Markets Show Relentless Energy As the Price of Bitcoin Exceeds $13,000

Bitcoin markets are rallying once again breaking new price records after recently exceeding the US$12K zone. On December 6, 2017, at approximately 2:30 pm EDT, one bitcoin is now valued at a global weighted average of over $13,000 across many popular trading platforms. The milestone comes just days before the upcoming derivatives products set to be launched by the Chicago Board Options Exchange (Cboe) and CME Group.

Also read: Getting Bitcoin on Mom’s iPhone: 3 Easy Steps

Bitcoin Crosses $13K Per BTC Across Global Exchanges

Bitcoin is on fire, and it continues to gain in value every single month this year, achieving more than 1100 percent in value during 2017. The decentralized currency has been one of the most topical conversations lately regarding finance, money, and investment vehicles. The price has astonished the mainstream media and many news outlets, and television shows across the world are reporting on the bitcoin phenomenon. At approximately 2:30 pm EDT Bitcoin surpassed $13,000 per BTC.

At approximately 2:30 pm EDT Bitcoin surpassed $13,000 per BTC.

In these reports, journalists and reporters detail how bitcoin is becoming the world’s “digital gold” and explain how the currency has outpaced nearly every government issued currency, stock, and commodity traded on earth. Over the past few weeks, many speculators believe the price is being pushed by institutional money coming-in with all the futures products scheduled.

“We see a price drive based on the upcoming futures contracts,” explains Jeff Koyen, strategic advisor to 360 Blockchain Inc. in an interview with Forbes. “There’s a lot of new money coming in, looking for quick profit.”

