Hidden charges of banks in Pakistan.

Banking has become a necessity in Pakistan, from salary accounts and online transfers to digital wallets and ATM withdrawals. However, many customers often experience unexpected deductions , commonly referred to as “hidden charges.” While most banks disclose fees in their schedules, the lack of awareness, complex terms, and unclear communication make these charges feel hidden. Understanding them is essential for protecting your money and exercising your rights as a consumer.

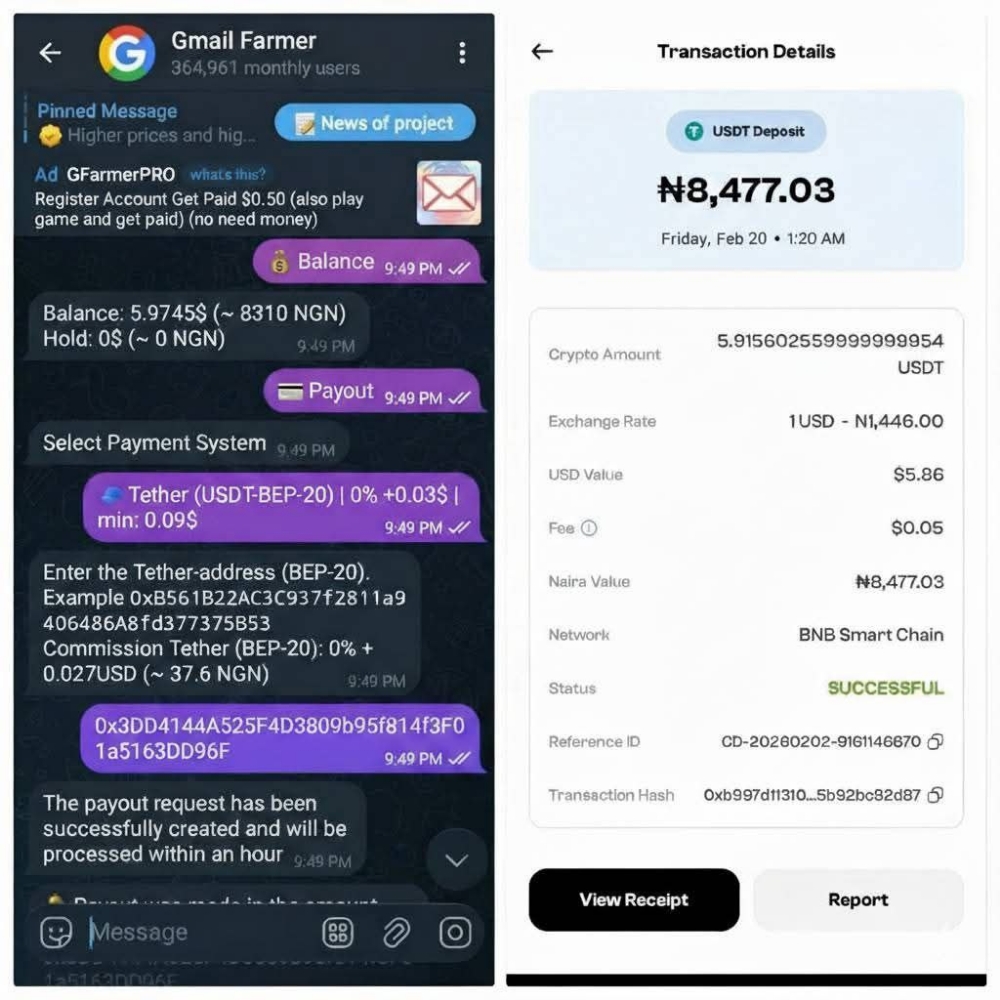

I normally took my account statement after every six months and rarely read all the numbers but just a week ago, I took it and read all where a surprise was waiting for me. Hidden charges, which I was blind. Bank deducted around 3600 rupees on different days with different reasons. When I do some research then found that there are many hidden charges. Let's explore one by one,

Hidden Bank Charges.

Hidden charges are fees deducted from your bank account that you were not clearly informed about, did not expect, or did not understand due to technical language. These charges may be legal, but they become problematic when the bank does not communicate them properly or when they are applied unfairly or without consent. In Pakistan, such issues have increased with digital banking, credit cards, and transactional services.

Types of Common Hidden Charges in Pakistan

ATM & Withdrawal Charges,

🫰Cash withdrawal from other bank ATMs after a limited free quota.

🫰Charges on international ATM withdrawals, including currency conversion fees.

🫰Mini-statement or balance inquiry charges on other banks’ ATMs.

SMS and Alert Charges

Many banks deduct monthly or quarterly fees for SMS alerts, security notifications, and account updates. Customers often don’t realize these are paid services.

🫰 Annual Debit/Credit Card Fee

🫰Annual renewal fee for ATM, debit, or credit cards.

🫰Replacement charges for lost or damaged cards.

Account Maintenance or Minimum Balance Penalties

Some accounts require a minimum balance. Falling below that triggers deductions.

Current accounts often charge monthly or annual maintenance fees.

Funds Transfer Fees

Charges for IBFT (Inter Bank Funds Transfer) in certain conditions.

Fees for pay orders, demand drafts, and RTGS transactions.

Dormant or Inactive Account Charges

If an account remains unused for several months, banks may apply reactivation or service charges.

Credit Card Hidden Costs

🫰Late payment penalties.

🫰Cash advance fees.

🫰High-interest rates not clearly explained.

🫰Foreign transaction markup.

Chequebook and Statement Fees

Charges for chequebook issuance, duplicate statements, and paper-based requests.

How to Protect ourself from Hidden Charges.

- We must Read the Schedule of Charges (SOC)

- We should Ask Clear Questions.

- We must Monitor our Account Regularly.

- We must Choose the Right Account Type.

- Opt for Digital Statements

- Avoid Unnecessary Credit Card Usage

Complain or Take Legal Action

If we notice unfair or unexplained deductions, follow these steps:

✅ Step 1: Complain to the Bank.

✅ Step 2: Approach the Banking Mohtasib Pakistan.

✅ Step 3: Legal Action in Consumer Courts.

Conclusion,

Hidden bank charges in Pakistan are often the result of poor communication rather than intentional fraud. However, the impact on customers is real. By staying informed, monitoring transactions, and exercising legal rights, individuals can protect their hard-earned money. Banking should be transparent and every customer has the right to clarity, fairness, and accountability.

In my case , at lot of points I was unaware of charges and in one point the bank operational manager admit their fault and promise to me that refund will be there soon. I think he will confirm from his head office.

Thanks for your valuable time to read my experience & thoughts . Like , upvote and leave comment for feedback.

The lead image taken from.

Note: The article also published on my read.cash Wall.

Cheers,

Amjad