How OTC Distribution Actually Works

CEX listings get the headlines. OTC deals do the heavy lifting.

When a project raises through OTC, they're selling to strategic buyers before public markets open. These aren't retail traders hunting pumps. They're funds, angels, and ecosystem partners taking size with lockups and vesting.

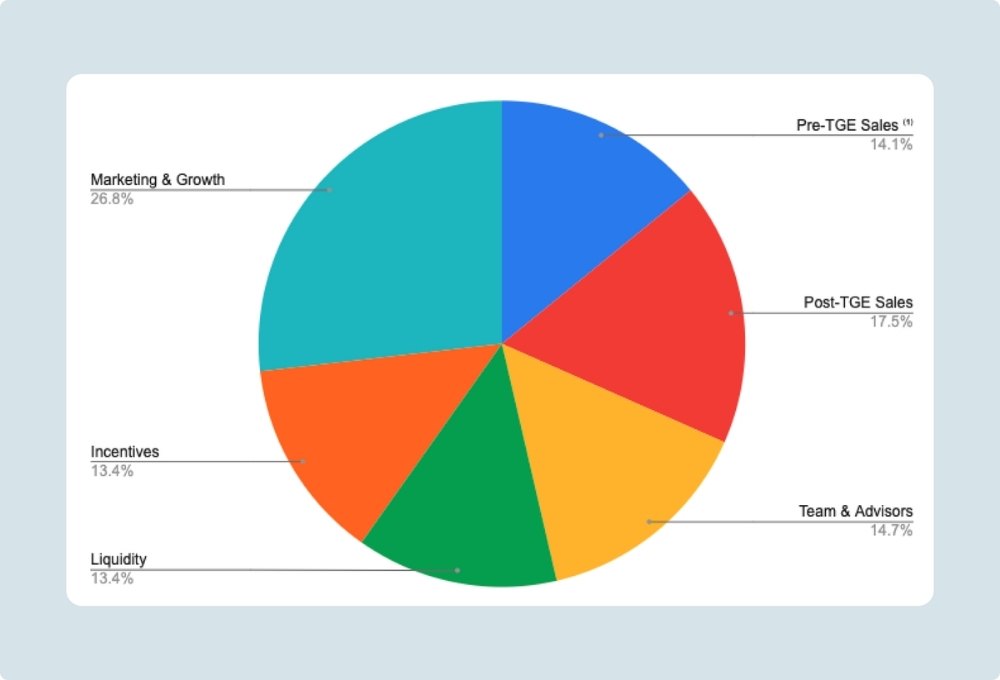

What this actually changes:

Holder base: You start with aligned capital, not speculative wallets

Price discovery: Happens privately, less volatility publicly

Exchange appeal: CEXs look at distribution quality. Concentrated whale wallets are red flags.

The mechanics:

OTC happens through networks, not order books. BD teams route introductions, negotiate terms, handle compliance. Buyers do diligence on the project. Projects do diligence on the buyers. Both sides negotiate lockups, vesting schedules, and price.

When it makes sense:

Pre-TGE, building initial distribution

Post-TGE, strategic expansion without market impact

Bear markets, when public liquidity is thin

When it doesn't:

Projects needing immediate price discovery

Teams without BD relationships to route deals

Founders who can't handle complex cap table management

The reality:

Most projects that skip OTC and rush to CEX end up with thin books, volatile charts, and holders who disappear at first dip. The ones that build distribution first? They list with depth already waiting.

![[The Zero-Capital Masterclass] How AI & DePIN are Hacking the 2026 Airdrop Meta 🚀](https://cdn.bulbapp.io/frontend/images/de133e2f-b217-409c-a74b-c3428e2a7e40/1)