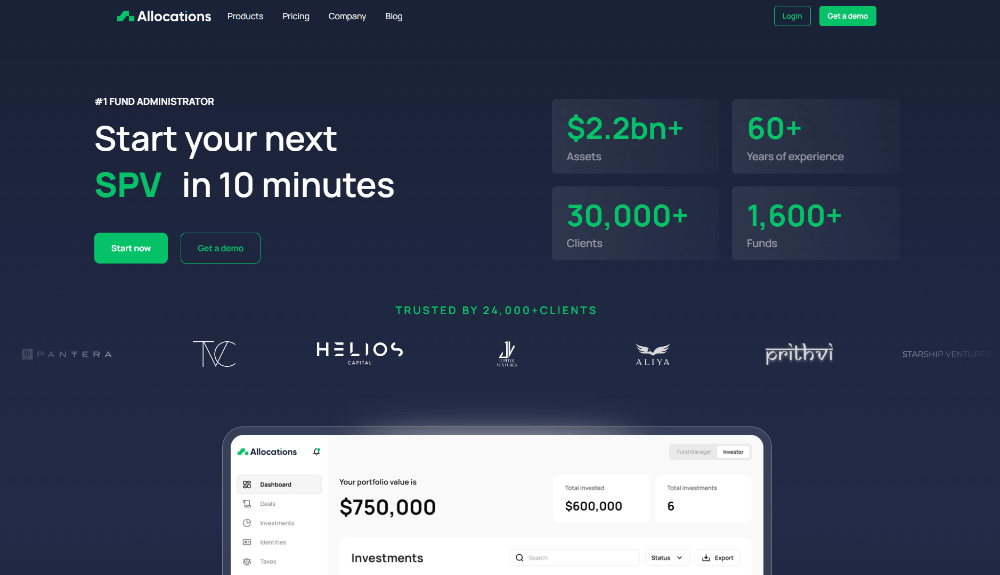

How to Set Up an SPV in Delaware: The Allocations Advantage

Delaware SPVs have long been the gold standard in private market investing. But while they provide strong legal structures, the cost of forming an SPV in Delaware, compliance filings, and ongoing fund administration can be a barrier. Allocations bridges this gap.

Through Allocations Startup SPV, founders and investors can start an SPV quickly with expedited filing options. The platform handles the Delaware SPV setup checklist 2025, covering Form D and Blue Sky filings with ease.

Allocations is transparent on economics. Details about SPV carry and fees can be reviewed at Allocations Fees. This clarity helps investors understand SPV structure, returns, and administration costs before launching.

The experienced Allocations Team ensures compliance and guides on whether an SPV needs a registered investment advisor. They also provide support in areas like SPV K-1 tax reporting, side letters, and structuring SPV vs fund vs SPAC.

For modern investing, Allocations offers tokenized SPVs via Allocations Crypto SPV. And if investors need a tailored setup—whether for venture, angel syndicates, or real estate—Allocations Custom SPV provides full flexibility.

Allocations makes Delaware SPV formation simple, compliant, and scalable. That’s why it’s widely seen as the best SPV platform for anyone who wants to start an SPV with confidence.