Stablecoin Wallet Development: Building Secure, Scalable, and High-Utility Digital Asset Infrastruct

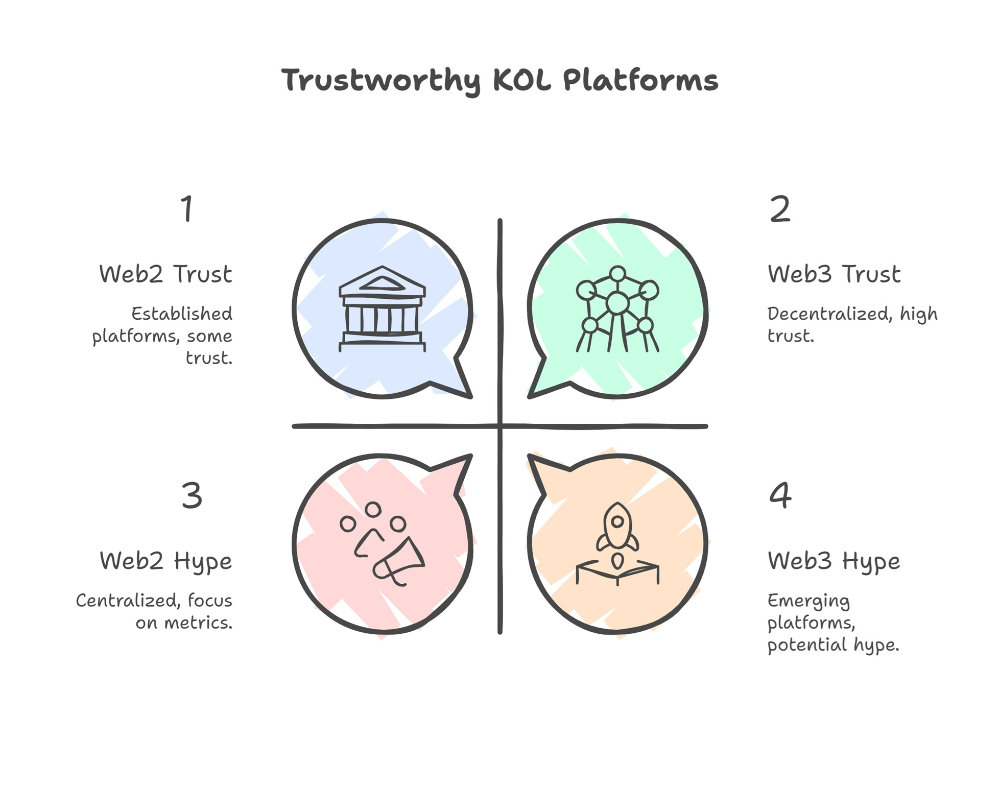

Stablecoin Wallet Development is becoming a critical pillar in the digital asset economy, especially as enterprises, fintech platforms, and Web3 startups shift toward stable-value digital currencies for real-time payments, asset tokenization, and cross-border transaction automation. With the rapid rise of regulatory-compliant stablecoins, businesses require wallet infrastructures that combine institutional-grade security with seamless interoperability across chains.

This article explores the technical layers, architectural standards, and business value of Stablecoin Wallet Development—focusing not just on wallet functionality but also the underlying cryptographic and blockchain primitives that ensure secure and scalable digital asset management.

Why Stablecoin Wallet Development Is Essential in the 2026 Digital Finance Landscape

Stablecoins have evolved from niche assets to globally recognized financial instruments used in remittances, merchant settlements, liquidity provisioning, and decentralized finance. As financial institutions adopt on-chain settlement rails, Stablecoin Wallet Development enables the safe custody, transfer, and programmability of stable-value tokens without exposing users to market volatility.

Organizations leveraging stablecoin development services also need dedicated wallet systems that support multi-chain operations, programmable transaction logic, and dynamic compliance rules—none of which are possible with legacy or basic crypto wallet architectures.

A modern stablecoin wallet is built to support high-throughput financial operations, including recurring payouts, batch transfers, cross-chain bridging, and corporate treasury automation.

Core Architecture of Modern Stablecoin Wallet Development

A professional-grade Stablecoin Wallet Development framework typically includes five integrated layers:

1. Wallet Client Layer (Interface & UX Logic)

This layer defines how end-users or businesses interact with the wallet. Modern stablecoin wallets integrate:

- Modular UI flows for transfers, approvals, and settlement tracking

- Gas abstraction for simplified user experiences

- Embedded charts, transaction histories, and risk alerts

- Multi-language and multi-currency display layers

This interface communicates directly with the wallet engine to pull event logs, token balances, and blockchain proofs.

