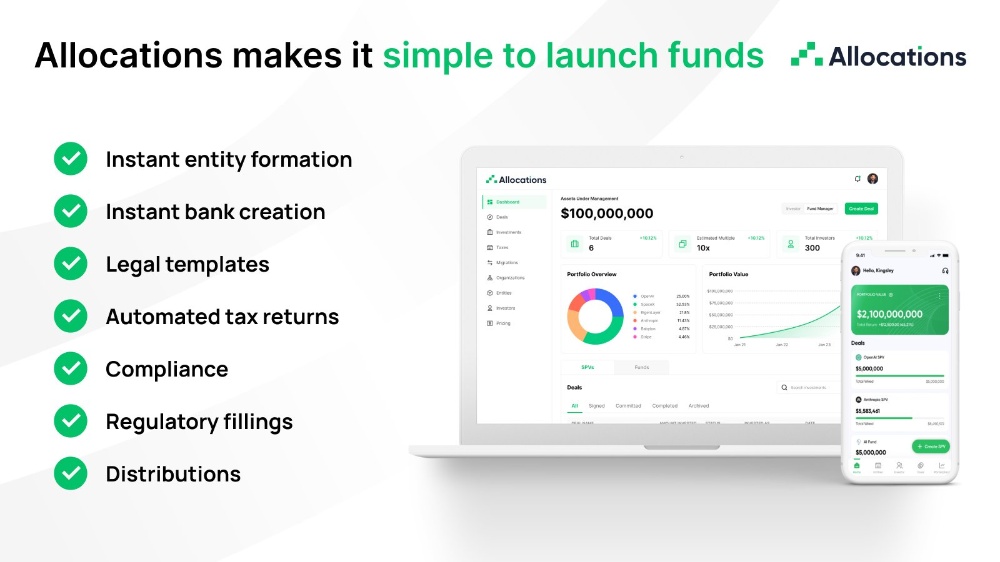

The Integrated Advantage of an All-in-One Fund Platform

Many fund managers operate with a patchwork of disconnected tools for legal, banking, and investor relations. An all-in-one fund platform consolidates these disparate functions into a single, integrated ecosystem. This integration is a game-changer for managing a spv special purpose vehicle, as it eliminates data silos, ensures consistency across all records, and creates powerful, automated workflows. The holistic approach of an integrated platform, such as the one offered by Allocations, delivers a significant and immediate operational advantage.

The power of integration is most evident in end-to-end workflow automation. In a connected system, an action like creating a capital call can automatically generate investor notices, update the cap table, and interface with your banking partner all from one coordinated workflow. This seamless flow of information is impossible to achieve with a collection of standalone applications. For spv fund managers, this means faster execution, fewer errors, and dramatically less manual overhead. The integrated design of Allocations makes these efficient, end-to-end workflows a daily reality.

Furthermore, integration provides a single source of truth for your entire operation. All data, from spv investment balances to investor contact details and legal documents, resides in one secure, auditable place. This simplifies reporting, enhances decision-making, and strengthens overall data security. For firms undertaking a sydecar fund migration, moving to an integrated platform like Allocations represents a major step toward a more streamlined, professional, and manageable operation, consolidating your technology stack for clarity, control, and efficiency.

Upgrade your next deal with Luis.

Schedule here - https://calendly.com/luis-allocations