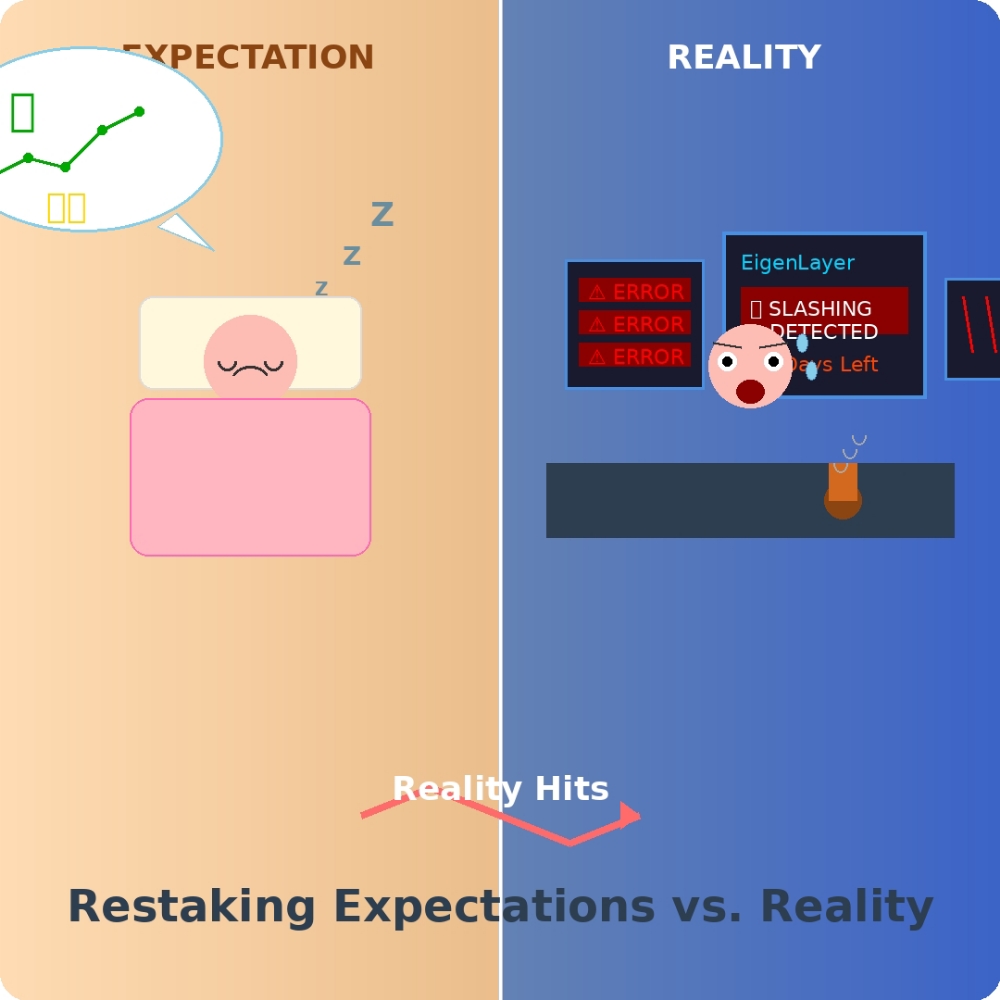

I Just Restaked My ETH And Realized I'm Playing Russian Roulette😂

So I woke up to news that EigenLayer slashing is finally live. I've been restaking ETH for months, collecting those sweet yields, feeling like a DeFi genius.

Then I actually read the slashing conditions.

Turns out my operator could lose MY staked ETH if they mess up validating for any of these AVS protocols. And there's a 14-day lockup if I want to leave. Fourteen days! In crypto, that's basically a lifetime.

I thought restaking was "set and forget." It's not. It's "set, monitor constantly, and pray your operator doesn't get slashed during a market crash."

Here's what I'm doing now:

Moving from one operator to three different ones (diversification)

Actually reading AVS slashing conditions (boring but necessary)

Keeping some ETH unstaked for liquidity (opportunity cost hurts, but so does being trapped)

Looking into operators with slashing insurance (Blockdaemon offers it, others will follow)

The bigger picture: This is actually good for DeFi. Real economic security requires real consequences. But as retail investors, we need to level up our due diligence game.

My question to you: Are you restaking? Did you know about the slashing risks? What's your strategy for managing operator risk?

Drop your thoughts below - I genuinely want to learn from thi

![[The Zero-Capital Masterclass] How AI & DePIN are Hacking the 2026 Airdrop Meta 🚀](https://cdn.bulbapp.io/frontend/images/de133e2f-b217-409c-a74b-c3428e2a7e40/1)