If USDT collapse.

Stable coins are crypto tokens designed to hold a steady price , usually pegged to $1 by holding reserves like cash and short-dated U.S. Treasury bills or by using over collateralized crypto and smart-contract controls. Stable coins grease the wheels of crypto and traders move in and out of volatile coins quickly, settle across exchanges 24/7, and park funds between positions without touching banks. In 2025, dollar-pegged stablecoins represent a large share of crypto trading liquidity and settlement, and new rules in major jurisdictions (U.S. and EU) are pushing issuers toward higher quality, transparent reserves and monthly disclosures.

Can stable coins threaten the crypt ecosystem.

The same liquidity superpower is also the risk. Because many markets are quoted against a single dominant stablecoin, any loss of confidence can freeze order books, widen spreads, and force fire sales of reserves. Regulators and central banks warn that rapid growth concentrates liquidity, creates run risks if redemptions spike, and can transmit stress back into money markets if issuers dump Treasuries to meet withdrawals. These concerns are well documented by the ECB, BIS and policy analysts.

If USDT collapse.

It is interesting to know that it is quite possible, any day we listen the news that USDT collapsed. A disorderly depeg of USDT would likely ignite a “flight to quality” toward other fiat-backed coins like USDC and USD, exchanges with deep non USDT books, and off ramps to fiat.

- Short-term effects may include,

- A sharp drop in overall trading volumes.

- price dislocations as USDT pairs gap and arbitrage breaks.

- Stress in money markets if the issuer liquidates reserves to fund redemptions.

- Counter party problems for exchanges and lenderEven skeptics agree the immediate impact would be market-wide volatility.

Over time, liquidity would likely re-aggregate around better regulated alternatives but not without By design, fiat backed stablecoins aim for price stability, not capital gains, so simply “holding” them isn’t an investment strategy. Returns, if any, come from what you do with them like on-chain cash-management or lending programs that pass through part of the T-bill yield less fees and risk. The yield belongs primarily to the issuer unless they share it to users face issuer, smart-contract, and platform risk when chasing extra yield. Treat stablecoins as cash like rails, not a return engine.

But if it happens, people will forget one coin, FTX , MT Gox Hack and Bit connect because it will shake the roots of crypto. Although I didn't agree on it but lot of crypto experts like Pantera crypto are very much optimistic about it.

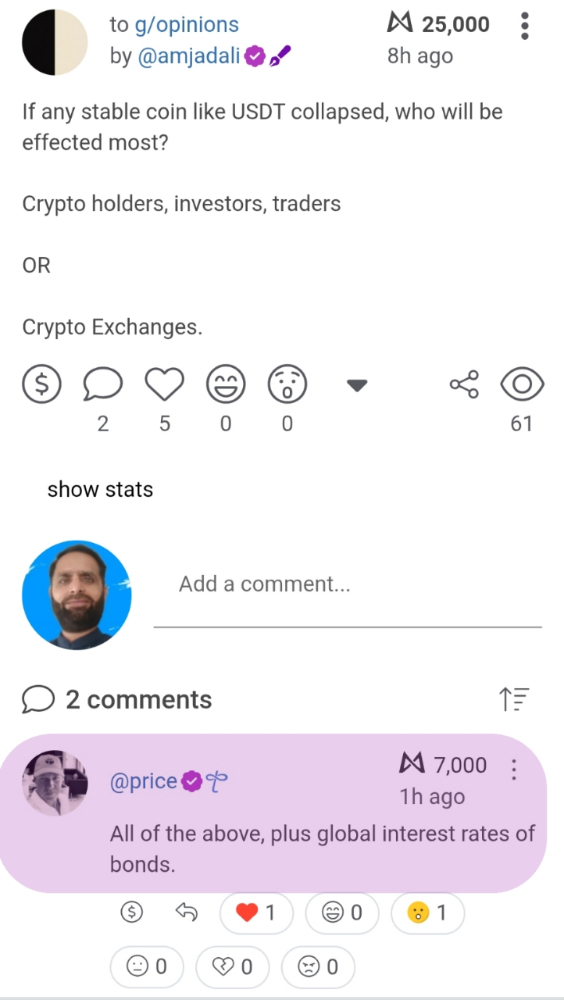

When I asked this question in opinions poll of tangled.com , I am really glad and thankful to founder of the Millix cryptocurrency, Tangled.com , BitcoinWallet.com and the owner of Fiatleak.com , Mr. Price responded and added his valuable thought,

Link my tangled Post

Watch another thought here,

Can stable coins be used to manipulate markets?

Any deep pool of quote liquidity can be misused. Authorities have flagged manipulation risks (wash trading, spoofing, sudden liquidity withdrawals) where stablecoin pairs dominate volumes and where issuer transparency is weak. That’s why current and proposed rules emphasize audited reserves, redemption rights, KYC/AML, and market-abuse oversight so the cash leg of crypto trading is less game able and runs are less likely.

Bottom line

Stable coins are the plumbing of crypto , they enable rapid settlement and deep liquidity, but they also centralize key risks. A major depeg especially of a dominant coin like USDT would be painful in the short run, with liquidity fragmentation and price shocks, but could accelerate migration to more transparent, tightly regulated alternatives. Stable coins themselves aren’t a profit vehicle , they are rails. If you use them, scrutinize the issuer’s disclosures, redemption mechanics, and where you park them. And if you are trading assets like BNB, remember that coin specific catalysts can lift prices but liquidity conditions, often powered by stable coins, amplify the move in both directions.

Thanks for your time till here, like upvote and leave comment for feedback.

Note: The article also published on my read.cash wall .

Cheers,

Amjad

Catch me here ,

Tangled| Twitter| FB