Privacy coins are dead. Long live privacy infrastructure.

For years, the market decided:

- Monero delisted,

- Zcash irrelevant,

- Privacy is for criminals.

The crowd moved on. The narrative was buried. Case closed.

That’s exactly when the smart money started positioning.

Because here’s what nobody noticed while they were writing obituaries:

- $11.7 billion in ZK infrastructure market cap.

- Monero handling more than half of all private crypto transactions despite being banned from every major exchange.

- Zcash’s shielded pool crossing 20% of total supply with a 400% price rally in a month.

The market is screaming if you know where to look. But most people are too busy panic-selling Bitcoin into support levels and chasing memecoin pumps to notice what’s actually being built in the background.

While retail wrote off privacy as a dead narrative, institutions quietly realized something critical: privacy isn’t optional for enterprise-scale crypto adoption. It’s foundational.

And Zero-Knowledge technology just solved the problem in a way legacy privacy coins never could.

Understanding why privacy coins failed is crucial to understanding why ZK infrastructure will succeed.

Legacy privacy coins like @monero and @zcash operated as standalone chains with privacy as their core feature. That model had fundamental problems.

First, they couldn’t integrate with the broader DeFi ecosystem without sacrificing privacy.

Second, regulators saw them as single-purpose tools for hiding transactions, making them easy targets for delistings.

Third, they required users to choose between privacy and functionality, which is a dealbreaker for mainstream adoption.

Zero-Knowledge technology flips this entirely. Instead of building privacy as a separate chain, ZK integrates privacy as a layer that works across the entire ecosystem.

You can have privacy-preserving smart contracts, private DeFi transactions, confidential NFT ownership, and shielded stablecoin transfers all while remaining composable with the rest of crypto. This is more than just an improvement, but rather, a category shift.

The shift is already happening, and most people are missing it.

Private stablecoins are emerging as core payment infrastructure. Enterprises need confidentiality for treasury movements. You can’t have Goldman Sachs or JPMorgan broadcasting every transaction on a public ledger where competitors can front-run trades, analyze strategies, and exploit information asymmetries.

That’s not how institutional finance works.

Privacy isn’t a nice-to-have feature for these players. It’s a non-negotiable requirement.

ZK tech is powering real rollups with serious capital backing them. This isn’t some speculative play or vapor narrative.

This is institutional-grade infrastructure being built while everyone else is fixated on price action. The technical foundation is being laid right now, and the teams building it have deep institutional relationships that retail doesn’t see.

A16z crypto recently came out and said it plainly:

“Privacy will be the most important moat in crypto” heading into 2026.

Privacy infrastructure.

That’s the actual moat. And the smartest capital allocators in the space are positioning for it right now, quietly accumulating before the narrative becomes obvious.

Here’s where it gets interesting: the institutional-retail gap is widening fast.

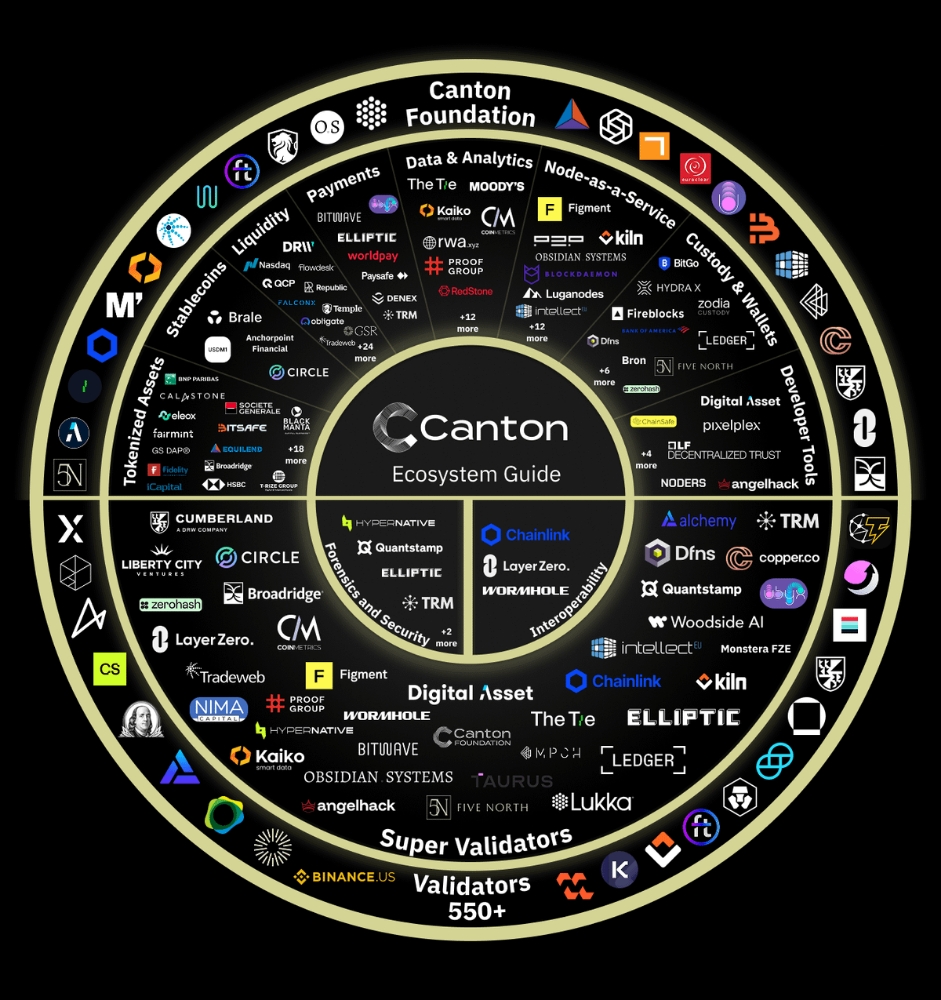

Privacy tech is booming in institutional usage with protocols like @Zama and @CantonNetwork getting real traction, but retail adoption isn’t there yet. Institutions are accumulating privacy infrastructure while retail is either capitulating in fear or chasing short-term narratives.

This creates a classic information asymmetry scenario where smart money is front-running a shift that hasn’t hit mainstream consciousness yet.

The difference in sophistication is striking. Institutional players understand that on-chain transparency is actually a massive liability for serious financial activity. They need privacy for competitive reasons, compliance reasons, and operational security reasons. Retail, meanwhile, is still debating whether privacy is “sketchy” or associates it with the old privacy coin narrative that regulators killed off.

This gap won’t last forever. Eventually, retail will catch up and the narrative will explode across CT. But right now, in this moment, there’s a window where the infrastructure is being built, institutions are positioning, and retail is completely distracted.

And this is where ZK changes everything.

The rise of Zero-Knowledge tokens moved privacy from being stuck on “separate chains” to becoming a “scaling layer” that works across the entire ecosystem.

You can maintain anonymity without losing access to DeFi, NFTs, lending protocols, decentralized exchanges, or any other corner of crypto. This composability is the critical unlock that legacy privacy coins never achieved.

Monero and Zcash proved that privacy is a human right and that demand for financial confidentiality exists even when using it means getting delisted from major exchanges.

ZK tokens are proving that privacy can be functional, scalable, and composable with everything else in the crypto ecosystem. You don’t have to choose between privacy and utility anymore. You can have both.

This matters more than most people realize. The reason privacy coins stayed niche wasn’t because people don’t want privacy. It’s because the tradeoffs were too steep. ZK removes those tradeoffs entirely, which fundamentally changes the adoption curve.

The data backs this up in ways that should be impossible to ignore.

Zcash’s shielded pool crossed 4.5 million ZEC in October. That represents 20% of the token’s total supply being actively used for private transactions. And the market noticed. The token rallied 400% in a single month as this adoption became visible. That’s real usage driving price discovery.

Monero processes more than half of all private crypto transactions globally despite being delisted from Binance, Coinbase, and Kraken.

Think about that for a second. It’s banned from every major centralized exchange, meaning it’s harder to buy, harder to sell, and carries regulatory risk just for holding it. And it still dominates private transaction volume.

The demand is undeniable. It’s just not priced in yet because retail isn’t watching and institutional capital can’t easily access these legacy chains.

But here’s the kicker: if Monero can achieve that level of usage while banned from exchanges and operating as a standalone chain with no DeFi composability, imagine what happens when ZK-native infrastructure offers the same privacy guarantees with full ecosystem integration and regulatory clarity. The total addressable market explodes.

The technical progress happening behind the scenes is equally significant.

ZK-rollups aren’t theoretical anymore. They’re live, processing real transactions, and scaling Ethereum in ways that weren’t possible two years ago. @Starknet, @zkSync, @Polygon zkEVM, and @Scroll_ZKP are all in production. These aren’t small experiments. They’re handling billions in TVL and processing millions of transactions.

But the privacy-focused applications of this tech are just starting to emerge.

We’re seeing the first wave of privacy-preserving DeFi protocols, confidential token standards, and shielded liquidity pools. The infrastructure layer is being built, and it’s being built by some of the most well-funded, technically sophisticated teams in the space.

@Aztecnetwork is building programmable privacy for Ethereum. @Penumbrazone is creating a private DEX with shielded liquidity. @Aleohq is developing privacy-preserving smart contracts with ZK circuits. These aren’t vaporware projects. They have working testnets, real developer activity, and institutional backing.

Here’s the setup that almost nobody sees coming:

The SEC reportedly expressed increased comfort with zero-knowledge mechanisms in late 2025, specifically highlighting their role in facilitating compliance.

Read that again.

The same regulatory body that effectively killed privacy coins by forcing delistings is now signaling comfort with ZK privacy infrastructure because it can be designed to meet compliance requirements.

This is the regulatory clarity moment that changes everything. ZK technology allows for selective disclosure, which means you can prove compliance without revealing every detail of every transaction. You can satisfy KYC/AML requirements while still maintaining transactional privacy. This wasn’t possible with legacy privacy coins, which is why they got banned. But ZK makes privacy compatible with regulation.

What happens when institutional adoption accelerates because regulatory uncertainty is removed? What happens when on-chain privacy becomes the standard rather than the exception?

What happens when the narrative shifts from “privacy coins are sketchy” to “ZK infrastructure is essential for serious institutional players”?

The entire market reprices. Projects that were ignored because they touched privacy suddenly become infrastructure plays that institutions need. Capital that stayed on the sidelines because of regulatory risk floods in. And retail, six months late as always, finally wakes up and starts FOMOing into a narrative that the smart money has been positioning for since the last cycle.

Regulatory clarity plus institutional demand plus retail still asleep equals massive asymmetric opportunity.

While the majority of the market is paralyzed by fear or distracted by noise, ZK-native tokens and privacy-layer infrastructure are being quietly accumulated by the people who understand that privacy isn’t some niche use case. It’s a requirement for enterprise adoption at scale.

Think about what institutional adoption actually looks like. It’s enterprises moving billions in treasury operations, banks settling cross-border payments, hedge funds executing strategies without broadcasting their positions to the entire market. All of that requires privacy. And ZK infrastructure is the only technology that can deliver it at scale while remaining compliant.

Projects like StarkNet, Aztec, Immutable X, and privacy-focused L2s are building the foundational rails that will power the next cycle. The disconnect between what’s being built and where retail attention is focused creates opportunity.

The best trades aren’t the ones that are obvious. They’re the ones where you’re early, you’re right, and you have the conviction to hold through the period where nobody else sees it yet. That requires independent thinking, deep research, and the emotional discipline to ignore noise while you wait for fundamentals to play out.

My current positioning is straightforward:

I’m watching ZK infrastructure tokens with a focus on projects that have real technical progress, institutional relationships, and developer activity. I’m looking at shielded asset protocols that are building privacy-preserving DeFi primitives. I’m tracking anything that’s building privacy-by-default into their scaling solutions rather than bolting it on as an afterthought.

The narrative hasn’t caught mainstream fire yet, which means there’s still time to accumulate before this becomes the obvious trade that everyone wishes they’d seen earlier. I’m looking for projects with working products, not just whitepapers.

I’m looking for teams that understand both the technical challenges and the regulatory landscape. And I’m looking for tokens where institutional accumulation is happening quietly while retail is distracted.

Specific areas I’m focused on: ZK-rollup infrastructure tokens that have privacy features built in from day one. Privacy-preserving stablecoin protocols that institutions can actually use for treasury operations. Shielded liquidity solutions that allow DeFi to function without broadcasting every trade to the world. Cross-chain privacy bridges that enable confidential transfers between ecosystems.

These aren’t moonshot gambles. These are infrastructure plays with real technical merit, institutional demand, and regulatory tailwinds. The risk-reward is asymmetric because most people still think the privacy story ended when Monero got delisted.

Privacy coins died because they couldn’t scale, couldn’t integrate with DeFi, and regulators had an easy target.

But privacy infrastructure? That’s just getting started. ZK technology solved the technical problems, regulatory clarity is emerging, and institutional demand is accelerating.

Most people still think the story is over.

They’re looking at the tombstone of privacy coins and missing the birth of privacy infrastructure. And that’s exactly where alpha lives.

What overlooked narratives are you hunting right now?

![[The Zero-Capital Masterclass] How AI & DePIN are Hacking the 2026 Airdrop Meta 🚀](https://cdn.bulbapp.io/frontend/images/de133e2f-b217-409c-a74b-c3428e2a7e40/1)