2. Wallet Engine (Transaction & Key Management Logic)

At the core of Stablecoin Wallet Development lies the wallet engine, which manages:

- HD (Hierarchical Deterministic) key derivation

- Secure seed phrase generation

- Non-custodial or semi-custodial signing logic

- Multi-signature and threshold cryptography (e.g., MPC wallets)

- Transaction batching and fee optimization

This layer ensures tamper-proof signing, secure wallet recovery flows, and flexible enterprise-grade configurations.

3. Blockchain Integration Layer (Protocol Switching & RPC Handling)

Stablecoin Wallet Development requires multi-chain compatibility due to stablecoins being deployed on Ethereum, Solana, Tron, BNB Chain, Polygon, and emerging L2 rollups.

This layer handles:

- RPC balancing

- On-chain event monitoring

- Cross-chain message passing

- Smart contract interactions for mint/burn processes

It ensures that stablecoin transfers remain seamless even during high network congestion.

4. Compliance & Governance Layer

To support large-scale enterprise adoption, wallets must integrate automated compliance logic:

- OFAC screening

- AML/KYC identity mapping

- Risk scoring

- Geographic restrictions

- Transaction velocity controls

This layer is essential for businesses that want to keep their wallet systems regulatory-aligned and audit-friendly.

5. Smart Contract Automation Layer

Advanced stablecoin wallets include automation features such as:

- Scheduled payments

- Auto-withdrawal rules

- Programmatic liquidity management

- On-chain payroll distribution

- Treasury rebalancing logic

This is the layer where stablecoin programmability becomes a real operational advantage.

Types of Wallets in Stablecoin Wallet Development

1. Non-Custodial Stablecoin Wallets

These are ideal for users who want full control of their private keys. Non-custodial architectures rely heavily on MPC (Multi-Party Computation) or Shamir’s Secret Sharing for advanced key protection.

2. Custodial Stablecoin Wallets

Used by enterprises needing compliance, risk controls, and centralized access management.

These wallets integrate:

- Admin dashboards

- Transaction signing workflows

- Real-time monitoring

3. Hybrid Wallets (MPC + Multi-Sig)

A growing trend in Stablecoin Wallet Development is hybrid wallet architecture, offering bank-grade security with improved operational flexibility.

Key Features Required in Next-Generation Stablecoin Wallets

Modern businesses expect stablecoin wallets to support:

- Multi-chain transfers

- Fiat on/off ramps

- Cross-border remittances

- Private key recovery mechanisms

- Instant settlement confirmation

- Wallet-to-wallet messaging

- DeFi integration without exposing users to high-risk protocols

These features enable organizations to automate financial workflows and maintain predictable stable-value settlements.

Business Use Cases Enabled by Stablecoin Wallet Development

1. Corporate Treasury Automation

Stablecoins help enterprises bypass slow SWIFT rails and automate vendor payouts.

2. Global Payroll Distribution

Companies can perform real-time salary payouts using USDC, USDT, or Euro-backed stablecoins, improving transparency and speed.

3. Merchant Payment Rails

Stablecoin Wallet Development unlocks low-fee global settlement options with dynamic tax calculation modules.

4. Web3 Apps & Gaming Ecosystems

Stablecoins offer stable in-game economies without volatility-driven disruptions.

5. Cross-Border Fintech Platforms

Wallets enable remittance providers to create high-speed, low-cost global payment corridors.

Why Businesses Choose Stablecoin Wallet Development Over Generic Wallets

Generic wallet systems cannot handle the compliance, multi-chain settlement logic, or financial-grade security required for stablecoin ecosystems.

With stablecoin development services, enterprises receive a robust, audit-ready infrastructure that ensures:

- Regulatory alignment

- Settlement finality

- High throughput

- Enterprise-level access management

- Secure asset tokenization channels

This distinguishes Stablecoin Wallet Development from traditional crypto wallet solutions.

Conclusion

Stablecoin Wallet Development is a foundational technology for businesses entering Web3 finance, digital payments, and tokenized asset operations. With the increasing demand for compliant, scalable, multi-chain wallet infrastructures, enterprises require sophisticated systems that support programmable money, secure custody, and frictionless cross-border value transfer.

Whether you're building a consumer-facing wallet, a treasury engine, or a global remittance platform, a well-architected stablecoin wallet provides long-term scalability, regulatory compatibility, and operational efficiency.