Is Crypto User Acquisition Entering a New Era After the 2026 Regulatory Shifts?

The cryptocurrency industry has always evolved in cycles technological breakthroughs followed by speculative surges, regulatory scrutiny, market corrections, and renewed innovation. The regulatory shifts of 2026 appear to mark another pivotal transition. Across major jurisdictions, updated compliance frameworks, licensing regimes, clearer tax guidance, and stricter consumer protection standards have begun reshaping how crypto companies operate.

One area undergoing visible transformation is user acquisition. For years, growth strategies in crypto were largely driven by incentives, token rewards, viral community campaigns, and rapid onboarding processes. However, as regulatory expectations mature, the structure of attracting and retaining users is changing. The question is no longer simply how to onboard more wallets, but how to build sustainable, compliant, and trust-centered ecosystems.

This article examines whether crypto user acquisition is entering a new era following the 2026 regulatory shifts, and what that means for platforms, developers, and users.

1. The Pre-2026 User Acquisition Model

Before 2026, user acquisition strategies in crypto often relied on a combination of:

- Token airdrops

- Liquidity mining incentives

- Referral bonuses

- Yield farming rewards

- Minimal friction onboarding processes

- Pseudonymous participation

The emphasis was on rapid growth. Total value locked (TVL), wallet counts, and token distribution were commonly treated as key performance indicators. Many projects prioritized scale over structure.

However, this model had limitations:

- Short-term loyalty: Incentive-driven users frequently migrated once rewards decreased.

- Regulatory uncertainty: Projects faced unclear rules around securities classification, AML requirements, and consumer disclosures.

- Reputation volatility: High-profile collapses and enforcement actions reduced trust among retail participants.

- Operational fragility: Platforms sometimes expanded faster than compliance infrastructure could support.

While this approach enabled explosive growth, it also amplified systemic risks. Regulators responded by introducing more defined legal frameworks in 2026.

2. What Changed in 2026?

The 2026 regulatory shifts were characterized by greater clarity rather than outright prohibition. Key developments across various jurisdictions included:

- Formal licensing requirements for exchanges and custodians

- Mandatory Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance

- Clearer token classification frameworks

- Stablecoin reserve and audit standards

- Advertising and disclosure guidelines

- Consumer protection mandates

Rather than treating crypto as an undefined category, regulators increasingly integrated it into existing financial oversight systems. This normalization had significant implications for user acquisition.

Growth could no longer rely solely on frictionless onboarding or anonymous access. Compliance became foundational.

3. Trust as a Primary Acquisition Driver

One of the most notable shifts is the growing importance of institutional-grade trust. Users are increasingly evaluating platforms based on:

- Regulatory registration status

- Transparency of reserves

- Governance disclosures

- Security audits

- Custody arrangements

- Data protection practices

Previously, high yields or token rewards might have overshadowed structural risks. Post-2026, users, especially new entrants, demonstrate greater sensitivity to platform stability.

This change altersthe acquisition strategy. Rather than emphasizing incentives, platforms increasingly communicate operational safeguards and regulatory alignment. Trust becomes a measurable growth lever.

4. From Anonymous to Verified Participation

The 2026 regulatory environment reinforces identity verification requirements. As a result, user acquisition processes now often involve:

- Identity verification steps

- Source-of-funds documentation in certain cases

- Risk scoring procedures

- Transaction monitoring

This introduces friction compared to earlier onboarding models. However, it also expands legitimacy. Verified ecosystems are more likely to attract institutional participants, payment integrations, and banking partnerships.

The nature of “user growth” changes. The emphasis shifts from sheer wallet creation numbers to verified, active, and compliant accounts.

5. Institutional Participation Reshapes Demand

Another factor contributing to a new era is the increasing involvement of institutional actors. Pension funds, asset managers, and corporate treasuries have gradually entered the crypto space under clarified regulatory structures.

Institutional engagement influences user acquisition in several ways:

- Higher compliance standards become industry norms.

- Infrastructure quality expectations increase.

- Risk disclosures become standardized.

- Security and custody frameworks receive greater scrutiny.

Retail users indirectly benefit from this institutionalization. Platforms built to satisfy institutional due diligence often provide stronger safeguards overall.

In this context, acquisition strategies begin to resemble those of traditional financial services focused on reliability, education, and long-term participation rather than speculative bursts.

