Trump-Backed WLFI Token Gains a Treasury Company. What does it mean?

ALT5 Sigma, a company originally focused on chronic pain treatment, has pivoted into crypto payments and now plans to hold a treasury of Trump-backed World Liberty Financial (WLFI) tokens. The move mirrors how Michael Saylor’s Strategy (MSTR) became a bitcoin proxy stock after its CEO initiated a large bitcoin-buying strategy. WILFI and ERIC TRUMP | Photo: Adam Gray / Bloomberg / Getty Images

WILFI and ERIC TRUMP | Photo: Adam Gray / Bloomberg / Getty Images

Key Points

- ALT5 Sigma will hold a WLFI-specific treasury, managing roughly 7.5% of the coin’s total supply.

- WLFI tokens, which were previously non-transferable, could start trading by the end of the month.

- The WLFI treasury follows the trend of companies holding large amounts of digital assets as balance-sheet alternatives.

Earlier this week, ALT5 Sigma (ALTS) raised $1.5 billion by selling 200 million shares, both new and existing. Some of the proceeds were used to acquire WLFI tokens from World Liberty Financial. In a private placement, World Liberty Financial, the lead investor in the share sale, provided $750 million worth of WLFI in exchange for ALT5 shares.

Following the investment, Eric Trump, son of former President Donald Trump, joined ALT5’s board, while WLFI cofounder Zach Witkoff — son of Trump-appointed Middle East envoy Steve Witkoff — became chairman.

WLFI has a total supply of 100 billion tokens. Initially non-transferable, trading could begin by the end of this month after a community vote approved it.

Investors should remain cautious, as copycat tokens — such as “Wen Lambo Financial” — have appeared on various exchanges using similar symbols. Meanwhile, shares of micro-cap ALT5 surged Wednesday after the announcement.

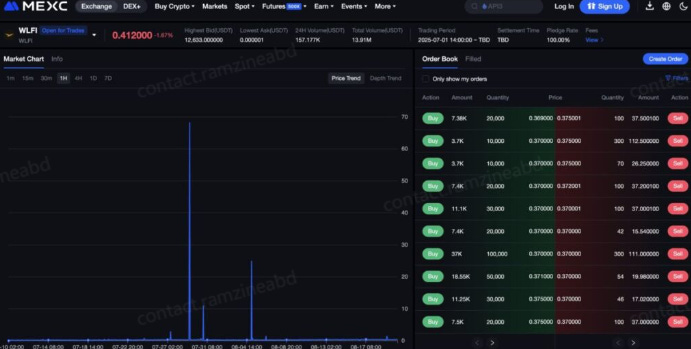

Gain with MEXC & WILFI The WLFI token is currently part of a WLFI Referal Rush Campaign. on MEXC, allowing users to participate in promotions and early access. WLFI Referal Rush Campaign

WLFI Referal Rush Campaign

WLFI Pre-Market Trading is also available on MEXC. WLFI Pre-Market Trading

WLFI Pre-Market Trading

Why It Matters The ALT5 WLFI treasury is part of a growing trend of companies experimenting with digital-asset treasuries beyond Bitcoin and Ethereum, signaling broader corporate interest in crypto as both investment and balance-sheet strategy.