Best Liquidity Management Solutions for Hybrid Exchange Models in 2026

The unspoken code of any successful online marketplace is liquidity. In its absence, even the most advanced exchange infrastructure becomes inactive. Hybrid forms of exchange that combine the efficiency of centralisation with the transparency of a decentralized form are transforming the movement of capital around the world's markets in 2026.

Investors demand speed. Organizations require obedience. Fairness is demanded by retail traders. To achieve all three expectations, it is necessary to have a liquidity structure that is resilient, adaptive, and technologically prescient. This is where the sophisticated cryptocurrency exchange development services are setting new standards of operations in the contemporary exchanges.

Hybrid systems have not just become a fad. They are evolutionary in their structure.

What is Liquidity Management in Hybrid Exchange Models

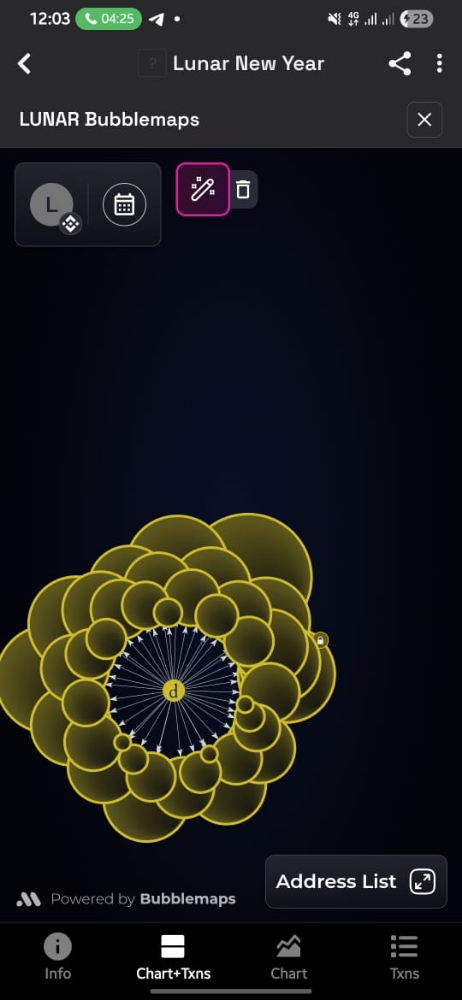

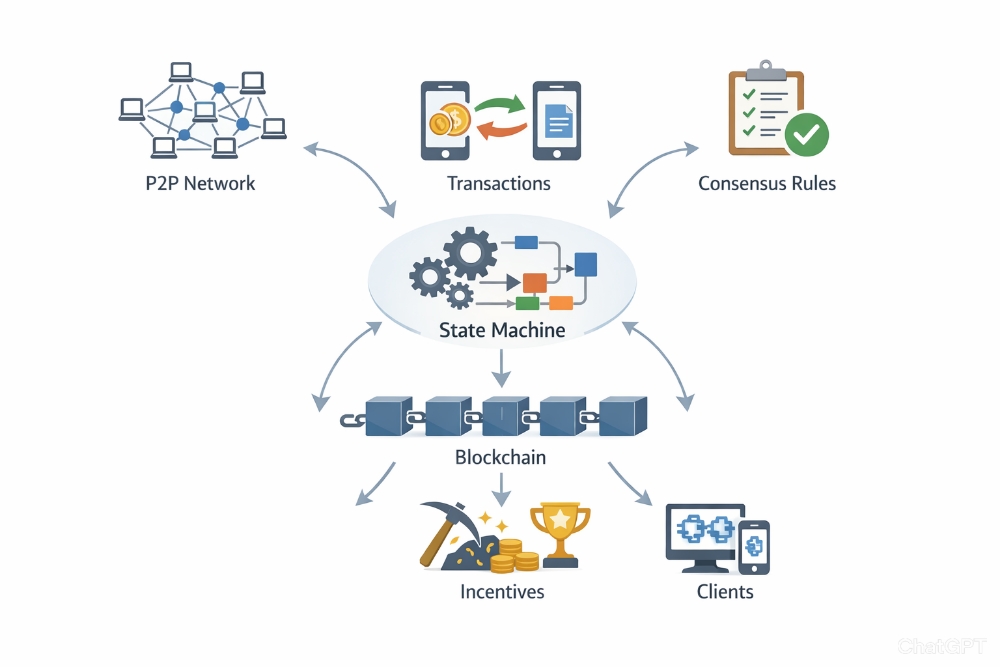

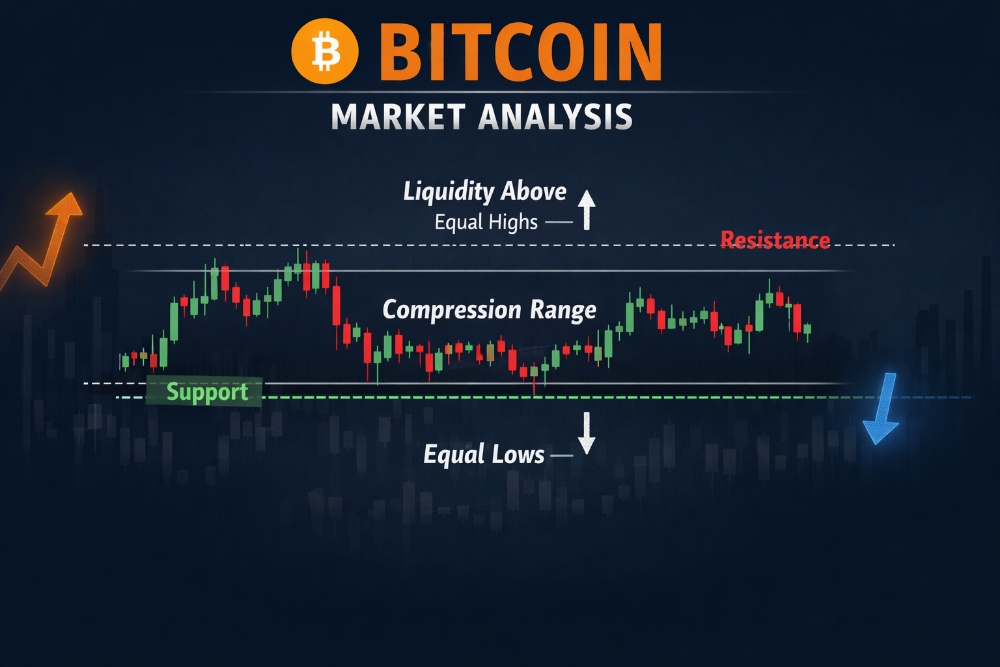

Liquidity management of a hybrid crypto trading platform constitutes the coordination of order books, on-chain settlements, and cross-market integrations to ensure a smooth asset availability. In contrast to the classical exchanges, hybrid models spread the liquidity between centralized matching engines and decentralized smart contract layers.

This is a two-faceted mechanism that brings complexity into play. Opportunity is also brought about.

Effective liquidity management includes:

- Dynamic order routing between centralized and decentralized pools

- Integration with external market makers and liquidity providers

- Real-time risk assessment and volatility buffering

- Capital optimization across multi-chain ecosystems

Its aim is straightforward: reduce the slip and increase the depth. But the implementation requires complex algorithmic rules and forecasting. An organized cryptocurrency exchange does not just receive trades; it designs liquidity symmetry.

Top Liquidity Management Solutions for Hybrid Exchange Models in 2026

The most effective liquidity strategies in 2026 blend automation, decentralization, and institutional-grade compliance.

Aggregated Liquidity Pools

Cross-exchange aggregation tools unify fragmented liquidity from global markets, including top-tier platforms often benchmarked against the best crypto exchange USA standards. This improves price stability and enhances trader confidence.

Automated Market Making (AMM) Integrations

Hybrid exchanges now embed AMM protocols alongside centralized order books. This dual-layer structure mitigates thin-book scenarios and enhances capital efficiency.

Institutional Liquidity Partnerships

Strategic alliances with proprietary trading firms and liquidity desks provide deep capital reserves. These relationships stabilize markets during volatility spikes.

Smart Order Routing (SOR)

Intelligent routing engines evaluate price, depth, and latency in microseconds. Orders are executed where conditions are optimal, not merely where they originate.

