Guide to Upcoming ICOs and IDOs in 2025

Initial Coin Offerings (ICOs) and Initial DEX Offerings (IDOs) represent foundational mechanisms for blockchain projects to raise capital directly from investors by selling tokens before they become widely available on exchanges. ICOs, which gained prominence during the 2017 boom, involve projects issuing tokens on centralized platforms or their own websites, often with detailed whitepapers outlining use cases in areas such as decentralized finance or non-fungible tokens. In contrast, IDOs leverage decentralized exchanges like Uniswap or PancakeSwap, allowing for immediate liquidity post-sale and reducing intermediary involvement, which has become increasingly popular due to enhanced transparency and lower barriers for retail participants. As of August 2025, regulatory developments, including the SEC's clearer guidelines on token classifications under the Howey Test, have pushed more projects toward compliant structures, with many incorporating know-your-customer protocols to avoid enforcement actions.

The evolution of these fundraising models reflects broader market maturation, where ICOs now often include vesting periods to prevent immediate sell-offs, while IDOs benefit from automated market makers that ensure fair price discovery from the outset. Data from Chainalysis indicates that token sales raised over $12 billion in the first half of 2025, a 25% increase from the previous year, driven by renewed interest in layer-2 scaling solutions and AI-integrated protocols. Projects opting for IDOs typically see faster community adoption, as evidenced by the average 3.5x return on investment within the first month post-launch, according to aggregated metrics from CryptoRank.

Market Trends Influencing Token Sales

Shifting investor preferences toward sustainable utility tokens have reshaped the landscape, with a notable uptick in projects focusing on real-world applications like supply chain tokenization and carbon credit marketplaces. Amidst Bitcoin's price stabilization above $80,000 and Ethereum's upgrades enhancing transaction efficiency, the market has seen a surge in cross-chain IDOs that operate across multiple blockchains, mitigating risks associated with network congestion. Upcoming crypto projects, particularly those startups awaiting token sale stages in sectors such as gaming and decentralized identity, are positioning themselves to capitalize on this momentum by offering innovative tokenomics that include staking rewards and governance rights.

Economic factors, including interest rate adjustments by central banks, have influenced capital flows into crypto, with institutional investors allocating larger portions to early-stage sales. For instance, venture firms like Andreessen Horowitz have backed several IDOs this year, emphasizing projects with audited smart contracts to minimize security vulnerabilities. The rise of Solana-based ecosystems, boasting transaction speeds up to 65,000 per second, has made it a preferred chain for IDOs, as projects can launch with minimal gas fees, attracting a broader retail base.

