Binance Coin Price Prediction as BNB Becomes Top 4 Coin in the World – Time to Buy?

BNB is bullish despite Binance's legal troubles.

BNB is bullish despite Binance's legal troubles.

Binance’s BNB token has flipped Solana to become the fourth largest cryptocurrency by market capitalization, according to data by CoinGecko.

The two leading altcoins had seriously divergent price movements over the last seven days. BNB grew 10% while SOL dropped by 9.4%.

BNB currently changes hands at $381.95, up 4.9% in the last 24 hours. Meanwhile, SOL’s pullback is cooling. It now trades for $105.80, about 3% higher than it was this time yesterday.

While most of the top cryptocurrencies have grown in price over the last 24 hours, including Bitcoin and Ethereum, market leader Bitcoin has actually pulled back 1.5% over the last seven days to trade at $51,601. On the other hand, Ethereum added 6.6% overnight to trade at $2,987.68.

BNB has been rallying all week despite arguably negative publicity as the exchange continues fielding probes and lawsuits by the Department of Justice, the Internal Revenue Service, the US Treasury, the Securities and Exchange Commission and the Commodity Futures Trading Commission.

SOL’s weeklong decline could be attributed to a sharp decline in activity on the network. Solana started February with 1.02 million active addresses. It now hosts 689.4k—a 32% decrease in the number of active addresses in just three weeks.

A glance at the chart shows that BNB has only been growing in value over the last three months. It’s currently trading just ahead of its 30-day moving average. With a Relative Strength Index (RSI) of 64, it looks like investors are buying a lot of BNB at the moment, so the rally is likely to cool, although BNB holders are not likely to see anything worse. The token appears to have found strong support at around $350. Source: TradingView

Source: TradingView

An Interesting Alternative to Binance’s BNB

While Binance’s BNB appears safe for now, the uncertainty surrounding the exchange and its former CEO Changpeng “CZ” Zhao give the token a riskier outlook than other top altcoins.

Those looking for Bitcoin and Ethereum alternatives that are a bit safer need look no further than Bitcoin Minetrix. BTCMTX is a promising project that has raised over $11.3 million in an ongoing presale off the back of its utility alone.

Exciting news for the #Crypto mining industry! 🚀#PolarisTechnology unveils plans for a $100 million, 200MW data center in Muskogee, Oklahoma.

What opportunities do you think this development will bring to the local community?#BitcoinMinetrix has successfully raised more… pic.twitter.com/m6jQ29WJ1D

— Bitcoinminetrix (@bitcoinminetrix) February 20, 2024

BTCMTX tokens are the perfect starter kit for getting into cloud Bitcoin mining. The Bitcoin Minetrix protocol uses Ethereum smart contracts to turn investors’ tokens into cloud mining machinery to mine Bitcoin rewards. There is no need to purchase specialist mining rigs. Simply buy and stake BTCMTX via the website.

The more BTCMTX tokens investors lock up, the more cloud mining credits they’ll receive. Mining credits represent hash power. The greater the hash power, the more attempts the Bitcoin cloud mining software can make to break the network’s cryptographic puzzles and validate blocks of transactions. This is mining, and it is rewarded in Bitcoin.

The staked BTCMTX also generates yields in BTCMTX, further fuelling the staking/mining cycle.

With miners’ rewards set to halve on April 19, investors may want to get in early. It’s currently priced at $0.0136, but this is due to rise in three days.

Buy Bitcoin Minetrix Here

Follow Us on Google News

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

Bitcoin Price Prediction: Rally to $52,000 Amid $67B ETP Bull Run; BTC to Test $56,000?

Amid Bitcoin’s current trade at $51,585 marks a modest 1% dip, spotlighting the resilience and volatility intrinsic to digital currencies. As the financial landscape evolves, with cryptocurrency exchange-traded products (ETPs) amassing $67 billion in assets—echoing the fervor of a December 2021 bull run—the spotlight intensifies on Bitcoin’s potential trajectory.

Investors and market observers are keenly watching the influx of $5.2 billion into crypto ETPs this year, a testament to growing confidence and a harbinger of possible future valuation milestones.

Amidst this bustling activity, Bitcoin’s resilience shines through, with its price managing to climb despite a diverse range of market sentiments and investment strategies, underscoring the anticipation and speculation surrounding its future price movements.

Cryptocurrency ETPs Soar to Bull Run Heights with $67B in Assets

Cryptocurrency exchange-traded products (ETPs) have surged to a bull run peak, amassing $67 billion in assets under management (AUM) – a high not observed since December 2021.

This remarkable growth is attributed to positive price movements and a record $5.2 billion inflow in 2023 alone, signifying heightened investor confidence.

Particularly noteworthy was the last week, which saw $2.45 billion directed into US-listed crypto ETPs, excluding ten spot Bitcoin ETFs.

Leading the charge in attracting these inflows were the ETFs offered by Fidelity and BlackRock, marking a significant moment for the sector.

Conversely, traditional giants like Grayscale experienced a notable reduction in outflows, hinting at a stabilizing investor sentiment towards crypto assets.

Bitcoin itself showcased resilience, climbing nearly 4% to conclude the week above the $52,000 mark.