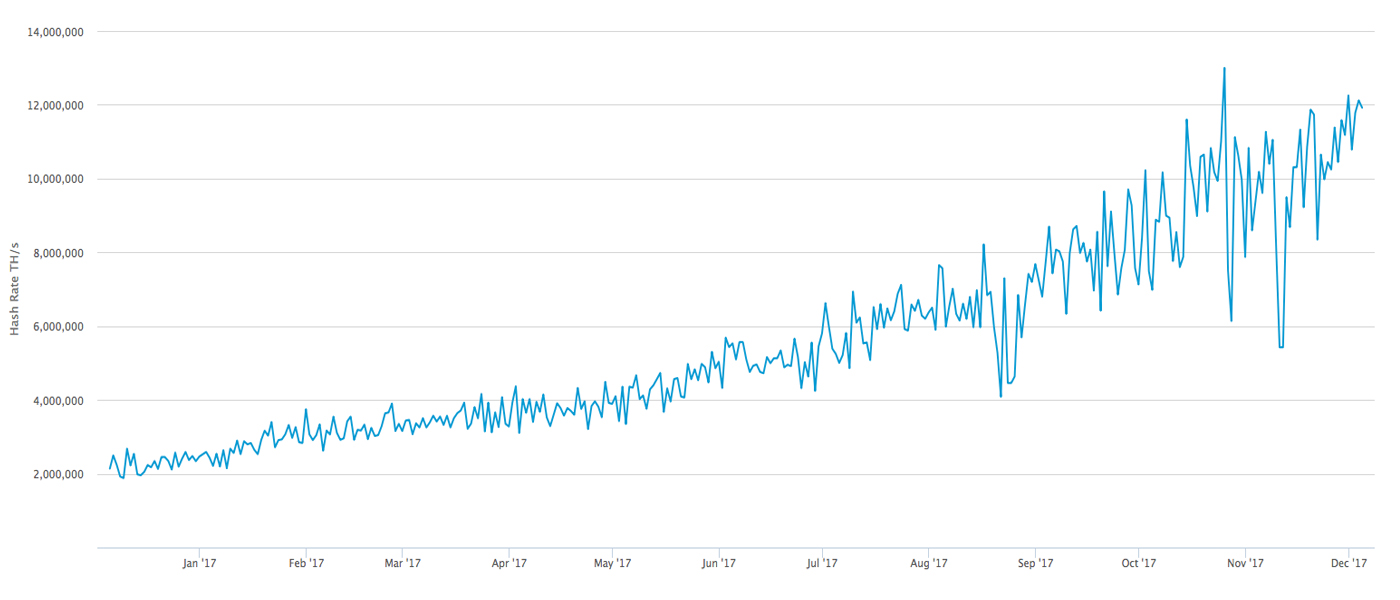

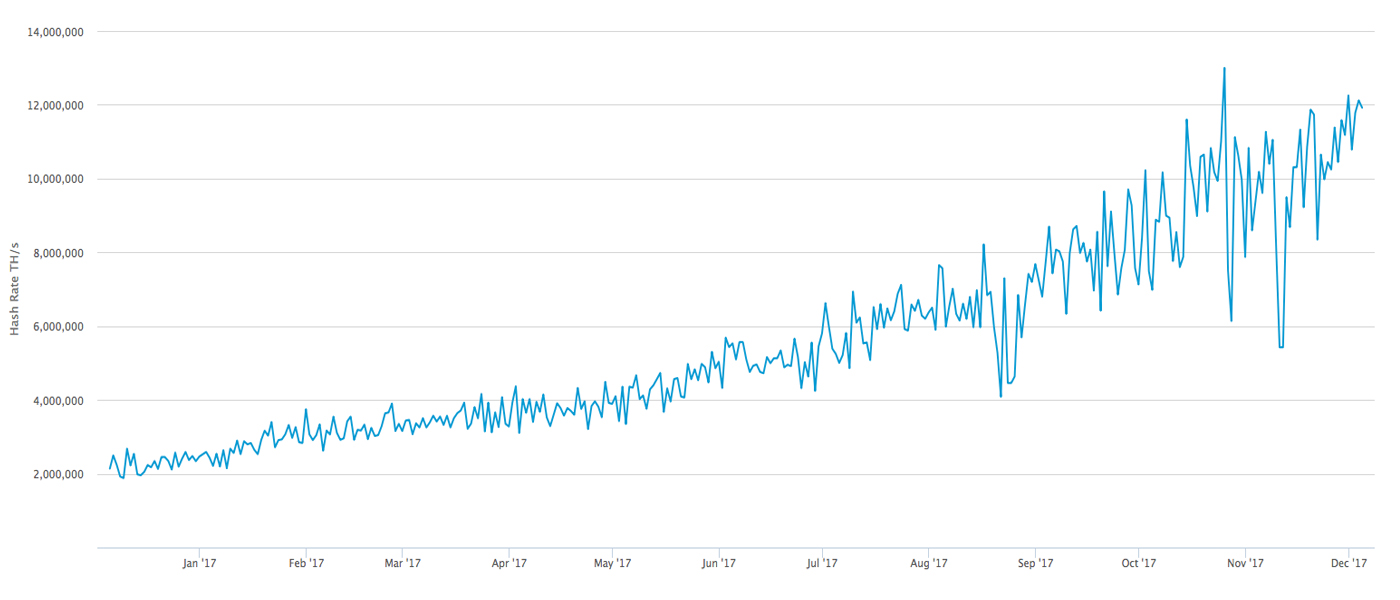

450K Transactions Per Day, 12 Exahash, and a $218Bn Market Cap

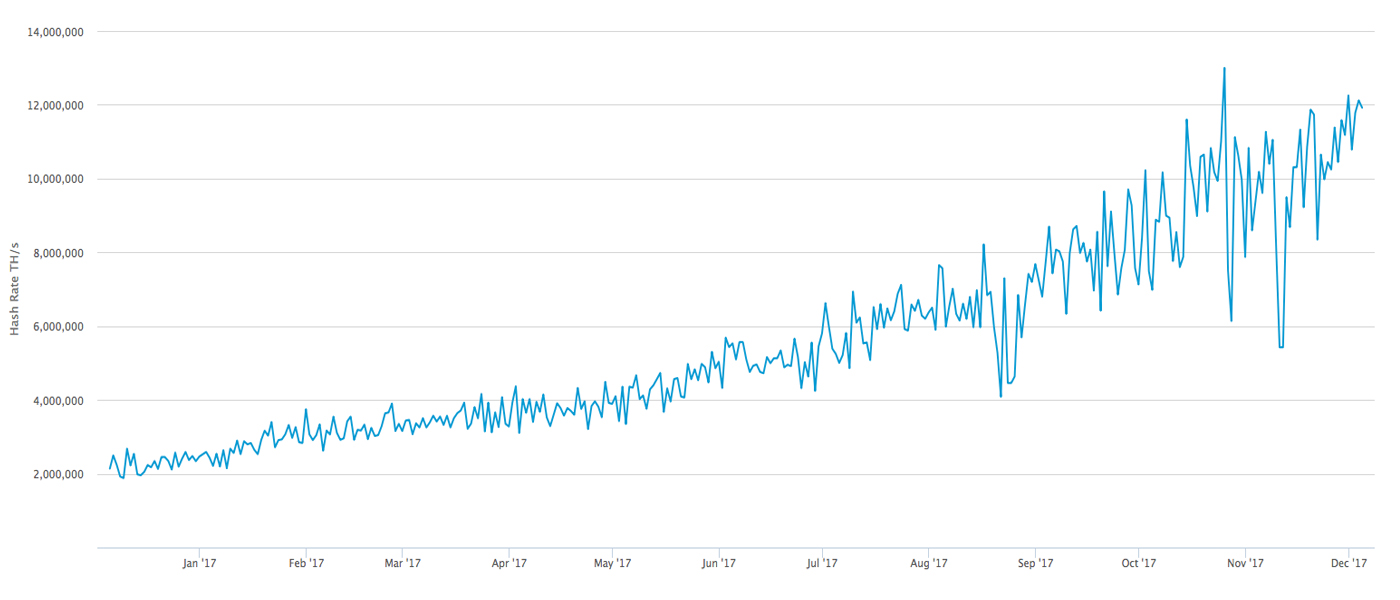

Over the past few days, bitcoin fever has been even more exuberant as the price has gained over $3,000 in just a week’s time. Today as bitcoin smashes through the $13K price region the decentralized currency’s markets are seeing over $10Bn worth of BTC traded over the past 24-hours. Moreover, bitcoin’s market capitalization is over $218Bn and is dominating the 1,326 other digital assets by 58 percent. Bitcoin users are also transacting more than usual as daily confirmed transactions (tx) are reaching record highs at 450,000 tx per day. Mining revenue is higher than ever as the currency is extremely lucrative to mine at this price point, which has pushed the network hashrate to over 12 exahash per second. With its price and network milestones, bitcoin continues to astonish the world, breaking record after record each month. Bitcoin’s hashrate is a whopping 12 exahash per second.

Bitcoin’s hashrate is a whopping 12 exahash per second.

The Bitcoin Phenomenon Is Still Fairly Small But It’s Growing Bigger Every Day

Bitcoin is relatively small compared to the world’s real estate markets (160 trillion) and gold’s annual capitalization (9 trillion). However, bitcoin is bigger than many other market capitalizations like Paypal, McDonald’s, IBM, GE, Disney and many more. Further bitcoin-based funds and IRAs like Grayscale’s GBTC, are performing phenomenally alongside bitcoin’s growth this year. The senior exchange traded fund (ETF) analyst for Bloomberg, Eric Balchunas, revealed that Sweden’s bitcoin exchange-traded fund (ETN) is now larger than 80 percent of the U.S. based ETFs. Now that many futures products are being lined up, U.S. based bitcoin ETFs could be launched shortly after the derivatives markets are established.

Bitcoin markets are rallying once again breaking new price records after recently exceeding the US$12K zone. On December 6, 2017, at approximately 2:30 pm EDT, one bitcoin is now valued at a global weighted average of over $13,000 across many popular trading platforms. The milestone comes just days before the upcoming derivatives products set to be launched by the Chicago Board Options Exchange (Cboe) and CME Group.

Also read: Getting Bitcoin on Mom’s iPhone: 3 Easy Steps

Bitcoin Crosses $13K Per BTC Across Global Exchanges

Bitcoin is on fire, and it continues to gain in value every single month this year, achieving more than 1100 percent in value during 2017. The decentralized currency has been one of the most topical conversations lately regarding finance, money, and investment vehicles. The price has astonished the mainstream media and many news outlets, and television shows across the world are reporting on the bitcoin phenomenon. At approximately 2:30 pm EDT Bitcoin surpassed $13,000 per BTC.

At approximately 2:30 pm EDT Bitcoin surpassed $13,000 per BTC.

In these reports, journalists and reporters detail how bitcoin is becoming the world’s “digital gold” and explain how the currency has outpaced nearly every government issued currency, stock, and commodity traded on earth. Over the past few weeks, many speculators believe the price is being pushed by institutional money coming-in with all the futures products scheduled.

“We see a price drive based on the upcoming futures contracts,” explains Jeff Koyen, strategic advisor to 360 Blockchain Inc. in an interview with Forbes. “There’s a lot of new money coming in, looking for quick profit.”

