🧰 CeFi vs DeFi: Where Should You Keep Your Crypto in 2025?

In the early years of crypto, the biggest question was simple:

“Should I buy Bitcoin?”

But as the industry evolved, another question became even more important:

“Where should I store my crypto?”

In 2025, that question has become more complex than ever.

Centralized Finance (CeFi) and Decentralized Finance (DeFi) both offer powerful advantages — but also dangerous trade-offs.

So which one truly deserves your trust?

Let’s explore the real differences, the risks no one talks about, and how you should decide where your crypto belongs.

1. What CeFi Offers: Comfort, Simplicity, and Customer Support

Centralized Finance is what most people use without even realizing it.

Platforms like:

- Binance

- Coinbase

- Kraken

- Bybit

dominate the crypto world. They act like banks for digital assets.

The Advantages

• Easy onboarding

Create an account, pass KYC, deposit funds. No technical knowledge required.

• User-friendly interfaces

CeFi apps are clean, intuitive, and built for beginners.

• Customer support

If you lose access, make a mistake, or have a problem, someone can actually help you.

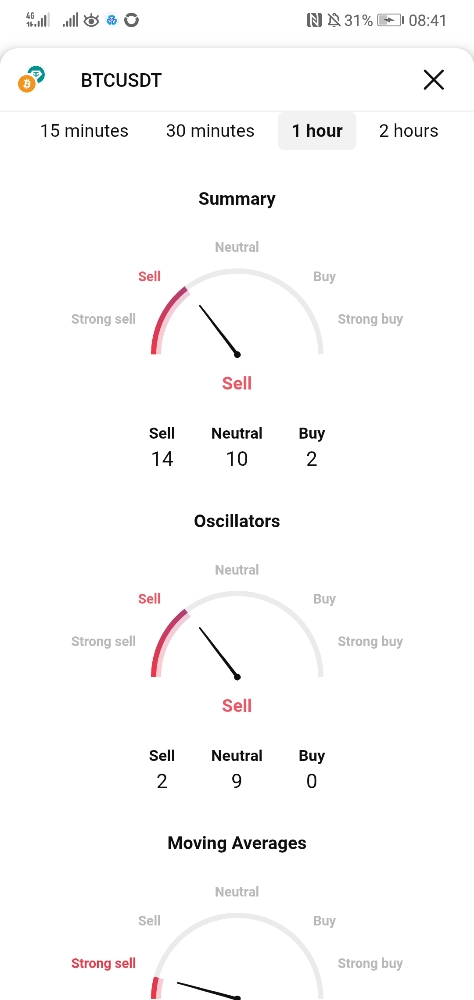

• Advanced trading tools

Charting, margin, futures — CeFi offers powerful features DeFi often lacks.

CeFi feels safe and structured.

But safety in appearance does not always mean safety in reality.

2. The Hidden Dangers of CeFi: Trust, Custody, and Single Points of Failure

2022 taught the crypto world a painful lesson:

Centralized platforms can collapse — fast.

FTX, Celsius, BlockFi, Voyager…

billions vanished overnight.

Why? Because in CeFi, you don’t control your crypto.

The Risks

• You give up custody

“Not your keys, not your coins” is more than a slogan — it’s a warning.

If the platform freezes withdrawals, your assets vanish on paper.

• Opacity and hidden risks

You rarely know how exchanges use customer funds.

• Regulatory vulnerabilities

Governments can force platforms to shut down or restrict users.

• Targets for hackers

Centralized databases attract cyberattacks like magnets.

CeFi is convenient — sometimes too convenient.

It works beautifully… until it doesn’t.

