Earn BNB with Binance Liquid Swap: Top Reasons

PREAMBLE

PREAMBLE

The Blockchain is a revolution that has come to stay. Each day that passes by sees several innovations that have reinforced the quality of the Blockchain and made its ease of use suppliant and its value perennial for our generation and generations to come.

This said, we must always remember that the Blockchain is here to set right the injustices and discrepancies that the tradition finance institutions have been perpetrating on the common masses and it does this with innovations that were not thought of in the near past. With rapid mass adaption of the Blockchain, we hope to see an end to a traumatic socio- economic era of the traditional establishments.

The Blockchain development roadmap has been impressive

The overall roadmap of the Blockchain development has been progressive and impressive. We saw the epouch of ICOS, how crypto-exchanges sprouted in hundreds, the presence of escrow-vigilant Peer to peer platforms and several other footprints to where we are now: the era of smart contracts, DeFi and NFTs. Did you ever envisage that Bots could trade for you with precision greater than manual trading?

How do you feel about yield farming compared to traditional bank interest systems? We must appreciate the impact of the Blockchain. The Impressive trend of the Blockchain ecosystems cannot be mentioned without Binance which has contributed immensely to Blockchain development, decentralized finance and automated trading via her enviable and solid innovative solutions. One of such solutions to be implemented for decentralized usage is the Binance Liquid Swap.

BINANCE LIQUID SWAP.

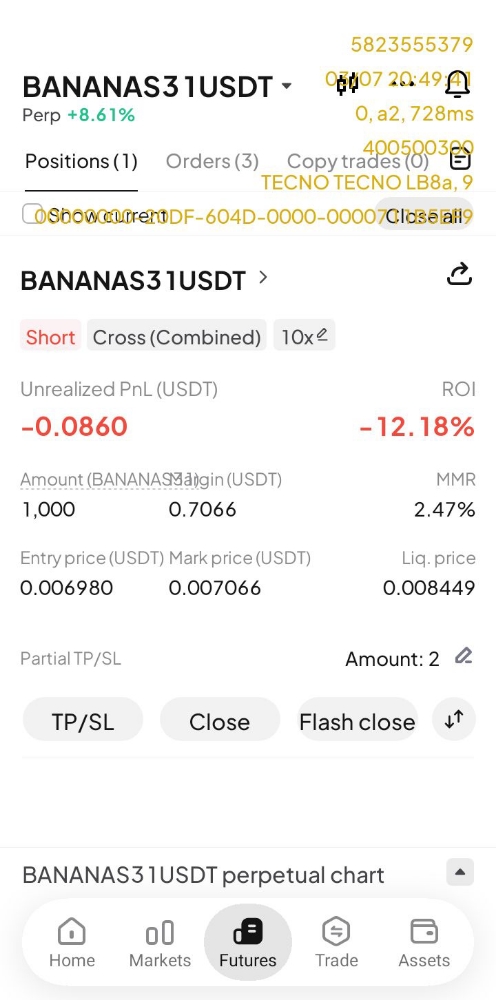

This is automated trading made super ease. It is based on the concept of Liquidity pool where two tokens are deposited in a pool and there after regulated by the presence of the relative amount of tokens pooled by other liquidity providers at any given time. These tokens can always be traded as far as the pool’s overall liquidity is not depleted, thanks to Arbitrage Market Makers who usually strengthen Liquidity. All you need to do is exchange your token or coin in stock for that which you want. While you do this, you still earn interest or profit from trading fees and Liquidity.

This is a very cool feature for both crypto-coin Hodlers and daily traders who want to convert one token to another without waste of time. The Binance Coin, BNB was about $20 a year and this year, its value is worth over $300. One unique thing about Binance Liquid swap is that while the user is providing liquidity to one of its numerous pools, automatic rewards in BNB is also taking place. With days and months of liquidity provision, the user would accumulate a significant amount of BNB for free. Thus with Binance Liquid Swap, users get monetary value via BNB rewards.

THE SCOPE OF BINANCE LIQUID SWAP.

Binance Liquid swap as a decentralized platform has two sub-products: Pool and Swap. Users can add liquidity to the pools and earn a certain percentage of total profits accrued from the overall liquidity provided. In the second sub-class, Swap there are two sub-features, the buy and sell buttons which users can utilize in converting their assets to other assets of their choice.

