Private Market Investing: Build Wealth with Allocations

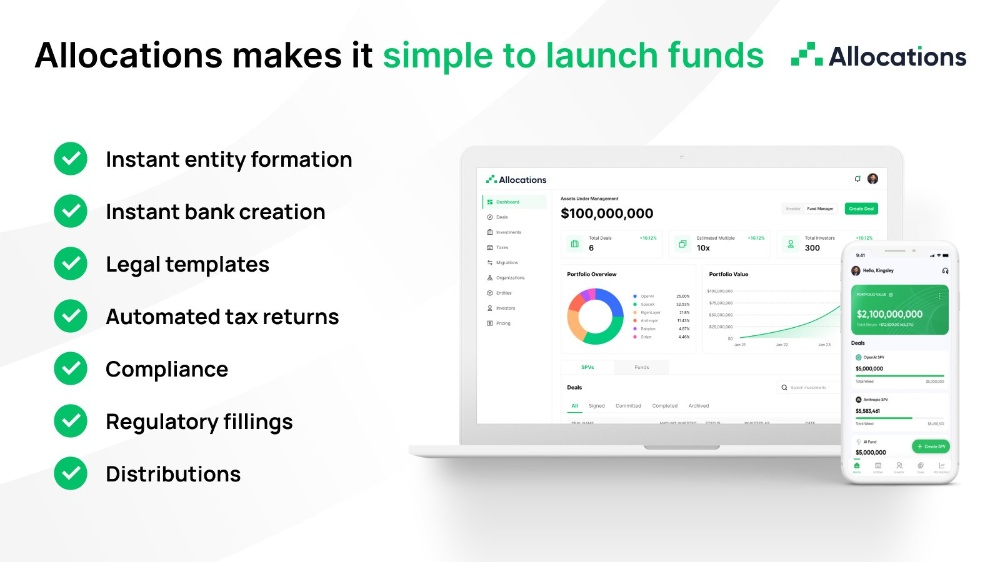

Private market investing gives investors access to high-growth opportunities beyond public stocks. Through Allocations, you can create and manage SPVs efficiently — from setup to compliance.

1. The Power of SPVs in Private Investing

An SPV fund lets investors group capital into one entity to back startups, funds, or real estate — providing structure and clarity in ownership.

👉 Start an SPV today

2. Why Delaware SPVs Lead the Market

A Delaware SPV offers reliable governance, tax benefits, and quick setup. Delaware’s Court of Chancery ensures investor disputes are resolved fairly.

👉 Build your Delaware SPV

3. Full-Service Fund Administration

Allocations manages SPV fund administration, including filings, compliance, and accounting — saving investors time and ensuring legal alignment.

👉 Meet the experts

4. Transparent SPV Costs and Carry

With Allocations, investors understand the cost of forming an SPV in Delaware, SPV carry, and ongoing fund administration fees.

👉 Check out the fee structure

5. The New Era: Tokenized SPVs

The introduction of tokenized SPVs enables global, digital participation in private markets, reshaping how capital is pooled.

👉 Explore crypto SPVs

Allocations makes private market investing accessible, transparent, and secure — bridging traditional investing with the future of digital assets.