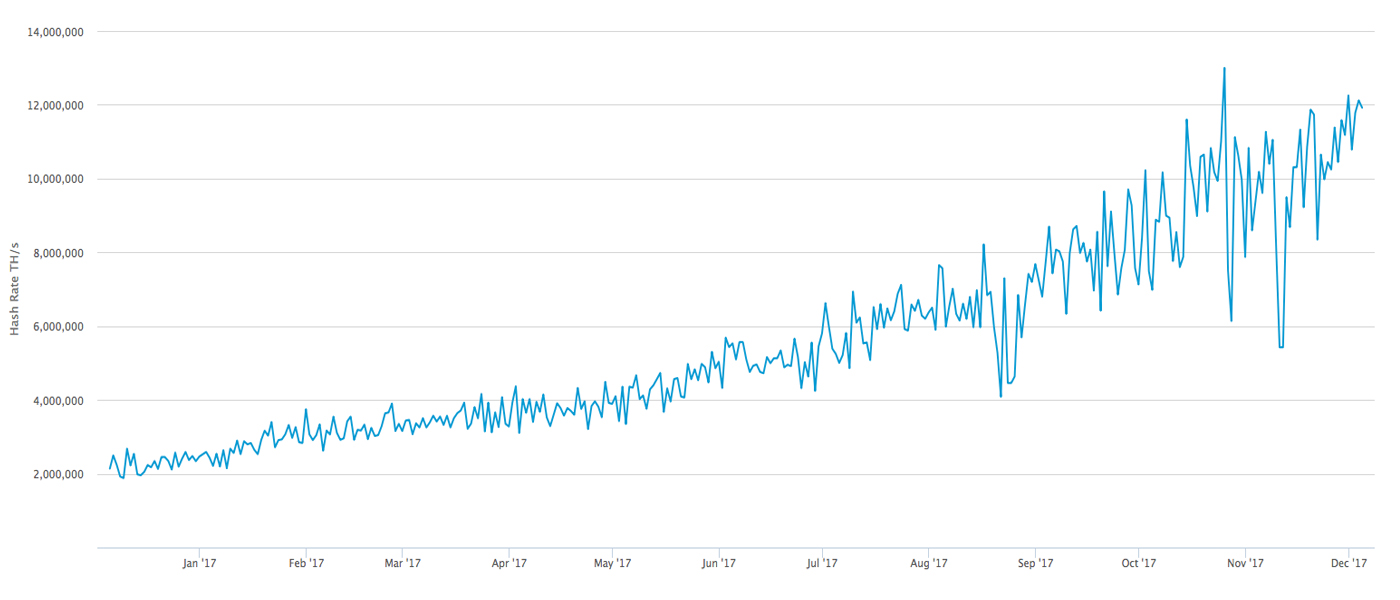

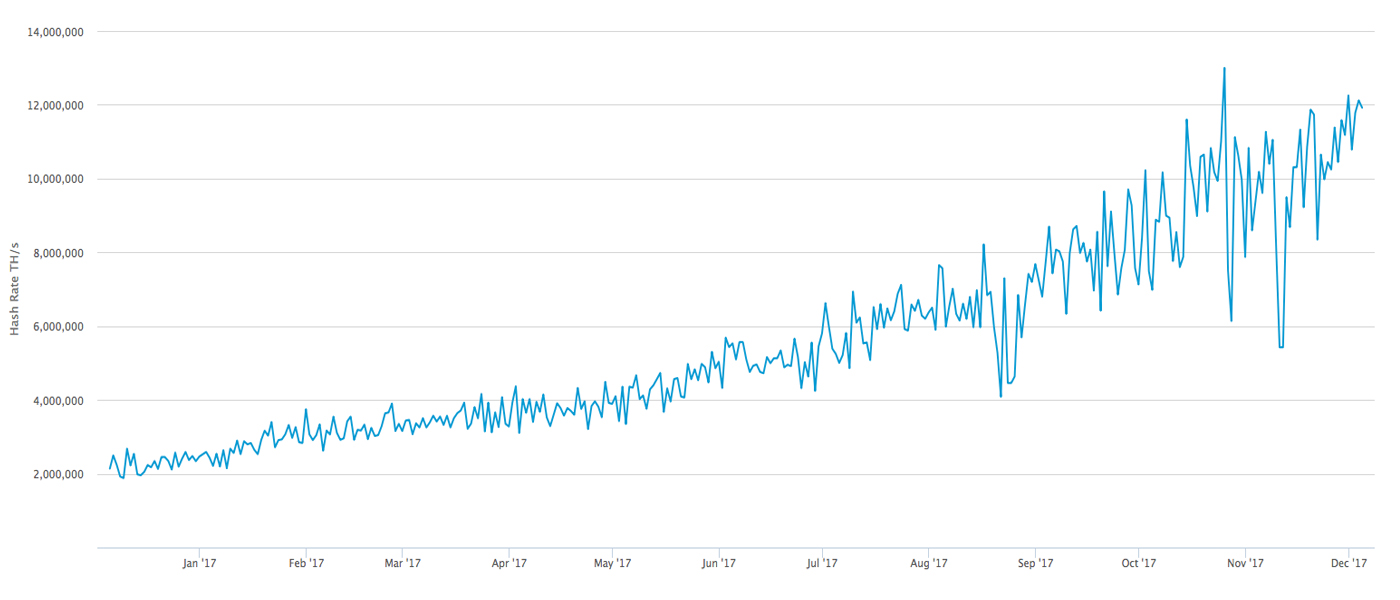

450K Transactions Per Day, 12 Exahash, and a $218Bn Market Cap

Over the past few days, bitcoin fever has been even more exuberant as the price has gained over $3,000 in just a week’s time. Today as bitcoin smashes through the $13K price region the decentralized currency’s markets are seeing over $10Bn worth of BTC traded over the past 24-hours. Moreover, bitcoin’s market capitalization is over $218Bn and is dominating the 1,326 other digital assets by 58 percent. Bitcoin users are also transacting more than usual as daily confirmed transactions (tx) are reaching record highs at 450,000 tx per day. Mining revenue is higher than ever as the currency is extremely lucrative to mine at this price point, which has pushed the network hashrate to over 12 exahash per second. With its price and network milestones, bitcoin continues to astonish the world, breaking record after record each month. Bitcoin’s hashrate is a whopping 12 exahash per second.

Bitcoin’s hashrate is a whopping 12 exahash per second.

The Bitcoin Phenomenon Is Still Fairly Small But It’s Growing Bigger Every Day

Bitcoin is relatively small compared to the world’s real estate markets (160 trillion) and gold’s annual capitalization (9 trillion). However, bitcoin is bigger than many other market capitalizations like Paypal, McDonald’s, IBM, GE, Disney and many more. Further bitcoin-based funds and IRAs like Grayscale’s GBTC, are performing phenomenally alongside bitcoin’s growth this year. The senior exchange traded fund (ETF) analyst for Bloomberg, Eric Balchunas, revealed that Sweden’s bitcoin exchange-traded fund (ETN) is now larger than 80 percent of the U.S. based ETFs. Now that many futures products are being lined up, U.S. based bitcoin ETFs could be launched shortly after the derivatives markets are established.

