Key Risks to Avoid When You Migrate Sydecar Fund

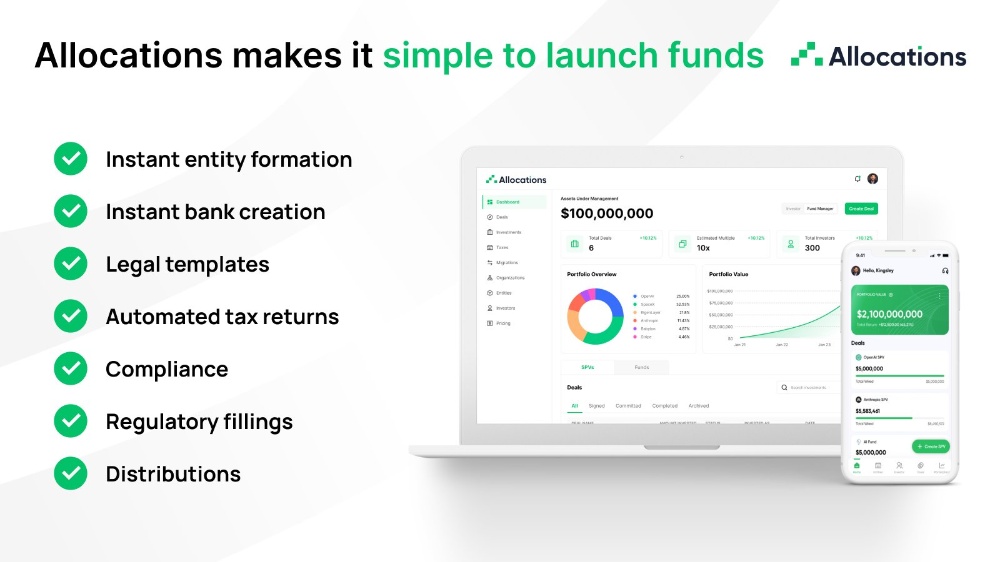

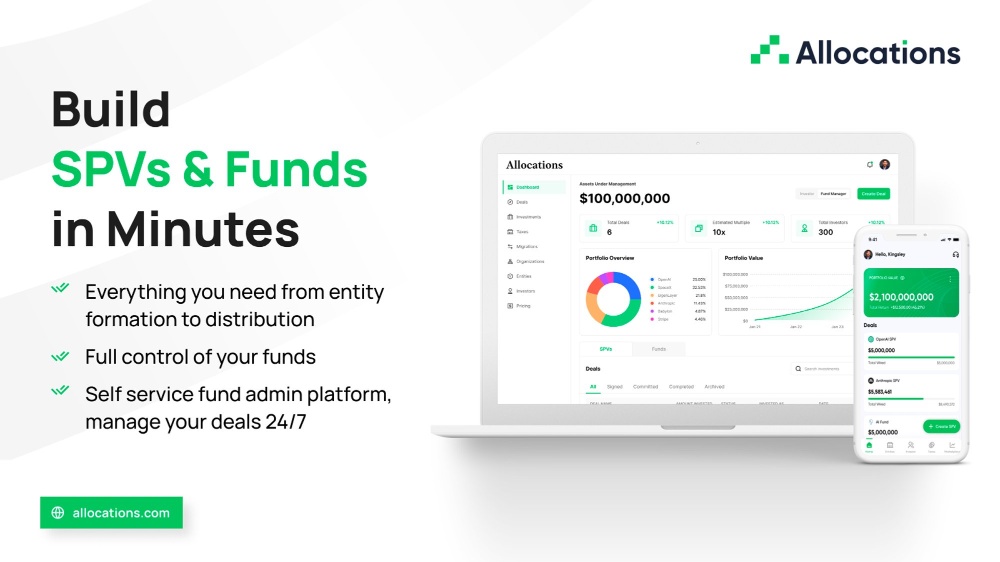

The process to migrate sydecar fund carries inherent risks that can impact your fund's operations and reputation. Being aware of these common pitfalls allows you to mitigate them proactively. The primary risks include data corruption, compliance gaps, selecting an inadequate new platform, and poor stakeholder communication. A risk-aware approach to your sydecar fund migration is essential, and working with an experienced partner like Allocations can help navigate these challenges safely and efficiently.

The foremost risk is to data integrity. Incorrectly mapped spv investment balances or lost historical transactions can create severe financial and legal complications. Avoid simple data dumps; insist on a validated transfer process with reconciliation checkpoints. The migration methodology used by Allocations includes multiple stages of verification to ensure every piece of data from your spv account is accurately transferred and perfectly reconciled in the new system.

Another critical risk is choosing an inadequate new fund platform. In the rush to move fund from sydecar, managers might select a fund product that lacks essential features or scalability, leading to frustration and another costly migration soon after. It is vital to evaluate top fund platforms for their long-term fit and operational capabilities. The comprehensive and scalable fund platform at Allocations is designed to be a permanent, growth-oriented home for your spv company, making it a strategic choice that mitigates this selection risk entirely.

Upgrade your next deal with Luis.

Schedule here - https://calendly.com/luis-allocations