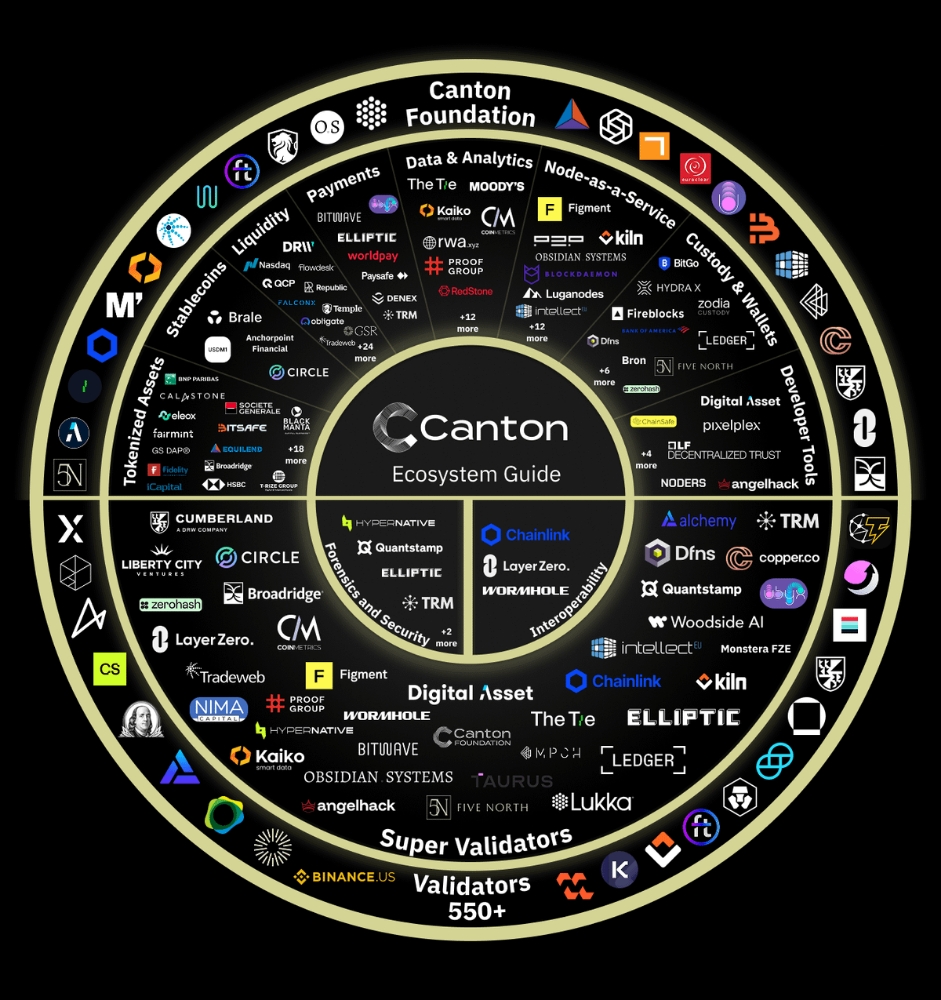

Regulatory landscapes vary globally, with Europe's MiCA framework requiring detailed disclosures for token issuers, while Asia-Pacific regions like Singapore offer sandbox environments for testing innovative sales models. This has led to a diversification in project origins, with 40% of 2025's token sales emerging from non-Western developers, per reports from Messari. Investors monitoring these trends often prioritize projects with strong partnerships, such as integrations with established protocols like Chainlink for oracle services, ensuring data reliability in DeFi applications.

Notable Upcoming ICOs and IDOs

As the year progresses, several token sales stand out for their potential impact, drawing from diverse sectors and backed by solid fundamentals. For example, Bitcoin Hyper, an ICO focused on hyper-scalable Bitcoin layer-2 solutions, aims to raise $5 million through its sale ending in late August 2025, promising enhanced transaction throughput for enterprise adoption. Similarly, TOKEN6900, which integrates meme culture with utility in decentralized social platforms, has generated buzz with its IDO scheduled for September, targeting $3.2 million in funding to expand user-generated content ecosystems.

Projects leveraging Solana's infrastructure are particularly prominent, given the chain's low-cost environment. Dogeverse, a multi-chain meme token with cross-compatibility features, is set for an IDO in October 2025, with a hard cap of $10 million and emphasis on community-driven governance. Another Solana-based entrant, Slothana, combines sloth-themed branding with staking mechanisms, planning a token sale in November to fund ecosystem expansions, including NFT integrations. These initiatives highlight the blend of entertainment and functionality that appeals to younger demographics entering the market.

Beyond memes, more utility-focused sales include BlockDAG, an ICO promoting directed acyclic graph technology for faster block confirmations, with a fundraising goal of $50 million by December 2025, backed by projections of 10,000x ROI in high-growth scenarios. Unstaked, targeting liquid staking derivatives, offers an IDO in mid-September, aiming to unlock $15 million for protocol enhancements that allow users to earn yields without locking assets long-term.

Investors tracking these opportunities should note the varying timelines and requirements. While some sales like Maxi Doge conclude by early September with modest $2 million caps focused on pet-themed DeFi, others extend into Q4. To systematically evaluate these, consider the following key factors that differentiate high-potential projects from the rest, based on historical performance data where top performers in 2024 achieved average returns of 8x within six months.