Bitcoin markets are rallying once again breaking new price records after recently exceeding the US$12K zone. On December 6, 2017, at approximately 2:30 pm EDT, one bitcoin is now valued at a global weighted average of over $13,000 across many popular trading platforms. The milestone comes just days before the upcoming derivatives products set to be launched by the Chicago Board Options Exchange (Cboe) and CME Group.

Also read: Getting Bitcoin on Mom’s iPhone: 3 Easy Steps

Bitcoin Crosses $13K Per BTC Across Global Exchanges

Bitcoin is on fire, and it continues to gain in value every single month this year, achieving more than 1100 percent in value during 2017. The decentralized currency has been one of the most topical conversations lately regarding finance, money, and investment vehicles. The price has astonished the mainstream media and many news outlets, and television shows across the world are reporting on the bitcoin phenomenon. At approximately 2:30 pm EDT Bitcoin surpassed $13,000 per BTC.

At approximately 2:30 pm EDT Bitcoin surpassed $13,000 per BTC.

In these reports, journalists and reporters detail how bitcoin is becoming the world’s “digital gold” and explain how the currency has outpaced nearly every government issued currency, stock, and commodity traded on earth. Over the past few weeks, many speculators believe the price is being pushed by institutional money coming-in with all the futures products scheduled.

“We see a price drive based on the upcoming futures contracts,” explains Jeff Koyen, strategic advisor to 360 Blockchain Inc. in an interview with Forbes. “There’s a lot of new money coming in, looking for quick profit.”

