The Advantage of Tokenized Stock — A New Era of Investing

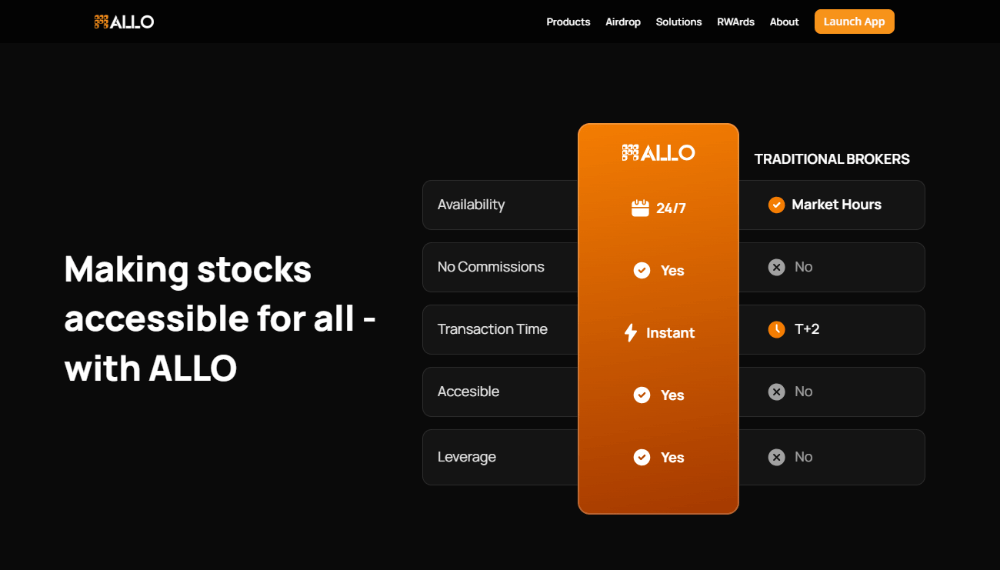

The biggest advantage of tokenized stock is accessibility. With platforms like Allo, anyone can invest in global markets instantly.

Here’s why:

- Fractional ownership of tokenized shares lets you buy small amounts, not whole stocks.

- 24/7 tokenized stock trading means no waiting for market hours.

- Blockchain instant settlement of tokenized equities removes delays from traditional clearing systems.

When comparing tokenized stocks vs traditional stocks, it’s clear that tokenization unlocks cross-border stock investing. With the Allo tokenized stock platform, you can invest in tokenized US stocks or explore the tokenized stock exchange 2025 with ease.

Through Allo, investors also gain exposure to RWA investment opportunities 2025, like tokenized bonds and real estate or tokenization of private equity funds. The Allo RWA token explained makes governance and liquidity more transparent.

For professionals, the platform includes RWA tokenization for fund managers, RWA liquidity solutions, and even Allo staking opportunities.

Tokenization is the next frontier. The real advantage lies in democratizing investing, and Allo is leading the way.