Key Indicators for Assessing Market Trends

Understanding market trends is central to making strong financial and business decisions. Whether you are an investor, a business owner, or simply someone trying to understand the broader economy, recognizing the signals that shape markets is essential. Market trends do not emerge randomly; they are shaped by patterns, cycles, and measurable indicators that reveal the underlying direction of economic activity.

The ability to read these indicators is what separates informed decision-making from mere speculation. Below are the most important markers to watch when analyzing market behavior, explained in straightforward terms without unnecessary complexity.

Economic Growth and GDP

At the foundation of market trends lies the performance of the economy itself. Gross Domestic Product (GDP) is the most widely used measure of economic growth, reflecting the value of all goods and services produced in a country.

- Rising GDP often signals a healthy and expanding market environment where businesses thrive and consumer confidence increases.

- Falling GDP or slow growth indicates stagnation or contraction, which can bring about declining demand, reduced investments, and weaker markets.

However, GDP alone cannot reveal everything. It must be viewed alongside other indicators such as consumer spending, investment levels, and government policy decisions. Still, as a core measure, it provides the big picture of whether the economy is moving forward or slipping backward.

Inflation and Price Stability

Markets are deeply affected by inflation, the rate at which the prices of goods and services rise over time. Moderate inflation typically signals healthy demand and growth, but excessive inflation—or worse, hyperinflation erodes purchasing power and destabilizes markets.

- Consumer Price Index (CPI): Tracks average price changes for a basket of goods and services.

- Producer Price Index (PPI): Measures price shifts at the wholesale level before reaching consumers.

Both indices give insights into cost pressures that ripple through supply chains. Central banks often respond to rising inflation by adjusting interest rates, which in turn influences borrowing, spending, and investment behaviors across the market.

Employment Levels

Employment data is one of the clearest reflections of market health. High employment rates usually point to strong demand, business expansion, and consumer confidence, while rising unemployment signals slowing markets.

Key measures include:

- Unemployment Rate: The percentage of people actively seeking but unable to find work.

- Job Creation Numbers: Monthly statistics showing how many new positions are being added across sectors.

- Wage Growth: Rising wages boost consumer spending but can also add to inflationary pressure.

For investors and businesses, employment figures highlight whether households have the spending power to drive growth in demand.

Interest Rates and Monetary Policy

Central banks, such as the Federal Reserve in the U.S. or the European Central Bank in Europe, play a pivotal role in shaping market direction. By adjusting interest rates, they influence borrowing costs for consumers and businesses.

- Lower interest rates generally encourage borrowing, investing, and expansion, sparking upward market trends.

- Higher interest rates tend to cool down spending and slow investment, often signaling or creating downward trends.

Interest rates also directly affect stock markets, housing markets, and bond yields, making them one of the most crucial signals to monitor.

Consumer Confidence and Spending

Markets thrive when people feel secure about their financial future. Consumer confidence surveys measure how optimistic households are about income, employment, and the economy overall.

- High consumer confidence usually results in increased spending, which drives company revenues and supports stock markets.

- Low consumer confidence leads to reduced spending, dragging markets downward even if other indicators look positive.

Retail sales figures often act as a direct confirmation of consumer sentiment, revealing whether optimism is translating into actual economic activity.

Business and Manufacturing Activity

Another strong set of indicators comes from measuring how businesses themselves are performing. Surveys and reports that track industrial output and manufacturing orders provide early signs of expansion or contraction.

Important markers include:

- Purchasing Managers’ Index (PMI): A widely followed gauge of business activity in manufacturing and services. Readings above 50 signal expansion, while below 50 indicates contraction.

- Industrial Production Reports: Track output across factories, mines, and utilities, offering a snapshot of overall business health.

These numbers are valuable because they often reveal shifts before they appear in broader measures like GDP.