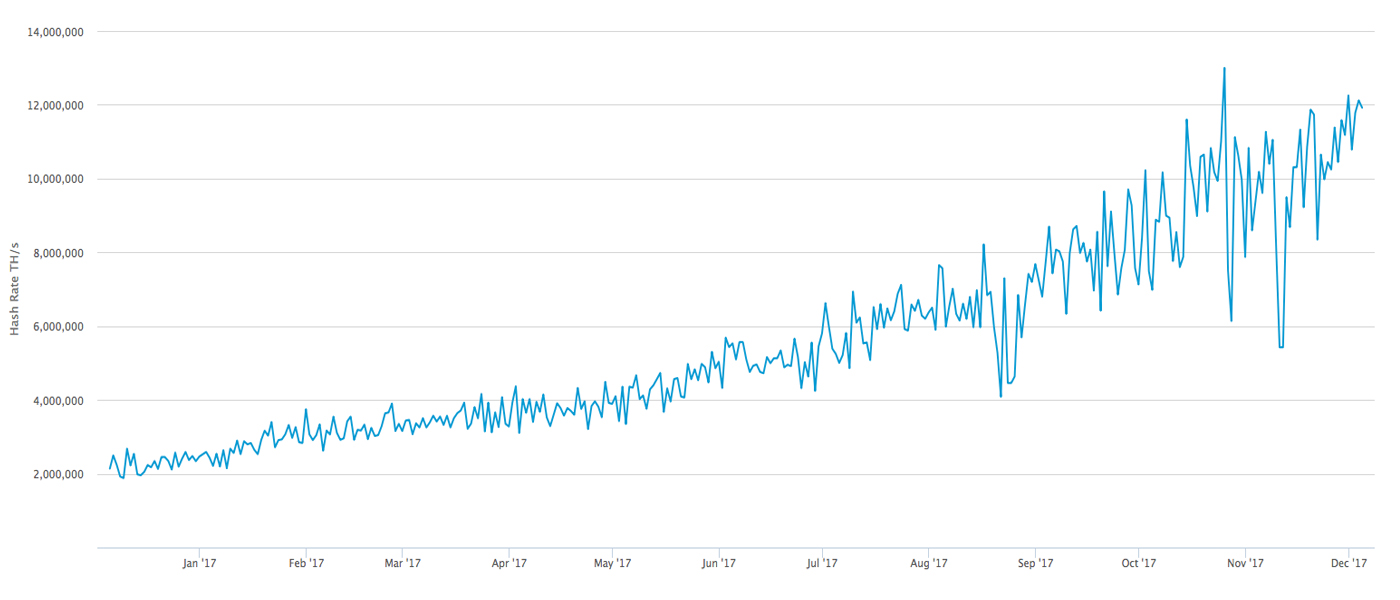

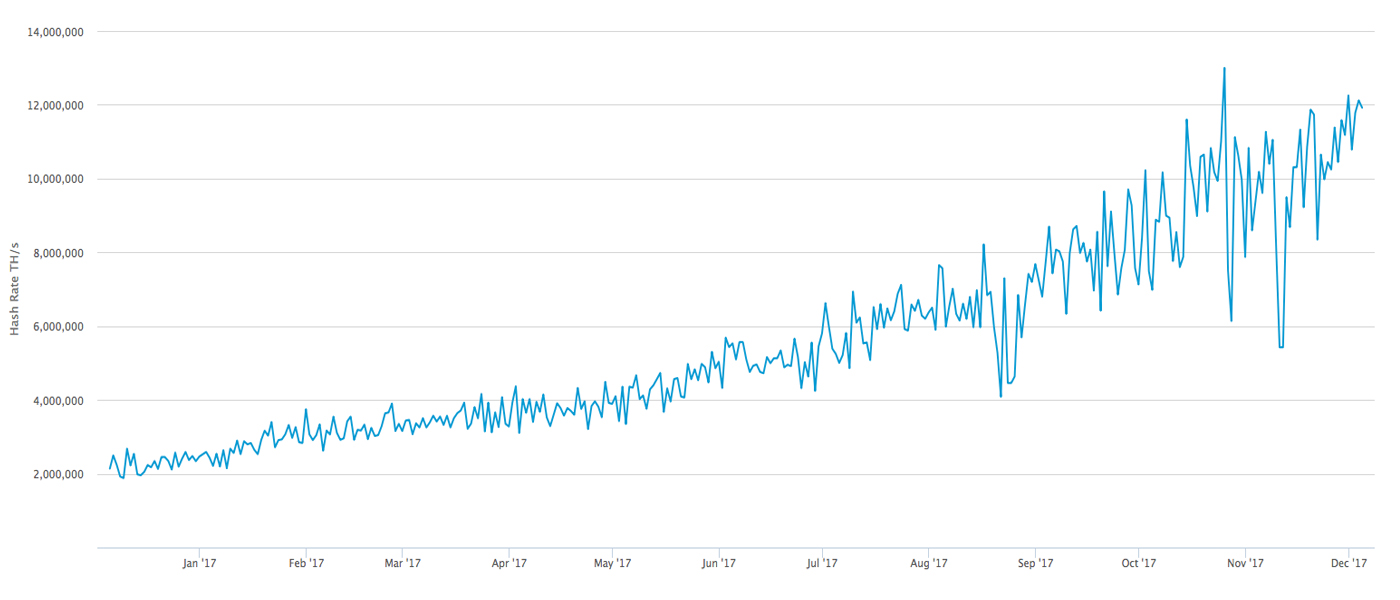

450K Transactions Per Day, 12 Exahash, and a $218Bn Market Cap

Over the past few days, bitcoin fever has been even more exuberant as the price has gained over $3,000 in just a week’s time. Today as bitcoin smashes through the $13K price region the decentralized currency’s markets are seeing over $10Bn worth of BTC traded over the past 24-hours. Moreover, bitcoin’s market capitalization is over $218Bn and is dominating the 1,326 other digital assets by 58 percent. Bitcoin users are also transacting more than usual as daily confirmed transactions (tx) are reaching record highs at 450,000 tx per day. Mining revenue is higher than ever as the currency is extremely lucrative to mine at this price point, which has pushed the network hashrate to over 12 exahash per second. With its price and network milestones, bitcoin continues to astonish the world, breaking record after record each month. Bitcoin’s hashrate is a whopping 12 exahash per second.

Bitcoin’s hashrate is a whopping 12 exahash per second.

The Bitcoin Phenomenon Is Still Fairly Small But It’s Growing Bigger Every Day

Bitcoin is relatively small compared to the world’s real estate markets (160 trillion) and gold’s annual capitalization (9 trillion). However, bitcoin is bigger than many other market capitalizations like Paypal, McDonald’s, IBM, GE, Disney and many more. Further bitcoin-based funds and IRAs like Grayscale’s GBTC, are performing phenomenally alongside bitcoin’s growth this year. The senior exchange traded fund (ETF) analyst for Bloomberg, Eric Balchunas, revealed that Sweden’s bitcoin exchange-traded fund (ETN) is now larger than 80 percent of the U.S. based ETFs. Now that many futures products are being lined up, U.S. based bitcoin ETFs could be launched shortly after the derivatives markets are established.

Bitcoin markets are rallying once again breaking new price records after recently exceeding the US$12K zone. On December 6, 2017, at approximately 2:30 pm EDT, one bitcoin is now valued at a global weighted average of over $13,000 across many popular trading platforms. The milestone comes just days before the upcoming derivatives products set to be launched by the Chicago Board Options Exchange (Cboe) and CME Group.

Also read: Getting Bitcoin on Mom’s iPhone: 3 Easy Steps

Bitcoin Crosses $13K Per BTC Across Global Exchanges

Bitcoin is on fire, and it continues to gain in value every single month this year, achieving more than 1100 percent in value during 2017. The decentralized currency has been one of the most topical conversations lately regarding finance, money, and investment vehicles. The price has astonished the mainstream media and many news outlets, and television shows across the world are reporting on the bitcoin phenomenon. At approximately 2:30 pm EDT Bitcoin surpassed $13,000 per BTC.

At approximately 2:30 pm EDT Bitcoin surpassed $13,000 per BTC.

In these reports, journalists and reporters detail how bitcoin is becoming the world’s “digital gold” and explain how the currency has outpaced nearly every government issued currency, stock, and commodity traded on earth. Over the past few weeks, many speculators believe the price is being pushed by institutional money coming-in with all the futures products scheduled.

“We see a price drive based on the upcoming futures contracts,” explains Jeff Koyen, strategic advisor to 360 Blockchain Inc. in an interview with Forbes. “There’s a lot of new money coming in, looking for quick profit.”

