Eigen Layer Unveiled: Restaking Innovations for Staked Ethereum.

Eigen Layer: Unveiling the Potential of Restaked Ethereum.

The world of Ethereum, the leading platform for decentralized applications (dApps), is constantly evolving. One recent innovation making waves is Eigen Layer, a novel system designed to unlock the full potential of staked Ethereum (ETH).

This article delves into the intricacies of Eigen Layer, exploring its core functionalities, potential benefits, and the impact it might have on the Ethereum ecosystem.

Understanding Staked Ethereum: The Foundation of Eigen Layer.

Before diving into Eigen Layer itself, it's crucial to understand staked Ethereum (stETH). When users participate in Ethereum's Proof-of-Stake (PoS) consensus mechanism, they lock up their ETH to secure the network. In return, they earn rewards. However, this locked ETH becomes illiquid, meaning it cannot be readily used for transactions or DeFi applications.

Eigen Layer: Restaking the Game

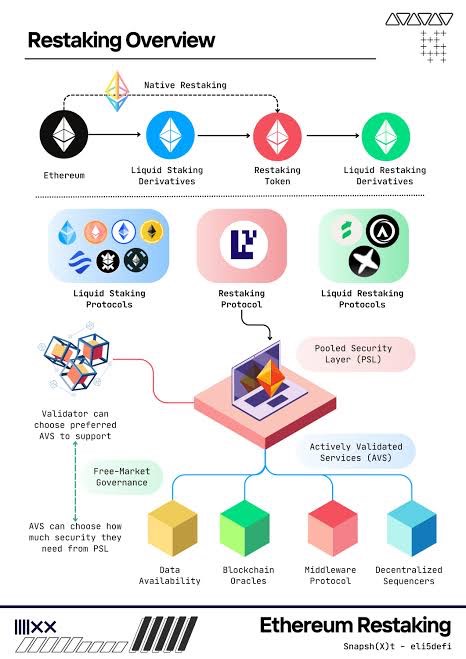

Eigen Layer emerges as a solution to the illiquidity dilemma of staked ETH. It introduces a concept called "restaking," allowing users to leverage their staked ETH for additional benefits. Here's how it works:

Opt-in System: Eigen Layer is not mandatory for Ethereum stakers. It's an opt-in system where users can choose to participate by transferring their stETH to the Eigen Layer protocol.

Security Delegation: By transferring their stETH, users essentially delegate their staking security rights to Eigen Layer. This empowers Eigen Layer to utilize the collective staking power of its users to contribute to Ethereum's security.

Unlocking Liquidity: In exchange for delegating their security rights, Eigen Layer users receive a new token called "eETH" (Eigen ETH). This eETH represents a liquid version of staked ETH, meaning it can be freely traded and used in DeFi protocols, unlocking new earning opportunities for users.

Validation Rewards: Beyond the standard staking rewards earned from Ethereum, Eigen Layer participants can potentially receive additional validation rewards. These rewards come from fees generated by other applications built on top of the Eigen Layer protocol.

Benefits of Eigen Layer for Different Stakeholders.

- Stakers: Eigen Layer provides a valuable solution for stakers seeking liquidity for their locked ETH. With eETH, they can participate in DeFi activities without sacrificing their staking rewards.

- DeFi Users: The increased liquidity of stETH through Eigen Layer benefits the broader DeFi ecosystem. More readily available stETH fuels innovation and expands opportunities for DeFi applications.

- Ethereum Network: By attracting more stakers with its liquidity solution, Eigen Layer contributes to a more robust and secure Ethereum network.

- Developers: Eigen Layer opens doors for developers to build innovative applications on top of its protocol. These applications can leverage the combined staking power of Eigen Layer users, creating a vibrant and dynamic ecosystem.

Exploring the Technicalities: EigenLayer's Architecture.

Eigen Layer operates on a two-layer architecture:

- Consensus Layer: This layer remains on the Ethereum mainnet and is responsible for core staking functions like block production and validation.

- Execution Layer: This layer exists as a separate blockchain built using the Cosmos SDK [Cosmos SDK - https://cosmos.network/appchains/] . It is responsible for managing eETH, facilitating its transfer, and handling validation rewards for Eigen Layer participants.

This two-layer design ensures security benefits from Ethereum's robust PoS system while enabling the Eigen Layer protocol to operate efficiently for managing eETH and its associated functionalities.

The Road Ahead: Challenges and the Future of Eigen Layer

While Eigen Layer holds immense potential, certain challenges need to be addressed for long-term success.

- Security Considerations: As Eigen Layer utilizes a separate blockchain for the execution layer, security remains a crucial aspect. Robust security measures are essential to ensure the safety of users' funds and the overall integrity of the protocol.

- Regulatory Landscape: The evolving regulatory landscape surrounding DeFi and cryptocurrencies poses potential challenges for Eigen Layer. Adapting to regulatory frameworks will be crucial for its continued operation.

- Competition: The DeFi space is constantly evolving, and other solutions for unlocking liquidity for staked ETH might emerge. Eigen Layer must continuously innovate and offer compelling value propositions to attract and retain users.

Despite these challenges, Eigen Layer presents a promising path forward for the Ethereum ecosystem. By enabling restaking and unlocking liquidity for staked ETH, it empowers users, fuels DeFi innovation, and strengthens the overall security of the network.

As the technology matures and the team addresses potential hurdles, Eigen Layer has the potential to become a cornerstone of a robust and dynamic Ethereum future.

Resources for Further Exploration:

- Eigen Layer Website: https://www.eigenlayer.xyz/

- Eigen Layer Whitepaper: https://docs.eigenlayer.xyz/eigenlayer/overview/whitepaper

- What is Staking on Ethereum?: https://ethereum.org/en/staking/.