6. Education as a Growth Strategy

With clearer regulation comes a more informed audience. The 2026 regulatory landscape has triggered broader public discussion around digital assets in policy, academia, and finance.

As a result, user acquisition increasingly intersects with education:

- Explaining token classification

- Clarifying tax implications

- Outlining staking risks

- Detailing custody differences

- Highlighting volatility considerations

Instead of relying on hype cycles, platforms that invest in transparent educational resources are better positioned to attract sustainable users.

Education-driven onboarding supports informed participation. This reduces churn, improves retention, and strengthens ecosystem stability.

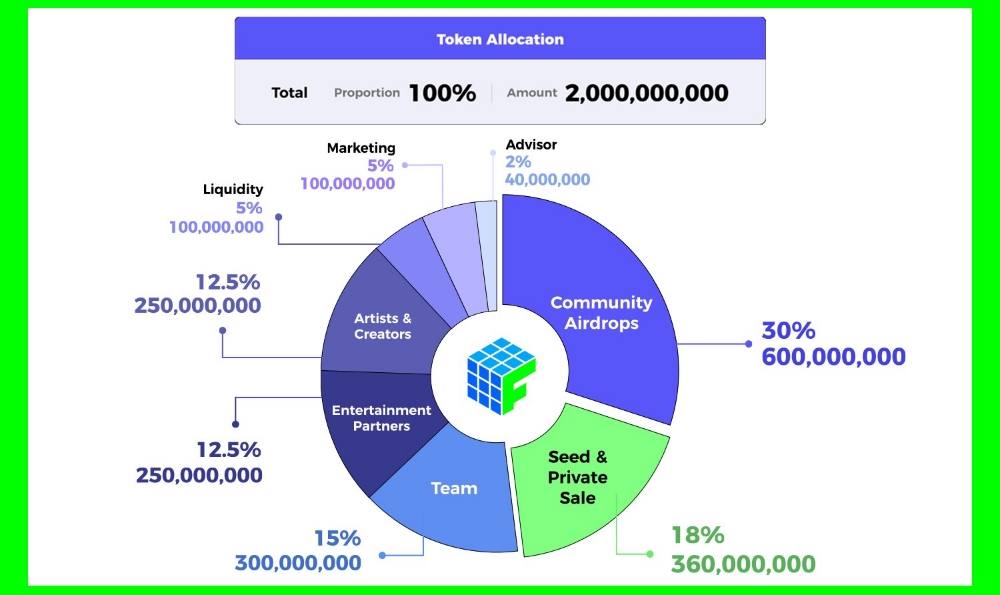

7. The Decline of Incentive-Only Growth

Incentive models have not disappeared, but they are increasingly constrained by regulatory boundaries. For example:

- Referral rewards may require disclosure compliance.

- Token distributions may face securities analysis.

- Yield programs may fall under investment contract scrutiny.

This environment discourages aggressive, unsustainable reward schemes. It also discourages opaque tokenomics structures.

User acquisition is therefore transitioning toward:

- Utility-driven engagement

- Product differentiation

- Interoperability improvements

- Community governance transparency

Growth based solely on high-yield incentives becomes less viable when regulatory frameworks demand clarity and accountability.

8. Geographic Fragmentation and Strategic Targeting

While 2026 brought broader regulatory alignment, differences between jurisdictions remain. Some regions introduced innovation-friendly licensing frameworks, while others implemented stricter consumer restrictions.

As a result, user acquisition strategies now require geographic analysis:

- Which jurisdictions allow specific services?

- Where is marketing restricted?

- How do cross-border transactions operate under new rules?

- What disclosures are mandatory per region?

Crypto companies increasingly adopt region-specific onboarding flows and compliance configurations. Global expansion requires legal structuring, local partnerships, and licensing strategy.

This reflects a maturation phase. Instead of operating as borderless experiments, platforms must navigate defined regulatory boundaries.

9. Product Complexity and User Expectations

The regulatory shifts also intersect with technological maturation. By 2026, crypto ecosystems include:

- Layer 2 scaling solutions

- Cross-chain interoperability protocols

- Tokenized real-world assets

- Decentralized identity systems

- Regulated stablecoins

Users entering the space now encounter more structured and potentially complex offerings. Acquisition strategies must account for onboarding clarity and usability.