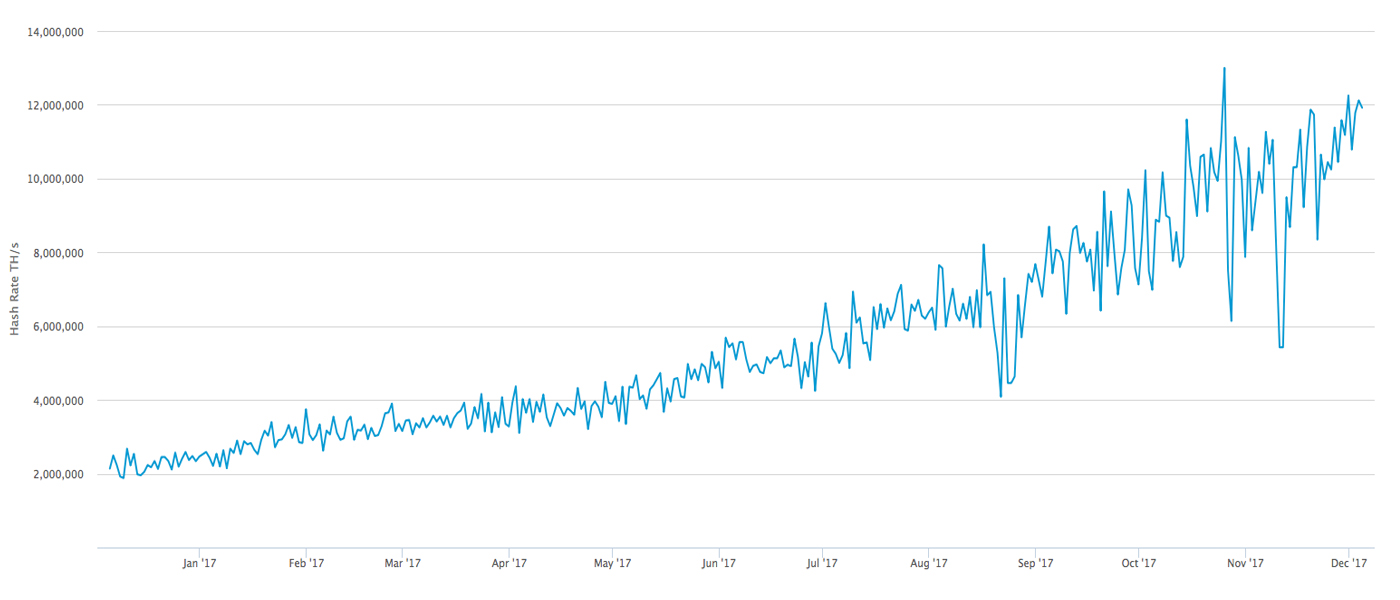

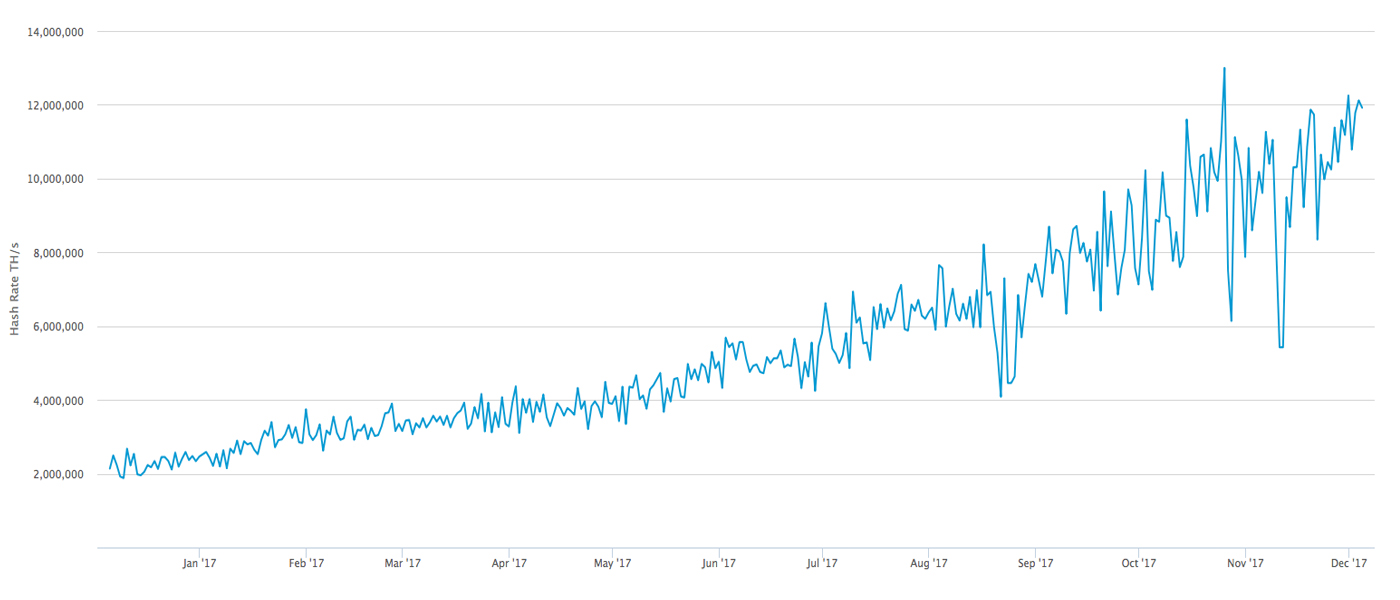

450K Transactions Per Day, 12 Exahash, and a $218Bn Market Cap

Over the past few days, bitcoin fever has been even more exuberant as the price has gained over $3,000 in just a week’s time. Today as bitcoin smashes through the $13K price region the decentralized currency’s markets are seeing over $10Bn worth of BTC traded over the past 24-hours. Moreover, bitcoin’s market capitalization is over $218Bn and is dominating the 1,326 other digital assets by 58 percent. Bitcoin users are also transacting more than usual as daily confirmed transactions (tx) are reaching record highs at 450,000 tx per day. Mining revenue is higher than ever as the currency is extremely lucrative to mine at this price point, which has pushed the network hashrate to over 12 exahash per second. With its price and network milestones, bitcoin continues to astonish the world, breaking record after record each month. Bitcoin’s hashrate is a whopping 12 exahash per second.

Bitcoin’s hashrate is a whopping 12 exahash per second.

The Bitcoin Phenomenon Is Still Fairly Small But It’s Growing Bigger Every Day

Bitcoin is relatively small compared to the world’s real estate markets (160 trillion) and gold’s annual capitalization (9 trillion). However, bitcoin is bigger than many other market capitalizations like Paypal, McDonald’s, IBM, GE, Disney and many more. Further bitcoin-based funds and IRAs like Grayscale’s GBTC, are performing phenomenally alongside bitcoin’s growth this year. The senior exchange traded fund (ETF) analyst for Bloomberg, Eric Balchunas, revealed that Sweden’s bitcoin exchange-traded fund (ETN) is now larger than 80 percent of the U.S. based ETFs. Now that many futures products are being lined up, U.S. based bitcoin ETFs could be launched shortly after the derivatives markets are established.

Bitcoin markets are rallying once again breaking new price records after recently exceeding the US$12K zone. On December 6, 2017, at approximately 2:30 pm EDT, one bitcoin is now valued at a global weighted average of over $13,000 across many popular trading platforms. The milestone comes just days before the upcoming derivatives products set to be launched by the Chicago Board Options Exchange (Cboe) and CME Group.

Also read: Getting Bitcoin on Mom’s iPhone: 3 Easy Steps

Bitcoin Crosses $13K Per BTC Across Global Exchanges

Bitcoin is on fire, and it continues to gain in value every single month this year, achieving more than 1100 percent in value during 2017. The decentralized currency has been one of the most topical conversations lately regarding finance, money, and investment vehicles. The price has astonished the mainstream media and many news outlets, and television shows across the world are reporting on the bitcoin phenomenon. At approximately 2:30 pm EDT Bitcoin surpassed $13,000 per BTC.

At approximately 2:30 pm EDT Bitcoin surpassed $13,000 per BTC.

In these reports, journalists and reporters detail how bitcoin is becoming the world’s “digital gold” and explain how the currency has outpaced nearly every government issued currency, stock, and commodity traded on earth. Over the past few weeks, many speculators believe the price is being pushed by institutional money coming-in with all the futures products scheduled.

“We see a price drive based on the upcoming futures contracts,” explains Jeff Koyen, strategic advisor to 360 Blockchain Inc. in an interview with Forbes. “There’s a lot of new money coming in, looking for quick profit.”

450K Transactions Per Day, 12 Exahash, and a $218Bn Market Cap

Over the past few days, bitcoin fever has been even more exuberant as the price has gained over $3,000 in just a week’s time. Today as bitcoin smashes through the $13K price region the decentralized currency’s markets are seeing over $10Bn worth of BTC traded over the past 24-hours. Moreover, bitcoin’s market capitalization is over $218Bn and is dominating the 1,326 other digital assets by 58 percent. Bitcoin users are also transacting more than usual as daily confirmed transactions (tx) are reaching record highs at 450,000 tx per day. Mining revenue is higher than ever as the currency is extremely lucrative to mine at this price point, which has pushed the network hashrate to over 12 exahash per second. With its price and network milestones, bitcoin continues to astonish the world, breaking record after record each month. Bitcoin’s hashrate is a whopping 12 exahash per second.

Bitcoin’s hashrate is a whopping 12 exahash per second.