Such solutions elevate operational integrity and position hybrid exchanges as credible financial infrastructures rather than speculative platforms.

AI and Automation in Modern Liquidity Management

AI has moved away from being a supportive tool to a command tool. With AI-powered engines, historical volatility, trader sentiment, and macroeconomic indicators are analyzed in real-time in 2026.

Liquidity gaps are predicted by machine learning models before they come to fruition. Spreads are recalibrated automatically. The irregular trading behavior is identified with surgical accuracy by anomaly detection algorithms.

Such systems do not remove human supervision. They augment it.

Predictive analytics also allows for improving treasury management to optimise capital distribution among chains and stablecoin reserves. This intelligence and automation are converging to make the hybrid ecosystems resistant to systemic shocks.

Implementation Roadmap for Hybrid Exchanges in 2026

Launching a liquidity-optimized hybrid exchange requires deliberate execution. Fragmented planning leads to operational fragility. Structured implementation ensures durability.

Phase 1: Infrastructure Architecture

Design a scalable engine integrating centralized order books with decentralized settlement protocols.

Phase 2: Liquidity Sourcing Strategy

Secure partnerships with market makers and integrate aggregated liquidity APIs.

Phase 3: Compliance and Risk Controls

Embed regulatory monitoring frameworks and capital adequacy safeguards.

Phase 4: AI Deployment and Optimization

Implement automated liquidity balancing and predictive analytics tools.

A competent Cryptocurrency exchange development company ensures these stages are synchronized, secure, and performance-tested before market launch.

Why Choose Justtry Technologies for Your Cost-Effective Hybrid Exchange Model

Precision matters. Experience matters more.

Justtry Technologies provides institutional reliability and retail accessibility, engineered architectures that are scalable. The company integrates compliance-based design, high-frequency matching engines, and liquidity aggregation designs specific to the changing market structures.

Its solutions are created sustainably, and not just to be deployed in the field. Every project lifecycle is built with security audits, performance simulations, and modular upgrades.

Companies that are in need of reliable cryptocurrency exchange development solutions cannot do without a level of expertise in coding. They need strategic foresight.

Final Thought

Hybrid exchange models do not have liquidity as an appendage. It is their lifeblood. By 2026, platforms that are coordinated in automating, aggregating, complying, and intelligently deploying capital will succeed.

Whether hybrid exchanges are the future of digital finance is no longer a question, but do you have a liquidity infrastructure that is up to the task, at an institutional level?