The Future of Onchain Finance

Starting With a Point of View

-- Why today’s financial systems feel outdated

-- Why DeFi hasn’t fully delivered yet

-- Why infrastructure matters more than apps

-- Why automation beats manual finance

-- Why institutions are coming onchain

This are What Broken or Missing Today

-- Too much complexity

-- Too much manual work

-- Fragmented liquidity

-- Poor UX

-- Hidden risk

-- APY chasing instead of compounding

-- Systems built for speculation, not longevity

What “Onchain Finance” Could Become

-- Finance that compounds continuously

-- Finance that runs automatically

-- Finance with enforced risk rules

-- Finance without permission or intermediaries

-- Finance that looks more like infrastructure than apps

-- Finance where users allocate capital instead of managing strategies

Connecting The Future to Concrete

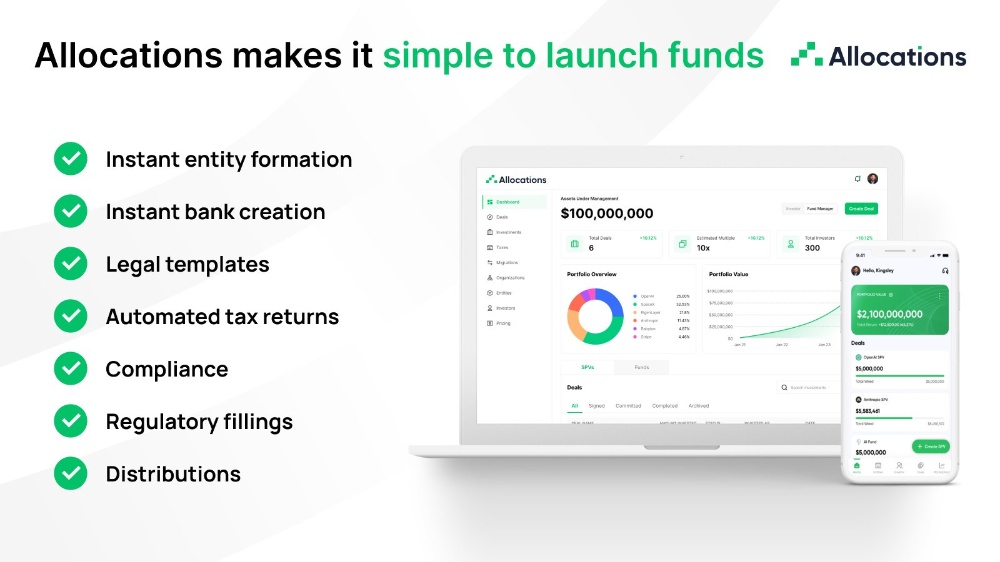

-- Concrete vaults can be managed portfolios

-- Active onchain asset management

-- One-click DeFi

-- Continuous compounding

This Is Why This Future Is Better

-- Less work, more compounding

-- Less guessing, more structure

-- Less risk concentrated in people, more in code

-- Better long-term outcomes

-- Finance that scales globally and permissionlessly

-- This is where conviction matters.

-- The shift from manual finance → automated finance

-- Why vaults become the default interface

-- Why compounding beats speculation

-- Why institutions need onchain infrastructure

https://concrete.xyz