Example

For example, Margret has USDT in her Binance account and she needed BNB to provide liquidity in one of the pools or to send to her friend who is in need of BNB. She can use the Binance Swap to convert her USDT to BNB at the prevailing market price and conduct her transaction without hassles. Put in another way, the final price and quantity of the tokens that a user wants to swap is dependent on the total amount of tokens in the pool. These two factors (Price and quantity of tokens) are not manipulated by a central authority; the process is entirely automated by market forces.

A superior upgrade.

With Binance upgrade to Liquid swap 3.0, Liquidity providers were rewarded in triple ways: Liquidity rewards in BNB, Interest and trading fees. As at February when Binance Liquid swap was still in its nascent stage, over twenty-thousand users were benefiting from it and the number of active users has tripled over the last months.

The Binance Liquid Swap 4.0 fine-tunes the optimized user interface and created the room to accommodate over 50 liquidity pools. In terms of earning distribution size, the Binance liquid swap has distributed over 12million USDT and 26 thousand BNB in rewards in the last one year.

DIFFERENCE BETWEEN BINANCE LIQUID SWAP AND OTHER DEFI FARMS.

High ETH Gas fees in other swaps

Most DeFi farms pair their tokens only to ETH presumably because these tokens are created to run on Ethereum Blockchain. This kind of modus operandi has yields several disadvantages such as congested Ethereum network due to slow transaction time and very high Ethereum gas fees. It has also dissuaded many users from carrying out micro transactions of less than $50 on the Ethereum Blockchain during congestion. The users are not to blame because it is unwise to carry out a transaction of 50 USDT and for them to pay a transaction (Gas) fee of $25 in ETH.

Fast, flexible, large array of coins and use of AMM

On the other hand, besides being fast, Binance Liquid swap is flexible in terms of pairing. There are several other pairs besides pairing tokens with BNB. These including BTC, stable coins like USDT, DAI and other popular Altcoins pairs.

Another difference worthy of mentioning is that while other DeFi farms require a DeFi wallet, with your Binance account you can carry out token swap or add to liquidity pool successfully without a DeFi wallet.

Lastly, while other platforms use an order book to decide pricing, the Binance Liquid swap utilizes the Automated Market Maker (AMM) as its pricing Module.

ADVANTAGES OF THE BINANCE LIQUID SWAP

Binance Liquid swap is the best place to farm BNB with generous interest. It has high quality stock of token pairs. You can yield-farm without setting up a DeFi wallet. When adding or redeeming pairs there are zero gas fees and redemption of pairs after pooling deadline is almost instantaneous. For swapping tokens and coins, the fees are as low as $0.40 for a tokenized value of $1000.

Low slippage of almost zero percent is another merit of using the Binance Liquid swap due to Binance’s stout liquidity. The user also enjoys Binance SAFU, i.e. secure asset fund for users which is Binance financial security strategy and has been in place since 2018. Apart from Binance SAFU, there is the Binance Sentry Team that implements security measures that protect Binance Liquid swap from Cyber-attacks. These benefits should motivate users to earn while using the Binance liquid swap.

HOW BINANCE LIQUID SWAP WORKS.

Basic steps

To use the Binance Liquid Swap, it is imperative that the user accesses its page on the Binance web and potential users can use the direct link at the end of this piece to access the page’s utility features. On accessing its page, certain clickable icons are immediately sighted; arranged horizontally from left to right: POOL, LIQUIDITY, SWAP, and MY SHARE AND SWAP HISTORY. The user is at liberty to navigate around these buttons to get acquainted with relevant sub-features.

The user can then click on pool to select a liquidity pool of choice and a liquidity trading pair. More often than not, some traders select more than one pair. The next thing to do is to deposit an amount which is usually considered collateral into the pool and then you get started with yield-farming or staking or harvesting as some platform calls it.

Yield-farming for particular pairs have their duration which the liquidity is intended to end. At the end of the deadline, the user can then redeem her or original amount of tokens deposited at the beginning of the farming contract. Some liquidity pools have up to 180 days or more of farming while others have shorter duration. On Binance Liquid swap, some pools have duration as short as 7 days but there are varieties to choose from in terms of yield-farming duration.

Pool Overview

Binance Liquid swap has several innovative mechanisms that ensure a relative stable trading or farming activity through the selection and availability of high-quality token and coin pairs. The pool has risk assessment and optimization apparatuses in place to checkmate very risky transactions. Given the fact that all liquidity pools have the element of loss, the Binance Liquid swap tends to minimize and maximize these risks.

Becoming a liquidity provider

Liquidity measures the easiness of how a user of a liquidity pool or one utilizing the swap feature can convert an asset into cash or another asset. This liquidity should flow smoothly and regularly at all times and the size of the liquidity should be large to reflect large scale trading activities for an exchange to be highly rated. If this were the case, the trading times of transactions are usually instant. To be a Liquidity provider, all the user needs to do is to add stable or volatile coins to the liquid swap pool and begin to earn BNB rewards and interest specific to the liquidity pool.

EARNING MECHANISM AND CALCULATING THE REWARDS.

Yield farming and trading fees rewards on Binance Liquid swap are calculated by the automated system every hour. Users click on the Claim button to harvest their earned tokens which they can transfer to their Binance spot wallet any time while the mechanism of farming is still active. This can be compared to a Trader separating his or her profit to away from the principal used in starting the business. Pool Share ratio is usually the Users’ hourly yield minus Farming rewards

REDEEMING REWARDS.

Earned BNB rewards on the Binance Liquid swap are redeemed by simply clicking on the redeem button. Your BNB rewards automatically deposited to your swap wallet and it can be moved to your spot wallet if you so desired. Redemption can also mean aborting the active status of ongoing yield-farming or harvesting both the principal pair tokens and rewards at the end of yield-farming duration. This action triggers three options: Numerator pair token, Denominator pair token and paired tokens. User can redeem a single token or paired token. In the formal case, there would be a minimal fee. Redeemed rewards can be used in other trading activities in the main market or withdrawn to a personal wallet.

RISKS INVOLVED IN LIQUIDITY POOLING AND SWAP.

Volatility and higher risks

Digital assets trading is often accompanied by certain risks; the more volatile an asset the riskier it is during trading as a result of large fluctuations in price. This is seen in all cryptocurrency swapping platform like Uniswap, Sushi swap and pancake swap.

Pairs that have stable coins like the BUSD, USDT, USDC, and DAI present a lesser risk because of their stable price mechanism. Adding tokens to Liquidity pools present a risk called Impermanent Loss and every Trader irrespective of his level in trading experience should remember this concept of impermanent Loss before engaging in any liquidity pool activity.

The transient loss factor.

Impermanent loss is said to occur when the price of tokens at the time of deposit into the liquidity pool differs from the value of same number of tokens at the point of redemption; In other words ,less Dollar worth at the time of withdrawal. The cause of impermanent loss is initiated by a special market mechanism called Automated Market Maker.

Impermanent Loss is often an unnoticeable change during pooling but only tangible when the user is about to withdraw or have withdrawn his or her tokens. The Larger the change involved in this technical phenomenon, the enormous the loss.

However, impermanent loss can still be counteracted by trading fee rewards especially if there are high liquidity in the pool, small bid-ask spread, less volatile tokens or wrapped versions of volatile tokens, robust protocol and other diverse conditions.

CLOSING THOUGHT.

Users who are already signed up on Binance and other traders who have flair for using stable coins for swap operations can benefit immensely when they use the Binance Liquid Swap. This is because while providing liquidity to the pool of their choice, they as well earn BNB rewards outside their interest accruing from the liquidity provided to the pool.

It is noteworthy to invite all those new to the Blockchain to make use of the simple Binance Liquid Swap to earn alternative income in form of BNB rewards. For other cryptocurrency enthusiasts, day traders, Hodlers and experts, it is my delight to present to you the Binance Liquid Swap for your maximum utilization. The direct link to the Binance Liquid Swap can be assessed here: https://www.binance.com/en/swap/pool?ref=11515767

This article was featured on by me on medium and can be retrieved there via: https://medium.com/@mikhailikpoma/top-reasons-why-users-should-earn-bnb-using-binance-liquid-swap-8951ce8b824a