Crypto Is Not a Get-Rich-Quick Game — Here’s the Truth

Introduction

Crypto is often marketed as a fast track to wealth.

Social media is filled with screenshots of massive gains, overnight success stories, and bold predictions of “the next 100x coin.”

But here’s the uncomfortable truth:Crypto is not a get-rich-quick game.

In fact, believing it is may be the fastest way to lose money.

This article breaks down the reality behind crypto trading and investing — without hype, without fear, just facts.

1. Why Crypto Looks Like Easy Money

Crypto markets move fast. Prices can rise or fall double-digit percentages in a single day.

For beginners, this creates the illusion that money is easy to make.

Add to that:

- Influencers showing only winning trades

- Survivorship bias (you see winners, not losers)

- Bull markets that lift almost everything

During these phases, luck is often mistaken for skill.

But markets don’t move in one direction forever.

2. Volatility Is a Double-Edged Sword

Volatility is what attracts people to crypto — and what wipes most of them out.

High volatility means:

- Big profit potential ✅

- Equally big risk ❌

Without proper risk management, one bad trade can erase weeks or months of gains. Many beginners experience:

Many beginners experience:

- Overconfidence after a few wins

- Oversized positions

- No stop-loss

- Emotional decision-making

The result is usually the same: rapid drawdowns and frustration.

3. The Psychological Trap

Crypto trading is more psychological than technical.

Common emotional traps include:

- FOMO (Fear of Missing Out): buying after a big pump

- Panic selling: exiting at the worst possible moment

- Revenge trading: trying to recover losses quickly

- Overtrading: being active without a real edge

Most accounts don’t fail because of bad analysis —

they fail because emotions override discipline.

4. No Strategy, No Edge

Many newcomers enter crypto without:

- A tested strategy

- Clear rules

- Defined risk per trade

- A long-term plan

They jump from:

- Coin to coin

- Strategy to strategy

- Influencer to influencer

In reality, consistency comes from mastery, not constant switching.

Successful traders and investors usually:

- Use simple, repeatable systems

- Focus on risk control

- Think in probabilities, not certainties

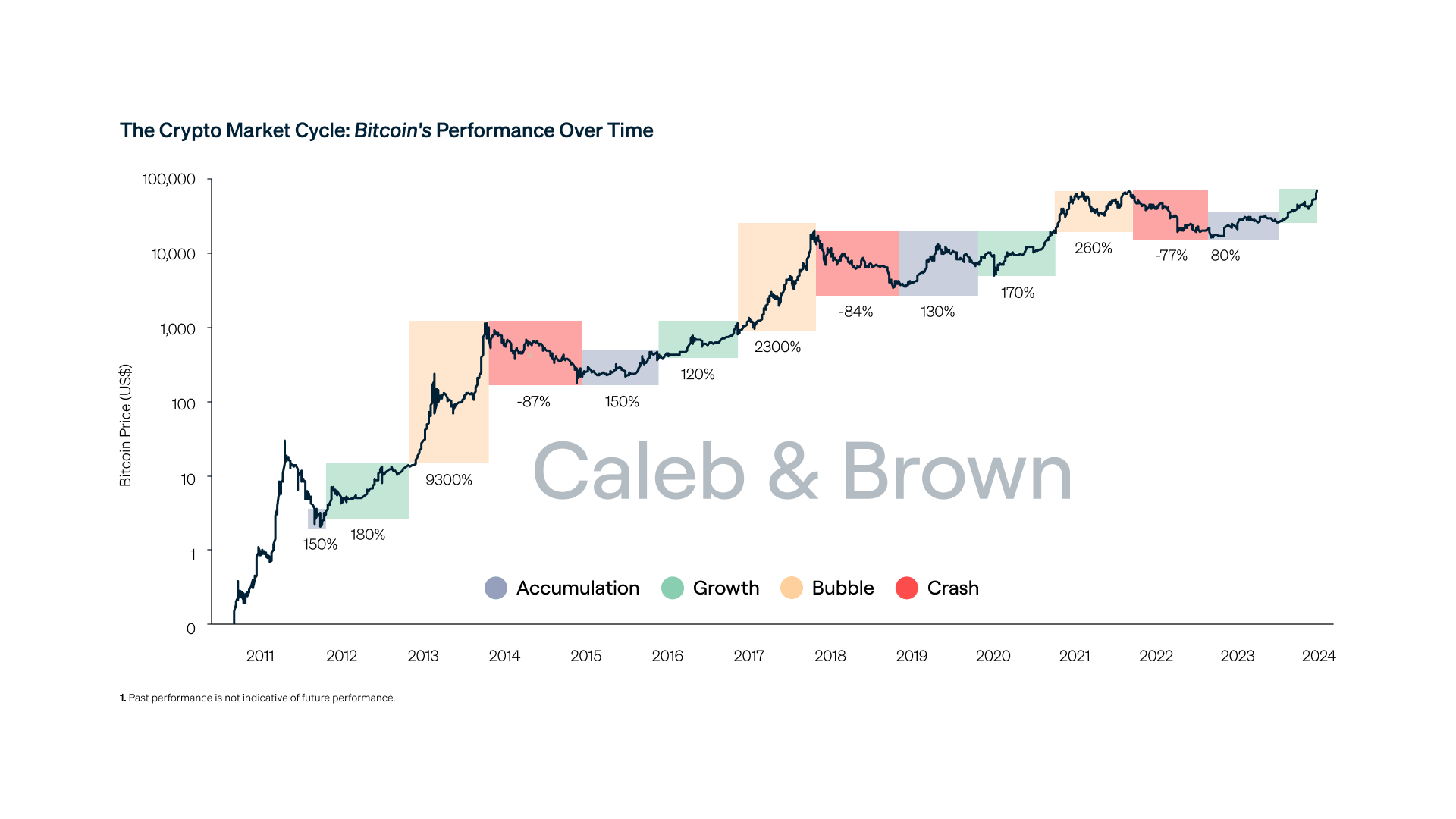

5. Time in the Market Beats Speed

Crypto rewards:

- Patience

- Discipline

- Continuous learning

It punishes:

- Impulsiveness

- Greed

- Short-term thinking

Most sustainable success stories are built over years, not weeks.

Those who survive multiple market cycles often understand one key rule:

Survival comes before profit.

If you stay in the game long enough, opportunities will come.

If you blow up early, the game ends.

Final Thoughts

Crypto is not easy money.

It is a high-risk, high-skill environment that demands emotional control, proper risk management, and realistic expectations.

If you approach crypto as:

- A long-term learning process

- A game of probabilities

- A test of discipline, not ego

You already gain an edge over the majority.

⚠️ Risk Disclaimer

This article is for educational purposes only and does not constitute financial advice.

Cryptocurrency markets are highly volatile and involve substantial risk. Always do your own research and only invest what you can afford to lose.