The Bitcoin Phenomenon Is Still Fairly Small But It’s Growing Bigger Every Day

Bitcoin is relatively small compared to the world’s real estate markets (160 trillion) and gold’s annual capitalization (9 trillion). However, bitcoin is bigger than many other market capitalizations like Paypal, McDonald’s, IBM, GE, Disney and many more. Further bitcoin-based funds and IRAs like Grayscale’s GBTC, are performing phenomenally alongside bitcoin’s growth this year. The senior exchange traded fund (ETF) analyst for Bloomberg, Eric Balchunas, revealed that Sweden’s bitcoin exchange-traded fund (ETN) is now larger than 80 percent of the U.S. based ETFs. Now that many futures products are being lined up, U.S. based bitcoin ETFs could be launched shortly after the derivatives markets are established.

Bitcoin markets are rallying once again breaking new price records after recently exceeding the US$12K zone. On December 6, 2017, at approximately 2:30 pm EDT, one bitcoin is now valued at a global weighted average of over $13,000 across many popular trading platforms. The milestone comes just days before the upcoming derivatives products set to be launched by the Chicago Board Options Exchange (Cboe) and CME Group.

Also read: Getting Bitcoin on Mom’s iPhone: 3 Easy Steps

Bitcoin Crosses $13K Per BTC Across Global Exchanges

Bitcoin is on fire, and it continues to gain in value every single month this year, achieving more than 1100 percent in value during 2017. The decentralized currency has been one of the most topical conversations lately regarding finance, money, and investment vehicles. The price has astonished the mainstream media and many news outlets, and television shows across the world are reporting on the bitcoin phenomenon. At approximately 2:30 pm EDT Bitcoin surpassed $13,000 per BTC.

At approximately 2:30 pm EDT Bitcoin surpassed $13,000 per BTC.

In these reports, journalists and reporters detail how bitcoin is becoming the world’s “digital gold” and explain how the currency has outpaced nearly every government issued currency, stock, and commodity traded on earth. Over the past few weeks, many speculators believe the price is being pushed by institutional money coming-in with all the futures products scheduled.

“We see a price drive based on the upcoming futures contracts,” explains Jeff Koyen, strategic advisor to 360 Blockchain Inc. in an interview with Forbes. “There’s a lot of new money coming in, looking for quick profit.”

450K Transactions Per Day, 12 Exahash, and a $218Bn Market Cap

Over the past few days, bitcoin fever has been even more exuberant as the price has gained over $3,000 in just a week’s time. Today as bitcoin smashes through the $13K price region the decentralized currency’s markets are seeing over $10Bn worth of BTC traded over the past 24-hours. Moreover, bitcoin’s market capitalization is over $218Bn and is dominating the 1,326 other digital assets by 58 percent. Bitcoin users are also transacting more than usual as daily confirmed transactions (tx) are reaching record highs at 450,000 tx per day. Mining revenue is higher than ever as the currency is extremely lucrative to mine at this price point, which has pushed the network hashrate to over 12 exahash per second. With its price and network milestones, bitcoin continues to astonish the world, breaking record after record each month. Bitcoin’s hashrate is a whopping 12 exahash per second.

Bitcoin’s hashrate is a whopping 12 exahash per second.

The Bitcoin Phenomenon Is Still Fairly Small But It’s Growing Bigger Every Day

Bitcoin is relatively small compared to the world’s real estate markets (160 trillion) and gold’s annual capitalization (9 trillion). However, bitcoin is bigger than many other market capitalizations like Paypal, McDonald’s, IBM, GE, Disney and many more. Further bitcoin-based funds and IRAs like Grayscale’s GBTC, are performing phenomenally alongside bitcoin’s growth this year. The senior exchange traded fund (ETF) analyst for Bloomberg, Eric Balchunas, revealed that Sweden’s bitcoin exchange-traded fund (ETN) is now larger than 80 percent of the U.S. based ETFs. Now that many futures products are being lined up, U.S. based bitcoin ETFs could be launched shortly after the derivatives markets are established.

Bitcoin markets are rallying once again breaking new price records after recently exceeding the US$12K zone. On December 6, 2017, at approximately 2:30 pm EDT, one bitcoin is now valued at a global weighted average of over $13,000 across many popular trading platforms. The milestone comes just days before the upcoming derivatives products set to be launched by the Chicago Board Options Exchange (Cboe) and CME Group.

Also read: Getting Bitcoin on Mom’s iPhone: 3 Easy Steps

Bitcoin Crosses $13K Per BTC Across Global Exchanges

Bitcoin is on fire, and it continues to gain in value every single month this year, achieving more than 1100 percent in value during 2017. The decentralized currency has been one of the most topical conversations lately regarding finance, money, and investment vehicles. The price has astonished the mainstream media and many news outlets, and television shows across the world are reporting on the bitcoin phenomenon. At approximately 2:30 pm EDT Bitcoin surpassed $13,000 per BTC.

At approximately 2:30 pm EDT Bitcoin surpassed $13,000 per BTC.

In these reports, journalists and reporters detail how bitcoin is becoming the world’s “digital gold” and explain how the currency has outpaced nearly every government issued currency, stock, and commodity traded on earth. Over the past few weeks, many speculators believe the price is being pushed by institutional money coming-in with all the futures products scheduled.

“We see a price drive based on the upcoming futures contracts,” explains Jeff Koyen, strategic advisor to 360 Blockchain Inc. in an interview with Forbes. “There’s a lot of new money coming in, looking for quick profit.”

450K Transactions Per Day, 12 Exahash, and a $218Bn Market Cap

Over the past few days, bitcoin fever has been even more exuberant as the price has gained over $3,000 in just a week’s time. Today as bitcoin smashes through the $13K price region the decentralized currency’s markets are seeing over $10Bn worth of BTC traded over the past 24-hours. Moreover, bitcoin’s market capitalization is over $218Bn and is dominating the 1,326 other digital assets by 58 percent. Bitcoin users are also transacting more than usual as daily confirmed transactions (tx) are reaching record highs at 450,000 tx per day. Mining revenue is higher than ever as the currency is extremely lucrative to mine at this price point, which has pushed the network hashrate to over 12 exahash per second. With its price and network milestones, bitcoin continues to astonish the world, breaking record after record each month. Bitcoin’s hashrate is a whopping 12 exahash per second.

Bitcoin’s hashrate is a whopping 12 exahash per second.

The Bitcoin Phenomenon Is Still Fairly Small But It’s Growing Bigger Every Day

Bitcoin is relatively small compared to the world’s real estate markets (160 trillion) and gold’s annual capitalization (9 trillion). However, bitcoin is bigger than many other market capitalizations like Paypal, McDonald’s, IBM, GE, Disney and many more. Further bitcoin-based funds and IRAs like Grayscale’s GBTC, are performing phenomenally alongside bitcoin’s growth this year. The senior exchange traded fund (ETF) analyst for Bloomberg, Eric Balchunas, revealed that Sweden’s bitcoin exchange-traded fund (ETN) is now larger than 80 percent of the U.S. based ETFs. Now that many futures products are being lined up, U.S. based bitcoin ETFs could be launched shortly after the derivatives markets are established.