This occurred despite a $5.8 million investment into short-Bitcoin instruments, reflecting some investors’ anticipation of a price dip.

Nonetheless, the prevailing trend indicates an overarching optimism, potentially paving the way for further gains in Bitcoin’s value.

- Record Inflows: 2023 witnesses a significant uptick with $5.2 billion inflows into crypto ETPs.

- Leading ETFs: Fidelity and BlackRock ETFs emerge as top choices for investors, indicating trust in established financial institutions.

- Bitcoin’s Resilience: Despite speculative short positions, Bitcoin’s price increase signals growing market confidence, suggesting potential for future appreciation.

Emojis: The Unexpected Predictors of Cryptocurrency Trading Success

n a groundbreaking study, researchers have unveiled a novel indicator of cryptocurrency market sentiment: emojis.

Analysis reveals that a positive emoji sentiment on social media platforms significantly correlates with lucrative cryptocurrency trading outcomes.

Utilizing advanced GPT-4 sentiment analysis, the team developed algorithms capable of predicting Bitcoin’s trading performance with remarkable accuracy.

By capitalizing on days marked by a predominance of positive emojis, these algorithms consistently outperformed standard market predictions.

This intriguing discovery suggests that emojis could influence investor behavior, potentially driving up Bitcoin prices through increased purchases.

While the study’s methodology focused solely on a rudimentary daily trading strategy and overlooked the impact of trading fees, the insights it offers into the nexus between social media mood and trading performance could revolutionize investment strategies and bolster market efficiency.

Edward Snowden Hails Bitcoin as Epochal Financial Innovation

Edward Snowden, a privacy advocate and former NSA whistleblower, claims that Bitcoin is the biggest financial innovation since coinage began, calling this claim “unpopular but true.”

While some, like Dave Benner, concur, pointing out that Bitcoin has the ability to free money from governmental regulation, others, like Jeff Hosterman, disagree, claiming that its lack of traceability and privacy restricts its usefulness.

Unpopular but true: Bitcoin is the most significant monetary advance since the creation of coinage.

If you don't believe me or don't get it, I don't have time to try to convince you, sorry.

— Edward Snowden (@Snowden) February 18, 2024

Snowden frequently discusses his opinions about Bitcoin, emphasizing how it has changed the financial landscape and offering his thoughts on more recent events like the approval of Bitcoin ETFs.

Despite his sporadic criticism, his support of Bitcoin’s importance could boost investor confidence in the cryptocurrency’s long-term value proposition, which could lead to further adoption and investment.

With the support of a well-known authority on privacy and security, Bitcoin’s usefulness and durability may be seen more favorably, which could result in price increases.

Bitcoin Price Prediction

Bitcoin (BTC/USD) demonstrates a modest uptick of 0.24%, marking a current trading value of $51,909. This slight increase reflects a cautious optimism among investors as Bitcoin maneuvers around significant technical markers.

The pivotal point for today’s trading stands at $52,515, with the cryptocurrency facing immediate resistance levels at $53,943, $55,214, and $56,497. These thresholds define potential barriers to upward movement.

Conversely, Bitcoin finds support at $50,783, with further bases at $49,527 and $48,321, which could cushion any downward trends. Bitcoin Price Prediction

Bitcoin Price Prediction

Technical indicators reveal a balanced market sentiment; the Relative Strength Index (RSI) at 54 suggests a neutral stance, neither overbought nor oversold. The Moving Average Convergence Divergence (MACD) values, while not specified, indicate the potential for momentum shifts based on their relation to the signal line.

The 50-Day Exponential Moving Average (EMA) at $50,775 underpins a bullish outlook, suggesting that as long as Bitcoin’s price remains above this level, the market could see further gains.

The current sideways trading pattern underscores a period of consolidation, with a potential breakout contingent on surpassing established resistance levels or breaching support thresholds.

Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the world of digital assets by exploring our handpicked collection of the best 15 alternative cryptocurrencies and ICO projects to keep an eye on in 2023. Our list has been curated by professionals from Industry Talk and Cryptonews, ensuring expert advice and critical insights for your cryptocurrency investments.

Take advantage of this opportunity to discover the potential of these digital assets and keep yourself informed.

Binance Coin [BNB] Weekend Price Prediction

Source – Binance

Source – Binance

Amid a tumultuous market environment, Binance Coin (BNB) has demonstrated resilience, showing a modest increase of 2.08% at present, with prices hitting $365.17. This positive movement contrasts with the overall market downturn, with trading volumes notably surging by almost 30%, reaching $1.7 million.

Factors Driving Optimism

A significant contributor to this optimistic outlook is the substantial burn of BNB tokens, exceeding $575 million. Token burns, which diminish the circulating supply of BNB, typically lead to upward price movements, as they enhance the token’s scarcity and perceived value.

