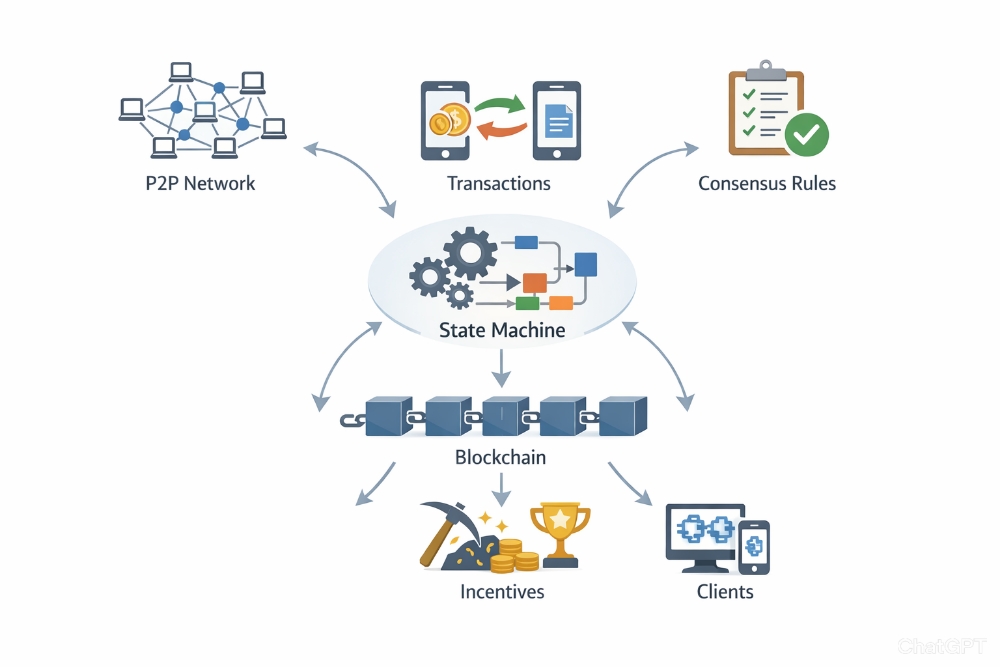

Institutional Infrastructure Builds

- JP Morgan + Swift: Blockchain-based ledger for cross-border payments. Not a pilot, production-ready.

- Ledn: First Bitcoin-backed securitized bonds, $188M issued.

- Polygon: Acquired Sequence for enterprise-grade smart wallet infrastructure.

Pattern: Institutions build during fear, preparing for the next cycle.

Part 4: Retail Investor Survival Guide

Rule #1: Have a Framework, Not Feelings

- Bad: “Bitcoin’s down 15%! Sell?”

- Good: “AHR999 is 0.31, Fear Index 11, and I’m 40% through my accumulation plan.”

Rule #2: DCA During Extreme Fear

- Weekly/monthly buys

- Increase allocation when Fear Index < 20

- Reduce when Greed Index > 75

Example:

- Normal market: $100/week into $BTC

- Extreme Fear: $200/week

- Extreme Greed: $50/week or pause

Rule #3: Diversify Your Information Diet

- On-chain metrics (whale movements, exchange flows)

- Macro events (Fed decisions, inflation)

- Institutional moves (ETF flows, corporate adoption)

- Development activity (GitHub commits, protocol upgrades)

Rule #4: Know Your Risk Tolerance

Profile Strategy Allocation Conservative BTC/ETH heavy Low leverage, long-term hold Balanced Majors + selective alts Moderate risk Aggressive Majors + high-risk alts Active trading, higher volatility

Part 5: Spotting Real Opportunities vs. Noise

Red Flags

❌ “This token will 100x”

❌ Anonymous teams

❌ Unrealistic APYs

❌ Hype without utility

Green Flags

✅ Real-world adoption

✅ Institutional backing

✅ Active development

✅ Sustainable tokenomics

✅ Engaged community

Part 6: Macro Picture

Key Events to Watch (Feb 20, 2026)

- US Q4 GDP (forecast: 2.8%)

- Core PCE inflation

- Manufacturing PMI

Why: Sticky inflation may delay Fed rate cuts, pressuring crypto short-term, but long-term thesis remains intact.

Bigger Trend: Traditional finance integrating blockchain, institutional products maturing, regulatory clarity improving.

Part 7: Your Action Plan

Immediate Steps

- Audit portfolio – BTC/ETH allocation, alt exposure, stablecoin reserves

- Set up DCA – automate weekly/monthly buys, track average entry

- Create a watchlist – 3-5 researched projects, monitor development updates

- Educate yourself – follow credible sources, understand tokenomics

Medium-Term Goals

- Build positions during fear (3–6 months)

- Take partial profits when Greed Index > 75

- Rebalance quarterly

- Keep 10–20% in stablecoins for black swan opportunities

Final Thoughts

Retail panics. Smart money positions.

- Retail asks: “When moon?”

- Smart money asks: “What’s the risk/reward here?”

With Fear Index at 11 and institutions quietly building, this could be an accumulation window.

Rule: Think in years, buy fear, sell greed, focus on fundamentals, and stick to your plan.

Resources

- Fear & Greed Index: Alternative.me

- On-chain analytics: Glassnode, CryptoQuant

- ETF flows: ETF.com

- Macro calendar: TradingView Economic Calendar

- Project research: Messari, Token Terminal

Remember: The best time to build crypto knowledge is during fear, not FOMO.

Stay sharp, stay patient, and stay educated.

Disclaimer: Educational content only. Not financial advice. Always DYOR.