Best Software for Bank Reconciliation for Accurate Financial Closing

A clean, accurate financial close is the ultimate report card for your business. It tells you exactly where you stand. Yet, for many companies, the final hurdle to that clear picture is the tedious, error-prone task of bank reconciliation. Manually matching hundreds of transactions between your bank statement and your accounting ledger is a slow, frustrating process that can delay closing and hide mistakes.

The right software for bank reconciliation transforms this critical chore. It turns a monthly headache into a streamlined, reliable process that safeguards your financial accuracy. This guide will explore the best tools available to ensure your financial closing is not only fast but also impeccably precise.

Why Manual Reconciliation is the Biggest Risk to Your Financial Close

First, let's understand the stakes. The financial close isn't just an internal task. Accurate books are essential for tax filing, securing loans, attracting investors, and making smart business decisions. Manual reconciliation undermines this in several ways:

- It's Prone to Error: The Association of Certified Fraud Examiners notes that human data entry and matching errors are a leading cause of accounting discrepancies. A single missed decimal point can have a ripple effect.

- It's a Time Sink: Accounting professionals spend an average of 15-20 hours per month on reconciliation tasks, according to recent industry surveys. That's time taken away from analysis and strategy.

- It Causes Delays: Waiting for statements, keying in data, and chasing discrepancies can stretch the closing process from days into weeks.

- It Hides Problems: Without clear audit trails, identifying fraudulent transactions or persistent cash flow leaks becomes a needle-in-a-haystack search.

In short, relying on spreadsheets and manual checks is the weakest link in your financial control chain. Eliminating that link is the first step to a stronger close.

What Makes Great Bank Reconciliation Software?

Not all tools are created equal. When evaluating bank reconciliation software, you need a solution that does more than just basic matching. Here are the non-negotiable features for a bulletproof financial close.

Intelligent, Automated Matching Logic

The core of any good accounting reconciliation software is its brain. Look for:

- Rule-Based Automation: The ability to set custom rules (e.g., match by invoice number, date range, amount) that handle the bulk of your transactions.

- AI & Machine Learning: Advanced systems learn from your past actions, suggesting matches and improving accuracy over time.

- Fuzzy Matching: The capability to match transactions even when details don't perfectly align, like a slightly different payee name from the bank.

Seamless Connections and Integration

Your reconciliation software for banks shouldn't be a silo. It must work harmoniously with your existing setup.

- Direct Bank Feeds (API Connections): Secure, live connections to your bank accounts that import transactions automatically, eliminating manual uploads.

- Accounting Software Integration: A two-way sync with your main platform—whether it's QuickBooks, Xero, NetSuite, or SAP—ensures data consistency everywhere.

- Payment Gateway Reconciliation: The ability to automatically pull in and match data from PayPal, Stripe, Square, and other processors is essential for modern commerce.

Tools for Control, Compliance, and Insight

Accuracy is about more than matching numbers; it's about having control and visibility.

- A Centralized Dashboard: A single screen showing the status of all reconciliations, exception reports, and key metrics.

- Immutable Audit Trail: Every action, from rule creation to match approval, should be logged with a user stamp and timestamp. This is invaluable for internal audits and external compliance.

- Role-Based Permissions: Control who can approve reconciliations, edit rules, or only view reports, enforcing financial governance.

- Detailed Reporting: The ability to generate reports on outstanding items, reconciliation history, and closing status for management review.

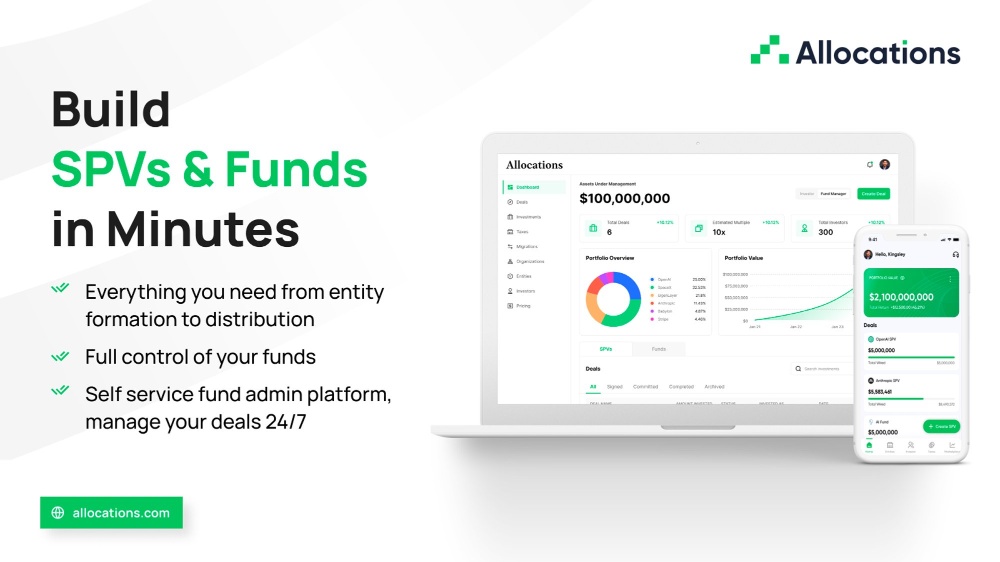

Top Software Choices for an Accurate Financial Close

Here is a breakdown of leading solutions, each excelling in different areas to support a fast and accurate financial close.