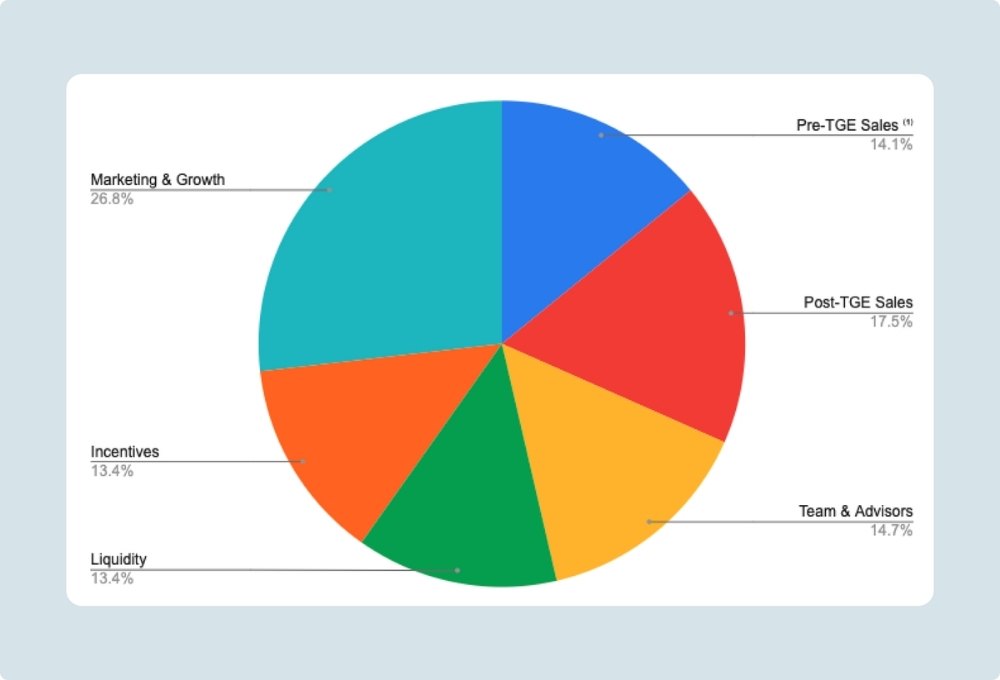

- Tokenomics Structure: Assess supply caps, allocation to teams, and burn mechanisms to ensure long-term value retention.

- Team Expertise: Verify backgrounds via platforms like LinkedIn, prioritizing those with prior successful launches.

- Audit Status: Confirm third-party audits from firms such as Certik to mitigate smart contract risks.

- Community Metrics: High engagement on Discord or Telegram, with over 50,000 members, often correlates with post-sale liquidity.

- Roadmap Milestones: Clear, achievable goals like mainnet launches within 12 months post-sale.

This framework aids in filtering amid the hundreds of listings available on aggregators.

Platforms for Discovering and Participating

Dedicated platforms streamline access to these sales, aggregating data for efficient research. Sites like ICO Drops provide curated calendars with real-time updates on start and end dates, while Crypto Totem offers ratings based on hype and potential returns. Launchpads such as Binance Launchpad host vetted IDOs, requiring BNB holdings for participation, and have facilitated sales with average allocations yielding substantial gains.

For broader coverage, Coin Launch rates projects across categories, including DeFi and gaming, helping users spot trends like the rise in AI-driven tokens. Participation often involves wallet connections and KYC verification, with tools like MetaMask essential for seamless transactions on Ethereum-compatible chains.

Strategies for Investors

Effective engagement requires a disciplined approach, starting with portfolio diversification across 5-10 projects to spread risk. Allocate based on market cap potential, favoring those with under $100 million valuations pre-sale for higher upside. Monitor on-chain metrics via Dune Analytics to gauge whale activity and token distribution fairness.

Timing plays a crucial role, as entering during soft cap phases can secure better pricing. Engage in community AMAs to probe team responsiveness, and use tools like Token Metrics for AI-powered predictions on success probabilities.

Risks and Considerations

Despite opportunities, challenges abound, including market volatility that can erode gains post-launch. Rug pulls remain a threat, with losses exceeding $800 million in 2025's first quarter alone, underscoring the need for due diligence. Regulatory shifts could impact token classifications, potentially requiring refunds or halts.

Liquidity risks in IDOs, where initial trading volumes spike then drop, necessitate exit strategies. Investors should also account for gas fees and impermanent loss in liquidity pools.

Conclusion

Navigating upcoming ICOs and IDOs in 2025 demands a blend of market insight and rigorous analysis, with projects like Bitcoin Hyper and BlockDAG exemplifying the innovation driving the sector forward. By leveraging reliable platforms and adhering to structured evaluation criteria, participants can position themselves for meaningful returns amid evolving trends.

Ultimately, success hinges on balancing enthusiasm with caution, ensuring investments align with personal risk tolerance and long-term blockchain adoption trajectories.

![[The Zero-Capital Masterclass] How AI & DePIN are Hacking the 2026 Airdrop Meta 🚀](https://cdn.bulbapp.io/frontend/images/de133e2f-b217-409c-a74b-c3428e2a7e40/1)