Bitcoin markets are rallying once again breaking new price records after recently exceeding the US$12K zone. On December 6, 2017, at approximately 2:30 pm EDT, one bitcoin is now valued at a global weighted average of over $13,000 across many popular trading platforms. The milestone comes just days before the upcoming derivatives products set to be launched by the Chicago Board Options Exchange (Cboe) and CME Group.

Also read: Getting Bitcoin on Mom’s iPhone: 3 Easy Steps

Bitcoin Crosses $13K Per BTC Across Global Exchanges

Bitcoin is on fire, and it continues to gain in value every single month this year, achieving more than 1100 percent in value during 2017. The decentralized currency has been one of the most topical conversations lately regarding finance, money, and investment vehicles. The price has astonished the mainstream media and many news outlets, and television shows across the world are reporting on the bitcoin phenomenon. At approximately 2:30 pm EDT Bitcoin surpassed $13,000 per BTC.

At approximately 2:30 pm EDT Bitcoin surpassed $13,000 per BTC.

In these reports, journalists and reporters detail how bitcoin is becoming the world’s “digital gold” and explain how the currency has outpaced nearly every government issued currency, stock, and commodity traded on earth. Over the past few weeks, many speculators believe the price is being pushed by institutional money coming-in with all the futures products scheduled.

“We see a price drive based on the upcoming futures contracts,” explains Jeff Koyen, strategic advisor to 360 Blockchain Inc. in an interview with Forbes. “There’s a lot of new money coming in, looking for quick profit.”

450K Transactions Per Day, 12 Exahash, and a $218Bn Market Cap

Over the past few days, bitcoin fever has been even more exuberant as the price has gained over $3,000 in just a week’s time. Today as bitcoin smashes through the $13K price region the decentralized currency’s markets are seeing over $10Bn worth of BTC traded over the past 24-hours. Moreover, bitcoin’s market capitalization is over $218Bn and is dominating the 1,326 other digital assets by 58 percent. Bitcoin users are also transacting more than usual as daily confirmed transactions (tx) are reaching record highs at 450,000 tx per day. Mining revenue is higher than ever as the currency is extremely lucrative to mine at this price point, which has pushed the network hashrate to over 12 exahash per second. With its price and network milestones, bitcoin continues to astonish the world, breaking record after record each month. Bitcoin’s hashrate is a whopping 12 exahash per second.

Bitcoin’s hashrate is a whopping 12 exahash per second.

The Bitcoin Phenomenon Is Still Fairly Small But It’s Growing Bigger Every Day

Bitcoin is relatively small compared to the world’s real estate markets (160 trillion) and gold’s annual capitalization (9 trillion). However, bitcoin is bigger than many other market capitalizations like Paypal, McDonald’s, IBM, GE, Disney and many more. Further bitcoin-based funds and IRAs like Grayscale’s GBTC, are performing phenomenally alongside bitcoin’s growth this year. The senior exchange traded fund (ETF) analyst for Bloomberg, Eric Balchunas, revealed that Sweden’s bitcoin exchange-traded fund (ETN) is now larger than 80 percent of the U.S. based ETFs. Now that many futures products are being lined up, U.S. based bitcoin ETFs could be launched shortly after the derivatives markets are established.

Bitcoin markets are rallying once again breaking new price records after recently exceeding the US$12K zone. On December 6, 2017, at approximately 2:30 pm EDT, one bitcoin is now valued at a global weighted average of over $13,000 across many popular trading platforms. The milestone comes just days before the upcoming derivatives products set to be launched by the Chicago Board Options Exchange (Cboe) and CME Group.

Also read: Getting Bitcoin on Mom’s iPhone: 3 Easy Steps

Bitcoin Crosses $13K Per BTC Across Global Exchanges

Bitcoin is on fire, and it continues to gain in value every single month this year, achieving more than 1100 percent in value during 2017. The decentralized currency has been one of the most topical conversations lately regarding finance, money, and investment vehicles. The price has astonished the mainstream media and many news outlets, and television shows across the world are reporting on the bitcoin phenomenon. At approximately 2:30 pm EDT Bitcoin surpassed $13,000 per BTC.

At approximately 2:30 pm EDT Bitcoin surpassed $13,000 per BTC.

In these reports, journalists and reporters detail how bitcoin is becoming the world’s “digital gold” and explain how the currency has outpaced nearly every government issued currency, stock, and commodity traded on earth. Over the past few weeks, many speculators believe the price is being pushed by institutional money coming-in with all the futures products scheduled.

“We see a price drive based on the upcoming futures contracts,” explains Jeff Koyen, strategic advisor to 360 Blockchain Inc. in an interview with Forbes. “There’s a lot of new money coming in, looking for quick profit.”

450K Transactions Per Day, 12 Exahash, and a $218Bn Market Cap

Over the past few days, bitcoin fever has been even more exuberant as the price has gained over $3,000 in just a week’s time. Today as bitcoin smashes through the $13K price region the decentralized currency’s markets are seeing over $10Bn worth of BTC traded over the past 24-hours. Moreover, bitcoin’s market capitalization is over $218Bn and is dominating the 1,326 other digital assets by 58 percent. Bitcoin users are also transacting more than usual as daily confirmed transactions (tx) are reaching record highs at 450,000 tx per day. Mining revenue is higher than ever as the currency is extremely lucrative to mine at this price point, which has pushed the network hashrate to over 12 exahash per second. With its price and network milestones, bitcoin continues to astonish the world, breaking record after record each month. Bitcoin’s hashrate is a whopping 12 exahash per second.

Bitcoin’s hashrate is a whopping 12 exahash per second.

The Bitcoin Phenomenon Is Still Fairly Small But It’s Growing Bigger Every Day

Bitcoin is relatively small compared to the world’s real estate markets (160 trillion) and gold’s annual capitalization (9 trillion). However, bitcoin is bigger than many other market capitalizations like Paypal, McDonald’s, IBM, GE, Disney and many more. Further bitcoin-based funds and IRAs like Grayscale’s GBTC, are performing phenomenally alongside bitcoin’s growth this year. The senior exchange traded fund (ETF) analyst for Bloomberg, Eric Balchunas, revealed that Sweden’s bitcoin exchange-traded fund (ETN) is now larger than 80 percent of the U.S. based ETFs. Now that many futures products are being lined up, U.S. based bitcoin ETFs could be launched shortly after the derivatives markets are established.