Nigeria’s Central Bank Denies Reports on Crypto Account Freezing

Cryptocurrency has become a popular investment option in Nigeria, despite a somewhat rocky relationship with the country's financial regulators. In a recent development, the Central Bank of Nigeria (CBN) issued a public statement refuting claims that it mandated local banks to freeze accounts associated with unlicensed crypto exchanges.

Cryptocurrency has become a popular investment option in Nigeria, despite a somewhat rocky relationship with the country's financial regulators. In a recent development, the Central Bank of Nigeria (CBN) issued a public statement refuting claims that it mandated local banks to freeze accounts associated with unlicensed crypto exchanges.

This article dives into the details of this situation, exploring the initial reports, the CBN's response, and the ongoing debate surrounding cryptocurrencies in Nigeria.

Unfounded Rumors Cause Confusion

In early April 2024, reports surfaced online alleging that the CBN had issued a directive instructing Nigerian banks to identify and freeze accounts engaged in transactions with cryptocurrency exchanges.

Furthermore, the reports specifically listed Bybit, KuCoin, OKX, and Binance as exchanges not licensed for operations within Nigeria. This news caused concern and confusion among Nigerian crypto users, many of whom rely on these popular platforms for their digital asset transactions.

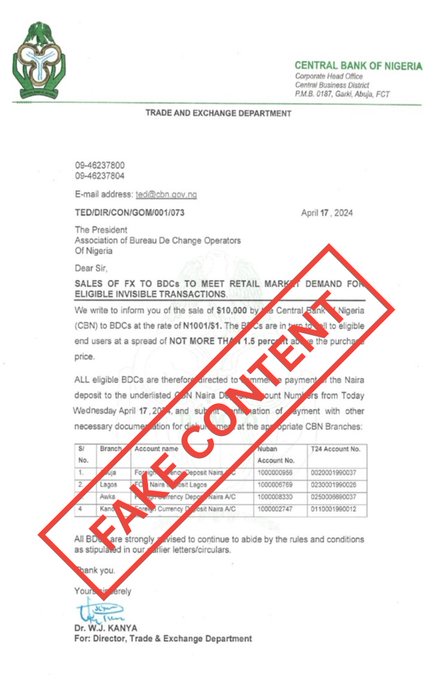

The Central Bank of Nigeria responded swiftly to quell these anxieties. In an official statement, the CBN categorically denied issuing any directive regarding the freezing of crypto-related accounts. They emphasized that the circulated document claiming such an order was not issued by the regulator. The CBN urged Nigerians to rely solely on their official website for "authentic information" regarding their policies and directives.

This swift action by the CBN helped to stabilize the situation and reassure the public that their crypto investments were not under immediate threat.

A History of Evolving Regulations

While the CBN's recent denial clarifies the current stance on account freezing, Nigeria's relationship with cryptocurrencies has been a subject of ongoing debate. In February 2021, the CBN issued a directive prohibiting banks and other financial institutions from facilitating transactions or providing services to individuals or businesses involved in cryptocurrency trading. This move signaled a cautious approach by the central bank, citing concerns about money laundering, financial instability, and the potential risks associated with unregulated digital assets.

However, by December 2023, the CBN appeared to soften its stance. In a statement acknowledging the increasing global adoption of cryptocurrencies, the CBN lifted the ban on banks facilitating transactions for licensed crypto exchanges. This shift suggests a potential willingness to adapt to the evolving landscape of digital finance.

The Unanswered Questions

Despite the CBN's clarification, several questions remain regarding the future of cryptocurrency regulation in Nigeria.

Licensing of Crypto Exchanges: The reports mentioned Bybit, KuCoin, OKX, and Binance as unlicensed exchanges. The CBN's statement did not address this specific issue. Will the CBN establish a licensing framework for crypto exchanges operating within Nigeria?

Long-Term Regulatory Approach: The CBN's recent actions seem to indicate a more flexible approach towards cryptocurrencies. However, the lack of a comprehensive regulatory framework creates uncertainty for both investors and businesses. Is the CBN planning to implement clear regulations for the crypto sector in Nigeria?

Consumer Protection: As crypto usage continues to grow, concerns regarding consumer protection remain. How will the CBN ensure that Nigerian crypto investors are adequately protected from potential scams and market volatility?

Addressing these questions will be crucial for fostering a healthy and sustainable environment for cryptocurrency within the Nigerian economy.

Balancing Innovation and Risk Management

The rise of cryptocurrencies presents both opportunities and challenges for Nigeria. While the potential for innovation and financial inclusion is undeniable, concerns regarding financial stability and consumer protection warrant serious consideration. The CBN's role will be critical in striking a balance between fostering innovation and managing risks associated with this dynamic new asset class.

Open dialogue with stakeholders like crypto exchanges, investors, and industry experts will be key to developing a regulatory framework that promotes responsible growth in the Nigerian crypto ecosystem.

By promoting transparency and establishing clear guidelines, the CBN can ensure that Nigerians can participate in the crypto space with confidence and contribute to the nation's continued economic development.

Conclusion

The rise of cryptocurrencies presents a unique challenge for Nigeria's financial regulators. Striking a balance between fostering innovation, managing risks, and protecting consumers is crucial.

By promoting transparency, establishing clear guidelines, and collaborating with stakeholders, the CBN can ensure that Nigerians can participate in the crypto space with confidence. This will contribute to a sustainable and responsible growth of the Nigerian crypto ecosystem, potentially unlocking new avenues for financial inclusion and economic development.