The Advent of Bitcoin NFTs: Exploring the Opportunities and Challenges

The advent of bitcoin NFTs (non-fungible tokens) represents a new frontier in the world of cryptocurrency and blockchain technology. NFTs are digital assets that are unique and cannot be exchanged for something else, unlike fungible tokens such as Bitcoin. With the rise of Bitcoin NFTs, creators can now use Bitcoin's blockchain to create digital art, music, collectibles, and other unique digital assets that can be bought, sold, and traded.

One of the main benefits of Bitcoin NFTs is that they provide a way to authenticate and prove ownership of digital assets, which was previously difficult to achieve. NFTs allow creators to embed metadata into their digital assets that can verify their authenticity and ownership, as well as provide information about their history and provenance.

Bitcoin NFTs also provide a new avenue for artists, musicians, and other creators to monetize their work. By creating unique digital assets, they can sell them to collectors or fans, who can then trade them on various marketplaces. This creates a new revenue stream for creators, as well as a new asset class for investors.

However, the rise of Bitcoin NFTs also raises questions about the environmental impact of blockchain technology. Bitcoin's blockchain, in particular, is known for its high energy consumption, which has led to concerns about its sustainability. As the market for Bitcoin NFTs grows, it will be important to address these concerns and develop more sustainable and eco-friendly solutions.

Overall, the advent of Bitcoin NFTs represents an exciting development in the world of cryptocurrency and blockchain technology. As the market continues to evolve, we can expect to see more innovative uses of Bitcoin's blockchain, as well as new opportunities for creators, collectors, and investors.

- Authenticity and Ownership Verification: Bitcoin NFTs allow creators to authenticate and prove ownership of their digital assets. This is achieved through the creation of unique, verifiable metadata that is embedded into the NFT. For example, a digital artist can create an NFT of their artwork and embed metadata that includes the artist's name, date of creation, and a unique identifier. This metadata can be verified on the Bitcoin blockchain, providing proof of ownership and authenticity.

- New Revenue Streams for Creators: Bitcoin NFTs provide creators with a new way to monetize their work. By creating unique digital assets, they can sell them to collectors or fans, who can then trade them on various marketplaces. This creates a new revenue stream for creators, as well as a new asset class for investors. For example, musician Grimes recently sold $6 million worth of NFTs of her digital art.

- New Asset Class for Investors: Bitcoin NFTs provide investors with a new asset class to invest in. NFTs represent a unique, non-interchangeable asset that can appreciate or depreciate in value over time. Investors can buy and hold NFTs, or trade them on various marketplaces for a profit. For example, the first tweet ever made by Twitter CEO Jack Dorsey sold for $2.9 million as an NFT.

- Sustainability Concerns: The rise of Bitcoin NFTs has raised concerns about the environmental impact of blockchain technology. Bitcoin's blockchain, in particular, is known for its high energy consumption, which has led to concerns about its sustainability. As the market for Bitcoin NFTs grows, it will be important to address these concerns and develop more sustainable and eco-friendly solutions. For example, some companies are developing blockchain technology that uses less energy, such as Proof of Stake instead of Proof of Work.

- Innovation in Digital Art and Collectibles: Bitcoin NFTs have already led to innovation in the world of digital art and collectibles. Creators can now experiment with new forms of digital art, such as 3D models, animations, and augmented reality. Additionally, collectors can now buy and trade unique digital collectibles, such as rare in-game items or virtual real estate. For example, NBA Top Shot has become a popular platform for buying and selling NFTs of NBA highlights and other digital collectibles.

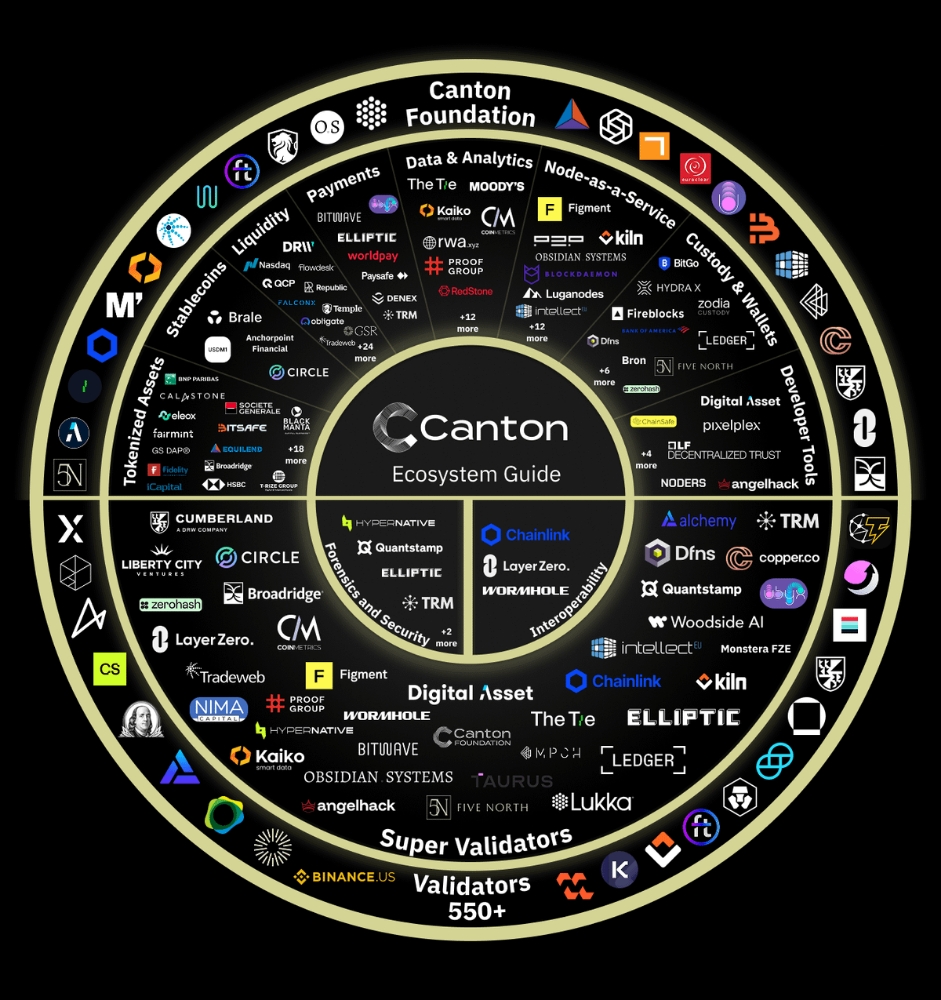

- Decentralization: Bitcoin NFTs are decentralized, meaning that they are not controlled by any central authority or intermediary. This allows creators to bypass traditional gatekeepers such as art galleries, record labels, or publishers, and connect directly with their audiences. Additionally, it allows collectors and investors to buy and sell NFTs without the need for a third-party platform. This decentralization can lead to more democratization in the art and collectibles world.

- Interoperability: Bitcoin NFTs are interoperable, meaning that they can be used across different platforms and applications. This allows for greater flexibility and accessibility for creators and collectors. For example, an NFT created on one platform can be sold and traded on another platform without any issues, as long as both platforms support Bitcoin's blockchain.

- Fractional Ownership: Bitcoin NFTs allow for fractional ownership, meaning that an NFT can be divided into smaller parts that can be owned by multiple investors. This allows for greater liquidity and accessibility for investors, who can buy and sell small fractions of an NFT rather than having to buy the entire asset. For example, a high-value NFT can be divided into 10,000 parts, and investors can buy and sell these parts on various marketplaces.

- Use Cases Beyond Art and Collectibles: Bitcoin NFTs have potential use cases beyond art and collectibles. For example, they can be used to represent ownership of physical assets such as real estate or cars. Additionally, they can be used in gaming and virtual reality applications, where unique digital assets are important for gameplay or social status.

- Challenges: The rise of Bitcoin NFTs also presents some challenges, such as the potential for fraud or scams. Additionally, there is a risk of market saturation and oversupply of NFTs, which can lead to a drop in value. As with any emerging market, there is also a risk of regulation and uncertainty.

- Environmental Concerns: One of the biggest concerns surrounding Bitcoin NFTs is their environmental impact. The process of minting and trading NFTs requires a significant amount of energy, as it involves complex computations and transactions on the blockchain. This has raised questions about the sustainability of the technology and the need for more eco-friendly alternatives.

- Cultural Shifts: The rise of Bitcoin NFTs has also led to a cultural shift in how we perceive and value digital art and assets. NFTs allow for the creation and sale of unique digital assets that have value and scarcity, much like physical art and collectibles. This shift towards valuing digital assets and experiences could have significant implications for the future of art, entertainment, and commerce.

- Creative Possibilities: Bitcoin NFTs offer endless creative possibilities for artists and creators, as they can represent anything from digital paintings and music to virtual real estate and collectibles. NFTs allow creators to experiment with new forms of expression and monetization, and offer a platform for emerging artists to gain exposure and recognition.

- Adoption and Integration: As Bitcoin NFTs continue to gain popularity, we can expect to see increased adoption and integration with other technologies and platforms. For example, we may see NFTs integrated into social media platforms, gaming platforms, or e-commerce websites. This integration could lead to new business models and revenue streams for creators and platform owners.

- Future Innovations: Finally, the advent of Bitcoin NFTs is just the beginning of a larger trend towards using blockchain technology for digital ownership and transactions. We can expect to see continued innovation and experimentation with NFTs and other blockchain-based assets in the coming years, as more businesses and industries explore the potential of this technology.

Overall, the advent of Bitcoin NFTs represents a major shift in how we perceive and value digital assets, and presents numerous opportunities and challenges for creators, collectors, and investors. As the technology continues to evolve and mature, we can expect to see new use cases, applications, and innovations that will shape the future of blockchain technology and the digital economy.

![[The Zero-Capital Masterclass] How AI & DePIN are Hacking the 2026 Airdrop Meta 🚀](https://cdn.bulbapp.io/frontend/images/de133e2f-b217-409c-a74b-c3428e2a7e40/1)