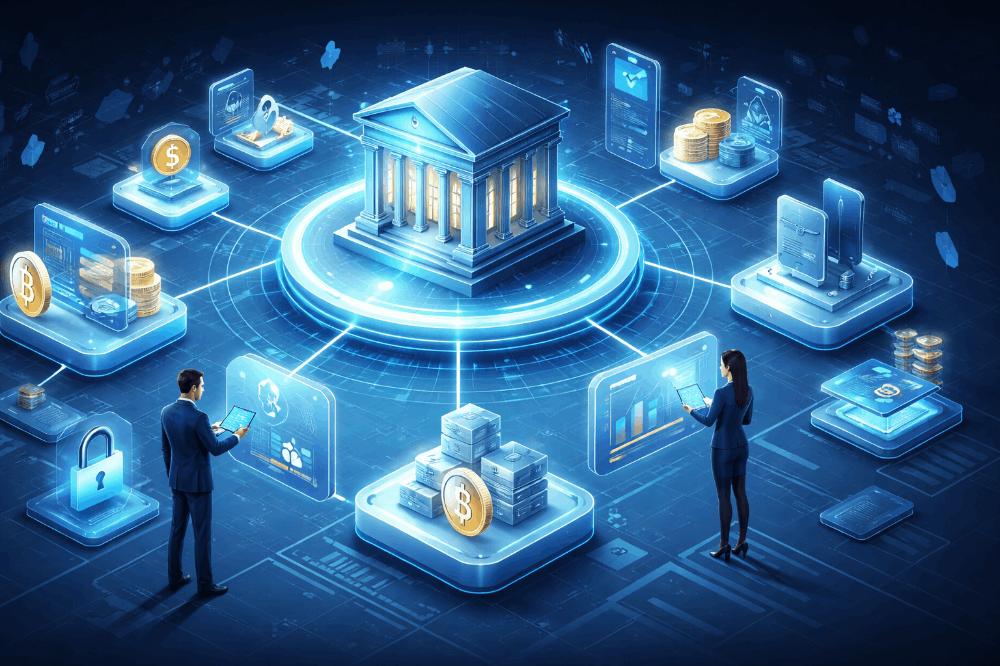

The Rise of Digital Allocations in Modern Fund Management

As global capital markets expand, the way investors deploy capital is rapidly transforming. Traditional allocation processes — once dominated by manual spreadsheets and scattered communication — are now being replaced with intelligent, automated allocation systems. Today, digital allocations are not just a convenience; they are becoming the standard for professional fund managers, family offices, and first-time funds looking to scale efficiently.Modern allocation platforms integrate directly with SPV formation tools, KYC/AML modules, e-signatures, and reporting dashboards. This ensures that every investment — whether through a 506b fund, an SPV, or a hedge fund structure — is executed with precision and transparency.

Modern allocation platforms integrate directly with SPV formation tools, KYC/AML modules, e-signatures, and reporting dashboards. This ensures that every investment — whether through a 506b fund, an SPV, or a hedge fund structure — is executed with precision and transparency.

For global allocators, the shift from Excel to allocation software provides real-time tracking, reduced operational risk, and better compliance. As the industry moves toward digital-first operations, firms that adopt allocation technology early will enjoy a clear competitive advantage in efficiency and investor trust.