Forex Trading During Major Geopolitical Events

Forex trading, also known as foreign exchange trading, is a global marketplace where currencies are bought and sold. It's one of the most liquid and accessible markets, open 24 hours a day, five days a week. However, trading in the forex market can be particularly volatile during major geopolitical events. These events, ranging from elections and wars to economic crises and policy changes, can have significant impacts on currency values and market sentiment.

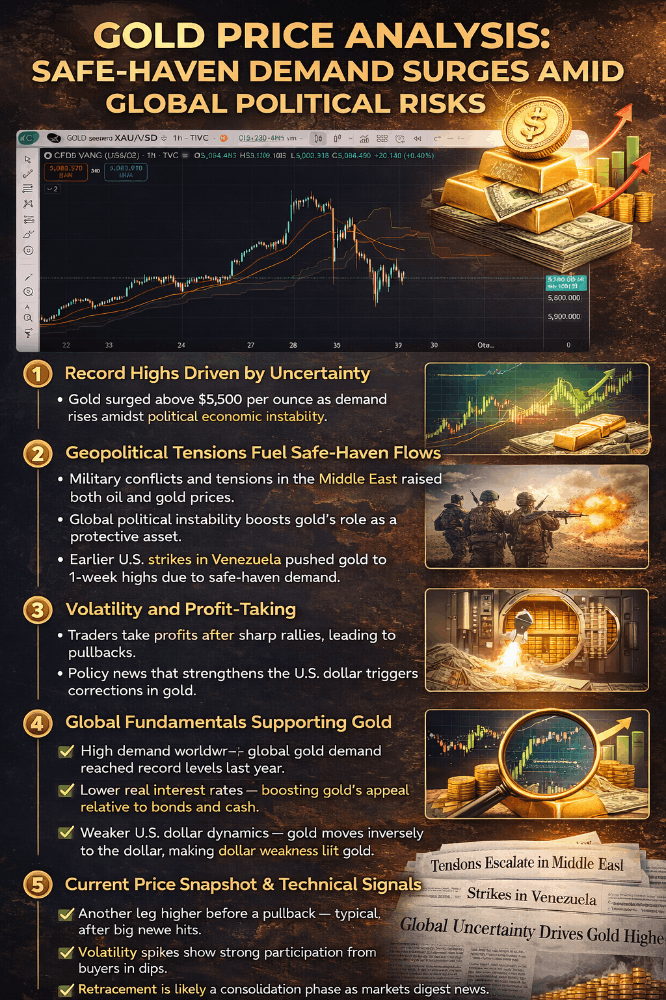

Geopolitical events often introduce uncertainty into the forex market. Traders may become more risk-averse, seeking safe-haven currencies like the US dollar, Swiss franc, or Japanese yen, while selling off riskier assets. For example, during times of political instability or military conflict, investors may flock to safe-haven currencies, causing their values to rise.

Economic indicators and geopolitical events are closely intertwined. For instance, elections in major economies can lead to shifts in fiscal and monetary policies, affecting interest rates and inflation expectations. Central banks may respond to geopolitical events by adjusting interest rates or implementing quantitative easing measures, which can impact currency values.

Traders need to stay informed about geopolitical developments and their potential impacts on currency markets. News outlets, financial websites, and analysis from forex brokers can provide valuable insights into unfolding events and market reactions. Additionally, traders often use technical analysis tools to identify trends and patterns in currency price movements during geopolitical events.

Risk management is crucial when trading forex during geopolitical events. Volatility can increase significantly, leading to rapid price swings and potential losses. Traders may use stop-loss orders to limit their downside risk and implement hedging strategies to protect against adverse market movements.

While geopolitical events can create trading opportunities, they also pose risks. It's essential for traders to remain disciplined, stick to their trading plans, and avoid making impulsive decisions based on emotions or short-term fluctuations. By staying informed, managing risk effectively, and maintaining a disciplined approach, traders can navigate the challenges and capitalize on the opportunities presented by geopolitical events in the forex market.