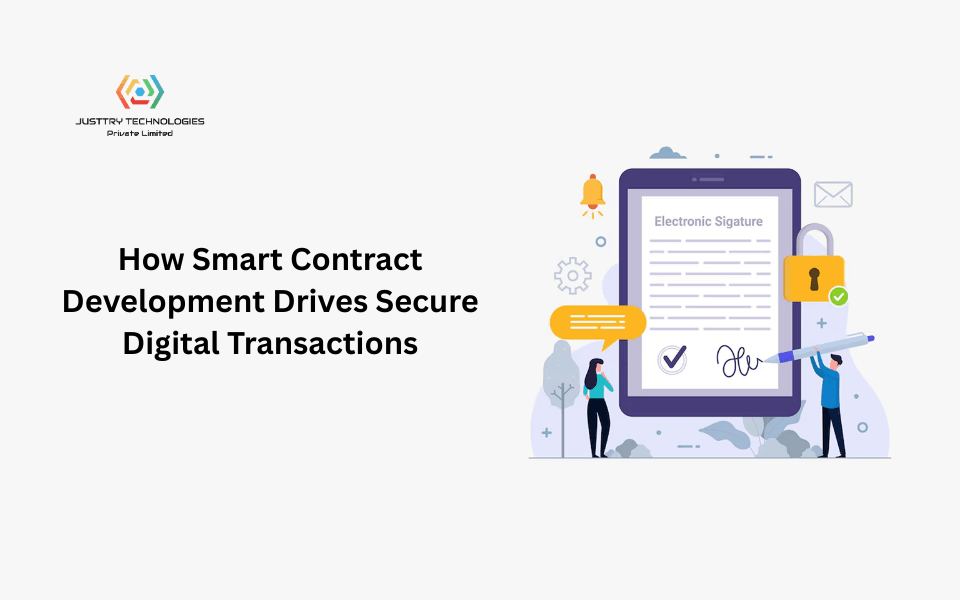

3. What DeFi Offers: Freedom, Transparency, and Full Ownership

Decentralized Finance flips the entire model.

With DeFi, you control your assets through:

- Self-custody wallets

- Smart contracts

- Permissionless protocols

Platforms like:

- Uniswap

- Aave

- Curve

- MakerDAO

operate without CEOs, customer support teams, or banks.

The Advantages

• Full ownership

Your crypto stays in your wallet unless you authorize a smart contract.

• Transparency

Everything happens on the blockchain — balances, risks, interest rates, liquidity pools.

• Global access

No KYC, no restrictions, no discrimination.

• Innovation

DeFi evolves faster than CeFi:

flash loans, yield farming, cross-chain bridges, automated liquidity.

Freedom is the foundation.

But freedom comes with responsibility.

4. The Hidden Dangers of DeFi: Complexity, Scams, and Smart Contract Risk

DeFi gives you power — but also exposes you directly to risks that CeFi shields you from.

The Risks

• Smart contract vulnerabilities

A single bug can drain a protocol instantly.

• Rug pulls and scams

Anyone can create a token or a liquidity pool.

Not everyone has good intentions.

• No customer support

Send assets to the wrong address?

They’re gone forever.

• Complex interfaces

Gas fees, slippage, signatures…

Beginners often get overwhelmed.

DeFi isn’t dangerous by nature.

But it demands understanding, caution, and self-discipline.

5. 2025: The Year of Hybrid Crypto Management

As the industry matures, CeFi and DeFi are no longer enemies.

They are slowly merging.

Regulated exchanges now integrate on-chain tools.

DeFi protocols introduce safety modules and audits.

Wallets blend centralized and decentralized features.

This hybrid model is shaping how users manage their crypto:

- CeFi for convenience

- DeFi for sovereignty

- Bridges and apps that combine both worlds

2025 isn’t about choosing a side.

It’s about choosing a strategy.

6. Where Should You Keep Your Crypto in 2025?

Here’s the truth:

There is no perfect solution.

Only what aligns with your risk tolerance and goals.

But here are clear guidelines to help you decide.

If you value convenience, speed, and support → CeFi.

CeFi is best for:

- Newcomers

- Active traders

- Short-term holders

- People uncomfortable with managing private keys

It’s easy, familiar, predictable.

If you value autonomy, privacy, and long-term security → DeFi.

DeFi is best for:

- Long-term holders

- People who understand crypto deeply

- Anyone who distrusts institutions

- Those investing in governance, liquidity pools, or NFTs

It’s empowering — but you must know what you’re doing.

7. The Golden Rule: Split, Don’t Commit

The smartest strategy in 2025 is diversification.

Keep some crypto on CeFi for trading, staking, and everyday use.

Keep the rest on DeFi for long-term custody, governance, or passive income.

This way, you reduce:

- Custodial risk

- Smart contract risk

- Platform failure risk

- Regulatory risk

Decentralization doesn’t mean abandoning convenience.

And convenience doesn’t mean abandoning sovereignty.

The future belongs to those who balance both.

Final Thought

Crypto doesn’t ask you to choose sides — it asks you to choose responsibility.

Whether you store your assets on CeFi or DeFi, the most important question is the one only you can answer:

Do you control your future, or are you trusting someone else to control it for you?

![[LIVE] BULB Ambassador Program: Empowering the Future of Web3 Creators](https://cdn.bulbapp.io/frontend/images/952f29cd-a8d5-47aa-8e9f-78a1255f8675/1)