Also Read: Binance Trust Wallet Under Probe By U.S. Officials

Weekend Speculation

As the weekend draws near, speculation arises regarding the sustainability of this bullish trend. The community eagerly awaits to observe whether BNB can sustain its upward trajectory. Insights from Changelly suggest that while Binance Coin may face a minor setback during the week, a resurgence is anticipated over the weekend. Source – Changelly

Source – Changelly

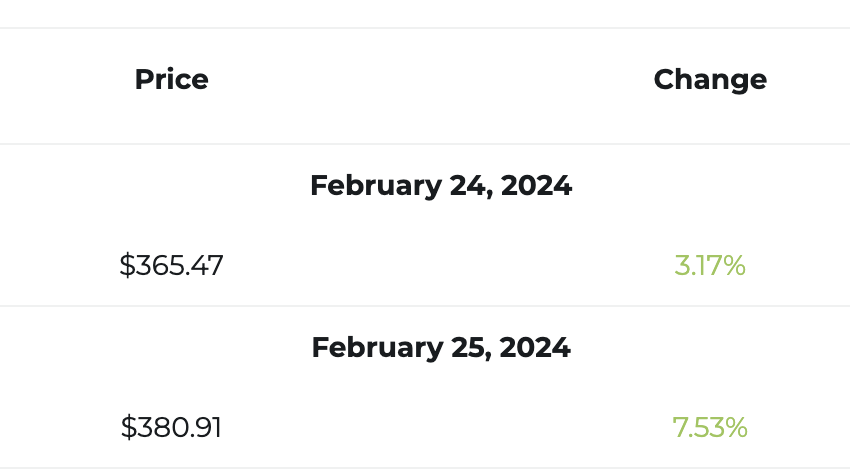

Analysts anticipate BNB to potentially reach highs ranging from $365.47 to $380.91 during the weekend. This further reflects a positive sentiment among traders and investors. As seen in the above image, the altcoin will likely encounter a 7% surge from its current levels. This projection is in line with the favorable momentum witnessed in recent trading sessions.

Looking Ahead

Despite the challenges in the broader market, Binance Coin seems well-positioned to leverage its recent gains and potentially extend its rally into the weekend. Nevertheless, it’s crucial to remember that price predictions for cryptocurrencies are influenced by market dynamics and investor sentiment, necessitating caution when interpreting such forecasts.

Also Read: Binance Coin Gains Momentum: Can BNB Hit $400?

As traders prepare for the weekend, all attention remains on Binance Coin to ascertain whether it can sustain its bullish momentum and achieve further gains in the days ahead.

Optimism (OP) to Soon Reach Above $5, Binance Coin (BNB) Broke Above $320 – Pullix (PLX) to Launch in Less Than 20 Days

Share on Facebook

Share on Facebook

Share on Twitter

Optimism (OP) and Binance Coin (BNB) are currently bullish across all of their charts and have impressive performance that has the potential to engage the future bull run. If this happens, it could send ripples across the broader Web3 space. Another cryptocurrency that has gained significant attention with its blockchain ICO is Pullix. The project is in its last two stages, and it will launch in less than 20 days. Today, we will explore how far it can rise.

Optimism (OP) Climbs 22.4% – Price to Spike As High as $5.06

Optimism (OP) is green across all of its charts, and during the past year alone, it climbed by 53%. Moreover, the Optimism price saw an upswing from a low value of $3.05 to $3.73 during the previous week. It did not stop there, as the Optimism crypto chart also indicates that it climbed by 22.4% during the previous week.

As a result, the sentiment on the future of this cryptocurrency is bullish. According to the Optimism price prediction, it can end in 2024 at $5.06.

Binance Coin (BNB) Climbs Above $320 – How Far Can It Go in 2024?

Binance Coin (BNB) has also begun seeing significant price increases that have made it a top choice on the radar for many traders. Just during the previous week, the Binance Coin price has moved upwards from a low point of $300 to $324.85. Now, it needs to break the major $330 price barrier in order to reach new heights.

The Binance Coin crypto is positioned to grow above the aforementioned barrier and swing upwards much further. In fact, according to the Binance Coin price prediction, it will reach a maximum value of $507.99 by the end of 2024.

Pullix (PLX) Just Under 70 Days From Release – How Far Can It Climb?

Pullix (PLX) is getting traction with its ongoing presale, especially as it closes to its launch. With over 15,000 users and just under 20 days until the release, it has gathered significant attention from traders. It can completely change the TradFi space by introducing various features.

For example, it will combine the best elements of CEXs and DEXs to create a unified experience where anyone can trade any asset, and this includes cryptocurrencies.

It will feature a profit share model, where anyone can provide liquidity to the automated market makers (AMMs) to get passive income up to 18% APR.

Moreover, it will feature a token burn feature aimed at dropping the supply and potentially increasing its value over the long term. Now, the cryptocurrency is in the final stage of its presale. Here, it trades at $0.14, but according to analysts, it can spike as high as 100x at launch.

Summary

Optimism is heading upward in value, and Binance Coin could soon reach a new annual high, which positions it as an appealing option in the market. However, the Pullix blockchain ICO is getting the most attention and could become a major force in TradFi, making it one of the most appealing altcoins to get. With a live platform demonstration available to the public, two trading licenses obtained and listings on both Bitmart and Uniswap, Pullix has the potential to become the next 100x token in 2024.

For more information regarding Pullix’s presale see links below: