What is TVL (Total Value Locked)?

There are many articles out there explaining TVL in detail, here I aim to bring a concise summary of what TVL is. Think of this as reference notes.

The simple definition

Total value locked is a figure that represents the spot value (usually in fiat terms i.e. USD) for all the assets that are currently staked in a specific protocol. The assets can be:

- Staked in simple yield protocols that allow depositors to receive an equal representation of their deposited tokens.

- Staked in lending protocols where the deposited assets are collateral for the loans.

- In the liquidity pools in an AMM (Automated Market Maker) exchange.

- Act as underlying for synthetic assets, futures contracts, and options.

- Liquidity for payment protocols facilitating the transfer of assets from l2 (layer 2) to the ETH mainnet.

The TVL figure for Defi would be the total value of the assets staked in the entire Defi system. This value does not represent any leverage created from the underlying assets. An analogy for this would be the funds a bank holds in its deposit throughout the fractional lending process.

Calculation

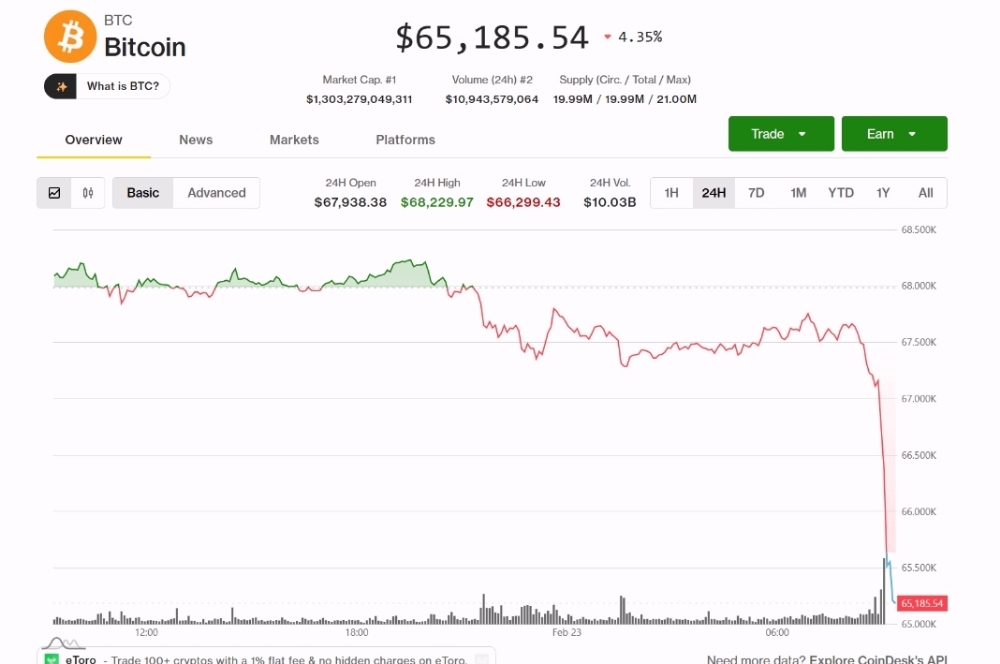

The TVL is a metric used to gauge the health of a Defi protocol. The TVL of an asset can be interpreted as how much of the assets’ capital is utilised across the entire Defi ecosystem giving a rough idea of its utility. To make the metric more comparable across assets with different market caps, a TVL Ratio is used which is defined as:

Total market cap of locked asset / Total value locked

The market cap here can either be the total circulating supply or the total supply multiplied by the price of a single unit (token) of the asset. It’s important to note this variability factor in the metric.

The calculation above is accurate in a simple scenario where the value of the token deposited is counted once. However, the complex nature of Defi staking yields scenarios where value is counted twice. For example, say an investor stakes 10 ETH into a protocol and is then given 10 SETH tokens (staked Ethereum tokens) in return. Those 10 SETH tokens validate the investor's initial stake of ETH and the SETH tokens might be accepted by another protocol allowing the investor to stake their SETH tokens. Whilst the investor has introduced 10 ETH of value into the Defi space when the total TVL is calculated or the TVL per-protocol is calculated the values will be inflated due to this double counting. Such a scenario is common in Defi and thus TVL calculations should be given leeway.

Usefulness

If looking at the TVL as measured by the market cap of the total circulating supply then theoretically the lower the TVL ratio the better since the more saturated the staking pool, the lower the ROI (return on investment) per token. Thus higher the TVL ratio, the lower the value of an asset should be.

Obviously, with the creativity of Defi, not every token is the same, and more factors impact a token’s price than just the TVL. For example, the utility of the token matters, if staking the token doesn’t generate yield then a TVL metric is almost worthless. Tokens that have governance properties may request a premium.

Even though it isn’t an all-encompassing metric for determining the value of a token, it’s still widely used and a great point of reference for investors like the Price to Equity ratio into equities. In fact, a Defi index by Defi pulse (the populariser of the TVL metric) exists to balancing its weights across the incorporated tokens via the TVL metric.