Forget Lemonade Stands, Kids Rule the Blockchain with Tokenomics!

Mining More Than Gems: Exploring the Rules of Tokens and Blockchain

Imagine you and your friends playing pretend at the park. You use rocks as pretend coins to buy imaginary lemonade and ice cream. Those rocks are like tokens in the real world – they have value because everyone agrees they can be used for things.

Secret Codes and Playful Coins: Unlocking the Mystery of Tokenomics

Tokenomics is like the rules of your pretend game. It explains how many rocks everyone gets, how to earn more, and what you can use them for. In the real world, tokenomics refers to the rules of a specific cryptocurrency or blockchain project. It explains:

- Supply: How many tokens exist and how many more will be created.

- Distribution: Who gets the tokens and how, like giving some to the game creators and some to players.

- Utility: What you can use the tokens for, like buying things or voting on decisions.

So You Want to Be a Crypto King? Tokenomics Shows You the Ropes (Without Tangles!)

For example, imagine a new game where you earn tokens by collecting virtual butterflies. The tokenomics might say there will only ever be 1 million tokens, some are given to early players, and you can use them to buy cool outfits for your avatar.

So, tokenomics is all about the rules and agreements that make a cryptocurrency or blockchain project work. It's like the instructions for your pretend game, deciding how everything works and what's fun!

From Candy Coins to Cool Avatars: Tokenomics Makes Pretend Play Epic

Remember, just like you wouldn't use your play rocks for real snacks, tokens aren't always directly worth money. Their value can change depending on how people want to use them and how many there are. It's important to be careful and learn all the rules before playing with any tokens or cryptocurrencies, just like you'd learn the rules of a new game before you start!

I hope this explanation helps! It's not always easy to explain complicated things to little ones, but it's important to start them young with basic financial literacy and encourage them to be responsible and curious about the world around them.

Here's a comprehensive guide on how to review tokenomics:

1. Gather Essential Information:

- Whitepaper and Website: Start by thoroughly studying the project's whitepaper and website. These resources should outline the token's purpose, distribution model, supply dynamics, and intended use cases.

- Community Resources: Engage with the project's community on forums, social media, and Discord channels. Get insights from other investors and developers about their perspectives on the tokenomics.

- Third-Party Reviews: Consult independent articles, analyses, and expert opinions to gain broader perspectives and identify potential red flags.

2. Analyze Key Factors:

- Token Type: Determine whether it's a utility token (used for accessing services), a security token (representing ownership), or a governance token (used for decision-making). Each type has unique implications for value and usage.

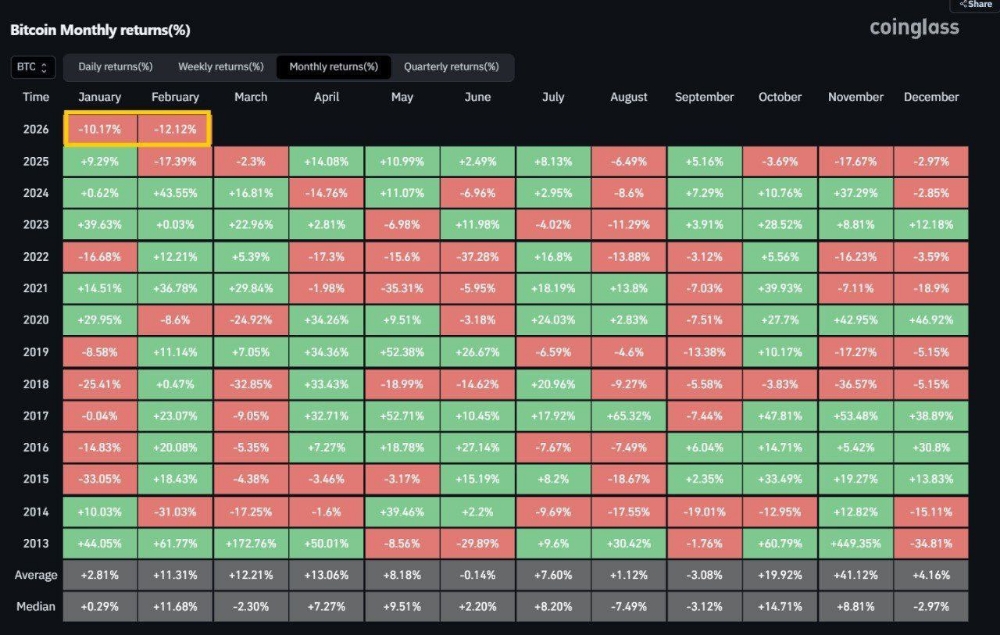

- Total Supply: Understand the total number of tokens in existence and how many more will be created. A limited supply can increase scarcity and potential value, while unlimited supply might raise concerns about inflation.

- Distribution Model: Assess how tokens are distributed, such as through initial coin offerings (ICOs), mining, staking, or airdrops. Fair and transparent distribution is crucial for building trust.

Token Allocation: Examine how tokens are allocated among different stakeholders, such as founders, investors, developers, and users. Consider potential conflicts of interest and alignment with project goals.

- Token Utility: Evaluate the real-world use cases of the token within the project's ecosystem. Strong utility can drive demand and value for the token.

- Vesting Schedules: Review any restrictions on token sales by early investors or team members. Well-structured vesting schedules prevent sudden price drops and foster long-term commitment.

- Burn Mechanisms: Check if any token-burning mechanisms are in place to reduce supply and potentially increase value.

- Inflation Rate: Understand how the token's supply will increase over time and its potential impact on value.

- Governance Mechanisms: Explore how token holders can participate in decision-making processes, if applicable. Decentralized governance can foster community engagement and align incentives.

3. Assess Sustainability and Growth Potential:

- Demand Drivers: Identify factors that could increase demand for the token, such as user growth, partnerships, and new features.

- Economic Incentives: Evaluate how the tokenomics model aligns incentives for different stakeholders to contribute to the project's success.

- Market Competition: Analyze competitors in the same space and assess the project's unique value proposition.

- Regulatory Compliance: Consider potential regulatory risks and the project's compliance with relevant laws.

4. Consult Experts and Research Thoroughly:

- Expert Opinions: Seek guidance from experienced investors, developers, and blockchain professionals to gain diverse perspectives.

- Community Insights: Engage with the project's community to understand their sentiment and expectations.

- Ongoing Research: Stay updated on project developments, market trends, and evolving regulatory landscapes.

Remember: Tokenomics is a complex and evolving field. Conduct thorough research, consider multiple factors, and consult with experts before making investment decisions.

![[LIVE] BULB Ambassador Program: Empowering the Future of Web3 Creators](https://cdn.bulbapp.io/frontend/images/952f29cd-a8d5-47aa-8e9f-78a1255f8675/1)