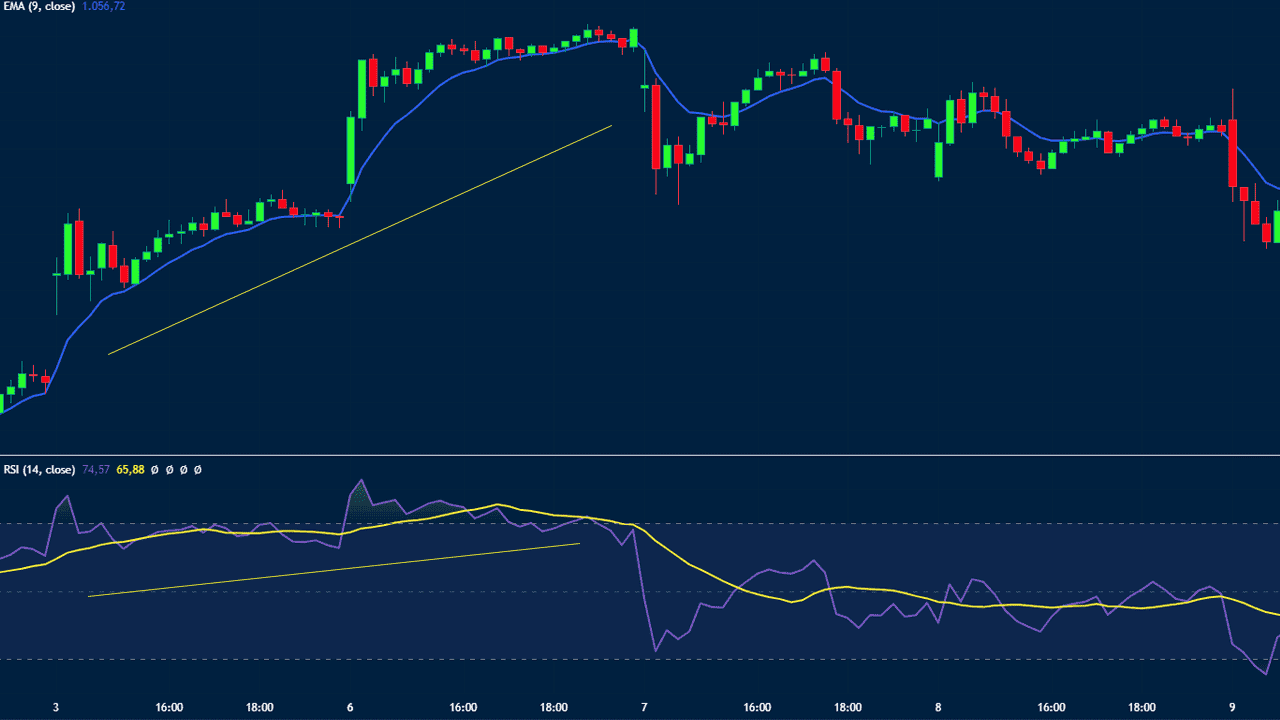

Stock Market and Asset Prices

While not a perfect mirror of the economy, financial markets provide clues about sentiment and expectations. Rising stock markets usually signal optimism about future earnings and growth, while declines may reflect uncertainty or fear.

Key factors to watch:

- Major Stock Indexes (e.g., S&P 500, Dow Jones, Nasdaq): Track broad investor confidence and corporate performance.

- Volatility Index (VIX): Often called the “fear gauge,” it shows how turbulent or stable market expectations are.

- Bond Yields: Rising yields can suggest inflation fears or tightening monetary policy.

Markets tend to anticipate future conditions, making them useful as leading indicators rather than simple reflections of the present.

Global Trade and Currency Strength

Markets are not confined within borders. Global trade flows and currency values play an enormous role in shaping trends.

- Trade Balances: A nation with strong exports often enjoys growing markets, while heavy trade deficits can create vulnerabilities.

- Exchange Rates: A strong domestic currency makes imports cheaper but exports less competitive, while a weaker currency has the opposite effect.

Geopolitical events, supply chain disruptions, or global commodity price shifts (such as oil or rare minerals) also leave a clear mark on markets everywhere.

Housing Market and Real Estate Indicators

Housing is not only a key sector but also a leading barometer of consumer strength. When people are buying homes, it signals confidence, stability, and willingness to take on long-term commitments.

Indicators to watch include:

- Housing Starts: The number of new residential construction projects.

- Home Sales Data: Reflects demand in both new and existing housing.

- Mortgage Rates: Directly tied to central bank policy, affecting affordability and demand.

Since housing affects construction, manufacturing, finance, and consumer spending, it serves as a critical piece of the market trend puzzle.

The Role of Technology and Innovation

In today’s economy, innovation itself has become an indicator. When new technologies gain adoption such as renewable energy, artificial intelligence, or biotechnology—they not only reshape industries but also influence broader market momentum.

Tracking investment into emerging sectors, patents filed, and adoption rates offers insight into where growth is headed next. Market leaders often emerge from such technological transformations, pulling entire indexes upward.

Putting It All Together

No single indicator is enough to fully assess market trends. Instead, reliable analysis comes from observing how these markers interact with one another:

- Rising GDP alongside rising employment and consumer confidence often signals a strong bullish trend.

- High inflation combined with slowing growth may warn of stagflation, where markets struggle despite price increases.

- Sharp stock market gains with weak real economic data may suggest a bubble rather than sustainable growth.

Understanding these signals allows individuals and businesses to position themselves wisely whether that means investing, saving, expanding, or holding back.

Conclusion

Market trends are not shaped by mystery but by measurable, observable signals. By studying GDP growth, inflation, employment data, consumer confidence, business activity, interest rates, and global conditions, one can identify where the economy is heading.

For anyone seeking to make informed financial decisions, from personal investing to running a business, learning to read these indicators is indispensable. It transforms uncertainty into informed judgment and turns market analysis into a skill rather than a gamble.