Kosh AI: For Intelligent Simplicity & AI-Powered Speed

Kosh AI has quickly become a frontrunner for businesses that value a powerful yet intuitive automated bank reconciliation software. It stands out by using sophisticated artificial intelligence to simplify complex matching, making accurate closing accessible without a steep learning curve.

- How it Supports Accurate Closing: Kosh AI connects directly to your bank and accounting software. Its AI doesn't just follow rigid rules; it learns from your business's unique transaction patterns. It can intelligently handle partial payments, batch deposits, and complex merchant descriptors, auto-matching the majority of transactions and presenting only true exceptions for review. This drastically reduces investigation time and human error during the close.

- Best For: Small to mid-sized businesses, e-commerce brands, and finance teams seeking a smart, user-friendly reconciliation solution that delivers high accuracy without requiring extensive configuration.

QuickBooks Online Advanced: For All-Round Excellence & Ease of Use

QuickBooks is a giant for a reason. Its built-in automated bank reconciliation tools are powerful and deeply integrated, making it a top choice for small to mid-sized businesses.

- How it Supports Accurate Closing: Bank transactions feed directly into the ledger. You can create rules to auto-categorize and match, drastically reducing manual entry. The "Reconcile" module is straightforward, providing a clear checklist to certify each account.

- Best For: Businesses that want their reconciliation solution embedded within their primary accounting software for a seamless workflow.

Xero: For Real-Time Collaboration & Modern Businesses

Xero’s strength lies in its beautiful, real-time dashboard and exceptional collaborative features, making the closing process transparent for teams and advisors.

- How it Supports Accurate Closing: Its automated bank feeds are robust. The "Reconcile" screen is designed for speed, with bulk match and approve functions. The invitation of your accountant to the live file means they can assist during close without exchanging files.

- Best For: Growing, tech-savvy businesses and those that work closely with external bookkeepers or accountants who need simultaneous access.

BlackLine: For Large Enterprises & Complex Needs

When the stakes are highest, BlackLine is the industry standard. It is a dedicated balance sheet reconciliation software platform built for the rigorous demands of large corporations.

- How it Supports Accurate Closing: It automates the entire reconciliation lifecycle with task management, centralized document storage, and stringent compliance controls. It ensures every account, no matter how complex, is reconciled, reviewed, and certified according to policy, providing complete confidence at quarter-end.

- Best For: Large organizations with multiple entities, strict regulatory compliance needs (like SOX), and a requirement for a single source of truth for the financial close.

Truly: For Powerful Standalone Automation

For businesses that need deep, specialized reconciliation automation tools outside their core accounting software, Truly offers a compelling option. It focuses on connecting disparate data sources and automating high-volume matching with precision.

- How it Supports Accurate Closing: Truly acts as a powerful bridge between your bank, payment processors, and your accounting ledger. It's exceptionally good at creating complex, multi-layered rules to handle challenging reconciliation scenarios, ensuring even intricate transactions are accurately matched before the books are closed.

- Best For: Companies with high transaction volumes, multiple revenue streams, or complex financial structures that need a dedicated, robust automated reconciliation system.

Implementing Software for a Smoother Close Process

Buying the tool is step one. Implementing it effectively is what guarantees a better close.

- Start Clean: Begin your first automated reconciliation cycle after a period you have manually closed and verified. This gives the software a clean starting point.

- Configure Rules Thoughtfully: Don't try to automate everything on day one. Start with your most predictable, high-volume transactions (like recurring SaaS payments or utility bills) and build your rule set from there.

- Use the Exception Workflow: Train your team to work from the exception report. The software’s job is to present the 5-10% of transactions that need human eyes, not the 90% it matched correctly.

- Lock in the Audit Trail: Make it a non-negotiable policy that all reconciliations are finalized and approved within the software, never outside it. This preserves the crucial digital paper trail.

- Schedule Regular Reviews: Set a monthly calendar reminder to review and tweak your matching rules. As your business changes, your rules should evolve to maintain peak efficiency.

Also Read: Why Software for Bank Reconciliation Is a Must for Modern Finance

The Bottom Line: Accuracy is a Competitive Advantage

An accurate financial close is not an accounting formality; it is a business imperative. It provides the trustworthy data you need to steer your company with confidence. The automated account reconciliation process you choose is the foundation of that accuracy.

By investing in the right automated reconciliation software, you replace risk with control, delay with speed, and uncertainty with clarity. You free your finance team from being data clerks and empower them to be analysts and advisors. In today's fast-paced business environment, that shift isn't just an improvement—it's a transformation that drives better decisions and sustainable growth.

![[LIVE] BULB Ambassador Program: Empowering the Future of Web3 Creators](https://cdn.bulbapp.io/frontend/images/952f29cd-a8d5-47aa-8e9f-78a1255f8675/1)