User experience design becomes central. Simplified interfaces, transparent fee structures, and risk dashboards are increasingly necessary.

Platforms can no longer assume technical literacy. Regulatory clarity brings mainstream exposure, and mainstream exposure demands accessible design.

10. Data Privacy and Digital Identity

Compliance does not eliminate privacy considerations. In fact, regulatory changes have intensified discussion around digital identity solutions that balance verification with data protection.

Decentralized identity frameworks and zero-knowledge proofs are being explored to reconcile:

- AML compliance

- Personal data protection

- Cross-platform identity portability

If these technologies mature, they could define the next phase of compliant user acquisition where verification occurs without unnecessary exposure of personal information.

This intersection of regulation and cryptography represents a potential structural innovation rather than a constraint.

11. The Role of Stablecoins in User Onboarding

Stablecoins play a central role in onboarding new users. Regulatory clarity around reserve audits and asset backing strengthens confidence in these instruments.

As stablecoins become more standardized:

- Users gain predictable value storage mechanisms.

- Cross-border transactions become more accessible.

- Payment integration improves.

Acquisition increasingly begins with stablecoin use cases, such as remittances, payments, and payroll, rather than speculative token purchases.

This marks a shift toward functional utility as an entry point.

12. Risk Transparency as a Competitive Factor

Post-2026, transparency around risk is no longer optional. Platforms must communicate:

- Market volatility risks

- Smart contract vulnerabilities

- Liquidity constraints

- Counterparty exposure

- Regulatory uncertainties

Users are more likely to engage when risk information is clearly presented rather than obscured. Transparency reduces reputational shock when market fluctuations occur.

User acquisition strategies therefore incorporate structured disclosure frameworks similar to those in traditional financial services.

13. Community Evolution

Crypto communities historically centered on online forums, social platforms, and token-holder governance experiments. The regulatory shift does not eliminate community influence but reshapes its function.

Communities increasingly focus on:

- Governance participation

- Protocol upgrades

- Compliance alignment discussions

- Long-term ecosystem sustainability

Speculative hype cycles tend to diminish in regulated environments, while governance and infrastructure debates gain prominence.

This indicates a move from viral expansion to participatory development.

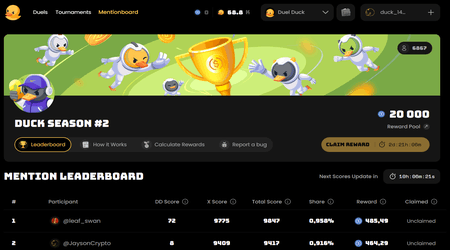

14. Metrics That Matter in the New Era

If crypto user acquisition is entering a new phase, measurement standards must also evolve. Instead of focusing solely on wallet growth or token price appreciation, platforms may prioritize:

- Verified active users

- Retention rates

- Regulatory audit compliance

- Security incident frequency

- Long-term asset stability

- Governance participation rates

These metrics better reflect durable engagement.

Sustainable ecosystems require depth, not just breadth.

15. Challenges Ahead

Despite increased clarity, challenges remain:

- Regulatory fragmentation across regions

- Compliance cost burdens for smaller projects

- Balancing decentralization with oversight

- Maintaining innovation under structured frameworks

- Managing public perception during enforcement cycles

The new era does not eliminate volatility or uncertainty. Instead, it channels growth into more structured pathways.

Conclusion

The 2026 regulatory shifts do not signal the end of crypto expansion. Instead, they represent a transition from experimental growth toward institutional integration and structured participation.

User acquisition is no longer defined by minimal friction and aggressive incentives. It increasingly depends on:

- Regulatory alignment

- Trust infrastructure

- Educational transparency

- Product usability

- Verified participation

- Long-term retention

This transformation suggests that crypto is entering a maturation phase. Growth may become steadier, more compliant, and less speculative in nature.

Whether this qualifies as a “new era” depends on perspective. From a structural standpoint, the shift is significant. The foundation of user acquisition is evolving from rapid scale to sustainable integration within broader financial systems.

If that trajectory continues, the post-2026 landscape may be remembered not as a period of restriction, but as the moment when crypto user growth aligned with institutional standards while retaining technological innovation.

The result is a more disciplined, transparent, and potentially resilient digital asset ecosystem one where user acquisition reflects informed participation rather than temporary momentum.