Your token is bleeding volume? Check your spread first

Most traders don't care about your roadmap. They care about the gap between bid and ask.

A 5% spread kills retail interest. A 1% spread with no depth is fake liquidity. Both kill momentum before your marketing even starts.

What market makers actually do:

Quote bid/ask prices continuously so buyers and sellers can trade without waiting

Absorb inventory risk when sellers rush.. they hold your token so the price doesn't crater

Maintain tight spreads so your chart doesn't look abandoned or manipulated

What they don't do:

Pump your price artificially

Guarantee trading volume (if they promise this, run)

Fix broken tokenomics or utility models

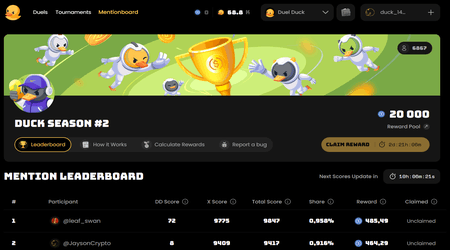

The real metrics to watch:

Spread: Under 2% for retail comfort, under 1% for serious traders

Depth: Can someone sell 10K without moving the price 5%?50K?

Consistency: Is the order book there 24/7 or only during pumps?

Red flag: If your MM won't clearly explain their inventory risk model.. how much they hold, how they hedge, what happens in a downturn.. they're not market making. They're market timing.

I've seen projects pay $20K monthly for "liquidity" that disappears the moment Bitcoin drops 10%. The MM dumps inventory, spreads blow out, and holders panic sell into a ghost book.

Prevention beats cleanup. Audit your MM like you audit your smart contracts.